Trading algorithm platforms integration offers efficiency and precision in trading. It reduces human error and optimizes trading strategies.

Integrating trading algorithm platforms can revolutionize your trading experience. These platforms use advanced algorithms to execute trades swiftly and accurately. This automation saves time and minimizes the risk of errors. Traders can focus on strategy rather than manual operations. The efficiency of algorithmic trading can lead to better returns and a competitive edge.

With real-time data analysis, traders can make informed decisions quickly. This integration is essential for staying ahead in the fast-paced trading environment. Whether you are a seasoned trader or a beginner, using algorithm platforms can enhance your trading success.

Introduction To Trading Algorithms

Trading algorithms have revolutionized the financial markets. They offer traders a way to automate their strategies and decisions. These algorithms use complex mathematical models to analyze market data. This results in faster and more efficient trading.

Integrating trading algorithm platforms provides numerous benefits. These include increased speed, accuracy, and the ability to handle large volumes of trades. Let’s explore more about trading algorithms and their history.

What Are Trading Algorithms?

Trading algorithms are computer programs. They use predefined rules to execute trades. These rules are based on variables like timing, price, and volume. The goal is to make profitable trading decisions.

Traders use these algorithms to remove human emotions from trading. They rely on data and statistical analysis instead. This results in consistent and disciplined trading.

History Of Algorithmic Trading

Algorithmic trading began in the 1970s. During this time, exchanges started to use electronic trading systems. These systems replaced manual trading floors.

In the 1980s, large financial firms developed automated trading systems. They were used to handle large volumes of trades efficiently.

By the 2000s, algorithmic trading became widespread. This was due to advancements in technology and increased market competition. Today, it accounts for a significant portion of trading volume worldwide.

Credit: aws.amazon.com

Efficiency And Speed

Integrating trading algorithm platforms brings remarkable efficiency and speed. Traders benefit from rapid trade execution and reduced latency. This ensures that their trading strategies are executed swiftly and precisely.

Faster Trade Execution

With trading algorithm platforms, trades are executed in milliseconds. Algorithms analyze market data and execute trades instantly. This speed is crucial in volatile markets. Traders can capitalize on fleeting opportunities. Human traders cannot match this speed.

Reduced Latency

Latency is the delay between a trade order and its execution. Trading algorithms minimize this delay. The integration of advanced algorithms reduces latency significantly. This ensures that trades are executed at the best possible prices. Reduced latency leads to better trade outcomes and increased profits.

Accuracy And Precision

Trading algorithm platforms have transformed the way traders operate. These platforms provide unparalleled accuracy and precision, essential for effective trading. Integrating these systems offers numerous benefits that enhance trading outcomes.

Minimizing Human Error

Human errors in trading can be costly. Fat fingers, emotional decisions, and miscalculations often lead to losses. Trading algorithm platforms significantly reduce human error. The algorithms execute trades based on pre-set rules. This ensures trades are accurate and timely.

Consider a scenario where a trader manually enters a trade. They might accidentally add an extra zero, turning a 100-share order into a 1,000-share order. An algorithm eliminates such risks, trading only what is programmed.

Here is a comparison of manual trading vs algorithm trading:

| Manual Trading | Algorithm Trading |

|---|---|

| Prone to errors | Minimizes errors |

| Emotion-driven | Rule-based |

| Inconsistent execution | Consistent execution |

Consistent Performance

Consistency is crucial in trading. Human traders may have off days. Algorithms perform consistently, regardless of market conditions. They follow the set parameters without deviation, ensuring steady performance.

Algorithms can handle large volumes of data at high speed. This allows them to execute trades faster than humans. A consistent approach improves overall trading performance.

Here are the benefits of consistent performance:

- Reliable trade execution

- Reduced risk of large losses

- Improved profitability over time

In summary, trading algorithm platforms offer significant advantages. They enhance accuracy and precision, minimize human error, and ensure consistent performance.

Cost Reduction

Integrating trading algorithm platforms offers significant cost reduction benefits. These platforms streamline processes, reducing expenses and boosting profitability.

Lower Transaction Costs

Trading algorithms can execute trades more efficiently. This results in lower transaction costs compared to manual trading. Algorithms can analyze market data quickly. They place trades at optimal times. This reduces the spread and other associated fees.

A study showed that algorithmic trading can cut costs by up to 50%. This saving is crucial for high-frequency traders. Lower costs directly increase profit margins.

Reduced Need For Manual Intervention

Automated trading reduces the need for manual intervention. This means fewer human errors and less labor cost. Traders can focus on strategy and analysis. The algorithm handles the execution.

