Enterprise-grade wealth management software tools streamline financial planning and investment management. These tools offer robust features for portfolio management, risk analysis, and client reporting.

Wealth management software tools are essential for financial advisors and firms. They help in managing clients’ investments efficiently. These tools provide detailed analytics and insights. Advisors can make better decisions with real-time data. They also ensure compliance with regulations. User-friendly interfaces make them accessible to non-tech users.

Automation features save time on routine tasks. Security features protect sensitive financial data. Integration capabilities allow seamless connection with other systems. Overall, these tools enhance productivity and client satisfaction. They are a must-have for modern wealth management.

Introduction To Wealth Management Software

Wealth management software tools are transforming financial services. These tools help enterprises manage assets efficiently. They offer real-time data, seamless integration, and advanced analytics. Businesses can now provide personalized services to clients. This enhances client satisfaction and boosts profitability.

Importance For Enterprises

Enterprises need wealth management software for various reasons. Firstly, it improves operational efficiency. Automated processes save time and reduce errors. Secondly, it enhances client relationships. Personalized services meet client needs better.

Thirdly, these tools offer robust compliance features. They ensure adherence to regulatory requirements. This minimizes legal risks. Finally, wealth management software provides valuable insights. Data analytics help in making informed decisions.

Key Features

Wealth management software comes with several key features. Let’s explore them:

- Portfolio Management: Tracks and manages client portfolios. Offers real-time updates and performance reports.

- Risk Management: Identifies and mitigates financial risks. Uses advanced algorithms for risk assessment.

- Client Reporting: Generates detailed reports for clients. Enhances transparency and trust.

- Compliance Monitoring: Ensures adherence to regulatory standards. Reduces legal risks and penalties.

- Data Security: Protects sensitive client information. Uses encryption and secure access controls.

These features make wealth management software indispensable. Enterprises can streamline operations and improve client satisfaction.

