To automate tasks with trading algorithm platforms, use automated trading software. These platforms execute trades based on predefined criteria.

Automated trading platforms are powerful tools for modern traders. They help save time and reduce human error. Traders can set specific rules for buying and selling assets. The software then executes trades based on these rules. This eliminates the need for constant monitoring.

It also ensures trades are made promptly, maximizing potential profits. Automated trading is accessible to both beginners and experts. It offers a range of customizable features. These platforms are essential for efficient and effective trading in today’s fast-paced markets. With them, you can stay ahead of the competition.

Introduction To Trading Algorithms

Trading algorithms have transformed the financial markets. They automate complex trading processes and improve efficiency. This section will introduce you to the world of trading algorithms. Learn the basics and explore their benefits.

What Are Trading Algorithms?

Trading algorithms are computer programs. They execute trades based on predefined criteria. These criteria can include price, volume, timing, and other market conditions. Algorithms scan the market data and make decisions in real-time. They aim to capitalize on market opportunities quickly.

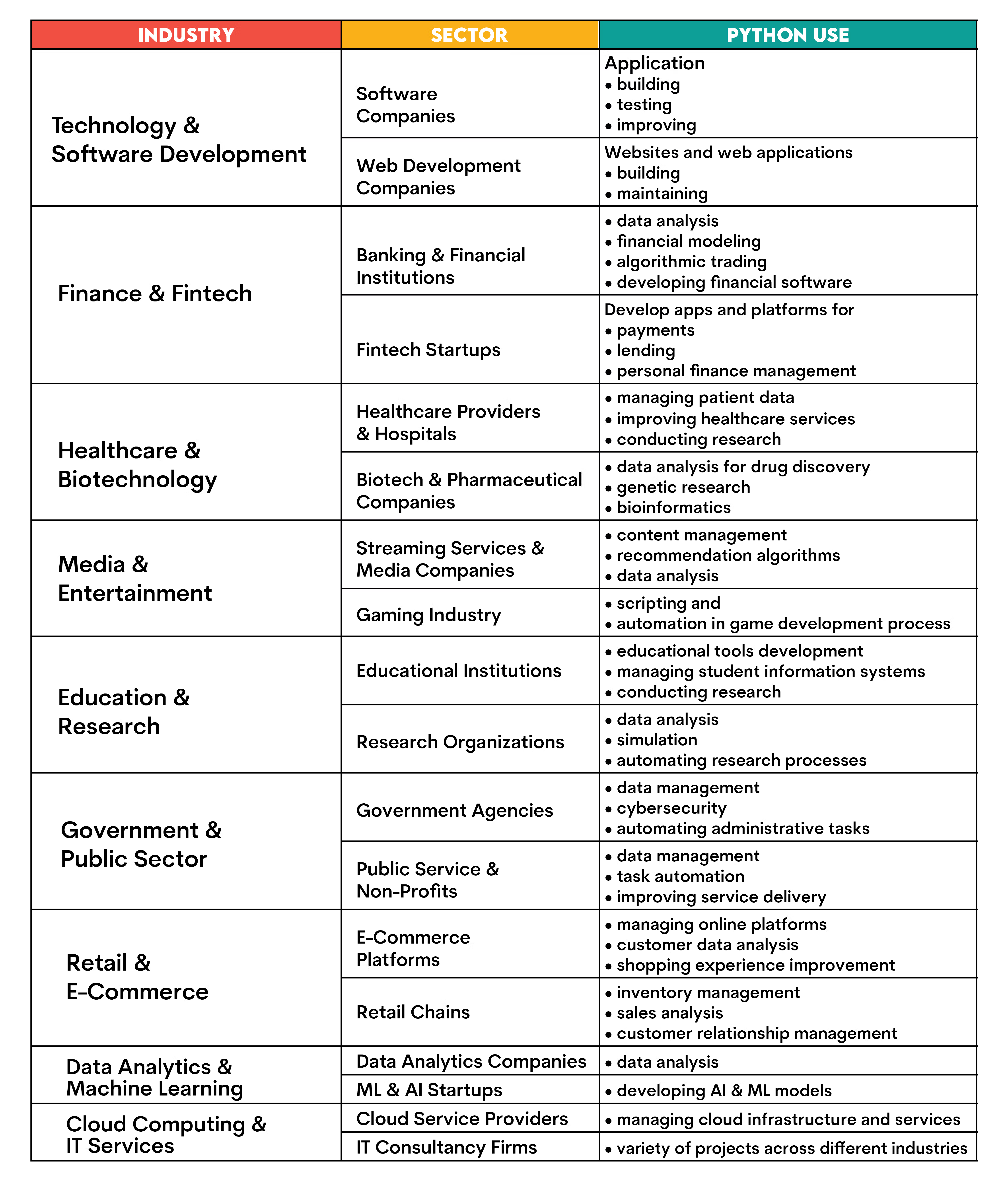

Developers write trading algorithms using programming languages. Popular languages include Python, C++, and Java. These algorithms can be simple or highly sophisticated. They range from basic moving average strategies to advanced machine learning models.

