Choosing the right trading algorithm platform boosts your trading efficiency. Research is key to finding the best fit.

Selecting a trading algorithm platform requires careful consideration. Your choice impacts your trading success and efficiency. Understand your industry needs and goals before making a decision. Look for platforms with user-friendly interfaces and robust support. Reliable performance and security should be top priorities.

Evaluate platform features like backtesting, customization, and integration options. Check user reviews and expert recommendations to guide your decision. Cost and scalability matter too, especially for growing businesses. Make sure the platform aligns with your long-term trading strategies. A well-chosen platform can significantly enhance your trading outcomes.

Introduction To Trading Algorithm Platforms

Trading algorithm platforms have revolutionized the trading industry. They allow traders to automate their strategies. This leads to more efficiency and better results. Choosing the right platform is crucial for success.

What Are Trading Algorithm Platforms?

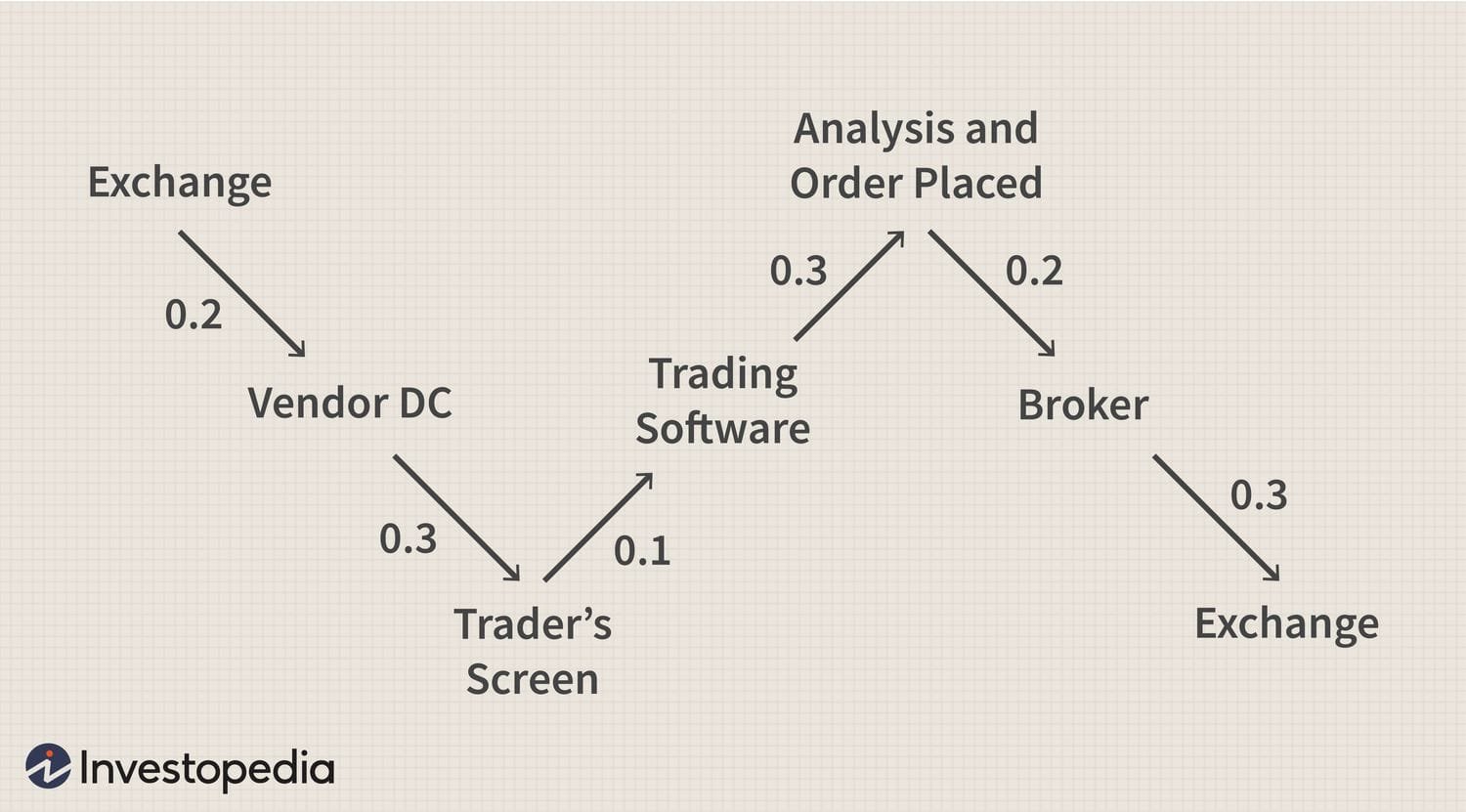

Trading algorithm platforms are software systems. They execute trades automatically. These platforms use pre-defined algorithms. They analyze market data in real-time. This helps in making quick trading decisions.

The platforms can handle large volumes of data. They can execute trades at high speed. This minimizes the chances of human error. They are ideal for day traders and high-frequency traders.

Importance Of Choosing The Right Platform

Choosing the right trading algorithm platform is vital. The right platform can enhance your trading performance. It can provide accurate data analysis. It can also offer robust security features.

A good platform should have a user-friendly interface. It should be easy to navigate. It should offer customization options. This allows you to tailor the platform to your trading needs.

The platform should also offer reliable customer support. This ensures you get help when needed. It should be compatible with various devices. This allows you to trade on the go.

| Feature | Importance |

|---|---|

| Data Analysis | Provides accurate market insights |

| Security Features | Keeps your trades and data safe |

| User Interface | Makes trading easy and intuitive |

| Customization Options | Allows tailored trading strategies |

| Customer Support | Provides help when needed |

| Device Compatibility | Enables trading on various devices |

Credit: www.leewayhertz.com

