Cloud-based wealth management software helps manage financial assets online. It offers secure, accessible, and efficient financial planning.

Wealth management involves handling investments, taxes, and estate planning. Cloud-based solutions simplify these tasks. Users can access their financial data anytime, anywhere. This flexibility makes managing wealth more convenient. Security is a top priority, with encryption and secure login features.

These tools also offer real-time updates and reports. This helps users stay informed about their financial status. Cloud solutions reduce the need for physical paperwork. They also save time and resources. Many platforms offer user-friendly interfaces. This makes them easy to use, even for those with limited tech skills.

Introduction To Cloud-based Wealth Management

The financial industry is evolving rapidly. Cloud-based wealth management is at the forefront of this transformation. It offers a modern solution to traditional wealth management practices. This technology revolutionizes how financial advisors and clients manage their wealth.

What Is Cloud-based Wealth Management?

Cloud-based wealth management uses cloud technology for financial services. It allows secure access to data and tools from anywhere. This technology streamlines operations, reduces costs, and enhances client satisfaction.

Here are some key features:

- Real-time data access

- Advanced analytics

- Automated processes

- Enhanced security

- Scalability

Importance In Modern Finance

Cloud-based solutions are crucial in modern finance. They bring many benefits to the table.

Here’s a list of their importance:

- Cost Efficiency: Reduces the need for expensive infrastructure.

- Flexibility: Adapts to business needs quickly.

- Accessibility: Provides access to financial data anytime, anywhere.

- Security: Offers high levels of data protection.

- Innovation: Facilitates the adoption of new technologies.

Cloud-based wealth management is changing the financial landscape. It provides tools that are essential for today’s financial advisors. Embracing this technology is no longer optional. It is a necessity for staying competitive.

| Feature | Description |

|---|---|

| Real-time data access | Enables immediate updates and decisions. |

| Advanced analytics | Provides insights for better investment strategies. |

| Automated processes | Reduces manual errors and saves time. |

| Enhanced security | Protects sensitive financial data. |

| Scalability | Grows with your business needs. |

Key Features Of Cloud-based Solutions

Cloud-based wealth management software solutions offer several key features. These features help financial advisors manage their clients’ assets efficiently. Let’s explore these features in detail.

Real-time Data Access

One of the most significant advantages is real-time data access. Advisors can view client portfolios instantly. This feature allows for quick decision-making. It ensures that advisors are always up-to-date.

Real-time data access also enhances client communication. Clients can receive immediate updates on their investments. This builds trust and transparency between advisors and clients.

Enhanced Security Measures

Security is a top concern in wealth management. Cloud-based solutions offer enhanced security measures to protect sensitive data.

Some of the key security features include:

- Data encryption

- Two-factor authentication

- Regular security audits

- Access controls

These measures ensure that client data remains secure. Advisors can focus on managing assets without worrying about security breaches.

Benefits For Financial Advisors

Cloud-based wealth management software offers numerous benefits for financial advisors. These tools enhance efficiency, improve client interactions, and streamline operations. Let’s explore how these solutions can be advantageous.

Streamlined Operations

Cloud-based solutions simplify daily tasks for financial advisors. They automate routine processes, reducing manual work. This saves time and minimizes errors.

