Best wealth management software tools include Personal Capital, Wealthfront, and Betterment. They offer robust features for effective financial planning.

Managing wealth is crucial for financial stability. Various software tools help in this process. Personal Capital tracks your assets and expenses. Wealthfront offers automated investment services. Betterment provides personalized financial advice. These tools simplify wealth management. They are user-friendly and offer detailed insights.

Users can monitor investments, plan for retirement, and set financial goals. The software helps in making informed decisions. Many have mobile apps for easy access. Choosing the right tool depends on personal needs. Explore these options to find the best fit.

Introduction To Wealth Management Software

Managing wealth can be complicated. Many people use wealth management software. These tools help manage finances. They track investments, plan budgets, and monitor spending. They make financial planning easier.

Wealth management software offers many features. These include portfolio tracking, tax calculation, and financial goal setting. These tools can simplify complex financial tasks. They help you make better financial decisions.

Importance Of Wealth Management

Managing wealth is important. It helps you grow your money. It ensures financial stability. Proper wealth management means better investment decisions. It helps you reach your financial goals.

Using software can make wealth management easier. It provides tools for tracking and planning. It offers insights into your financial health. This can help you make informed decisions.

Evolution Of Software Tools

Software tools have evolved over the years. Early tools were simple. They offered basic features like budgeting. Now, tools are more advanced. They provide detailed insights and analytics.

Today’s tools integrate with various financial institutions. They offer real-time data and updates. This helps in making timely decisions. The evolution of these tools has made wealth management more efficient.

| Feature | Early Tools | Modern Tools |

|---|---|---|

| Budgeting | Basic | Advanced |

| Portfolio Tracking | Limited | Detailed |

| Real-Time Data | No | Yes |

| Integration | Minimal | Extensive |

Key Features To Look For

Choosing the best wealth management software tools requires careful consideration. You need to ensure that the software meets specific criteria. Here are some key features to look for:

User-friendly Interface

A user-friendly interface is crucial. Users should be able to navigate the software easily. Look for a clean layout and intuitive design. This ensures that all users, regardless of their tech-savviness, can operate it smoothly.

- Simple navigation menus

- Clear icons and labels

- Customizable dashboards

Comprehensive Reporting

Accurate and detailed reporting is essential for wealth management. The software should offer comprehensive reporting features. This includes financial statements, performance analysis, and predictive analytics.

| Feature | Description |

|---|---|

| Financial Statements | Provides a summary of financial activities. |

| Performance Analysis | Analyzes the performance of investments. |

| Predictive Analytics | Forecasts future financial trends. |

Security And Compliance

Security and compliance are non-negotiable. The software must adhere to industry standards. It should protect sensitive financial data and comply with regulations.

- Encryption of data

- Regular security audits

- Compliance with GDPR, FINRA, and other regulations

Top Wealth Management Tools For 2024

As we step into 2024, the financial landscape evolves. Wealth management tools are more important than ever. The right software can streamline your financial planning and investment management. Here are the top wealth management tools to consider in 2024.