Key Features To Consider

Choosing the right trading algorithm platform is crucial. It ensures that your trading strategies are effective and efficient. Here are the key features to consider.

User Interface

A user-friendly interface is vital. It allows traders to navigate easily. Look for platforms with intuitive dashboards. Ensure that the interface is easy to use and understand. This minimizes errors and enhances trading efficiency.

Customization Options

Customization options are important. Different industries have unique needs. Make sure the platform allows for customizable algorithms. This feature helps tailor the platform to specific trading strategies. Look for features like:

- Custom Indicators

- Strategy Builders

- Backtesting Capabilities

Data Integration

Data integration is crucial for real-time trading. Ensure the platform supports multiple data sources. This includes:

- Market Data Feeds

- Historical Data

- News Feeds

Effective data integration helps in making informed decisions. It also allows for accurate backtesting and strategy development.

Top Platforms For Stock Trading

Choosing a trading algorithm platform for stock trading is crucial. The right platform can enhance your trading experience and increase profits. This guide explores the top platforms for stock trading with detailed overviews.

Platform 1 Overview

Platform 1 is known for its user-friendly interface and advanced tools. It offers real-time data and customizable charts. The platform is ideal for both beginners and experienced traders.

- Real-time data for accurate trading decisions

- Customizable charts for tailored analysis

- Supports various stock exchanges

| Feature | Details |

|---|---|

| User Interface | Intuitive and easy to navigate |

| Data Access | Real-time market data |

| Customization | Multiple chart options |

Platform 2 Overview

Platform 2 excels with its automated trading algorithms. It offers backtesting capabilities and comprehensive analytics. The platform integrates with several brokerages for seamless trading.

- Automated trading for efficiency

- Backtesting to test strategies

- Comprehensive analytics for in-depth insights

| Feature | Details |

|---|---|

| Trading Algorithms | Automated and efficient |

| Backtesting | Test strategies before live trading |

| Analytics | In-depth insights and reports |

Platform 3 Overview

Platform 3 offers a robust security framework and excellent customer support. It supports a wide range of stocks and has an easy-to-use mobile app. This platform is perfect for traders on the go.

