Choose the best trading algorithm platforms by considering reliability and user reviews. Evaluate features, fees, and customer support.

Choosing the right trading algorithm platform is crucial for successful trading. A reliable platform ensures your trades execute efficiently. User reviews can provide insights into the platform’s performance and trustworthiness. Look for platforms with transparent fees and robust features. Good customer support can assist you in times of need.

Ease of use is important, especially for beginners. Research and compare multiple platforms before making a decision. This will help you find the best fit for your trading needs. Always prioritize security and data protection.

Introduction To Trading Algorithm Platforms

Trading algorithm platforms are essential for modern traders. These platforms help in automating trading strategies. They make trading faster and more efficient. Choosing the right platform is crucial for success.

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software programs. They use algorithms to trade assets automatically. These platforms can analyze market data quickly. They execute trades based on predefined rules. Traders use them to maximize profits and minimize losses.

Here are some key features of trading algorithm platforms:

- Automated trading

- Backtesting of trading strategies

- Real-time market data analysis

- Risk management tools

Importance Of Choosing The Right Platform

Choosing the right trading algorithm platform is very important. The right platform can enhance trading performance. It provides accurate data and reliable execution. A poor choice can lead to significant losses.

Consider these factors when choosing a platform:

| Factor | Importance |

|---|---|

| Reliability | Ensures continuous trading without interruptions |

| Speed | Fast execution to take advantage of market movements |

| Customization | Allows tailoring strategies to specific needs |

| Support | Provides help in case of issues |

Make sure to research each platform thoroughly. Read user reviews and expert opinions. Test the platform with small trades first. This ensures it meets your needs.

Credit: ftmo.com

Types Of Trading Algorithms

Choosing the best trading algorithm platform can be challenging. Knowing the types of trading algorithms helps make an informed decision. Different algorithms suit different strategies. Here are some common types of trading algorithms:

Trend Following Algorithms

Trend following algorithms identify and follow market trends. They aim to buy when prices rise and sell when prices fall. These algorithms use moving averages, channel breakouts, and related indicators. They work well in trending markets but may struggle during sideways movements. Examples include:

- Moving Average Crossover

- Price Channel Breakout

- Relative Strength Index (RSI)

Mean Reversion Algorithms

Mean reversion algorithms assume that prices return to their average over time. They identify overbought or oversold conditions and take opposite positions. These algorithms are effective in range-bound markets. They often use Bollinger Bands, Moving Average, and RSI indicators. Some common mean reversion strategies are:

- Bollinger Bands Strategy

- Pairs Trading

- Statistical Arbitrage

Arbitrage Algorithms

Arbitrage algorithms exploit price differences across markets. They aim to buy low in one market and sell high in another. These algorithms require fast execution and low latency. They often involve complex calculations and high-frequency trading. Key types of arbitrage algorithms include:

- Statistical Arbitrage

- Convertible Arbitrage

- Fixed Income Arbitrage

Choosing the right trading algorithm platform depends on your strategy. Knowing these types can help you make better choices.

Key Features To Look For

Choosing the right trading algorithm platform can be a daunting task. It’s important to know what features are essential. This guide will highlight the key aspects to consider.