Here are some common types of trading algorithms:

- Trend-following algorithms: These algorithms follow market trends.

- Arbitrage algorithms: They exploit price differences between markets.

- Market-making algorithms: They provide liquidity by buying and selling assets.

- Scalping algorithms: These focus on small, quick profits.

Benefits Of Automation

Automation offers several benefits for traders. Here are the key advantages:

| Benefit | Description |

|---|---|

| Speed | Algorithms execute trades faster than humans. |

| Accuracy | Algorithms reduce human errors in trading decisions. |

| Consistency | Algorithms follow predefined rules consistently. |

| Efficiency | Algorithms can analyze vast amounts of data quickly. |

Automation also helps in removing emotions from trading. Emotional decisions can lead to losses. Algorithms make decisions based on data and logic. This enhances the overall trading strategy.

Another benefit is the ability to backtest. Traders can test their algorithms on historical data. This helps in refining the strategies before deploying them in live markets.

In summary, trading algorithms offer speed, accuracy, and efficiency. They enable traders to capitalize on market opportunities effectively.

Credit: payhip.com

Choosing The Right Platform

Automating tasks with trading algorithm platforms can save you a lot of time and effort. But finding the right platform is key to success. The right platform should meet your needs and help you achieve your goals.

Popular Platforms

Here are some popular trading algorithm platforms:

- MetaTrader 4 (MT4): Known for its user-friendly interface.

- MetaTrader 5 (MT5): Offers more advanced features.

- TradingView: Great for charting and social trading.

- QuantConnect: Ideal for quantitative analysis.

- Alpaca: Commission-free trading API.

Key Features To Look For

When choosing a platform, consider these key features:

| Feature | Description |

|---|---|

| Ease of Use | The platform should be user-friendly and easy to navigate. |

| Customization | Allows you to customize trading strategies to fit your needs. |

| Backtesting | Enables you to test your strategies using historical data. |

| Real-time Data | Provides up-to-date market data for accurate trading. |

| Security | Ensures your data and transactions are secure. |

Choosing the right platform is crucial. Make sure it fits your needs and goals.

Setting Up Your Trading Algorithm

Setting up your trading algorithm is crucial. It ensures smooth and efficient operation. Follow these steps to get started.

Initial Configuration

Begin with the initial configuration. Choose a reliable trading platform. Ensure it supports algorithmic trading.

Next, create an account. Fill in your details accurately. This is important for security.

After that, connect your trading account. Use API keys provided by your broker. This allows seamless integration.

Finally, verify your account. Most platforms require email or phone verification. This step is essential for safety.

Customizing Your Strategy

Customizing your strategy is key to success. Begin by defining your trading goals. Are you looking for short-term gains or long-term investments?

Next, choose your trading assets. Stocks, currencies, or commodities. The choice depends on your goals.

Then, set your risk levels. Decide on stop-loss and take-profit limits. This protects your investment.

After that, develop your algorithm. Use coding languages like Python. Many platforms provide templates to start with.

Finally, backtest your strategy. Use historical data to test your algorithm. This helps identify potential issues.

| Step | Action |

|---|---|

| 1 | Choose a trading platform |

| 2 | Create an account |

| 3 | Connect your trading account |

| 4 | Verify your account |

| 5 | Define your trading goals |

| 6 | Choose your trading assets |

| 7 | Set your risk levels |

| 8 | Develop your algorithm |

| 9 | Backtest your strategy |

Example Code

Here is a simple example of a trading algorithm in Python:

import pandas as pd

def simple_moving_average(data, window):

return data.rolling(window=window).mean()

data = pd.read_csv('historical_data.csv')

sma = simple_moving_average(data['Close'], window=20)

print(sma.tail())

Backtesting Your Strategy

Backtesting is a critical step in developing a trading algorithm. It allows traders to evaluate their strategies using historical data. By doing so, traders can determine if their strategies are likely to be profitable in the future. This process helps identify potential flaws and optimize the strategy before risking real money.

Importance Of Backtesting

Backtesting helps traders understand how their strategies would have performed in the past. This provides insight into the strategy’s potential future performance. It highlights any weaknesses and helps refine the strategy. Without backtesting, traders may risk significant losses. Historical data provides a realistic picture of market behavior.

- Identifies strengths and weaknesses of a strategy

- Provides performance metrics

- Reduces risk by testing before live trading

Tools And Techniques

Several tools are available for backtesting trading strategies. These tools can simulate trades using historical data. Some popular backtesting tools include:

| Tool | Description |

|---|---|

| MetaTrader | A popular platform with built-in backtesting features. |

| TradingView | Offers powerful backtesting tools with scripting support. |

| QuantConnect | A cloud-based platform for algorithmic trading and backtesting. |

There are several techniques for backtesting. These include:

- Walk-Forward Optimization: Divides data into in-sample and out-of-sample sets.