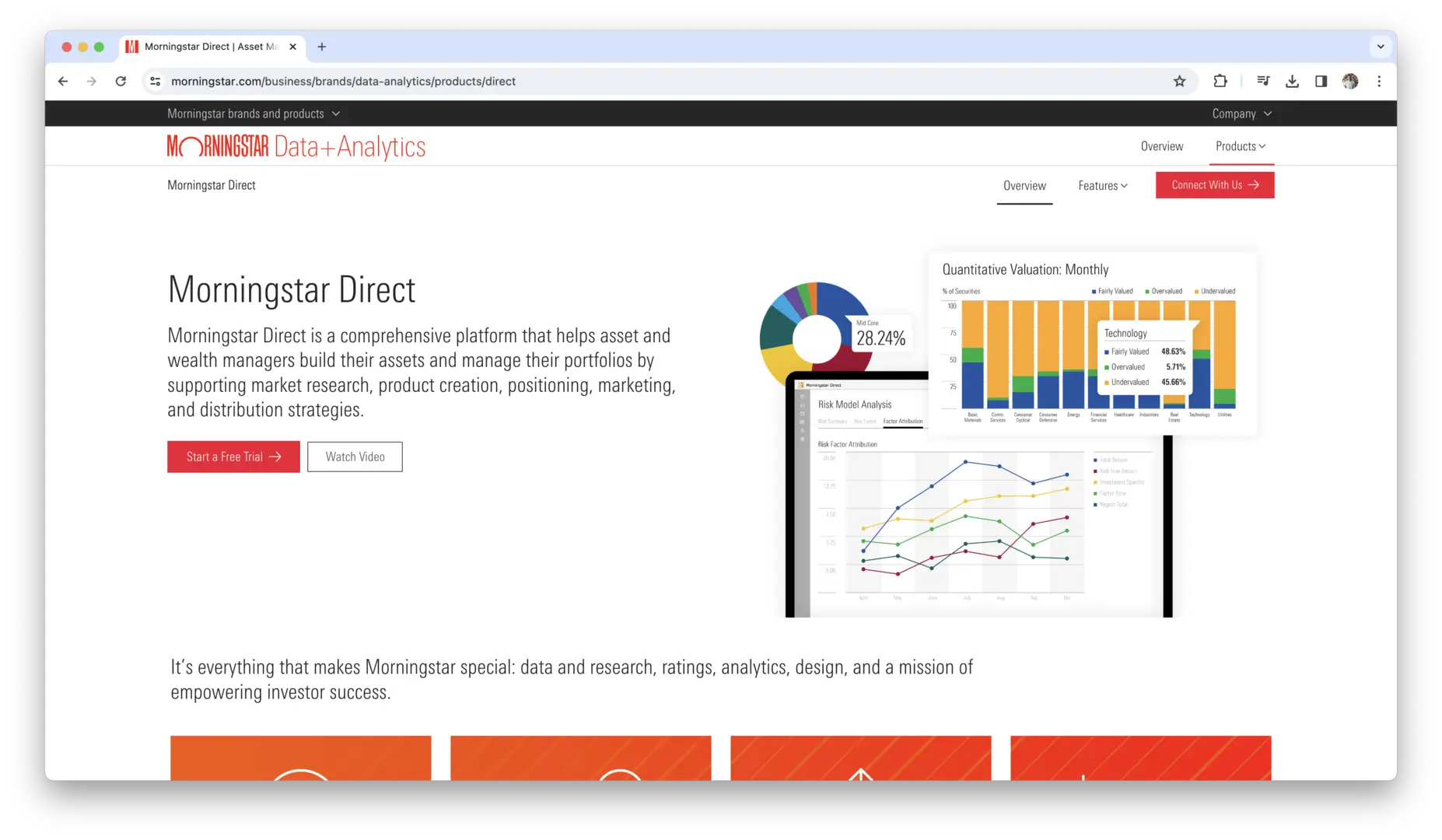

Tool 1: Overview And Features

Tool 1 is a comprehensive solution for wealth management. It offers a range of features designed to simplify financial planning.

- Real-time portfolio tracking: Keep track of your investments easily.

- Advanced analytics: Make informed decisions with detailed reports.

- Customizable dashboards: Tailor your view to your needs.

This tool also provides secure data encryption, ensuring your financial information is safe.

Tool 2: Overview And Features

Tool 2 stands out with its user-friendly interface and robust features. It caters to both novice and experienced users.

- Automated financial advice: Get tailored recommendations based on your profile.

- Goal tracking: Set and monitor financial goals effortlessly.

- Integration with other apps: Sync with your favorite financial apps.

With its intuitive design, Tool 2 makes wealth management accessible to everyone.

Tool 3: Overview And Features

Tool 3 is known for its powerful investment management capabilities. It provides a suite of tools for detailed portfolio analysis.

- Risk assessment: Understand the risks associated with your investments.

- Tax optimization: Maximize your returns by minimizing taxes.