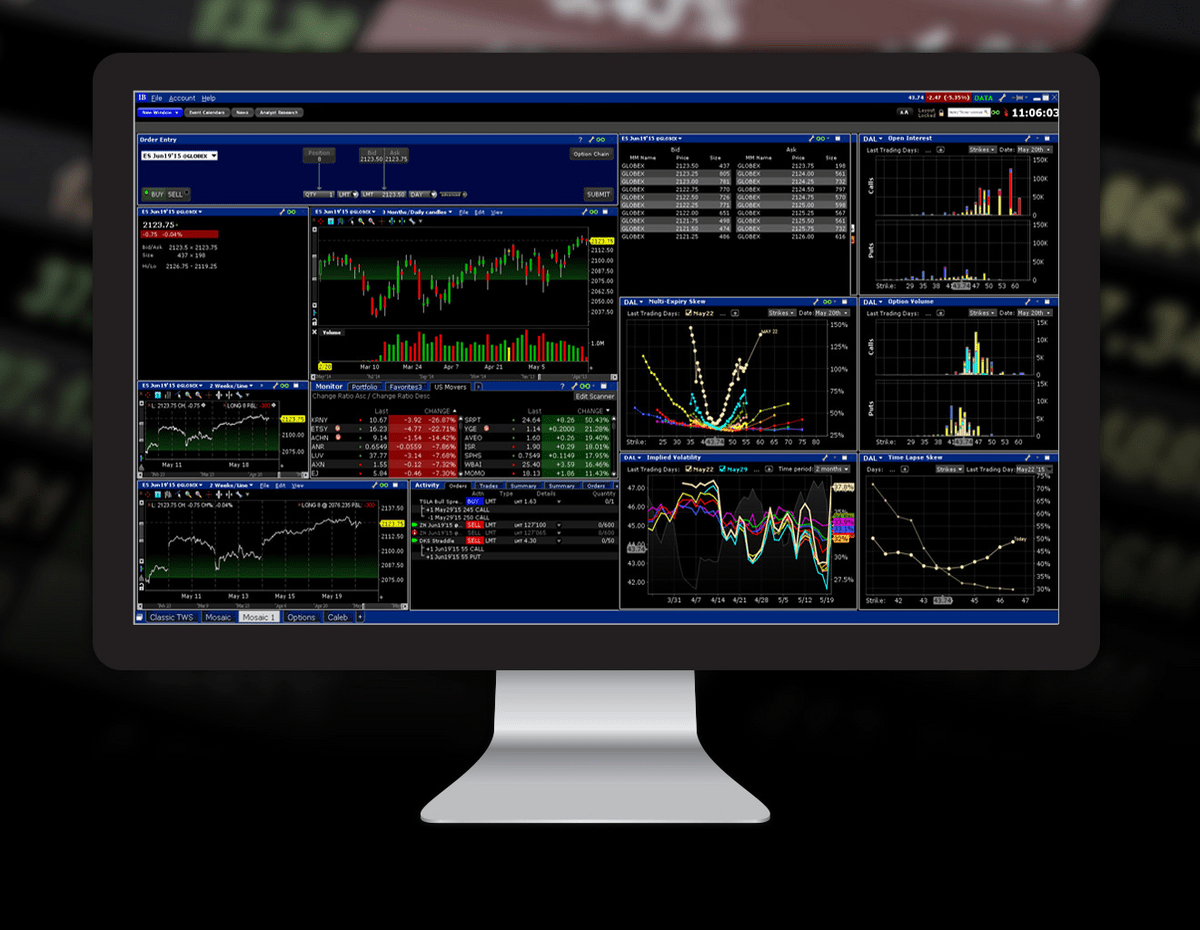

User-friendly Interface

A user-friendly interface is crucial for any trading platform. It should be easy to navigate. Users should find it simple to execute trades.

Look for platforms with clear menus and buttons. A clean layout can significantly improve your trading experience. Ensure the platform supports multiple devices, including mobile phones.

Customization Options

Customization options allow you to tailor the platform to your needs. Look for features like:

- Customizable dashboards

- Personalized alerts

- Adjustable trading parameters

These options help you optimize your trading strategies. They also make the platform more user-friendly.

Real-time Data And Analytics

Access to real-time data is a must for successful trading. Ensure the platform provides live updates. This includes market prices and trends.

Look for advanced analytics tools. They should offer detailed reports and insights. This helps in making informed trading decisions.

Some platforms also offer automated analysis. This feature can save you time and effort.

| Feature | Importance |

|---|---|

| User-Friendly Interface | High |

| Customization Options | Medium |

| Real-Time Data and Analytics | High |

Credit: www.wallstreetzen.com

Evaluating Platform Performance

Choosing the best trading algorithm platforms requires careful evaluation. Platform performance is key to success. This involves assessing backtesting capabilities, execution speed, and reliability. Below, we delve into these critical aspects.