- Monte Carlo Simulation: Tests strategy under random sequences of trades.

- Parameter Optimization: Adjusts parameters to find the best settings.

Backtesting provides invaluable insights into your trading strategy. It ensures you’re prepared for live trading. Proper backtesting can save time and money.

Risk Management

Risk management is crucial in trading algorithm platforms. It helps protect your investments. Managing risk ensures better financial stability. Automation aids in maintaining discipline and consistency.

Setting Limits

Setting limits is an essential part of risk management. Define clear rules for losses and gains. Use stop-loss orders to minimize potential losses. Set take-profit levels to secure gains. These limits prevent emotional trading.

- Use stop-loss orders

- Set take-profit levels

- Automate limit orders

Automated platforms execute these limits precisely. They reduce human error and enhance trading discipline. Always review and adjust limits as needed.

Diversification

Diversification is spreading investments across various assets. It reduces the risk of significant losses. Allocate your investments in different sectors. This approach protects against market volatility.

| Asset Type | Example |

|---|---|

| Stocks | Technology, Healthcare |

| Bonds | Government, Corporate |

| Commodities | Gold, Oil |

Automated platforms can help diversify your portfolio. They analyze data and recommend investment options. Diversification minimizes risks and maximizes potential returns.

Effective risk management is the key to successful trading. Using automated platforms ensures consistent and disciplined trading practices.

Credit: www.stratascratch.com

Monitoring And Adjusting

Automating tasks with trading algorithm platforms is not a set-and-forget process. Constant monitoring and timely adjustments are crucial. This ensures your trading strategies remain effective and profitable. Below, we’ll delve into the importance of real-time monitoring and knowing when to make adjustments.

Real-time Monitoring

Real-time monitoring allows you to track your trades as they happen. It helps you spot any issues quickly. This is key for keeping your algorithm running smoothly.

Using real-time dashboards can help you see vital metrics. These include:

- Trade execution times

- Profit and loss reports

- Market conditions

Many platforms offer alerts and notifications. These can inform you of unusual activity or errors. Some common alert types include:

- Price triggers

- Volume changes

- Execution errors

Keep an eye on these metrics. They help you ensure your algorithm is performing as expected.

When To Make Adjustments

Knowing when to make adjustments is as important as monitoring. Market conditions can change rapidly. Your algorithm must adapt to these changes.

Here are signs that adjustments are needed:

| Sign | Description |

|---|---|

| Decreased Performance | Your profits are dropping. |

| Increased Errors | More trades are failing. |

| Market Shifts | The market behaves differently. |

To make effective adjustments, consider these steps:

- Review historical data to find trends.

- Test new strategies in a simulated environment.

- Implement changes gradually to assess their impact.

By staying vigilant and proactive, you can ensure your trading algorithm remains effective.

Advanced Tips From Experts

Automating tasks with trading algorithm platforms can elevate your trading strategy. Experts offer advanced tips for maximizing benefits. This section covers optimizing performance and staying updated with market trends.

Optimizing Performance

Performance optimization is crucial for trading algorithms. Experts suggest the following tips:

- Backtest Regularly: Test your algorithms with historical data. This helps identify potential issues.

- Fine-Tune Parameters: Adjust settings and parameters for better results. Small changes can make a big difference.

- Monitor Latency: Ensure your system responds quickly to market changes. Low latency can improve trade execution.

- Resource Allocation: Dedicate sufficient resources to your trading platform. This includes CPU, memory, and bandwidth.

Staying Updated With Market Trends

Keeping up with market trends is vital for algorithmic trading success. Here are some expert recommendations:

- Subscribe to Financial News: Stay informed with the latest market news. Reliable news sources provide valuable insights.

- Use Trend Analysis Tools: Utilize tools that analyze market trends. These tools help identify profitable trading opportunities.

- Join Trading Communities: Engage with other traders in online forums. Share knowledge and learn from others’ experiences.

- Follow Market Influencers: Keep an eye on influential traders and analysts. Their insights can guide your trading decisions.

By following these advanced tips, you can enhance your trading algorithm platform’s performance and stay ahead in the market.

:max_bytes(150000):strip_icc()/Roboadvisor-roboadviser_final-9c0f2c35944e4da6aae8646a832069d1.png)

Credit: www.investopedia.com

Common Pitfalls To Avoid

Automating tasks with trading algorithm platforms can save time and increase efficiency. But it’s easy to make mistakes. Here are common pitfalls to avoid.

Overfitting

Overfitting happens when an algorithm is too closely tuned to past data. It performs well on historical data but poorly on new data. This can lead to unexpected losses.

