To build a trading strategy, choose a reliable algorithm platform. Test your strategy thoroughly before trading.

Trading algorithm platforms can help investors automate their trades. These platforms use pre-set rules and data analysis to execute trades. They offer the advantage of speed, accuracy, and efficiency. Users can create custom strategies based on their goals. Testing these strategies with historical data is important.

It helps ensure they will perform well in real market conditions. Many platforms provide backtesting tools for this purpose. Once tested, users can deploy their strategies in live trading. This way, they can maximize profits and minimize risks. With the right approach, trading algorithm platforms can be powerful tools for investors.

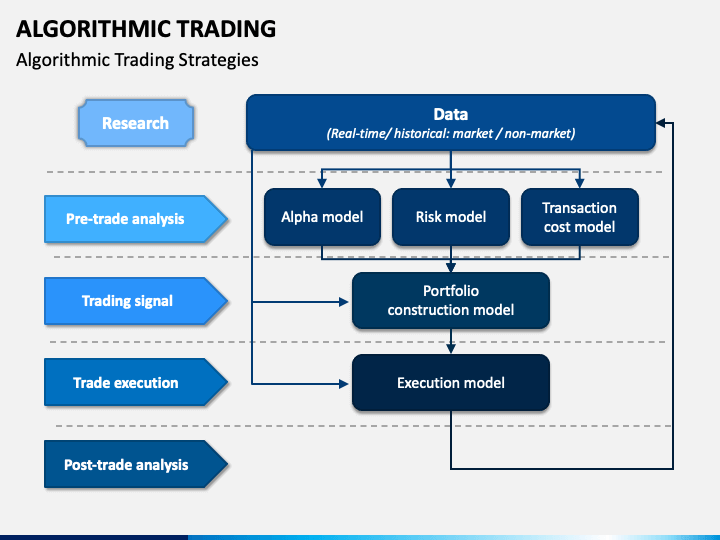

Introduction To Trading Algorithms

Trading algorithms are transforming the financial markets. They enable traders to make quick and precise decisions. These advanced systems use complex mathematical models. They analyze vast amounts of data in real-time. This makes trading more efficient and less prone to human error.

What Are Trading Algorithms?

Trading algorithms are pre-programmed instructions. They automate trading decisions. These algorithms analyze market conditions. They execute trades at optimal times. They follow specific rules and criteria. This ensures consistency and accuracy in trading.

Traders use various types of algorithms:

- Trend-following algorithms: These identify and follow market trends.

- Arbitrage algorithms: These exploit price differences across markets.

- Market-making algorithms: These provide liquidity by placing buy and sell orders.

Benefits Of Using Algorithms

Using trading algorithms offers many benefits:

- Speed: Algorithms execute trades in milliseconds.

- Accuracy: They reduce the risk of human error.

- Consistency: They follow predefined rules consistently.

- Efficiency: They analyze large amounts of data quickly.

- Emotion-free trading: They eliminate emotional decision-making.

Below is a comparison table highlighting the benefits:

| Benefit | Description |

|---|---|

| Speed | Executes trades faster than humans. |

| Accuracy | Reduces errors by following precise rules. |

| Consistency | Maintains a consistent trading strategy. |

| Efficiency | Handles vast data sets quickly. |

| Emotion-free trading | Removes emotions from trading decisions. |

Trading algorithms offer a strategic advantage. They help traders stay ahead in competitive markets.

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

Credit: www.investopedia.com

Choosing The Right Platform

Building a strategy with trading algorithm platforms starts with choosing the right one. The right platform can significantly impact your trading success. It offers the tools and features you need. Selecting the right platform involves several key considerations.

Popular Algorithm Platforms

Some of the most popular trading algorithm platforms include:

- MetaTrader 4 (MT4) – Known for its user-friendly interface and robust features.

- MetaTrader 5 (MT5) – An upgraded version of MT4 with additional functionalities.

- TradingView – Offers advanced charting tools and community-driven insights.

- NinjaTrader – Ideal for advanced traders needing sophisticated analysis tools.

- QuantConnect – Focuses on quantitative analysis and algorithmic trading.

Factors To Consider

When choosing a trading algorithm platform, consider the following factors:

| Factor | Details |

|---|---|

| User Interface | The platform should be easy to use and navigate. |

| Cost | Consider subscription fees or transaction costs. |

| Features | Look for features like backtesting, real-time data, and alerts. |

| Community Support | A strong community can provide support and share insights. |

| Security | Ensure the platform has robust security measures. |

Choosing the right platform is crucial for your trading strategy. Evaluate each option based on your needs and preferences. Consider the factors mentioned to make an informed decision.

Setting Up Your Account

Building a strategy with trading algorithm platforms starts with setting up your account. This is a critical step that ensures you can use the platform effectively. Below, you’ll find a detailed guide to help you through this process.

Registration Process

The registration process is straightforward. Follow these simple steps:

- Visit the platform’s website.