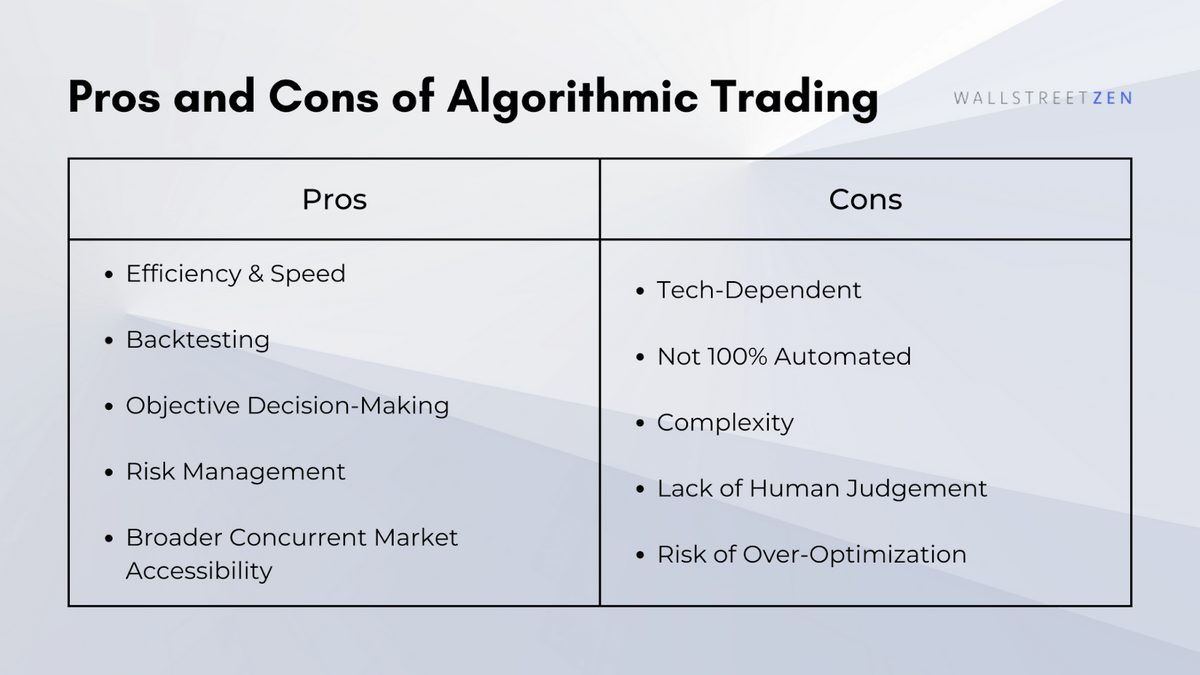

Backtesting Capabilities

Backtesting lets traders test strategies on historical data. It shows if a strategy works before real trading. Look for platforms with robust backtesting tools. The best platforms offer detailed reports and analytics. They should allow testing on various market conditions. Accuracy and comprehensive data are essential.

Execution Speed

Execution speed is vital for trading success. Delays can cause missed opportunities or losses. Choose platforms with fast and reliable trade execution. Latency and processing speed should be minimal. Low latency means faster trade execution. High-speed platforms give a competitive edge.

Reliability And Uptime

Reliability ensures consistent trading without interruptions. Uptime refers to the platform’s availability. Aim for platforms with 99.9% uptime or better. Frequent downtimes can disrupt trading and cause losses. Reliable platforms have redundant systems and regular maintenance. They offer customer support to handle issues promptly.

| Criteria | Key Features |

|---|---|

| Backtesting Capabilities |

|

| Execution Speed |

|

| Reliability and Uptime |

|

Security And Compliance

Choosing the right trading algorithm platform means prioritizing security and compliance. These factors ensure your investments stay safe and legal.

Data Protection Measures

Platforms must have robust data protection measures. This ensures your personal and financial information stays secure. Look for encryption technologies like SSL and TLS. These technologies protect data during transmission. Platforms should also have strong firewalls. Firewalls prevent unauthorized access to your data.

Regulatory Compliance

Always check if the platform follows regulatory compliance. This means they adhere to financial laws and regulations. Verify if the platform is registered with financial authorities. Registration ensures the platform operates legally. Also, check if they comply with international standards. This includes GDPR and PCI DSS for data protection. Compliance with these standards guarantees the platform values security.

User Authentication

Ensure the platform uses robust user authentication methods. Two-factor authentication (2FA) is crucial. It adds an extra layer of security. This prevents unauthorized access to your account. Look for platforms that offer biometric authentication. Fingerprint or facial recognition provides added security. Regular password updates and complexity requirements are also essential. They keep your account safe from breaches.

Cost Considerations

Choosing the best trading algorithm platforms involves many factors, but cost considerations are crucial. Traders must be aware of all potential costs to avoid unexpected expenses. Below, we break down the main cost categories to consider.

Subscription Fees

Many trading algorithm platforms require a subscription fee. These fees can vary significantly. Here is a table showing different subscription models:

| Platform | Monthly Fee | Annual Fee |

|---|---|---|

| Platform A | $30 | $300 |

| Platform B | $50 | $500 |

| Platform C | $100 | $1000 |

Some platforms offer discounts for annual subscriptions. Check if a trial period is available before committing.