With algorithms, trades are executed based on pre-set rules. This ensures consistency and reliability. Reduced manual intervention also means lower staffing costs. Companies can allocate resources more efficiently.

| Benefit | Details |

|---|---|

| Lower Transaction Costs | Efficient trade execution, reduced fees, higher profit margins |

| Reduced Manual Intervention | Fewer errors, lower labor costs, resource efficiency |

Market Analysis

Market analysis is crucial in trading. Integrating trading algorithm platforms can enhance it. These platforms offer tools for better market insights.

Real-time Data Processing

Real-time data processing is key. Trading algorithms analyze data instantly. This allows traders to react quickly. They can make decisions based on current market trends.

Here are some benefits of real-time data processing:

- Up-to-date information on market changes

- Immediate response to market fluctuations

- Enhanced decision-making speed

- Reduced risk of outdated information

Advanced Analytical Tools

Advanced analytical tools provide deeper market insights. These tools help in identifying patterns. They also predict future trends accurately.

Some benefits of advanced analytical tools include:

- Accurate market trend predictions

- Identifying profitable trading opportunities

- Reducing human error in analysis

- Enhancing overall trading strategy

Here is a quick comparison of manual analysis vs. algorithmic analysis:

| Aspect | Manual Analysis | Algorithmic Analysis |

|---|---|---|

| Speed | Slow | Fast |

| Accuracy | Variable | High |

| Consistency | Low | High |

| Scalability | Limited | Unlimited |

Integrating these tools can revolutionize trading. They provide a competitive edge. Traders gain a better understanding of the market.

Risk Management

Effective risk management is crucial in trading. Trading algorithm platforms can help manage risks. They offer advanced tools and automated features. These tools ensure traders can minimize losses and protect investments.

Automated Risk Controls

Trading algorithms use automated risk controls. These controls help manage risks efficiently. They can monitor market conditions in real-time. Based on pre-set rules, they can execute trades or halt them. This automation reduces the chance of human error. It ensures decisions are made quickly and accurately.

- Real-time market monitoring

- Pre-set trading rules

- Quick and accurate decisions

Diversification Strategies

Diversification strategies help spread investments. They reduce the impact of a single loss. Algorithm platforms can handle multiple assets. This makes it easier to diversify. They can also adjust portfolios automatically based on market changes. This keeps investments balanced and reduces risk.

- Spread investments across different assets

- Reduce impact of individual losses

- Automatic portfolio adjustments

| Benefit | Description |

|---|---|

| Automated Risk Controls | Monitor markets and execute trades based on rules |

| Diversification Strategies | Spread investments to reduce risk |

Scalability

Scalability is one of the key benefits of trading algorithm platforms. It allows traders to manage more tasks with ease. Let’s explore how these platforms handle large volumes and adapt to market changes.

Handling Large Volumes

Trading algorithm platforms can process huge amounts of data. They handle thousands of transactions per second. This speed is impossible for humans to match. It ensures no opportunity is missed. The platforms also reduce human errors.

The platforms use advanced technologies. These include machine learning and artificial intelligence. They analyze data quickly. This enables traders to make informed decisions faster. The platforms also provide real-time updates. This helps in making timely trades.

Adapting To Market Changes

The market is always changing. Trading algorithm platforms adapt quickly. They use algorithms to predict changes. This helps traders stay ahead. The platforms also offer automated trading. This means trades are made without human intervention. It saves time and effort.

These platforms constantly learn from the market. They adjust their strategies accordingly. This improves the chances of success. The platforms also provide insights and analytics. This helps traders understand market trends better.

In summary, scalability in trading algorithm platforms helps in handling large volumes and adapting to market changes. This leads to better trading outcomes.

Credit: www.mdpi.com

Future Trends

Trading algorithm platforms are evolving rapidly. Future trends are shaping the landscape. These trends promise more efficiency and accuracy. Let’s explore some exciting developments.