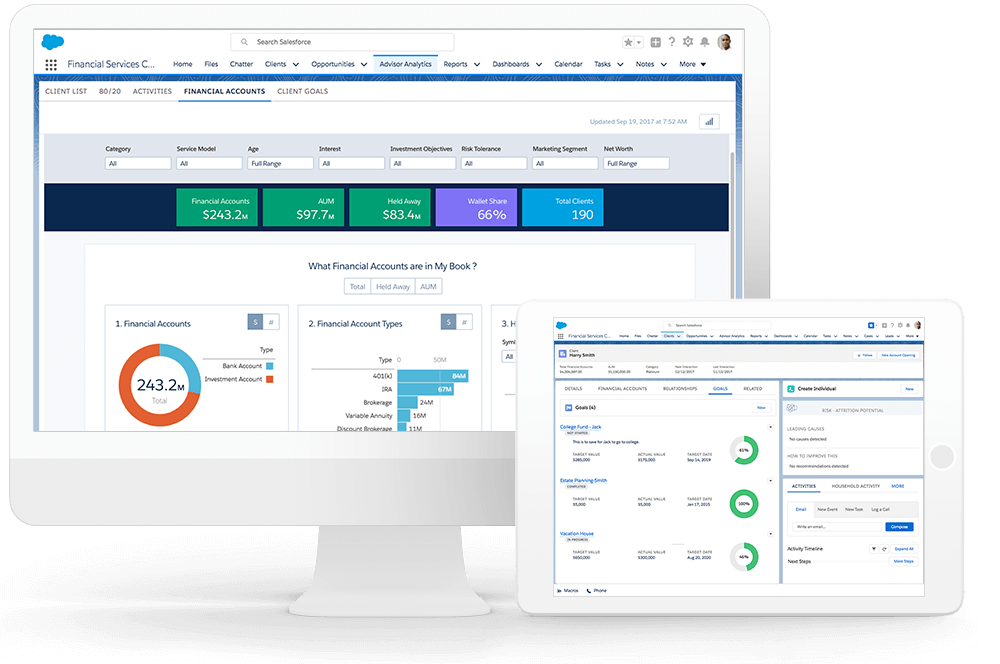

A comprehensive dashboard provides real-time data. This enables quick decision-making. Advisors can access client portfolios, financial reports, and analytics in one place.

Here are some key features:

- Automated data entry

- Real-time financial tracking

- Centralized client information

These features lead to more efficient operations and better service delivery.

Improved Client Communication

Effective communication is crucial for financial advisors. Cloud-based software enhances interaction with clients. It offers secure messaging and document sharing.

Clients receive timely updates on their investments. This transparency builds trust and strengthens relationships. Advisors can also schedule automated reports and alerts.

Consider the following benefits:

- Secure client messaging

- Easy document sharing

- Automated reports and alerts

These tools ensure clients stay informed and engaged. This leads to higher satisfaction and loyalty.

Credit: wicket.io

Client Advantages

Cloud-based wealth management software offers numerous advantages to clients. It revolutionizes how clients interact with their financial planners and manage their investments. These solutions provide enhanced personalization, accessibility, and efficiency, ensuring clients receive top-notch services.

Personalized Financial Planning

Clients benefit from personalized financial planning through cloud-based software. The software analyzes financial data to create tailored financial plans. These plans align with the client’s goals and risk tolerance.

Clients can access various tools and resources. These tools help in budgeting, retirement planning, and investment strategies. The software also offers real-time updates, ensuring clients stay informed about their financial status.

With automated insights and recommendations, clients can make informed decisions. This personalized approach enhances their financial well-being.

24/7 Account Access

One of the significant advantages is 24/7 account access. Clients can access their accounts anytime, anywhere, using any device. This flexibility ensures that clients can monitor their financial status at their convenience.

Clients can view account balances, transaction history, and portfolio performance. They can also make transactions, like transferring funds or adjusting investments. The software provides real-time data, ensuring clients have the latest information.

This constant accessibility enhances client satisfaction and trust in the wealth management firm.

Integration With Existing Systems

Integrating cloud-based wealth management software with existing systems is a crucial aspect for financial institutions. Ensuring a smooth transition and functionality is key. This integration process involves several steps to guarantee that existing data and tools are seamlessly incorporated into the new system.

Seamless Data Migration

Seamless data migration is essential for a successful integration. This process involves transferring all existing data into the new cloud-based system without any loss or corruption. Proper planning and execution are necessary to achieve this.

Here are some key steps involved in seamless data migration:

- Assessing current data quality and structure

- Mapping data fields to the new system

- Ensuring data integrity and accuracy

- Testing the migration process

- Monitoring post-migration performance

These steps ensure that the data migration process is efficient and effective. This allows institutions to continue operations without disruptions.

Compatibility With Other Tools

Compatibility with other tools is another important aspect of integration. The cloud-based wealth management software should work seamlessly with existing tools and applications. This ensures a cohesive workflow and enhances productivity.

Some common tools that need to be compatible include:

| Tool | Purpose |

|---|---|

| CRM Systems | Manage client relationships |

| Portfolio Management Tools | Track and analyze investments |

| Accounting Software | Handle financial transactions |

Ensuring compatibility with these tools helps in creating a unified system. This integration reduces the need for manual data entry and minimizes errors.

A well-integrated system enhances the overall efficiency and effectiveness of wealth management operations.

Credit: www.erpcloudtraining.com

Challenges And Considerations

Cloud-based wealth management software solutions offer many benefits. But, they come with their own set of challenges and considerations. Understanding these challenges helps in making better decisions. Below are key areas to focus on:

Data Privacy Concerns

Data privacy is a major concern for wealth management firms. Sensitive financial data needs top-notch security. Cloud services must comply with data protection laws. Regular audits ensure data is safe and secure.