- Comprehensive reporting: Generate detailed financial reports.

Tool 3 is ideal for those who seek in-depth analysis and strategic planning.

Credit: www.10xsheets.com

Comparison Of Top Tools

Choosing the best wealth management software tools can be a daunting task. Each tool offers unique features, pricing models, and customer support options. This section will help you compare the top tools to make an informed decision.

Pricing Models

Pricing is crucial when selecting wealth management software. Here’s a comparison of the pricing models for top tools:

| Tool | Free Trial | Subscription Model | One-time Fee |

|---|---|---|---|

| Tool A | Yes | Monthly/Yearly | No |

| Tool B | No | Monthly | Yes |

| Tool C | Yes | Yearly | No |

Unique Selling Points

Each tool has unique features that make it stand out. Here’s a breakdown:

- Tool A: AI-driven insights, real-time data analysis, and customizable dashboards.

- Tool B: Comprehensive financial planning, tax optimization, and risk management tools.

- Tool C: User-friendly interface, robust security features, and seamless integration with other software.

Customer Support

Customer support is vital for any software tool. Here’s how the top tools compare:

| Tool | Email Support | Phone Support | Live Chat | 24/7 Support |

|---|---|---|---|---|

| Tool A | Yes | Yes | No | Yes |

| Tool B | Yes | No | Yes | No |

| Tool C | Yes | Yes | Yes | Yes |

Benefits Of Using Wealth Management Software

Wealth management software tools have revolutionized the financial industry. They offer numerous benefits to both advisors and clients. These tools streamline processes, enhance decision-making, and reduce risks. Let’s explore some of the key benefits in detail.

Efficiency And Automation

Wealth management software improves efficiency through automation. Routine tasks are automated, saving time and reducing errors. Advisors can focus more on strategic planning. Clients receive timely and accurate reports. The software handles data entry, updates, and calculations automatically. This ensures consistency and reliability in financial management.

Enhanced Decision Making

Advanced analytics in wealth management software support better decision making. The software provides real-time data and insights. Advisors can analyze trends and market conditions quickly. Clients receive personalized investment recommendations. Historical data and projections help in making informed choices. This enhances portfolio performance and client satisfaction.

Risk Management

Risk management is crucial in wealth management. The software identifies potential risks and alerts advisors. It assesses market volatility and client risk profiles. Diversification strategies are suggested to mitigate risks. Advisors can monitor compliance and regulatory changes. This proactive approach ensures client portfolios are safeguarded.

Here is a quick summary of the benefits:

| Benefit | Description |

|---|---|

| Efficiency and Automation | Automates routine tasks, saves time, and reduces errors. |

| Enhanced Decision Making | Provides real-time data and personalized recommendations. |

| Risk Management | Identifies risks and suggests diversification strategies. |

Credit: www.robo-advisorfinder.com

Challenges And Limitations

Wealth management software tools offer significant benefits. But, they come with challenges and limitations. These issues are crucial to understand for effective use.

Data Privacy Concerns

Data privacy is a major concern. Wealth management software handles sensitive information. This includes personal and financial data. Protecting this data is crucial.

Software tools must comply with data protection laws. This includes GDPR and CCPA. Ensuring compliance is challenging and requires constant updates. Breaches in data security can lead to severe consequences. These include financial loss and loss of client trust.

Integration Issues

Integration with existing systems can be complex. Wealth management software must work with other tools. These tools include accounting software and CRM systems.

Integration issues can lead to data inconsistencies. This affects decision-making and client service. Ensuring seamless integration requires technical expertise. This can be costly and time-consuming.

Cost Implications

The cost of wealth management software is a significant factor. Initial setup and licensing fees can be high. Ongoing maintenance and updates add to the cost.