- Robust security to protect data

- Excellent customer support

- Mobile app for trading anywhere

| Feature | Details |

|---|---|

| Security | High-level encryption |

| Support | 24/7 customer service |

| Mobile App | Available for iOS and Android |

Best Platforms For Forex Trading

Choosing the right trading algorithm platform is crucial for successful forex trading. The right platform can enhance your trading experience and maximize your profits. Here, we will explore the best platforms for forex trading, detailing their features and benefits.

Platform 1 Overview

MetaTrader 4 (MT4) is one of the most popular platforms for forex trading. It offers a user-friendly interface and a range of features.

- Customizable Charts: MT4 allows traders to customize their charts for better analysis.

- Automated Trading: The platform supports automated trading through Expert Advisors (EAs).

- Wide Range of Indicators: MT4 comes with numerous technical indicators.

MT4 supports multiple devices, including desktop and mobile, ensuring you can trade anywhere.

Platform 2 Overview

MetaTrader 5 (MT5) is the successor to MT4 with enhanced features. It supports more assets and has improved tools.

- Advanced Charting Tools: MT5 offers advanced charting tools for detailed analysis.

- Economic Calendar: The platform includes an integrated economic calendar.

- Improved Order Management: MT5 provides better order management capabilities.

MT5 is ideal for traders who need more advanced tools and functionalities.

Platform 3 Overview

cTrader is another top choice for forex trading. It is known for its intuitive interface and advanced trading features.

- Depth of Market (DoM): cTrader provides detailed market depth information.

- Automated Trading: The platform supports automated trading with cAlgo.

- Multiple Timeframes: cTrader offers multiple timeframes for better trading strategies.

cTrader is designed for traders who seek a seamless and professional trading experience.

| Platform | Key Features |

|---|---|

| MetaTrader 4 | Customizable Charts, Automated Trading, Wide Range of Indicators |

| MetaTrader 5 | Advanced Charting Tools, Economic Calendar, Improved Order Management |

| cTrader | Depth of Market, Automated Trading, Multiple Timeframes |

Leading Platforms For Cryptocurrency Trading

Choosing the right trading algorithm platform is crucial for success in cryptocurrency trading. The right platform can significantly impact your trading efficiency and profitability. Below, we explore three leading platforms that have gained popularity among cryptocurrency traders.

Platform 1 Overview

Platform 1 offers a user-friendly interface and advanced trading tools. It supports various cryptocurrencies and allows users to create custom trading bots. Key features include:

- Real-time market data

- Automated trading strategies

- High security standards

Platform 1 also provides comprehensive customer support and detailed tutorials. This helps traders at all experience levels.

Platform 2 Overview

Platform 2 is known for its robust analytical tools and customizable algorithms. It caters to both beginner and advanced traders. Key features include:

| Feature | Description |

|---|---|

| Backtesting | Test strategies with historical data |

| Paper Trading | Practice without risking real money |

| API Access | Integrate with other tools |

Platform 2 also offers a vibrant community forum. Here, traders can share insights and strategies.

Platform 3 Overview

Platform 3 stands out for its high-frequency trading capabilities and low latency. This platform is ideal for traders who need speed. Key features include:

- Advanced charting tools

- Customizable dashboards

- Multi-exchange support

Platform 3 ensures secure transactions with its strong encryption protocols. It also offers 24/7 customer support for any issues.

Evaluating Platform Security

Choosing the right trading algorithm platform involves many factors. One of the most critical is platform security. Security ensures your data remains safe and your transactions are private. Let’s dive into some key aspects of evaluating platform security.

Data Protection

Data protection is vital for any trading platform. Ensure the platform uses encryption to safeguard your data. Look for platforms that employ SSL certificates. These certificates protect data during transmission.

