The best trading algorithm platforms tools include MetaTrader, TradingView, and QuantConnect. These tools offer advanced features and user-friendly interfaces for traders.

Trading algorithm platforms are essential for modern traders. They automate trading strategies and analyze market data. MetaTrader is popular for its robust features and ease of use. TradingView offers powerful charting tools and social trading features. QuantConnect provides an open-source platform for algorithmic trading.

These tools help traders make informed decisions and execute trades efficiently. They support various financial instruments and markets. With these platforms, traders can backtest strategies and optimize performance. Choosing the right tool can significantly enhance trading success.

Criteria For Selecting Platforms

Choosing the right trading algorithm platform is crucial. It impacts your trading success. Many factors should guide your decision. Here are key criteria to consider.

User-friendly Interface

A user-friendly interface makes trading easier. Look for platforms with intuitive designs. They should have clear navigation. Beginners should find it easy to use. Advanced traders should find detailed features.

Consider the following points:

- Simple and clean layout

- Easy access to tools and features

- Customizable dashboards

Security Features

Security features are essential for trading platforms. Your data and funds must be safe. Look for platforms with robust security protocols.

Key security features include:

| Feature | Description |

|---|---|

| Encryption | Protects your data from unauthorized access |

| Two-Factor Authentication (2FA) | Provides an extra layer of security |

| Regular Security Audits | Ensures the platform’s security measures are up-to-date |

:max_bytes(150000):strip_icc()/TopTechnicalAnalysisToolsforTraders-aa97055927804dfba26766f3eccfffb1.jpg)

Credit: www.investopedia.com

Top Trading Algorithm Platforms

Finding the best trading algorithm platforms can be challenging. These platforms help traders automate their strategies. Here, we explore the top trading algorithm platforms.

Platform 1 Overview

Platform 1 is known for its user-friendly interface. It offers a range of features for both beginners and experts.

- Backtesting: Test your strategies using historical data.

- Customization: Customize your trading algorithms easily.

- Integration: Integrates well with various brokers and exchanges.

The platform also provides educational resources. These resources help users understand algorithmic trading better.

Platform 2 Overview

Platform 2 is highly regarded for its advanced analytics. It caters to professional traders who need detailed insights.

- Real-time Data: Access to real-time market data.

- High-Speed Execution: Execute trades at lightning speed.

- Security: Offers top-notch security features to protect your data.

Traders can also benefit from its community forums. These forums provide a platform for sharing strategies and insights.

| Feature | Platform 1 | Platform 2 |

|---|---|---|

| Backtesting | Yes | Limited |

| Customization | Extensive | Moderate |

| Real-time Data | No | Yes |

| Security | Basic | Advanced |

Both platforms have their unique advantages. Choose the one that suits your needs best.

Platform Comparison

Choosing the best trading algorithm platform can be tricky. This section will help you compare the top platforms. We will look at Performance Metrics and Cost Analysis.

Performance Metrics

Performance metrics are crucial for evaluating trading platforms. Here are some key metrics to consider:

- Execution Speed: Faster execution can mean better trades.

- Accuracy: High accuracy reduces risk and increases profits.

- Backtesting: Good platforms offer thorough backtesting features.

- Risk Management: Effective risk management tools protect your investments.

| Platform | Execution Speed | Accuracy | Backtesting | Risk Management |

|---|---|---|---|---|

| Platform A | Very Fast | 98% | Excellent | Advanced |

| Platform B | Fast | 95% | Good | Basic |

| Platform C | Moderate | 90% | Average | Intermediate |

Cost Analysis

Cost is another important factor to consider. Here are some cost-related points:

- Subscription Fees: Monthly or yearly fees can add up.

- Transaction Fees: Look for platforms with low transaction fees.

- Hidden Costs: Be aware of any hidden charges.

- Free Trials: Some platforms offer free trials to test their features.

| Platform | Subscription Fees | Transaction Fees | Hidden Costs | Free Trials |

|---|---|---|---|---|

| Platform A | $30/month | 0.1% | None | Yes |

| Platform B | $20/month | 0.2% | Few | No |

| Platform C | $25/month | 0.15% | Some | Yes |

By comparing these metrics and costs, you can choose the best trading algorithm platform for your needs.

Essential Tools For Algorithmic Trading

Algorithmic trading relies heavily on technology and tools. These tools help traders make quick decisions. The right tools can give an edge in the market. Here, we will explore essential tools for algorithmic trading. These tools are crucial for backtesting and real-time data analysis.