- Click on the “Sign Up” button.

- Fill in your personal details such as name, email, and password.

- Agree to the terms and conditions.

- Click the “Submit” button to create your account.

After submitting, you will receive a confirmation email. Click the link in the email to verify your registration.

Account Verification

Account verification is an essential step. It ensures the security of your account. Follow these steps to verify your account:

- Log into your new account.

- Navigate to the “Account Settings” section.

- Click on “Verify Account”.

- Upload the required documents, such as ID and proof of address.

- Submit the documents for review.

Verification usually takes a few hours. You will receive an email once your account is verified.

Now your account is ready. Start building your trading strategies on the algorithm platform.

Developing Your Trading Strategy

Creating a strong trading strategy is crucial for success. A well-defined strategy guides your trading decisions. It minimizes risks and maximizes profits. Let’s explore how to develop a winning strategy using trading algorithm platforms.

Identifying Market Opportunities

Market opportunities are key to profitable trades. Use data to spot trends and patterns. Look for price movements and market signals. Pay attention to news and economic reports. These can affect market trends.

Analyze historical data for insights. Use indicators like moving averages and RSI. These tools help identify entry and exit points. Combine different indicators for a robust analysis.

Backtesting Your Strategy

Backtesting is essential for validating your strategy. It involves testing your strategy using historical data. This helps you understand how it would have performed in the past.

Use backtesting tools available on trading platforms. Input your strategy and run it against past data. Analyze the results carefully. Look for patterns and performance metrics.

Here are some key metrics to consider:

- Win Rate: The percentage of profitable trades.

- Profit Factor: The ratio of gross profit to gross loss.

- Maximum Drawdown: The largest loss from a peak to a trough.

Refine your strategy based on the backtesting results. Adjust parameters to improve performance. Ensure your strategy is robust and adaptable to market changes.

Implementing The Algorithm

Implementing the algorithm is a crucial step in building a trading strategy. This phase involves coding, integrating, and testing your trading algorithm. A well-implemented algorithm can execute trades efficiently, ensuring better performance in the market.

Coding Your Strategy

To start, coding your strategy involves translating your trading ideas into code. Choose a programming language that suits your needs. Popular choices include Python, R, and C++. Use clear and concise code to avoid errors.

Key points to consider:

- Define your trading rules clearly.

- Ensure the code is well-documented.

- Test the code with historical data.

Example code snippet in Python:

import pandas as pd

def moving_average_strategy(data, short_window, long_window):

signals = pd.DataFrame(index=data.index)

signals['signal'] = 0.0

signals['short_mavg'] = data['Close'].rolling(window=short_window, min_periods=1).mean()

signals['long_mavg'] = data['Close'].rolling(window=long_window, min_periods=1).mean()

signals['signal'][short_window:] = np.where(signals['short_mavg'][short_window:] > signals['long_mavg'][short_window:], 1.0, 0.0)

signals['positions'] = signals['signal'].diff()

return signals

Integrating With The Platform

After coding, the next step is integrating with the platform. Ensure the platform supports your chosen language and has the necessary APIs.

Steps to integrate:

- Connect to the platform’s API.

- Authenticate your account.

- Upload and run your algorithm.

Example API integration in Python:

import requests

def connect_to_platform(api_key):

base_url = 'https://api.tradingplatform.com'

headers = {'Authorization': f'Bearer {api_key}'}

response = requests.get(f'{base_url}/account', headers=headers)

if response.status_code == 200:

print("Connected successfully")

else:

print("Failed to connect")

api_key = 'your_api_key_here'

connect_to_platform(api_key)

Proper integration ensures your algorithm runs seamlessly. Regularly monitor and update your algorithm to adapt to market changes.

Credit: www.quantifiedstrategies.com

Monitoring And Adjusting

Building a strategy with trading algorithm platforms is crucial. It requires constant monitoring and adjusting to ensure optimal performance. This section delves into the importance of real-time monitoring and making necessary adjustments. Both are key to maintaining a successful trading algorithm strategy.

Real-time Monitoring

Real-time monitoring allows you to track your algorithm’s performance instantly. It helps you understand how the algorithm reacts to market changes. You can observe patterns and identify any anomalies.

Traders can use dashboards to view live data. These dashboards show key metrics like profit, loss, and trade volume. Using these insights, you can make informed decisions quickly.

| Metric | Description |

|---|---|

| Profit | Measures the financial gain from trades. |

| Loss | Tracks the financial loss from trades. |

| Trade Volume | Shows the number of trades executed. |

Making Adjustments

Making adjustments is vital to keep your strategy effective. Market conditions change, and your algorithm must adapt.

- Identify the areas needing improvement.

- Analyze the performance data.

- Implement the necessary changes.

Regular adjustments help in minimizing losses and maximizing profits. It ensures the algorithm stays aligned with your trading goals.