Businesses must ask these questions:

- Is the cloud provider compliant with GDPR and other regulations?

- What encryption methods are in place?

- How often does the provider perform security audits?

Choosing a provider with a strong security track record is crucial. Always check for certifications and past security incidents.

Cost And Roi Analysis

Analyzing costs and return on investment (ROI) is important. Cloud-based solutions can be expensive. But, they offer many benefits that justify the cost.

Here is a cost-benefit table:

| Cost | Benefit |

|---|---|

| Subscription Fees | Access to latest features |

| Training Costs | Improved productivity |

| Maintenance Fees | Reduced downtime |

Evaluate both direct and indirect costs. Understand how the software impacts efficiency. Ensure the benefits outweigh the costs for a positive ROI.

Future Trends In Cloud-based Wealth Management

The future of cloud-based wealth management looks bright. Emerging technologies are reshaping the industry. Investors and managers must stay updated on these trends. Let’s explore some key trends driving this transformation.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing wealth management. These technologies offer personalized investment advice. They can analyze vast amounts of data in real-time.

AI-powered tools can predict market trends. This helps in making informed decisions. They also enhance customer service through chatbots and virtual assistants.

| AI/ML Feature | Benefit |

|---|---|

| Predictive Analytics | Better market predictions |

| Automated Trading | Efficient trade executions |

| Personalized Advice | Tailored investment strategies |

Blockchain Integration

Blockchain technology is gaining traction in wealth management. It offers transparency and security. Transactions are recorded in an immutable ledger.

Blockchain reduces fraud and errors. It also speeds up transaction processing. Digital assets and cryptocurrencies can be easily managed through blockchain.

- Transparency: Every transaction is visible to authorized parties.

- Security: Cryptographic algorithms ensure data integrity.

- Efficiency: Faster processing of transactions.

Blockchain also supports smart contracts. These automate and enforce contract terms, reducing the need for intermediaries.

Case Studies And Success Stories

Cloud-based wealth management software solutions have transformed the financial industry. Many firms have adopted these solutions to enhance their services. This section highlights real-world case studies and success stories.

Leading Firms Adopting Cloud Solutions

Several top firms have embraced cloud technology. These firms have seen remarkable improvements in their operations. Here are some leading examples:

- Firm A: Implemented a cloud-based system for portfolio management. They reported a 30% increase in efficiency.

- Firm B: Adopted cloud solutions for client data management. They saw a 40% reduction in data retrieval time.

- Firm C: Used cloud software to streamline financial reporting. They experienced a 25% decrease in reporting errors.

Impact On Client Satisfaction

Client satisfaction is crucial for wealth management firms. Cloud-based solutions have significantly improved client experiences.

Here are key benefits observed:

- Better Access: Clients have 24/7 access to their financial information.

- Enhanced Communication: Real-time updates keep clients informed about their portfolios.

- Personalized Services: Cloud systems allow for tailored financial advice.

These benefits have led to higher client satisfaction and loyalty.

| Firm | Improvement | Client Satisfaction Rate |

|---|---|---|

| Firm A | 30% increase in efficiency | 95% |

| Firm B | 40% reduction in data retrieval time | 92% |

| Firm C | 25% decrease in reporting errors | 90% |

Credit: wicket.io

Frequently Asked Questions

What Is Cloud-based Wealth Management Software?

Cloud-based wealth management software is a digital tool hosted on the cloud. It helps financial advisors manage clients’ investments. It provides real-time data, analytics, and reporting.

How Does Cloud-based Software Benefit Wealth Managers?

Cloud-based software offers scalability, accessibility, and cost-effectiveness. It allows wealth managers to access client information from anywhere. This improves efficiency and client service.

Is Cloud-based Wealth Management Software Secure?

Yes, it is secure. Most cloud-based solutions use advanced encryption and security protocols. This ensures that client data is protected and confidential.

Can Small Firms Use Cloud-based Wealth Management Software?

Yes, small firms can use cloud-based wealth management software. It is cost-effective and scales according to the firm’s needs. This makes it accessible for firms of all sizes.

Conclusion

Cloud-based wealth management software offers efficient and flexible solutions. It enhances productivity and provides real-time insights. This technology ensures secure and accessible financial management. Embrace these tools for better client experiences. Stay competitive in the evolving financial landscape with cloud-based solutions.

Invest in modern software to streamline your wealth management processes.