Backtesting Tools

Backtesting tools are vital for traders. These tools help test strategies using historical data. They show how a strategy would have performed in the past. This helps refine and improve trading strategies before using real money.

Popular backtesting tools include:

- QuantConnect: Supports multiple languages and offers extensive data libraries.

- MetaTrader 5: Provides built-in backtesting capabilities and a wide range of technical indicators.

- Amibroker: Known for its speed and flexibility in testing trading systems.

Real-time Data Tools

Real-time data tools are crucial. They provide up-to-the-minute market data. This data is essential for making informed trading decisions.

Key real-time data tools include:

- TradingView: Offers real-time data, charting tools, and social features.

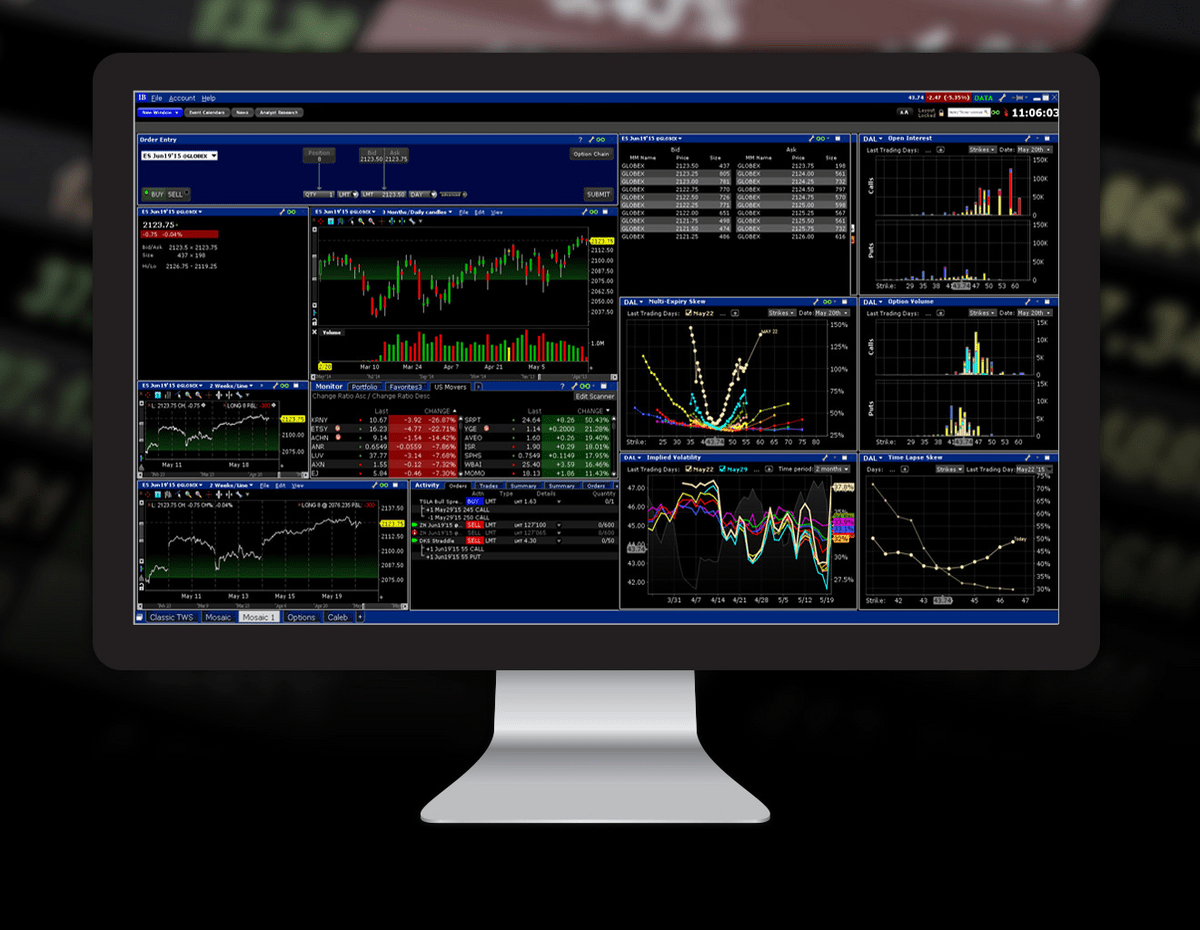

- Interactive Brokers: Provides comprehensive real-time data and analysis tools.

- Alpha Vantage: Delivers real-time and historical market data through easy-to-use APIs.

Advanced Features To Look For

Choosing the best trading algorithm platform can be challenging. Knowing which advanced features to look for can help. This section explores the most critical features.

