Trading algorithm platforms boost productivity by automating trading processes. They reduce human error and save time.

Trading algorithm platforms offer significant advantages for traders. These platforms automate trading processes, which helps save valuable time. Algorithms can analyze vast amounts of data quickly. This allows traders to make informed decisions faster. Automated trading also reduces the risk of human error.

This can lead to more consistent and profitable trades. Many platforms provide user-friendly interfaces. This makes them accessible even for beginners. They often include tools for backtesting strategies. This helps traders refine their methods before investing real money. Overall, trading algorithm platforms enhance productivity, making trading more efficient and effective.

Credit: www.leewayhertz.com

Introduction To Trading Algorithm Platforms

Trading algorithm platforms have revolutionized the financial industry. These platforms use automated systems to execute trades. This helps traders to make better decisions faster.

Algorithmic trading, also known as algo trading, uses computer programs. These programs follow a set of instructions to place a trade. The instructions are based on timing, price, and quantity.

What Are Trading Algorithms?

Trading algorithms are step-by-step instructions for trading. They are coded into software programs. These instructions can include conditions for buying or selling stocks. They can also include conditions for stopping trades.

Algorithms help traders to perform complex calculations quickly. They can analyze large amounts of data in seconds. This makes trading more efficient and less prone to errors.

Importance Of Algorithmic Trading

Algorithmic trading offers many benefits. First, it removes human emotions from trading. Emotions can lead to poor decisions. Algorithms follow set rules. This makes trading more consistent.

Second, algorithms can trade at high speeds. This speed is crucial in fast-moving markets. Being faster than human traders gives an edge.

Third, algorithmic trading increases accuracy. The algorithms are tested and refined. This reduces the chances of errors. Traders can trust the system to execute trades correctly.

Here is a simple comparison table:

| Feature | Manual Trading | Algorithmic Trading |

|---|---|---|

| Speed | Slow | Fast |

| Accuracy | Prone to Errors | High |

| Emotions | Emotional | Emotionless |

Using trading algorithms can greatly improve productivity. Traders can focus on strategy. The algorithms handle the execution. This leads to better results.

Credit: resumeworded.com

Benefits Of Using Trading Algorithm Platforms

Trading algorithm platforms are transforming the financial market landscape. They provide a range of benefits, enhancing traders’ productivity and accuracy.

Increased Speed And Efficiency

Trading algorithms can process large volumes of data in seconds. They execute trades at speeds humans can’t match. This speed ensures you capitalize on fleeting market opportunities.

Algorithms also work around the clock. This means trades can happen even when you’re asleep. The continuous operation maximizes potential profits and keeps you competitive.

Here’s a quick comparison of human vs. algorithm trading:

| Aspect | Human Trading | Algorithm Trading |

|---|---|---|

| Speed | Slower | Faster |

| Data Processing | Limited | Extensive |

| Operation Hours | Limited to human availability | 24/7 |

Reduced Human Error

Human traders are prone to errors. Emotions and biases can cloud judgment. Trading algorithms eliminate these issues. They follow preset rules without deviation.

Algorithms don’t get tired or distracted. This consistency improves trading accuracy. By minimizing errors, algorithms protect your investments and optimize returns.

Here are some common human errors algorithms avoid:

- Emotional decisions

- Miscalculations

- Delayed reactions to market changes

Key Features Of Top Trading Algorithm Platforms

Enhancing productivity in trading requires the right tools. Top trading algorithm platforms offer essential features. These features help traders make smarter decisions faster.

Real-time Data Processing

Real-time data processing is crucial. It allows traders to react instantly. With this feature, market data gets processed as it arrives. This ensures traders never miss an opportunity. They can make quick decisions based on the latest information.

Here are some benefits of real-time data processing:

- Immediate market insights

- Accurate trade execution

- Reduced latency

- Better risk management

Customizable Algorithms

Customizable algorithms are another key feature. They allow traders to tailor strategies. Traders can create algorithms that fit their trading style. This flexibility can lead to better trading outcomes.

Some advantages of customizable algorithms include:

- Personalized trading strategies

- Adaptable to market changes

- Optimized performance

- Scalability for growth

Customizable algorithms empower traders. They can test and tweak strategies. This leads to continuous improvement and higher productivity.

Credit: www.facebook.com

How To Choose The Right Platform

Choosing the right trading algorithm platform is crucial. This decision can significantly impact your trading success. Not all platforms are the same. Each one offers unique features and tools. This guide will help you make an informed choice.

Assessing Your Trading Goals

Start by defining your trading goals. What do you want to achieve with automated trading? Some traders aim for high-frequency trades. Others prefer long-term investment strategies.

- Are you interested in day trading?

- Do you want to automate your swing trades?

- Are you looking for long-term investment automation?