Small firms may find these costs prohibitive. They might struggle to justify the investment. Balancing cost and benefits is crucial for all firms.

| Challenge | Impact |

|---|---|

| Data Privacy Concerns | Potential breaches and compliance issues |

| Integration Issues | Data inconsistencies and technical difficulties |

| Cost Implications | High initial and ongoing expenses |

Future Trends In Wealth Management Software

The world of wealth management is evolving rapidly. New technologies are revolutionizing the way wealth is managed. To stay ahead, wealth managers must embrace these future trends. The following sections explore the key trends shaping the future of wealth management software.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning are transforming wealth management. These tools analyze large datasets with ease. They provide insights that help make informed decisions. AI-powered software can predict market trends accurately. This technology saves time and reduces human error.

- Automated Portfolio Management

- Risk Assessment

- Predictive Analytics

AI and Machine Learning offer personalized investment strategies. This customization improves client satisfaction. Wealth managers can offer tailored advice to each client.

Blockchain Technology

Blockchain Technology is gaining traction in wealth management. It ensures secure and transparent transactions. Blockchain reduces the risk of fraud. It also simplifies the process of record-keeping.

| Benefits | Description |

|---|---|

| Security | Immutable records ensure data integrity. |

| Transparency | Every transaction is traceable. |

| Efficiency | Reduces paperwork and speeds up processes. |

Blockchain also enables smart contracts. These automate and enforce contract terms. This reduces the need for intermediaries.

Personalization

Personalization is key in modern wealth management software. Clients expect tailored services. Software tools now offer personalized dashboards. These dashboards display relevant information for each client.

- Customized Investment Plans

- Personalized Financial Reports

- Adaptive User Interfaces

Personalization enhances the client experience. It builds trust and fosters long-term relationships. Wealth managers can meet unique client needs effectively.

Credit: www.10xsheets.com

Tips For Choosing The Right Tool

Selecting the best wealth management software tool can be challenging. With many options available, it’s crucial to choose one that fits your needs. Here are some essential tips to guide you in making the right decision.

Assessing Your Needs

First, identify what you need from a wealth management tool. Make a list of necessary features. Consider aspects like portfolio tracking, financial planning, and tax management. Think about the size of your investment portfolio and your financial goals. This will help you narrow down your options.

- Portfolio Tracking

- Financial Planning

- Tax Management

Discuss these needs with your financial advisor. They can provide insights and recommendations. Ensure the tool aligns with your financial strategy.

Trial And Feedback

Many software providers offer free trials. Use these trials to test the tool’s features. Pay attention to ease of use and user interface. Does the tool offer the functionalities you need?

- Sign up for a free trial

- Test all the features

- Evaluate ease of use

Gather feedback from current users. Look for reviews and testimonials. These can provide valuable insights into the tool’s performance and reliability.

Scalability And Flexibility

Choose a tool that can grow with your needs. Ensure it can handle an increasing number of investments. The tool should adapt to changing financial landscapes and regulations. Flexibility is key for long-term use.

Consider tools that offer customization options. This allows you to tailor the software to your specific needs. A scalable and flexible tool ensures you won’t outgrow it.

| Key Feature | Importance |

|---|---|

| Scalability | High |

| Flexibility | High |

By following these tips, you can select the best wealth management software tool. This ensures your financial management is efficient and effective.

Frequently Asked Questions

What Is Wealth Management Software?

Wealth management software helps manage investments, assets, and financial planning. It provides tools for portfolio management, risk assessment, and financial forecasting.

Why Use Wealth Management Software?

Wealth management software streamlines financial planning and investment management. It offers better insights, efficiency, and accuracy, helping achieve financial goals.

How To Choose The Best Wealth Management Software?

To choose the best software, consider features, user reviews, cost, and compatibility. Ensure it meets your specific financial needs.

Can Wealth Management Software Improve Financial Planning?

Yes, it improves financial planning by providing detailed analytics, forecasting, and personalized advice. It helps make informed decisions.

Conclusion

Choosing the right wealth management software is essential. It can simplify your financial planning. The tools mentioned offer great features. They help you track investments and manage assets efficiently. Make an informed decision and boost your financial growth. Start using the best wealth management software today for a secure future.