Ai And Machine Learning Integration

AI and Machine Learning are game changers in trading. These technologies can analyze vast amounts of data quickly. They can make predictions based on historical data. This can help traders make smarter decisions.

Look for platforms that use AI to identify patterns. Machine Learning can adapt to new data. This helps in refining trading strategies over time. These features can give you a competitive edge.

Customizable Algorithms

Customization is key in trading. Customizable Algorithms allow traders to tailor strategies. This flexibility can suit different trading styles and goals. Some platforms offer a drag-and-drop interface. This makes it easy to build and modify algorithms.

Look for features that allow backtesting. Backtesting helps in evaluating the performance of your strategies. You can test them against historical data. This can reduce risks and improve profitability.

| Feature | Benefits |

|---|---|

| AI and Machine Learning | Quick data analysis, smarter decisions, pattern identification |

| Customizable Algorithms | Tailored strategies, backtesting, risk reduction |

These advanced features can significantly impact your trading success. Choose a platform that offers these tools.

User Reviews And Testimonials

Choosing the best trading algorithm platform can be tough. User reviews and testimonials help make the decision easier. They give real insights from people who have used these tools.

Success Stories

Many users share their success stories. These stories highlight how the platform changed their trading experience.

- Jane D.: “I doubled my investment in three months with this tool!”

- Mike P.: “The algorithm helped me make smarter trades every day.”

- Sarah L.: “I was a beginner, but now I trade like a pro.”

These positive experiences show the power of the platform. They build trust for new users.

Common Complaints

Not all reviews are positive. Some users have faced issues with the platforms. Common complaints help identify potential problems.

| Complaint | Details |

|---|---|

| Slow Updates | “The platform sometimes lags during market peaks.” |

| Complex Interface | “It’s hard to navigate for beginners.” |

| High Fees | “Transaction fees can be high for small traders.” |

Understanding these complaints helps users make informed choices. They can weigh the pros and cons before committing.

Future Of Trading Algorithms

Trading algorithms have revolutionized the financial markets. They offer automation, speed, and efficiency. The future of trading algorithms is bright and promising. This post explores the significant trends and changes ahead.

Technological Advancements

Technology is evolving at a rapid pace. New innovations are transforming trading algorithms. Artificial intelligence (AI) and machine learning (ML) are leading the way. They help algorithms learn and adapt quickly. This enhances accuracy and performance.

Quantum computing is another game-changer. It processes vast amounts of data in seconds. This boosts the speed of trading algorithms. Blockchain technology is also making waves. It offers transparency and security in transactions.

Below is a table summarizing key technological advancements:

| Technological Advancement | Impact on Trading Algorithms |

|---|---|

| Artificial Intelligence | Improves learning and adaptability |

| Machine Learning | Enhances accuracy and performance |

| Quantum Computing | Processes data at unprecedented speeds |

| Blockchain Technology | Ensures transparency and security |

Regulatory Changes

Regulations are crucial in shaping the future of trading algorithms. Governments are focusing on transparency and accountability. New regulations ensure fair play in financial markets. They aim to prevent market manipulation and fraud.

Regulatory bodies are setting new standards. These include stricter compliance requirements. Firms must adhere to these standards. This ensures the integrity of trading algorithms.

Key regulatory changes include:

- Enhanced compliance requirements

- Increased transparency in transactions

- Stricter oversight on algorithmic trading

- Provisions to prevent market manipulation

These changes are shaping a better future for trading algorithms. It ensures a fair and transparent trading environment.

Credit: www.reyazat.com

Credit: www.wallstreetzen.com

Frequently Asked Questions

What Are The Top Trading Algorithm Platforms?

The top trading algorithm platforms include MetaTrader, QuantConnect, TradeStation, AlgoTrader, and NinjaTrader. These platforms offer robust tools for backtesting and execution.

How Do Trading Algorithms Work?

Trading algorithms use mathematical models to analyze market data. They execute trades based on predefined criteria, eliminating human emotion.

Are Trading Algorithm Platforms Secure?

Yes, reputable trading algorithm platforms prioritize security. They use encryption, secure APIs, and regular updates to protect user data and transactions.

Can Beginners Use Trading Algorithm Tools?

Yes, many platforms offer beginner-friendly features. They provide tutorials, templates, and support to help novices get started with algorithmic trading.

Conclusion

Choosing the best trading algorithm platform is crucial. It can boost your profits. Each platform has unique features. Find one that fits your needs. Start trading smarter today. Happy trading!