By making these adjustments, you can enhance the algorithm’s efficiency. It keeps your strategy robust against market fluctuations.

Risk Management

Building a trading algorithm platform requires a robust strategy. One key aspect is risk management. Proper risk management helps protect investments and ensures long-term success. Here are some essential techniques.

Setting Stop-loss Limits

Stop-loss limits are crucial in trading. They help minimize potential losses. Setting these limits requires careful analysis. You should determine a maximum acceptable loss for each trade.

Here is a simple example of setting stop-loss limits:

| Trade Type | Investment Amount | Stop-Loss Limit |

|---|---|---|

| Stock A | $1000 | 5% |

| Stock B | $1500 | 3% |

Diversifying Your Portfolio

Diversifying your portfolio is another essential risk management technique. Diversification reduces risk by spreading investments across different assets. This way, a loss in one area is offset by gains in another.

Here are some ways to diversify your portfolio:

- Invest in various asset classes

- Include stocks, bonds, and commodities

- Consider different sectors

A well-diversified portfolio includes various investments. This approach helps balance potential losses and gains.

Evaluating Performance

Building a strategy with trading algorithm platforms requires rigorous performance evaluation. This ensures your algorithm is effective and profitable. Evaluating performance is crucial for identifying strengths and weaknesses. It helps in making necessary adjustments for optimal results.

Analyzing Results

Analyzing results involves examining the algorithm’s historical performance. This can be done using backtesting techniques. Backtesting uses historical data to simulate trading strategies. It helps in understanding how the algorithm would have performed in the past.

| Metric | Description |

|---|---|

| Profitability | Measures the total profit or loss over a period. |

| Drawdown | Shows the peak-to-trough decline during a specific period. |

| Sharpe Ratio | Indicates risk-adjusted returns of the strategy. |

Optimizing The Algorithm

Optimizing the algorithm involves fine-tuning to enhance performance. This process includes adjusting parameters and settings. The goal is to maximize returns while minimizing risks.

Follow these steps to optimize your algorithm:

- Identify key parameters affecting performance.

- Run multiple simulations with different settings.

- Analyze the outcomes of each simulation.

- Select the best-performing parameters.

Optimization ensures your trading strategy is robust and adaptable. It helps in achieving consistent performance in various market conditions.

Future Trends In Algorithmic Trading

Algorithmic trading continues to evolve, driven by technological advances and market needs. As we look ahead, understanding future trends in algorithmic trading becomes crucial. This section explores significant trends shaping the future of this dynamic field.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming algorithmic trading. These technologies offer powerful tools for analyzing vast data sets. They help traders make informed decisions faster.

AI-driven algorithms can predict market trends with high accuracy. ML models learn from historical data, improving over time. This allows for better strategy formulation and risk management.

Here are some benefits of AI and ML in trading:

- Enhanced Data Analysis: Process large volumes of data quickly.

- Predictive Analytics: Forecast market movements effectively.

- Automated Trading: Execute trades without human intervention.

The integration of AI and ML in trading platforms makes them smarter and more efficient. They adapt to changing market conditions and optimize performance.

Regulatory Considerations

Regulations play a vital role in algorithmic trading. Traders must comply with rules set by regulatory bodies. These rules ensure fair and transparent trading practices.

Key regulatory considerations include:

- Market Surveillance: Monitoring for fraudulent activities.

- Risk Management: Implementing measures to manage risks effectively.

- Transparency: Ensuring clarity in trading operations.

Regulatory frameworks vary across regions. Traders must stay updated with changes to remain compliant. Non-compliance can lead to penalties and legal issues.

Here is a table summarizing some important regulatory bodies:

| Region | Regulatory Body |

|---|---|

| United States | SEC (Securities and Exchange Commission) |

| European Union | ESMA (European Securities and Markets Authority) |

| United Kingdom | FCA (Financial Conduct Authority) |

Adhering to regulatory standards ensures the integrity of the trading environment. It builds trust among market participants and fosters a healthy trading ecosystem.

Credit: www.sketchbubble.com

Frequently Asked Questions

What Is A Trading Algorithm Platform?

A trading algorithm platform is software that uses algorithms to automate trading strategies. These platforms help traders execute trades quickly and efficiently.

How Do Trading Algorithms Work?

Trading algorithms analyze market data and execute trades based on predefined criteria. They help minimize human error and optimize trading strategies.

Why Use A Trading Algorithm Platform?

Using a trading algorithm platform can enhance trading efficiency and accuracy. It helps traders to capitalize on market opportunities faster.

Are Trading Algorithms Profitable?

Trading algorithms can be profitable if well-designed and properly managed. They require continuous monitoring and adjustments to stay effective.

Conclusion

Creating a trading strategy with algorithm platforms offers many benefits. It ensures efficient, data-driven decisions and reduces emotional trading. With the right tools, you can improve your trading performance. Start exploring these platforms to enhance your trading journey. Remember, consistency and discipline are key to success.