Enterprise-grade trading algorithm platforms offer robust tools for professional traders. They provide advanced analytics, automation, and high-speed execution.

Enterprise-grade trading platforms are essential for serious traders. They provide tools for advanced analytics and automation. These platforms handle large volumes of data swiftly. They ensure quick and accurate trade execution. Professional traders rely on these tools to make informed decisions.

The platforms offer customizable features to meet specific needs. They also include risk management tools for safety. Enterprise-grade platforms support various asset classes. They integrate with other financial systems seamlessly. These platforms are crucial for staying competitive in the trading world.

Introduction To Trading Algorithms

Trading algorithms have revolutionized the world of finance. They offer speed and efficiency in executing trades. This section introduces you to the basics of trading algorithms.

Importance In Modern Trading

Trading algorithms are essential in today’s financial markets. They execute trades faster than humans can. This speed is crucial in capturing market opportunities. Algorithms also reduce the risk of human error. They follow predefined rules, ensuring consistency in trading.

Here are some key benefits of trading algorithms:

- Speed: Execute trades in milliseconds.

- Accuracy: Follow rules strictly, reducing errors.

- Efficiency: Handle large volumes of trades seamlessly.

- Data Analysis: Analyze vast amounts of data quickly.

Brief History

Trading algorithms have a rich history. They date back to the 1970s. The first algorithms were simple and used for basic tasks. Over time, they evolved and became more sophisticated.

Here is a brief timeline of trading algorithms:

- 1970s: Introduction of basic algorithms for market analysis.

- 1980s: Development of more complex trading strategies.

- 1990s: Rise of high-frequency trading algorithms.

- 2000s: Integration of machine learning and AI in trading algorithms.

Today, trading algorithms are an integral part of the financial industry. They continue to evolve, adapting to market changes and technological advancements.

Credit: www.alibabacloud.com

Key Features Of Enterprise-grade Platforms

Enterprise-grade trading algorithm platforms provide a robust set of features. These features are designed to handle high-frequency trading, massive data sets, and complex strategies. They are essential for financial institutions seeking to maintain a competitive edge. Let’s explore the key features of these platforms.

High Performance

High performance is crucial for trading algorithm platforms. They need to process transactions quickly and accurately. Low latency is a must to execute trades in milliseconds. This ensures you can capitalize on fleeting market opportunities.

Another aspect of high performance is real-time data analysis. Platforms must analyze vast amounts of data instantly. This helps in making informed decisions. Algorithms must also be optimized for speed. Efficient coding practices ensure the algorithms run smoothly.

Robust infrastructure supports high performance. This includes powerful servers, fast internet connections, and reliable software. All these elements work together to provide a seamless trading experience.

Scalability

Scalability is another vital feature of enterprise-grade platforms. As your trading volume grows, the platform must handle increased loads. Horizontal scaling allows adding more servers to manage higher demands. This ensures the platform remains stable under pressure.

Vertical scaling involves upgrading existing resources. This includes adding more memory or faster processors. Both scaling methods are crucial for maintaining performance as your needs grow.

Elastic scalability is also important. This means the platform can automatically adjust resources based on demand. It scales up during peak times and scales down when demand is low. This ensures cost-efficiency and optimal performance at all times.

Here’s a quick comparison of the features:

| Feature | Description |

|---|---|

| High Performance | Low latency, real-time data analysis, robust infrastructure |

| Scalability | Horizontal and vertical scaling, elastic scalability |

Popular Trading Algorithm Platforms

Enterprise-grade trading algorithm platforms have revolutionized the financial markets. These platforms offer advanced tools for developing and deploying trading strategies. In this section, we will explore some of the most popular trading algorithm platforms available today.

Platform A

Platform A stands out for its comprehensive features and user-friendly interface. It caters to both novice and experienced traders. Key features include:

- Real-time data analysis

- Customizable algorithm development

- Backtesting capabilities

- Integration with multiple brokers

Platform A also offers a range of educational resources. This helps traders to enhance their skills. Here is a quick comparison of its features:

| Feature | Description |

|---|---|

| Real-time data analysis | Provides instant market data updates |

| Customizable algorithm development | Allows coding of personalized strategies |

| Backtesting capabilities | Test strategies on historical data |

| Integration with brokers | Works with multiple brokerage accounts |

Platform B

Platform B is known for its high-speed execution and reliability. It is designed for professional traders. Key features include:

- High-frequency trading support

- Advanced risk management tools

- Comprehensive API access

- Robust security measures

Platform B excels in providing a secure and efficient trading environment. Here is a quick overview of its main features:

| Feature | Description |

|---|---|

| High-frequency trading support | Enables rapid trade execution |

| Advanced risk management tools | Helps in managing trading risks |

| Comprehensive API access | Allows integration with other systems |

| Robust security measures | Ensures data protection |

Essential Tools For Algorithmic Trading

Algorithmic trading has revolutionized the financial markets. It offers speed, efficiency, and precision. These advantages come from the essential tools that power trading algorithms. Here, we explore the key tools needed for successful algorithmic trading.