Another important feature is two-factor authentication. This adds an extra layer of security. Always choose platforms that offer this feature.

| Security Feature | Description |

|---|---|

| Encryption | Protects data during transmission |

| SSL Certificates | Ensures secure connections |

| Two-Factor Authentication | Adds an extra layer of security |

User Privacy

User privacy is a top priority. A secure platform will not share your data without consent. Look for platforms with a clear privacy policy. This policy should explain how your data is used and stored.

Check if the platform complies with GDPR or other data protection laws. This ensures your data is handled responsibly.

- Privacy Policy

- GDPR Compliance

- Data Usage Transparency

Compliance With Regulations

Compliance with regulations is essential for trading platforms. Choose platforms that follow industry standards. This includes adhering to financial regulations.

Ensure the platform is licensed and regulated by reputable authorities. This adds credibility and ensures the platform operates legally.

- Industry Standards

- Financial Regulations

- Licensed and Regulated

Cost And Pricing Models

Choosing a trading algorithm platform can be challenging. Understanding the cost and pricing models is crucial. This section explains the different pricing structures. This includes subscription plans, commission fees, and hidden costs.

Subscription Plans

Many platforms offer subscription plans. These plans often have tiered pricing. The cost depends on the features and services. Some platforms offer basic plans for beginners. Advanced plans may include more tools and support.

- Basic Plan: Ideal for new traders. Costs are usually low.

- Standard Plan: Suitable for intermediate traders. Includes more features.

- Premium Plan: Best for experienced traders. Offers all features.

Commission Fees

Platforms may charge commission fees on trades. These fees can add up over time. It’s important to understand the fee structure.

| Plan Type | Commission Rate |

|---|---|

| Basic | 0.1% per trade |

| Standard | 0.05% per trade |

| Premium | 0.02% per trade |

Hidden Costs

Some platforms have hidden costs. These can include data fees, withdrawal fees, and inactivity fees. Always read the fine print. Understanding these costs can save money in the long run.

- Data Fees: Charged for accessing real-time data.

- Withdrawal Fees: Applied when transferring funds out.

- Inactivity Fees: Charged if the account is inactive.

Credit: www.amazon.com

Customer Support And Community

Choosing a trading algorithm platform involves many factors. One crucial aspect is the customer support and community. A strong support system ensures you get help when needed. A vibrant community can provide valuable insights and tips.

Availability Of Support

Good trading platforms offer 24/7 support. This ensures you can get help at any time. Look for platforms that provide multiple support channels.

- Live Chat

- Email Support

- Phone Support

Check if they have a quick response time. This will help you resolve issues faster.

Community Forums

A strong community forum is a goldmine of information. Here, you can find answers to common questions. You can also share your experiences and learn from others.

Look for platforms with active forums. This shows that users are engaged and willing to help.

Educational Resources

Top platforms offer a variety of educational resources. These can help you understand the platform better. Look for the following resources:

- Video Tutorials

- Webinars

- Articles and Blogs

These resources can make your trading journey smoother. They help you learn at your own pace.

Final Thoughts

Choosing the right trading algorithm platform is crucial. It can impact your business’s success. This decision should be made carefully and thoughtfully.

Making The Right Choice

When choosing a platform, consider your specific industry needs. Not all platforms offer the same features. Make sure the platform supports the assets you trade. Review the customizability and user interface. A platform should be easy to use and adapt to your strategies.

Look for platforms with strong security features. Your data and transactions should be safe. Check the platform’s reputation and reviews. This can give insight into its reliability.

Consider the cost of the platform. Some platforms may have hidden fees. Ensure the cost fits within your budget. Additionally, evaluate the quality of customer support. Reliable support can save you time and stress.