| Feature | Benefit |

|---|---|

| Portfolio Management | Real-time updates and performance reports |

| Risk Management | Advanced algorithms for risk assessment |

| Client Reporting | Enhances transparency and trust |

| Compliance Monitoring | Reduces legal risks and penalties |

| Data Security | Encryption and secure access controls |

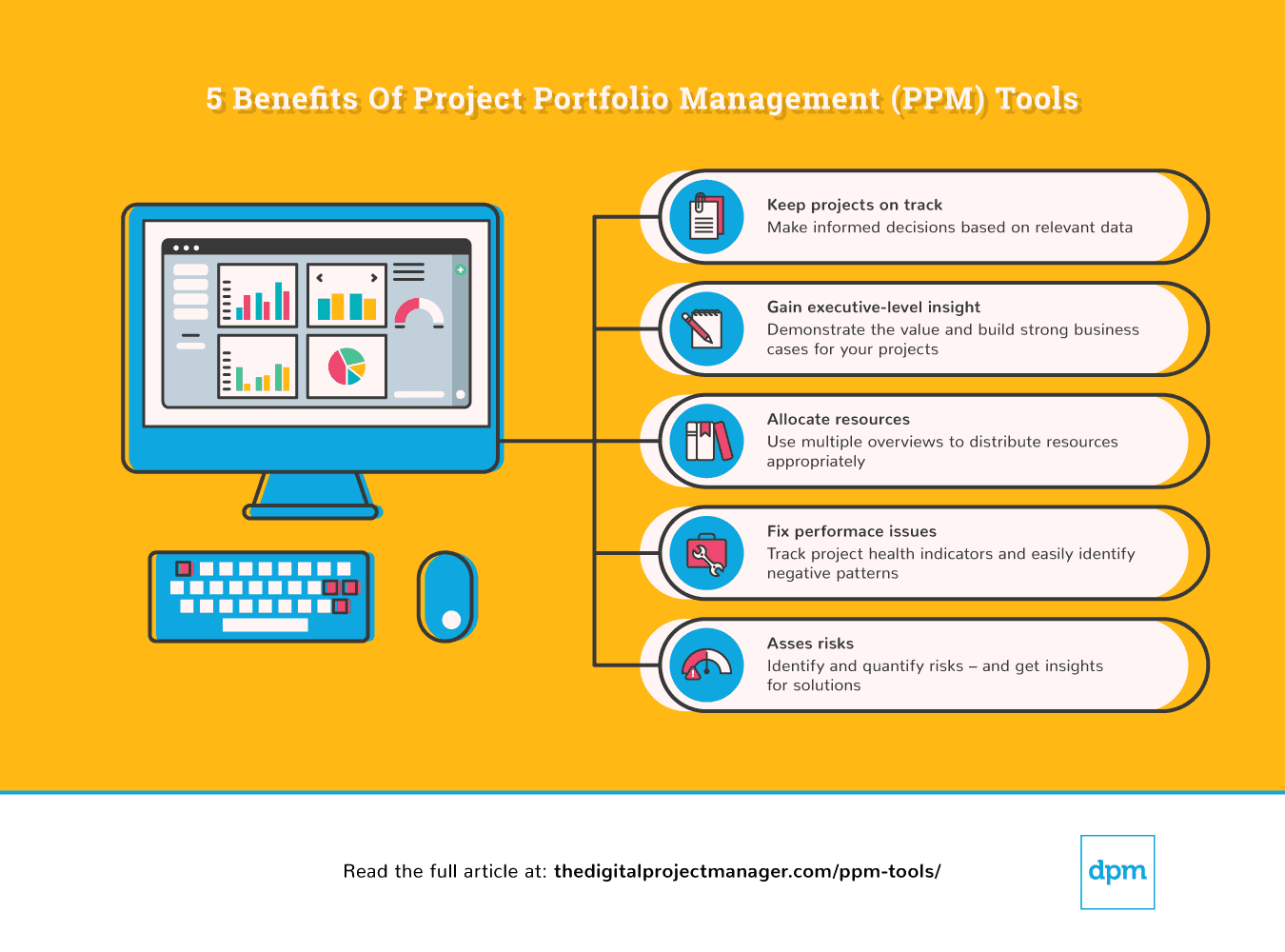

Credit: thedigitalprojectmanager.com

Benefits Of Wealth Management Software

Enterprise-grade wealth management software tools offer significant advantages to financial professionals. These tools enhance efficiency and improve client relationships. The software simplifies complex tasks and provides insightful data analysis. Let’s explore the key benefits of using wealth management software.

Enhanced Efficiency

Wealth management software tools automate repetitive tasks. This saves valuable time for financial advisors. Automated features include portfolio management, risk analysis, and reporting. Advisors can spend more time on strategic planning and client interaction.

The software integrates data from multiple sources. This provides a single view of all client assets. Advisors can make informed decisions quickly. Real-time updates ensure that all information is current and accurate.

| Task | Traditional Method | With Software |

|---|---|---|

| Portfolio Management | Manual entry and updates | Automated and real-time |

| Risk Analysis | Complex calculations | Automated risk assessment |

| Reporting | Manual report generation | Instant and customizable reports |

Improved Client Relationships

Wealth management software enhances client communication. Advisors can access client information quickly. This allows for personalized and timely advice. Clients feel valued and understood.

The software provides detailed insights into client portfolios. Advisors can identify opportunities and risks. This helps in tailoring investment strategies. Clients appreciate the proactive approach to managing their wealth.

- Quick access to client data

- Personalized financial advice

- Proactive risk management

Using wealth management software builds trust with clients. Transparency and accuracy in reporting are key. Clients see the value in the services provided.

Top Enterprise-grade Tools

Enterprise-grade wealth management software tools are vital for financial institutions. These tools streamline operations, improve client satisfaction, and enhance decision-making. Below, we explore the industry leaders and emerging solutions in this sector.

Industry Leaders

Several tools dominate the enterprise-grade wealth management software market. They offer advanced features and robust support.

| Tool | Key Features | Benefits |

|---|---|---|

| Envestnet |

|

|

| Addepar |

|

|

| Orion Advisor Tech |

|

|

Emerging Solutions

New solutions are also making their mark in wealth management software. These emerging tools offer innovative features and competitive advantages.

