There are several trading algorithm platform alternatives. They offer various features for traders.

Traders seek reliable platforms for automated trading. Different platforms cater to various needs and skill levels. Some popular options include MetaTrader, QuantConnect, and TradingView. MetaTrader is well-known for its user-friendly interface and extensive features. QuantConnect offers powerful algorithmic trading capabilities for more advanced users.

TradingView provides excellent charting tools and community insights. Each platform has unique strengths that benefit different trading styles. Researching and testing these platforms helps traders find the best fit. Choosing the right platform can enhance trading efficiency and success.

Credit: fundyourfx.com

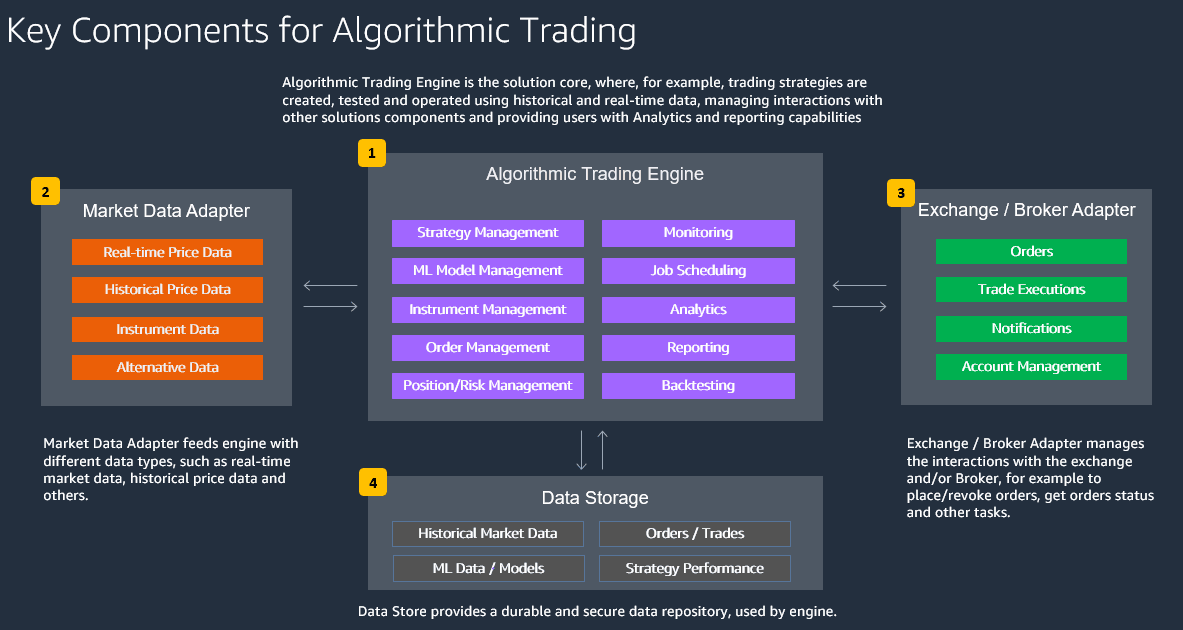

Introduction To Trading Algorithms

Trading algorithms have revolutionized the financial markets. They allow traders to execute orders at speeds and frequencies impossible for a human trader. This section will explore the basics of trading algorithms and their significance in modern trading.

What Are Trading Algorithms?

Trading algorithms are a set of rules and instructions. They are used to automate trading processes. These algorithms can analyze market data and make trading decisions. They can execute trades automatically based on predefined criteria.

Some common types of trading algorithms include:

- Trend-following algorithms: These identify and follow market trends.

- Arbitrage algorithms: These exploit price differences between markets.

- Market-making algorithms: These provide liquidity to the markets.

Importance In Modern Trading

Trading algorithms play a crucial role in modern trading. They ensure high-speed, high-frequency trading that human traders can’t match. These algorithms can analyze vast amounts of data quickly and efficiently.

Here are some key benefits:

| Benefit | Description |

|---|---|

| Speed | Algorithms execute trades in milliseconds. |

| Accuracy | They reduce human error in trading decisions. |

| Consistency | Algorithms follow predefined rules without emotional influence. |

In summary, trading algorithms have become essential. They help traders stay competitive in the fast-paced financial markets.