Future Trends In Trading Platforms

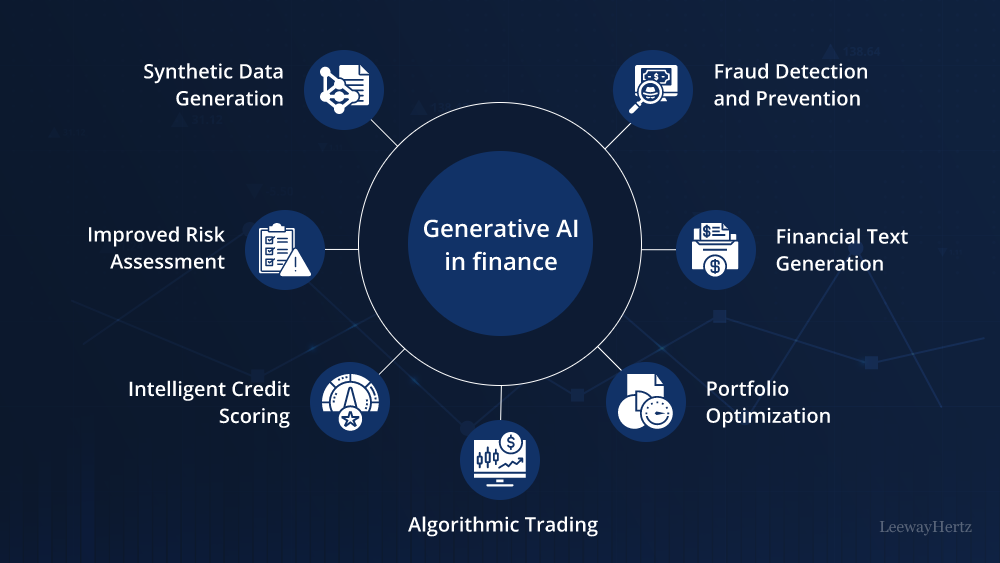

Trading platforms are constantly evolving. One emerging trend is the use of artificial intelligence and machine learning. These technologies can improve decision-making and efficiency.

Another trend is the rise of mobile trading. More traders are using mobile devices to manage their portfolios. Ensure your chosen platform has a robust mobile app.

Look out for blockchain technology. It is becoming more prevalent in trading platforms. Blockchain can enhance transparency and security.

Platforms are also incorporating social trading features. This allows traders to share strategies and insights. It can be a valuable resource for learning and growth.

Finally, keep an eye on regulatory changes. New regulations can impact trading platforms. Ensure your platform stays compliant with the latest rules.

| Feature | Description |

|---|---|

| Customizability | Ability to tailor the platform to your needs |

| Security | Measures to protect your data and transactions |

| Cost | Fees associated with using the platform |

| Customer Support | Availability and quality of help from the platform provider |