- InvestCloud

- Cloud-based platform

- Customizable dashboards

- Real-time analytics

InvestCloud enhances flexibility and provides instant insights.

- Black Diamond

- Portfolio management

- Client reporting

- Data integration

Black Diamond offers efficient management and detailed reporting.

- SEI Wealth Platform

- Comprehensive wealth management

- Scalable solutions

- Integrated services

SEI Wealth Platform scales with your business and integrates services seamlessly.

Credit: digital.ai

Key Features To Look For

Enterprise-grade wealth management software tools are essential for financial advisors and institutions. The right tool can streamline operations, enhance client satisfaction, and improve investment outcomes. Here are some key features to look for.

Customization Options

Customization options are crucial in wealth management software. These features allow you to tailor the software to fit your specific needs. This includes:

- Customizable dashboards

- Personalized client reports

- Adjustable workflows

With these options, you can create a system that works best for your team and clients. It ensures that the software grows with your business.

Security Measures

Security is paramount in wealth management. The software must offer robust security measures to protect sensitive information. Key security features include:

- Data encryption

- Two-factor authentication

- Regular security audits

These features help safeguard client data against breaches and unauthorized access. It builds trust with clients, knowing their information is secure.

Integration With Existing Systems

Enterprise-Grade Wealth Management Software Tools are essential for modern financial institutions. They streamline operations and enhance client satisfaction. One crucial aspect of these tools is their integration with existing systems. Seamless integration ensures efficiency and data consistency.

Crm Integration

CRM Integration is vital for wealth management software. It helps manage client relationships better. A connected CRM system ensures all client data is centralized. This leads to more personalized and efficient service.

Key benefits of CRM integration include:

- Improved client communication

- Centralized client information

- Automated workflows

- Enhanced data security

A table showcasing CRM integration features:

| Feature | Benefit |

|---|---|

| Client Data Synchronization | Ensures up-to-date information |

| Automated Alerts | Timely client follow-ups |

| Reporting | Better insights for decision-making |

Financial Planning Tools

Financial Planning Tools integration is also essential. It provides comprehensive financial management capabilities. These tools help in creating detailed financial plans. Integrating them ensures a unified approach to wealth management.

Key benefits of financial planning tools integration include:

- Holistic financial overview

- Detailed investment analysis

- Better risk management

- Improved client engagement

A table showcasing financial planning tools features:

| Feature | Benefit |

|---|---|

| Budgeting | Efficient allocation of resources |

| Portfolio Management | Optimized investment strategies |

| Risk Assessment | Minimized financial risks |

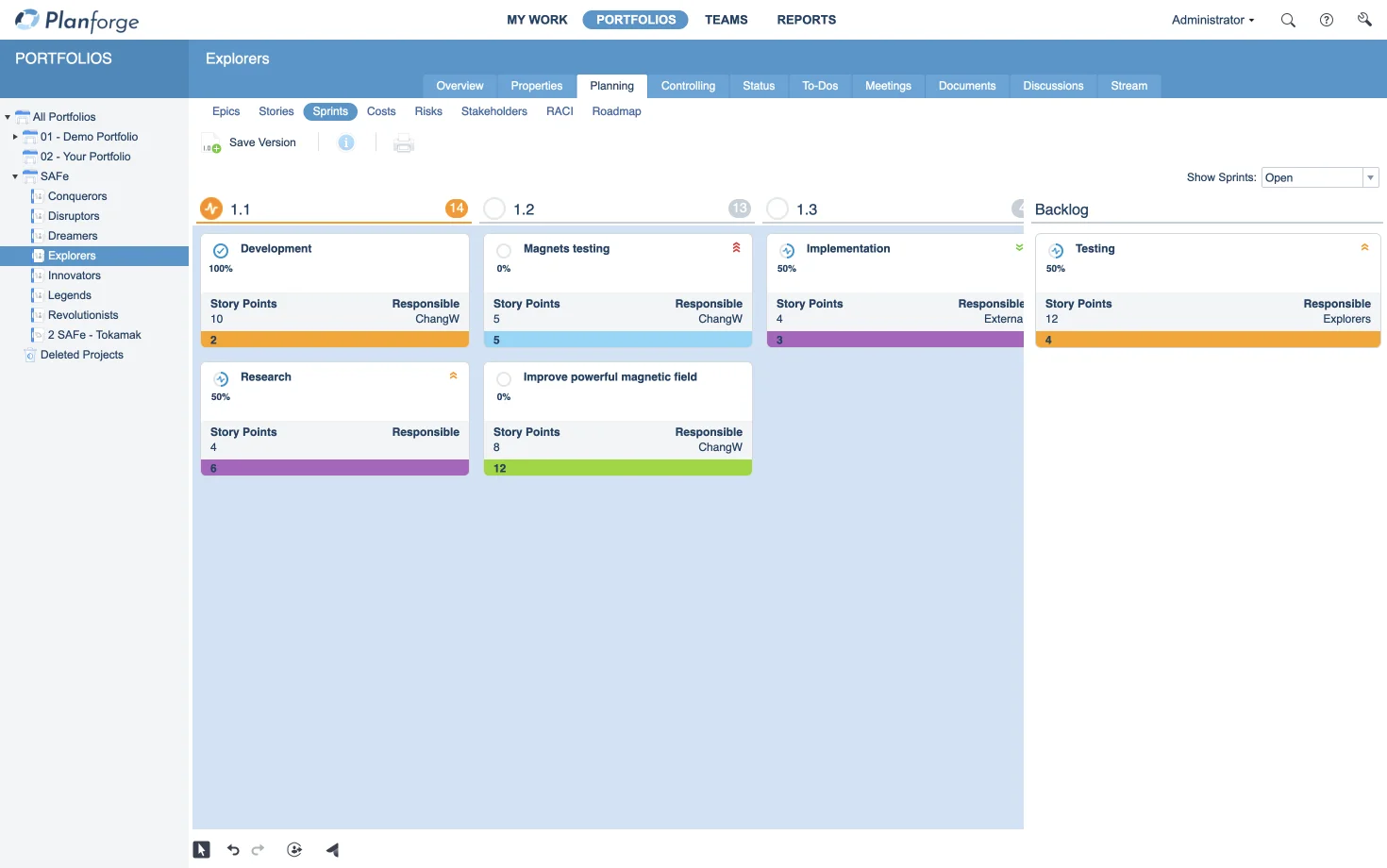

Credit: www.planforge.io

Cost Considerations

Investing in enterprise-grade wealth management software tools involves careful cost considerations. Understanding the financial impact helps firms make informed decisions. This section explores the initial investment and the long-term value of these tools.

Initial Investment

The initial investment in wealth management software includes various costs. These costs vary based on the software’s complexity and features. Here’s a breakdown:

| Cost Component | Estimated Range |

|---|---|

| Software License | $10,000 – $50,000 |

| Implementation Fees | $5,000 – $20,000 |

| Training and Onboarding | $2,000 – $10,000 |

Firms must budget for these initial costs to avoid surprises. A detailed cost analysis ensures financial preparedness and smooth implementation.

Long-term Value

The long-term value of wealth management software is significant. Here are key benefits:

- Enhanced efficiency in managing client portfolios.

- Improved client satisfaction through personalized services.

- Increased compliance with regulatory requirements.

These benefits contribute to the firm’s growth and profitability. Regular software updates and support also ensure continuous improvement. Investing in quality software yields substantial returns over time.

Real-world Case Studies

In this section, we dive into real-world case studies of enterprise-grade wealth management software tools. These examples illustrate the power and efficiency of these tools in real business environments. They also offer valuable lessons for future implementations.

Successful Implementations

Let’s explore some successful implementations of wealth management software tools:

| Company | Tool Used | Results |

|---|---|---|

| ABC Wealth Management | FinTools Pro | Increased client satisfaction by 30% |

| XYZ Investments | InvestMaster Suite | Reduced operational costs by 20% |

| Global Finance Corp | WealthSoft Enterprise | Boosted portfolio performance by 15% |

Lessons Learned

From these case studies, several key lessons emerge:

- Integration is Crucial: Ensure the software integrates well with existing systems.

- Training is Key: Staff must be well-trained to use new tools effectively.