Understanding your goals will help you choose the right platform. Different platforms cater to different trading styles. Make sure the platform aligns with your objectives.

Evaluating Platform Performance

Next, evaluate the performance of potential platforms. Look for user reviews and testimonials. Check the platform’s uptime and reliability. A good platform should have minimal downtime.

Consider the platform’s historical performance. Has it delivered consistent results in the past? Look for backtesting features. These allow you to test your strategies on historical data.

| Platform | Uptime | User Reviews | Backtesting |

|---|---|---|---|

| Platform A | 99.9% | Positive | Available |

| Platform B | 98.5%</td | Mixed | Available |

A reliable platform should also offer robust customer support. Check if they provide 24/7 support. Fast issue resolution is crucial in trading.

By assessing your goals and evaluating performance, you can choose the right platform. This will enhance your productivity in trading.

Implementing Trading Algorithms

Implementing trading algorithms can significantly enhance productivity in trading. These algorithms automate trading strategies, reducing human errors and speeding up the process. Below are key components to successfully implementing trading algorithms.

Backtesting Strategies

Backtesting is crucial to ensure your algorithm performs well. It involves testing the algorithm on historical data to see how it would have fared. This helps identify any flaws or areas for improvement.

Here are steps to backtest your trading algorithm:

- Gather historical data relevant to your trading strategy.

- Run your algorithm using this data.

- Analyze the results to check for performance and accuracy.

- Adjust the algorithm based on findings and re-test.

Ensuring robust backtesting strategies is key to successful algorithmic trading. It allows you to refine and optimize your strategy before live trading.

Real-time Execution

Real-time execution is critical for algorithmic trading. It ensures trades are executed at the right moment, maximizing profit potential. This involves integrating your algorithm with a trading platform that supports real-time data.

Key aspects of real-time execution include:

- Low latency: Ensures quick trade executions.

- Reliable data feeds: Provides accurate market data.

- Robust infrastructure: Handles high-frequency trading seamlessly.

The table below highlights some popular platforms for real-time execution:

| Platform | Features | Rating |

|---|---|---|

| MetaTrader | Supports multiple asset classes, low latency | 4.5/5 |

| NinjaTrader | Advanced charting, real-time data feeds | 4.3/5 |

| QuantConnect | Cloud-based, supports various languages | 4.6/5 |

Implementing effective real-time execution ensures your trading algorithm operates efficiently and successfully in live markets.

Monitoring And Optimizing Performance

Monitoring and optimizing performance is crucial for traders using algorithm platforms. Constant oversight ensures your trading strategies remain effective and profitable. Regular analysis and adjustments can lead to better results.

Analyzing Trading Results

Reviewing trading results is essential to understand performance. Look at the key metrics such as profitability, win rate, and drawdowns. Use a table to record these metrics for better visualization:

| Metric | Value |

|---|---|

| Profitability | 20% |

| Win Rate | 65% |

| Drawdowns | 10% |

Identify patterns in your trading results. Understand which algorithms perform best. Compare different time frames and market conditions. Make note of any anomalies or unexpected results.

Adjusting Algorithms For Better Results

Adjusting algorithms can help improve performance. Small tweaks can make a big difference. Consider the following steps:

- Backtest your algorithms with historical data.

- Adjust parameters to optimize performance.

- Monitor changes and their impact on results.

- Use machine learning to refine your algorithms.

Keep records of all adjustments. Track how each change affects performance. This helps in understanding what works best for your trading strategy.

Case Studies Of Successful Implementation

Trading algorithm platforms have transformed financial markets. Many traders have benefitted from these advancements. This section delves into real-world success stories. It highlights how retail traders and institutional investors have reaped rewards.

Retail Traders

Retail traders have seen significant benefits from trading algorithms. These platforms offer automation, reducing manual trading errors. For example, John, a part-time trader, implemented a simple moving average algorithm. Within six months, his portfolio grew by 20%. This growth was due to consistent trading strategies and minimized emotional trading.

Another success story involves Sarah, a novice trader. She used a trading algorithm to analyze market trends. This allowed her to make informed decisions. Sarah’s investments yielded a 15% return in just three months. The algorithm provided her with insights she couldn’t gather manually.

| Trader | Algorithm Type | Time Frame | Return on Investment |

|---|---|---|---|

| John | Simple Moving Average | 6 months | 20% |

| Sarah | Market Trend Analysis | 3 months | 15% |

Institutional Investors

Institutional investors have also benefitted from trading algorithms. Large firms have adopted these platforms for better efficiency. For instance, XYZ Capital implemented a high-frequency trading algorithm. This move resulted in a 25% increase in trading volume over a year. The firm also reported a 10% rise in annual profits.