Credit: www.etp-logistics.eu

Key Features To Look For

Choosing the right trading algorithm platform is crucial for success. Each platform offers unique features. Here are key features you should consider.

Customization Options

Customization options allow users to tailor algorithms to their needs. This feature provides flexibility and control. Look for platforms that offer:

- Customizable indicators

- Adjustable risk parameters

- Personalized dashboards

- User-friendly interfaces

These elements ensure the platform fits your trading style. A customizable platform adapts to changing market conditions.

Backtesting Capabilities

Backtesting capabilities let traders test strategies on past data. This helps in assessing performance. Important aspects include:

| Feature | Description |

|---|---|

| Historical Data Access | Provides data for testing strategies |

| Simulation Tools | Allows running strategies in simulated environments |

| Performance Metrics | Displays success rates and returns |

Backtesting helps refine and improve trading algorithms. It reduces risks and increases confidence in strategies.

Top Trading Algorithm Platforms

Finding the best trading algorithm platform can be challenging. Each platform offers unique features that cater to different trading styles and requirements. Below, we explore two top platforms known for their reliability and advanced tools.

Platform A

Platform A is well-known for its user-friendly interface. It offers a variety of tools suitable for both beginners and experienced traders.

- Advanced Charting: Provides detailed charts and technical indicators.

- Backtesting: Allows users to test strategies using historical data.

- Automation: Supports automated trading with customizable algorithms.

Platform A also supports multiple asset classes, including stocks, forex, and cryptocurrencies. This makes it versatile for traders looking to diversify their portfolios.

| Feature | Description |

|---|---|

| Advanced Charting | Detailed charts with technical indicators. |

| Backtesting | Test strategies using historical data. |

| Automation | Customizable automated trading algorithms. |

Platform B

Platform B is renowned for its robust security features and high-speed execution.

- High-Speed Execution: Executes trades rapidly to minimize slippage.

- Enhanced Security: Implements top-notch security protocols to protect user data.

- Customizable Interface: Allows users to personalize their trading dashboard.

Platform B also offers excellent customer support, ensuring users can get assistance whenever needed.

| Feature | Description |

|---|---|

| High-Speed Execution | Rapid trade execution to minimize slippage. |

| Enhanced Security | Top-notch security protocols to protect user data. |

| Customizable Interface | Personalize your trading dashboard. |

Platform A: Features And Benefits

Platform A is a powerful trading algorithm platform. It offers many features to help traders succeed. Let’s explore its key features and benefits.

User Interface

The user interface is simple and intuitive. Users can easily navigate through the platform. The dashboard provides real-time data. This helps traders make quick decisions.

Customizable charts and graphs allow users to tailor their view. This makes it easier to analyze market trends. Widgets can be added or removed based on user preference.

| Feature | Benefit |

|---|---|

| Real-time data | Quick decision-making |

| Customizable charts | Personalized analysis |

| Intuitive navigation | Ease of use |

Performance Metrics

Performance metrics are crucial for traders. Platform A provides detailed metrics to evaluate trading strategies. This helps in optimizing performance.

The platform offers backtesting tools. These tools simulate trades based on historical data. Traders can see potential outcomes before real-time execution.

- Detailed performance reports

- Backtesting tools

- Real-time performance tracking

Users can also set alerts for key performance indicators. This ensures they stay informed about significant changes.

Platform B: Features And Benefits

Platform B offers a wide range of features and benefits. It aims to enhance your trading experience. Let’s explore the key features and benefits of Platform B.

User Interface

The User Interface of Platform B is user-friendly. It is designed for both beginners and experts. The interface offers easy navigation. Users can find tools and features quickly.

- Clean Layout: The platform has a clean layout.

- Customizable Dashboard: Users can personalize their dashboard.

- Dark Mode: The platform offers a dark mode option.

These features make the platform visually appealing. They also improve usability.

Performance Metrics

Platform B provides detailed Performance Metrics. These metrics help users track their trades. They also help improve trading strategies.

| Metric | Description |

|---|---|

| Win Rate | Shows the percentage of successful trades. |

| Average Return | Indicates the average profit per trade. |

| Drawdown | Measures the peak-to-trough decline during a trade. |

These metrics provide valuable insights. They help traders make informed decisions. The detailed performance metrics enhance the overall trading experience.