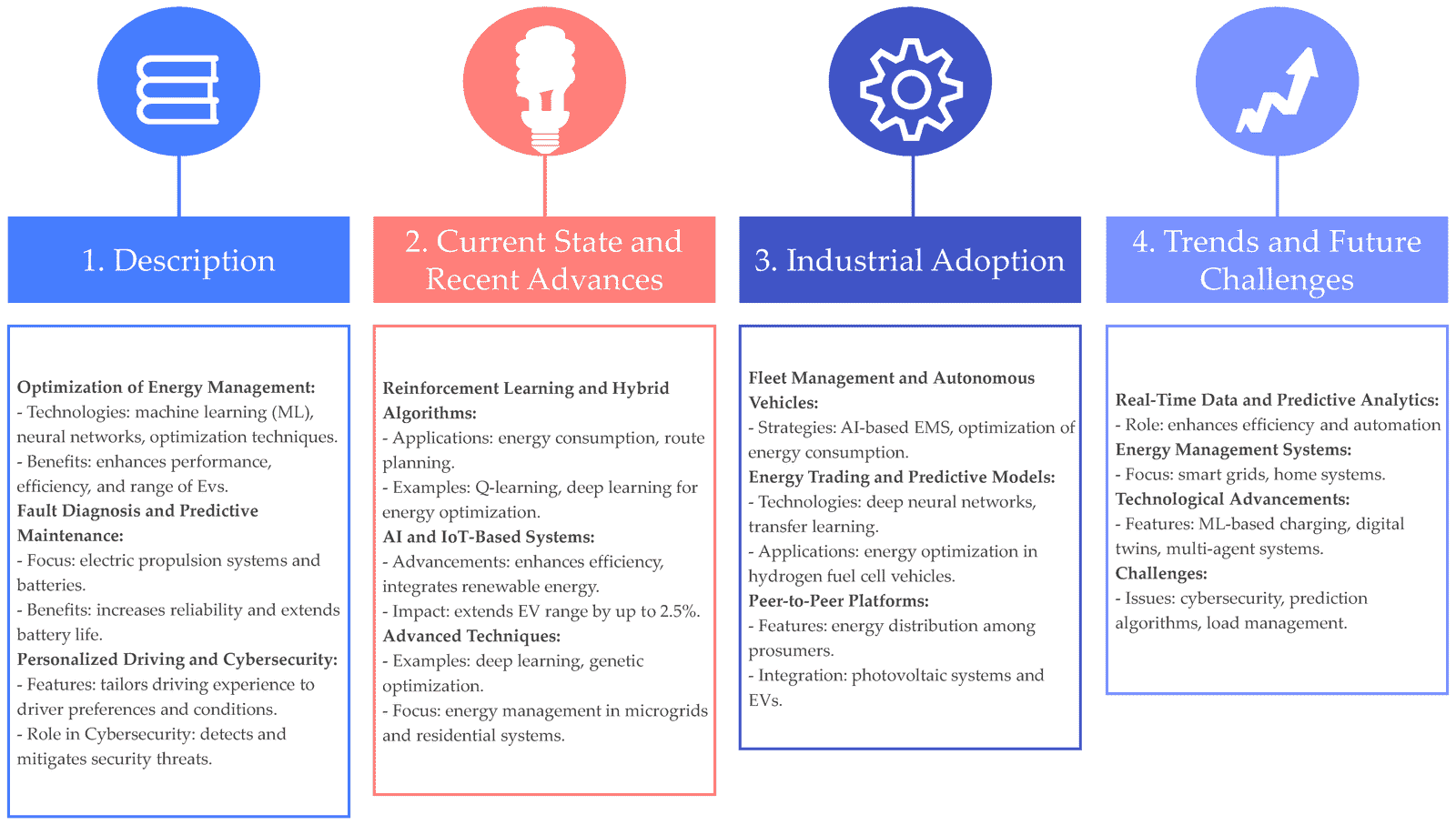

Artificial Intelligence Integration

Artificial Intelligence (AI) is transforming trading algorithms. AI can analyze vast datasets quickly. It helps in making informed decisions. AI integration enhances predictive analytics. This leads to better trading outcomes.

AI uses machine learning to adapt over time. It learns from historical data. This continuous learning improves trading strategies. AI-driven algorithms can identify patterns and trends. This increases the chances of profitable trades.

Key benefits of AI integration:

- Improved data analysis

- Enhanced predictive accuracy

- Adaptive learning and evolution

Blockchain And Trading Algorithms

Blockchain technology is revolutionizing trading algorithms. It provides transparency and security. Blockchain ensures immutable records of transactions. This builds trust among traders.

Blockchain enables smart contracts. These contracts execute automatically when conditions are met. This reduces the need for intermediaries. It leads to faster and cost-effective trades.

Benefits of blockchain in trading:

| Benefit | Description |

|---|---|

| Transparency | Clear and verifiable transaction records |

| Security | Protection against fraud and tampering |

| Automation | Smart contracts for seamless execution |

Integration of blockchain with trading algorithms ensures a robust trading environment. It combines the best of both technologies.

Credit: www.mdpi.com

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software solutions that automate trading decisions. They use predefined algorithms to execute trades based on market data.

How Do Algorithm Platforms Benefit Traders?

Algorithm platforms provide speed, efficiency, and accuracy. They minimize human error, analyze vast data sets, and execute trades quickly.

Can Trading Algorithms Reduce Trading Risks?

Yes, trading algorithms can reduce risks by eliminating emotional trading. They follow predefined rules and respond to market changes promptly.

Are Algorithm Platforms Suitable For Beginners?

Yes, many platforms offer user-friendly interfaces. Beginners can start with basic strategies and gradually explore advanced features.

Conclusion

Trading algorithm platforms provide numerous benefits. They enhance efficiency and reduce errors. These platforms also offer better market insights. Integration simplifies trading processes. Embrace this technology for improved trading results. It’s a smart move for any trader.