Another example is ABC Hedge Fund. They utilized a machine learning algorithm for risk management. The algorithm significantly reduced losses during market downturns. The fund’s performance improved by 18% within one year. This technology allowed them to stay ahead of competitors.

- XYZ Capital: High-frequency trading algorithm increased trading volume by 25%.

- ABC Hedge Fund: Machine learning algorithm improved performance by 18%.

Future Trends In Trading Algorithms

The future of trading algorithms promises exciting advancements. Enhanced productivity is achievable through cutting-edge technologies. Let’s explore the key trends shaping the future of trading algorithms.

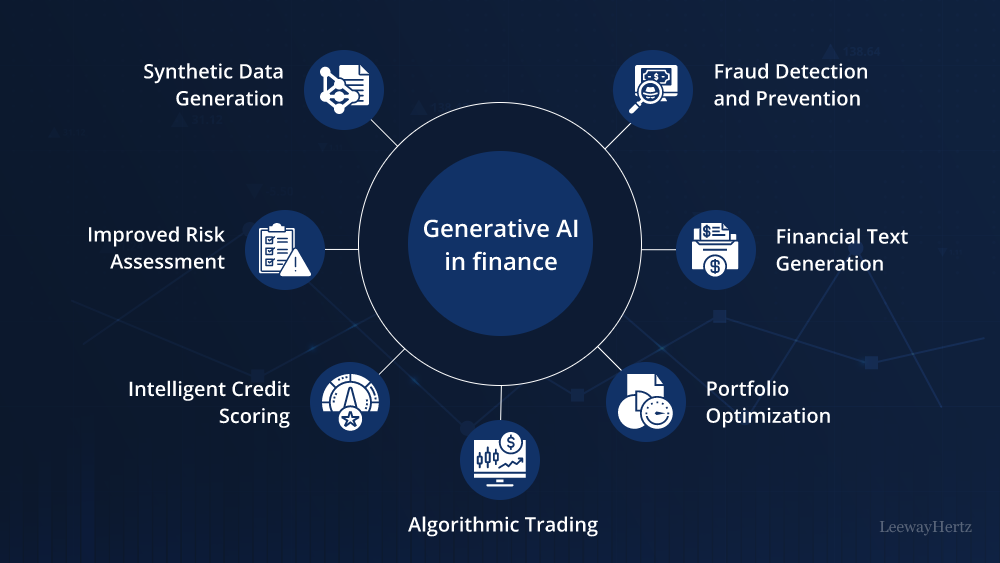

Ai And Machine Learning

AI and Machine Learning are revolutionizing trading algorithms. These technologies analyze massive datasets swiftly. They identify patterns that human traders often miss.

Here are some benefits:

- Improved Decision-Making: Algorithms learn from past data, enhancing decision accuracy.

- Speed: Trades are executed in milliseconds, ensuring optimal timing.

- Adaptability: Algorithms adapt to changing market conditions.

Machine learning models continuously evolve. They get better with more data. This leads to more profitable trades.

Integration With Blockchain Technology

Blockchain technology is another game-changer for trading algorithms. It offers transparency and security.

Consider these advantages:

- Enhanced Security: Blockchain’s decentralized nature ensures data integrity.

- Transparency: All transactions are recorded on a public ledger.

- Reduced Fraud: Immutable records prevent tampering.

Combining blockchain with trading algorithms creates a powerful tool. It enhances trust and efficiency.

| Technology | Benefits |

|---|---|

| AI and Machine Learning | Improved decision-making, speed, adaptability |

| Blockchain Technology | Security, transparency, reduced fraud |

Trading algorithms are evolving rapidly. AI, machine learning, and blockchain are key drivers. Embrace these trends to stay ahead.

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software that use pre-defined rules to execute trades. They help in automating trading strategies. This increases efficiency and reduces manual errors. They can analyze large datasets quickly.

How Do Trading Algorithms Boost Productivity?

Trading algorithms boost productivity by automating repetitive tasks. They allow traders to focus on strategy rather than execution. This reduces errors and increases speed. Algorithms can also analyze market data faster than humans.

Can Beginners Use Trading Algorithm Platforms?

Yes, beginners can use trading algorithm platforms. Many platforms offer user-friendly interfaces. They also provide educational resources. Some even have pre-built strategies for beginners. This makes it easier to start.

Are Trading Algorithms Profitable?

Trading algorithms can be profitable. They can execute trades faster and more efficiently. However, profitability depends on the strategy used. Proper testing and optimization are crucial. Market conditions also play a significant role.

Conclusion

Boost your efficiency with trading algorithm platforms. They save time and reduce errors. Simplify your trading strategy and stay ahead. Embrace technology to maximize your productivity. With these tools, trading becomes easier and smarter. Start today and see the difference.

Your trading success is just a click away.