Credit: aiscout.net

Comparing Platforms

Choosing the right trading algorithm platform is crucial. Different platforms offer various features. Below, we compare these platforms based on cost and user experience.

Cost Analysis

Understanding the cost is essential. Here is a table comparing the monthly fees of popular trading algorithm platforms:

| Platform | Monthly Fee | Transaction Fee |

|---|---|---|

| Platform A | $50 | 0.1% |

| Platform B | $30 | 0.15% |

| Platform C | $70 | 0.05% |

Platform A is the most expensive. Platform B is the cheapest option. Platform C offers the lowest transaction fee.

User Experience

User experience can make or break your trading. Here are some key points:

- Platform A: Intuitive interface, suitable for beginners.

- Platform B: Offers advanced tools, ideal for experienced traders.

- Platform C: Customizable dashboard, great for technical analysis.

Platform A has an easy-to-use design. Platform B provides advanced features. Platform C allows high customization.

Consider your needs. Pick the platform that matches your requirements. A good user experience can enhance your trading efficiency.

Security And Compliance

Trading algorithm platforms must prioritize security and compliance. These factors ensure user trust and legal operation. Let’s explore the key aspects under this topic.

Data Protection

Data protection involves safeguarding sensitive information. Trading platforms must use strong encryption methods.

- Encryption: Protects data from unauthorized access.

- Secure Servers: Store data in protected environments.

- Regular Audits: Ensure systems meet security standards.

Platforms should also implement multi-factor authentication. This adds an extra layer of security for users.

Regulatory Adherence

Regulatory adherence ensures platforms follow legal standards. They must comply with financial regulations.

- Licensing: Platforms must have proper licenses to operate.

- Reporting: Regularly report activities to regulatory bodies.

- Compliance Checks: Regular checks to ensure adherence to laws.

Adhering to regulations helps avoid legal issues and fines. It also builds user trust in the platform.

Future Trends In Trading Algorithms

The future of trading algorithms is exciting. With rapid advancements, new trends are emerging. These trends promise to change the way we trade. Let’s explore some of these exciting trends.

Ai And Machine Learning

AI and Machine Learning are changing trading algorithms. These technologies help in making better decisions. They analyze large amounts of data quickly. This helps in spotting trends and patterns.

AI can predict market movements. This makes trading more profitable. Machine Learning helps in improving these predictions over time. The more data it processes, the better it becomes.

Here is a table showing the benefits of AI and Machine Learning in trading:

| Benefits | Description |

|---|---|

| Speed | Processes data faster than humans. |

| Accuracy | Reduces errors in decision-making. |

| Adaptability | Learns and improves over time. |

Increasing Accessibility

Trading algorithms are becoming more accessible. This is great news for small traders. More platforms are offering these tools. This helps in leveling the playing field.

Open-source software is one reason for this accessibility. These tools are free to use. They provide powerful features without high costs. Here are some popular open-source trading platforms:

- QuantConnect

- Zipline

- Backtrader

Cloud computing also plays a role. It offers scalable solutions. Small traders can now use powerful systems. This was once only available to big companies.

Accessibility is key in the future of trading algorithms. It empowers more people to participate. This leads to a more diverse trading environment.

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software solutions for creating, testing, and deploying automated trading strategies. They help traders execute trades based on predefined criteria.

Why Use Trading Algorithm Platforms?

Trading algorithm platforms offer speed, precision, and efficiency. They reduce human error and allow for backtesting strategies.

Which Trading Algorithm Platforms Are Popular?

Popular trading algorithm platforms include MetaTrader, QuantConnect, and NinjaTrader. They offer various tools for strategy development and execution.

How To Choose A Trading Algorithm Platform?

Consider factors like ease of use, supported markets, customization options, and cost. Evaluate each platform’s features and user reviews.

Conclusion

Exploring trading algorithm platform alternatives can boost your trading success. Each platform has unique features to fit different needs. Evaluate options based on your goals and skills. Choose a platform that offers good support and resources. This will help you trade smarter and more effectively.

Happy trading!