- Customization: Tailor the software to meet specific business needs.

- Continuous Monitoring: Regularly monitor performance for ongoing improvements.

These lessons highlight the importance of thoughtful implementation and continuous support. They can guide future projects towards success.

Future Trends In Wealth Management Software

The future of wealth management software is bright. Enterprise-grade tools are evolving rapidly. New technologies are shaping the industry. Below, we explore key trends.

Ai And Automation

Artificial Intelligence (AI) is transforming wealth management. AI can analyze huge datasets quickly. This helps in making informed decisions. Automation reduces manual tasks. It streamlines operations and increases efficiency.

With AI, personalized advice is now possible. It tailors financial plans to individual needs. Robo-advisors are gaining popularity. They offer automated, algorithm-driven financial planning services with little human supervision.

Key benefits of AI and Automation:

- Increased operational efficiency

- Enhanced decision-making

- Personalized financial advice

- Cost reduction

Blockchain Technology

Blockchain technology offers a new level of transparency and security. It ensures that transactions are secure and immutable. This is crucial in wealth management.

Blockchain can also reduce operational costs. It eliminates the need for intermediaries. This leads to faster and cheaper transactions.

Key benefits of Blockchain Technology:

- Enhanced security

- Increased transparency

- Reduced operational costs

- Faster transactions

| Future Trend | Key Benefits |

|---|---|

| AI and Automation |

|

| Blockchain Technology |

|

Choosing The Right Solution

Choosing the right enterprise-grade wealth management software is crucial. It impacts efficiency, client satisfaction, and overall success. This section will help you navigate the selection process. We will focus on two key areas: assessing needs and vendor comparison.

Assessing Needs

Start by evaluating your firm’s specific requirements. Consider the following factors:

- Number of clients

- Range of services offered

- Data management needs

- Integration with existing systems

- Regulatory compliance

Discuss these needs with your team. Create a detailed list of essential features. This step ensures the software aligns with your firm’s goals.

Vendor Comparison

Once you have a clear understanding of your needs, compare different vendors. Use the table below to evaluate potential solutions:

| Vendor | Key Features | Pricing | Customer Support | User Reviews |

|---|---|---|---|---|

| Vendor A | Feature 1, Feature 2 | $$$ | 24/7 Support | 4.5/5 |

| Vendor B | Feature 3, Feature 4 | $$ | Business Hours | 4.0/5 |

| Vendor C | Feature 5, Feature 6 | $$$ | 24/7 Support | 4.8/5 |

Consider both qualitative and quantitative factors. Pay attention to user reviews. They provide insight into real-world performance.

Choosing the right solution involves careful assessment and comparison. Make informed decisions to select the best wealth management software for your firm.

Frequently Asked Questions

What Is Enterprise-grade Wealth Management Software?

Enterprise-grade wealth management software is a powerful tool designed for large-scale financial institutions. It helps manage investments, portfolios, and client relationships efficiently. These tools offer advanced features, robust security, and seamless integration with other systems. They ensure compliance with regulatory standards and enhance decision-making.

Why Use Wealth Management Software Tools?

Wealth management software tools streamline financial processes and improve efficiency. They provide comprehensive insights into investments and portfolios. These tools ensure data accuracy and compliance. They also enhance client relationship management and decision-making. Overall, they help financial institutions achieve better outcomes.

How Does Wealth Management Software Enhance Decision-making?

Wealth management software provides real-time data and advanced analytics. These features enable informed and strategic decision-making. The software also offers predictive insights and risk assessment. This helps financial advisors and institutions make better investment choices. Enhanced decision-making leads to improved client satisfaction and business growth.

What Features To Look For In Wealth Management Software?

Key features include portfolio management, real-time analytics, and robust security. Integration with other financial systems is crucial. Look for regulatory compliance and customizable reporting. Client relationship management tools are essential. Advanced features like AI and machine learning can enhance performance.

Conclusion

Choosing the right wealth management software is crucial for enterprises. It simplifies financial tasks and improves efficiency. These tools offer advanced features, ensuring better asset management. Investing in such software can lead to significant growth. Make a smart choice for your enterprise’s financial future.