Backtesting Tools

Backtesting tools are critical in algorithmic trading. They help traders test their strategies using historical data. This process helps in understanding the strategy’s performance. It reveals potential pitfalls and strengths.

Features of good backtesting tools:

- Access to extensive historical data

- Ability to simulate real market conditions

- Detailed performance metrics

- Graphical representation of results

These tools allow traders to optimize their strategies. They can tweak and refine for better performance.

Risk Management Tools

Risk management tools are essential for protecting investments. They help in identifying potential risks and mitigating them. These tools ensure the trading strategy remains viable.

Key features of risk management tools:

- Real-time risk assessment

- Automated stop-loss and take-profit orders

- Portfolio diversification analysis

- Stress testing against market shocks

Using risk management tools, traders can safeguard their capital. They can avoid significant losses and achieve consistent gains.

Maximizing Profits With Algorithmic Strategies

Maximizing profits with algorithmic strategies is a game-changer for traders. These strategies offer precision, speed, and the ability to handle large datasets. By using sophisticated algorithms, traders can automate trading processes, minimize human error, and capitalize on market opportunities.

Trend Following

Trend following is a powerful strategy. It identifies and capitalizes on market trends. Traders use historical data to predict future movements. The idea is to buy an asset when its price is rising and sell when it’s falling.

Key benefits of trend following:

- Easy to understand and implement.

- Works well in trending markets.

- Reduces emotional decision-making.

Mean Reversion

Mean reversion is another effective strategy. It assumes that prices will return to their average over time. Traders look for assets that deviate from their historical average. They buy undervalued assets and sell overvalued ones.

Key benefits of mean reversion:

- Profits from price corrections.

- Suitable for range-bound markets.

- Reduces risk by avoiding extreme price movements.

Credit: www.qlik.com

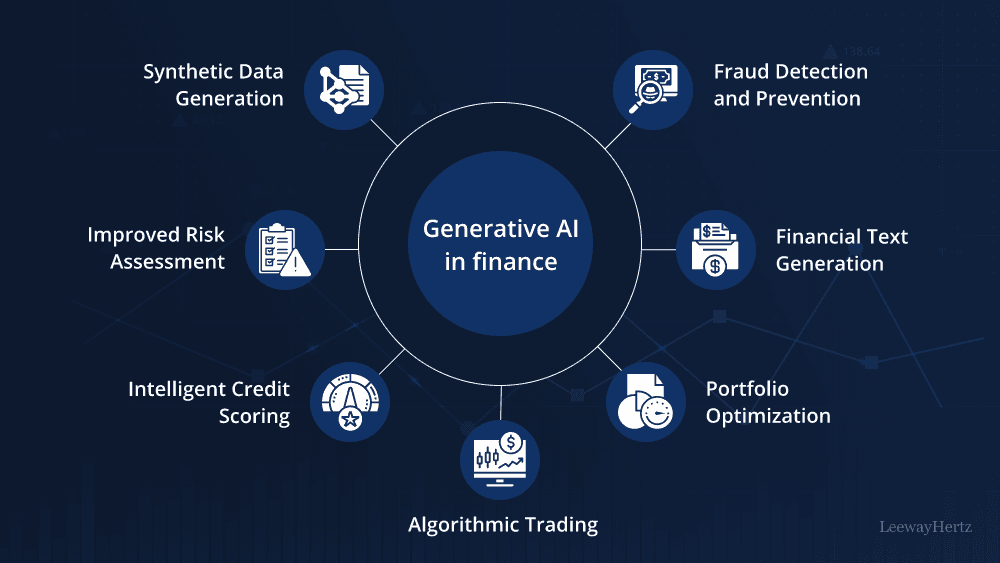

Integrating Artificial Intelligence

Integrating artificial intelligence (AI) into enterprise-grade trading algorithm platforms is revolutionizing financial markets. AI enables smarter, faster, and more accurate trading decisions. These platforms leverage AI to optimize trading strategies and improve market predictions.