| AI and Machine Learning | Technologies to improve trading decisions |

| Mobile Trading | Access and manage trades from mobile devices |

| Blockchain | Technology for enhanced security and transparency |

| Social Trading | Features for sharing strategies and insights |

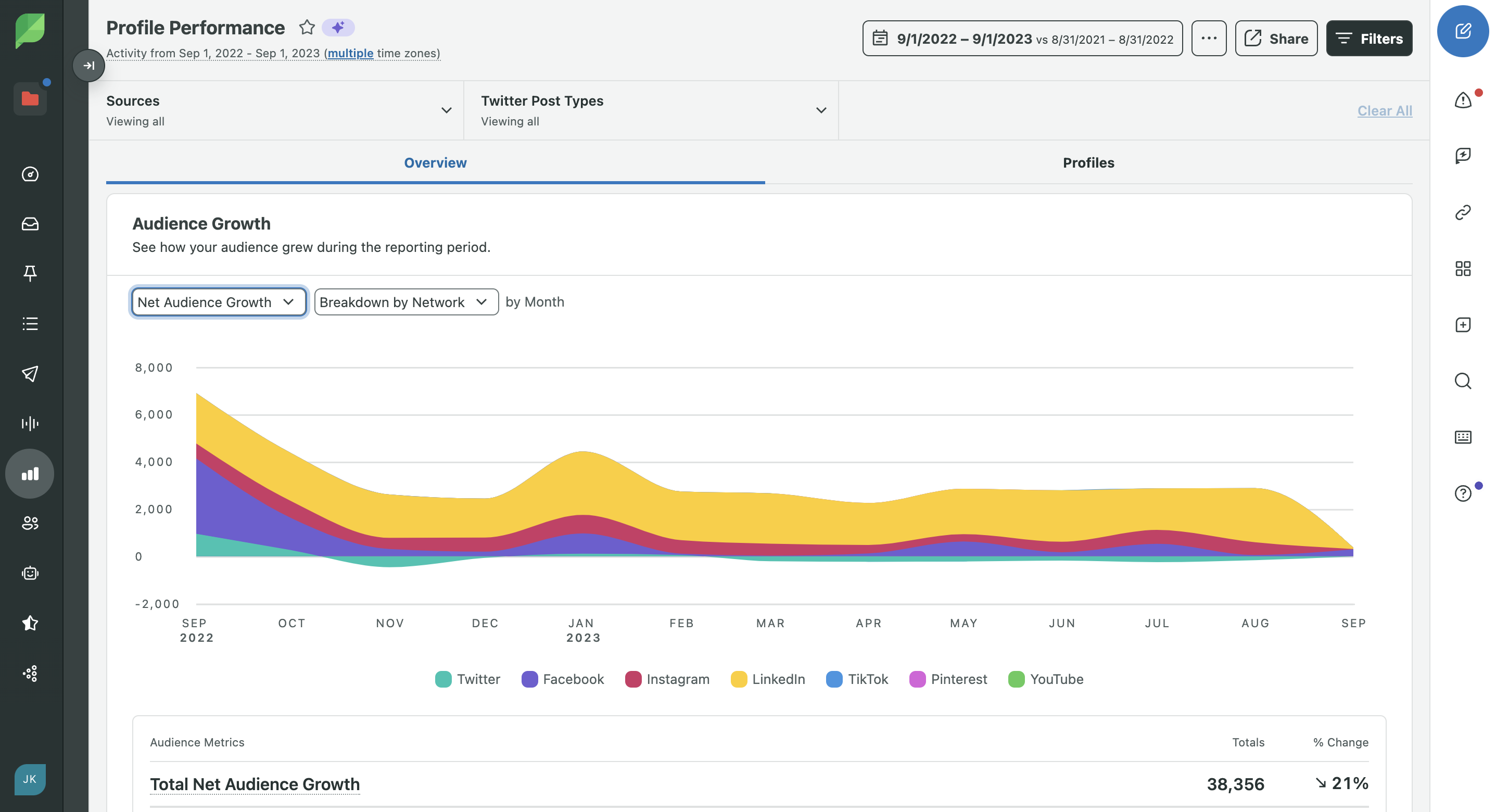

Credit: sproutsocial.com

Frequently Asked Questions

What Is A Trading Algorithm Platform?

A trading algorithm platform is software that executes trades using automated algorithms. It helps traders by analyzing market data. It then makes decisions based on pre-set criteria.

How To Choose A Trading Algorithm Platform?

Consider your trading goals, budget, and technical expertise. Look for reliability, security, and user-friendly interfaces. Check reviews and support options.

Why Use A Trading Algorithm Platform?

Using a trading algorithm platform saves time and reduces emotional trading. It increases trading efficiency and consistency. It also helps in executing complex strategies.

Are Trading Algorithm Platforms Secure?

Yes, most reputable platforms offer strong security measures. These include encryption and two-factor authentication. Always choose a well-reviewed and trusted platform.

Conclusion

Selecting the right trading algorithm platform is crucial. It can boost your trading success. Evaluate features and compare platforms carefully. Make sure it fits your industry needs. A well-chosen platform can enhance profits and reduce risks. Invest time in research and choose wisely.

Your trading future depends on it.