To avoid overfitting, split your data into training and testing sets. Use the training data to build your model. Test it on the testing data. This helps ensure your model generalizes well to new data.

Additionally, use cross-validation techniques. These methods help in assessing how the results will generalize to an independent dataset. This is essential for robust model performance.

Ignoring Market Conditions

Market conditions can change rapidly. Algorithms that do not adapt will become obsolete. Ignoring market conditions can result in missed opportunities and losses.

Monitor market trends regularly. Update your algorithms to reflect current market conditions. This ensures your strategies remain effective and relevant.

Consider incorporating macroeconomic indicators into your algorithms. This can help in making more informed decisions. Key indicators include interest rates, inflation, and employment data.

Always backtest your strategies under different market conditions. This will help you identify potential weaknesses. Adjust your algorithms accordingly.

Future Of Trading Algorithms

The future of trading algorithms looks bright. With advancements in technology, trading algorithms are becoming smarter and faster. They are changing the way we trade in the financial markets. Many traders are now using these advanced algorithms to automate their trading tasks.

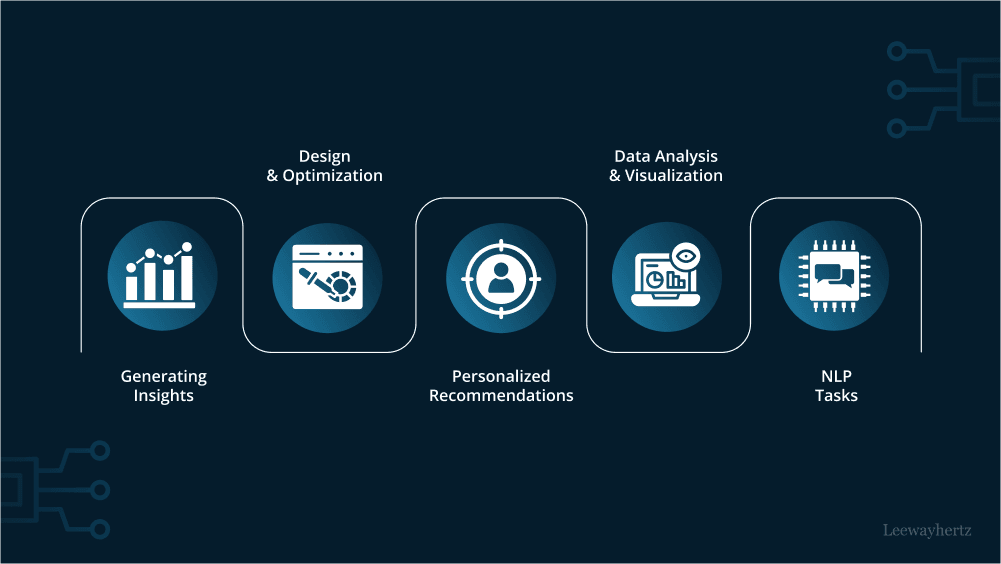

Emerging Technologies

Emerging technologies are revolutionizing the trading world. One of the most promising technologies is Artificial Intelligence (AI). AI can process large amounts of data quickly. It can also identify patterns that humans might miss.

- Machine Learning: This technology helps algorithms learn from past data and improve over time.

- Blockchain: Ensures secure and transparent transactions.

- Quantum Computing: Offers immense processing power, making algorithms even faster.

These technologies are making trading algorithms more efficient and reliable. They can analyze market trends in real-time and make decisions faster than ever before.

Predictions

The future of trading algorithms is full of exciting possibilities. Here are some predictions for the coming years:

- Increased use of AI-driven algorithms in trading.

- Greater adoption of blockchain technology for secure trading.

- More personalized trading strategies using machine learning.

- Expansion of quantum computing in algorithm development.

As these technologies continue to evolve, the trading landscape will transform. Traders will rely more on automated systems to make informed decisions. This will lead to more efficient and profitable trading strategies.

Frequently Asked Questions

What Is A Trading Algorithm Platform?

A trading algorithm platform is a software that automates trading tasks. It uses algorithms to execute trades based on predefined criteria.

How Do Trading Algorithms Work?

Trading algorithms analyze market data and make trading decisions. They execute trades automatically based on set rules and conditions.

Why Use Trading Algorithms?

Trading algorithms can execute trades faster than humans. They reduce emotional decision-making and improve efficiency and accuracy in trading.

Can Beginners Use Trading Algorithms?

Yes, beginners can use trading algorithms. Many platforms offer user-friendly interfaces and pre-built algorithms to get started easily.

Conclusion

Automating tasks with trading algorithm platforms boosts efficiency. It saves time and reduces errors. You can focus on strategy and analysis. Trading becomes smoother and more profitable. Embrace technology for better trading success. Start automating your trading tasks today. Your future self will thank you.