Machine Learning Models

Machine learning models play a crucial role in trading algorithms. These models analyze vast amounts of data to identify patterns and trends. They adapt and improve over time, making better trading decisions. Popular machine learning models include:

- Decision Trees

- Neural Networks

- Support Vector Machines

- Random Forests

Each model has its strengths and weaknesses. Selecting the right model is essential for optimal performance. Combining multiple models can enhance accuracy and reliability.

Predictive Analytics

Predictive analytics is a key component of AI in trading. It uses historical data to forecast future market movements. Predictive analytics helps traders make informed decisions. Key techniques include:

- Time Series Analysis

- Regression Analysis

- Sentiment Analysis

These techniques provide insights into market behavior. They help traders anticipate price changes and market volatility. Predictive analytics improves risk management and profitability.

| Technique | Purpose |

|---|---|

| Time Series Analysis | Forecast future prices |

| Regression Analysis | Identify relationships between variables |

| Sentiment Analysis | Analyze market sentiment from news and social media |

Integrating AI in trading algorithms transforms the trading landscape. It empowers traders with advanced tools for better decision-making and improved outcomes.

Security And Compliance

Security and compliance are critical for enterprise-grade trading algorithm platforms. Ensuring robust security and adherence to regulatory standards builds trust and reliability.

Data Protection

Data protection is a top priority in trading algorithm platforms. These platforms handle vast amounts of sensitive data. They must have advanced security measures to safeguard this information.

- Encryption: Platforms use strong encryption to protect data in transit and at rest.

- Access Control: Strict access controls ensure that only authorized users can access sensitive data.

- Regular Audits: Regular security audits help identify and fix vulnerabilities.

Implementing these measures helps prevent data breaches and ensures data integrity.

Regulatory Compliance

Regulatory compliance is essential for trading algorithm platforms. These platforms must adhere to various financial regulations.

| Region | Regulation | Requirement |

|---|---|---|

| USA | Sarbanes-Oxley Act (SOX) | Financial reporting and disclosure |

| Europe | MiFID II | Transparency and investor protection |

| Global | GDPR | Data privacy and protection |

Adhering to these regulations ensures platforms operate legally and ethically.

Failure to comply can result in hefty fines and loss of reputation.

Credit: www.nextiva.com

Future Trends In Trading Algorithms

The world of trading algorithms is rapidly evolving. With new technologies, traders can execute complex strategies more efficiently. Here, we explore some future trends in trading algorithms.

Quantum Computing

Quantum computing is set to revolutionize trading algorithms. Unlike traditional computers, quantum computers use quantum bits or qubits. This allows them to process vast amounts of data faster.

Benefits of Quantum Computing in Trading:

- Faster data processing

- More accurate predictions

- Enhanced risk management

Challenges:

- High cost of quantum computers

- Need for specialized knowledge

- Limited access to quantum technology

Blockchain Integration

Blockchain technology offers significant benefits for trading algorithms. Blockchain ensures data integrity and transparency. This makes it perfect for secure and efficient trading.

Frequently Asked Questions

What Are Enterprise-grade Trading Algorithm Platforms?

Enterprise-grade trading algorithm platforms are advanced systems designed for large-scale trading operations. They offer high performance, reliability, and security. These platforms support complex trading strategies and large volumes of transactions, making them suitable for institutional traders and financial firms.

How Do Trading Algorithm Tools Work?

Trading algorithm tools use mathematical models to analyze market data and execute trades. They automate the trading process, making decisions based on predefined criteria. These tools aim to optimize trading performance and reduce human error, enhancing efficiency and accuracy.

What Features Should A Trading Algorithm Platform Have?

A trading algorithm platform should have robust security, high-speed execution, and scalability. It should support multiple asset classes, offer real-time data analysis, and provide backtesting capabilities. User-friendly interfaces and integration with various trading systems are also essential features.

Why Choose Enterprise-grade Trading Platforms?

Enterprise-grade trading platforms offer superior performance, reliability, and security. They handle large transaction volumes and complex strategies. These platforms are designed for institutional traders, providing advanced features that cater to their specific needs, ensuring efficient and effective trading operations.

Conclusion

Choosing the right trading algorithm platform is crucial for success. These tools offer advanced features and reliability. They help traders make informed decisions quickly. By using these platforms, you can optimize your trading strategies. Enhance your trading experience with enterprise-grade tools.

Make the best choice and trade confidently.