Transaction Costs

Transaction costs are fees charged for buying and selling. These can include:

- Brokerage fees

- Commission fees

- Spread costs

These fees can quickly add up, affecting your overall profitability. Always compare transaction costs between platforms. Some platforms offer lower fees for high-volume traders.

Hidden Charges

Be aware of hidden charges that may not be immediately obvious. These can include:

- Data fees

- Withdrawal fees

- Inactivity fees

Hidden charges can erode your profits. Review the terms and conditions carefully. Contact customer support for clarification if needed.

Understanding all potential costs helps you choose the best trading algorithm platform for your needs.

Customer Support And Resources

Choosing the best trading algorithm platform requires more than just top-notch technology. Customer support and resources play a crucial role in your trading success. These elements ensure you can maximize the platform’s potential and overcome challenges swiftly. Let’s explore the key aspects of customer support and resources.

Availability Of Support

Reliable platforms offer 24/7 customer support. This availability ensures assistance at any trading hour. Multiple support channels are vital. Look for platforms with:

- Live chat

- Email support

- Phone support

A responsive support team can resolve issues quickly, minimizing downtime and maximizing trading opportunities.

Educational Materials

Quality educational materials enhance your trading skills. Leading platforms provide:

- Webinars and video tutorials

- E-books and articles

- Interactive courses

These resources help you understand complex trading strategies and improve decision-making.

Community And Forums

Active trading communities and forums offer valuable insights. Participating in these groups allows you to:

- Share experiences

- Learn from other traders

- Stay updated with market trends

Engage with these platforms to gain diverse perspectives and enhance your trading knowledge.

| Support Channel | Availability |

|---|---|

| Live Chat | 24/7 |

| Email Support | 24/7 |

| Phone Support | Business Hours |

Top Trading Algorithm Platforms

Choosing the best trading algorithm platforms can be tough. Many options exist, each with unique features. This section will guide you through the top trading algorithm platforms.

Platform A Overview

Platform A is user-friendly and perfect for beginners. It offers powerful tools and easy navigation. Key features include:

- Automated Trading: Execute trades automatically based on predefined rules.

- Backtesting: Test your strategies with historical data.

- Customizable Interface: Tailor the platform to your needs.

Platform A also provides extensive tutorials and customer support. This helps new users get started quickly.

Platform B Overview

Platform B is known for its advanced analytics. It is suitable for experienced traders. Key features include:

- Real-Time Data: Access to live market data for accurate decision-making.

- Algorithm Library: A vast library of pre-built algorithms.

- Risk Management: Advanced tools to manage trading risks.

Platform B integrates with various brokers. This provides flexibility and convenience for traders.

Platform C Overview

Platform C focuses on social trading and collaboration. It connects traders worldwide. Key features include:

- Copy Trading: Copy trades from successful traders.

- Community Support: Engage with other traders through forums and chat.

- Educational Resources: Access webinars, tutorials, and articles.

Platform C is ideal for those who value community and learning from others.

| Platform | Key Features | Best For |

|---|---|---|

| Platform A |

| Beginners |

| Platform B |

| Experienced Traders |

| Platform C |

| Social Traders |

Conclusion And Recommendations

Choosing the best trading algorithm platform can be daunting. This guide aims to simplify the process. Here, we’ll summarize key points and provide final recommendations.

Summary Of Key Points

Selecting the right platform involves several factors. These include:

- Ease of Use: The platform should be user-friendly.

- Cost: Consider subscription fees and hidden charges.

- Security: Ensure the platform offers robust security features.

- Customizability: Look for platforms that allow code customization.

- Performance: Check past performance and reviews from users.

- Support: Customer support should be accessible and helpful.

These factors collectively determine the platform’s suitability for your needs.

Final Recommendations

After evaluating various platforms, here are our top recommendations:

- Platform A: Best for beginners with its easy interface.

- Platform B: Ideal for advanced traders needing customization.

- Platform C: Excellent for those prioritizing security and support.

Each of these platforms excels in different areas. Choose one based on your specific requirements.

For a quick comparison, refer to the table below:

| Platform | Ease of Use | Cost | Security | Customizability | Support |

|---|---|---|---|---|---|

| Platform A | High | Low | Medium | Low | High |

| Platform B | Medium | High | High | High | Medium |

| Platform C | Low | Medium | High | Medium | High |

This comparison helps in making a well-informed decision.

Credit: www.wallstreetzen.com

Frequently Asked Questions

What Is A Trading Algorithm Platform?

A trading algorithm platform is software that uses algorithms to execute trades. It helps automate trading strategies.

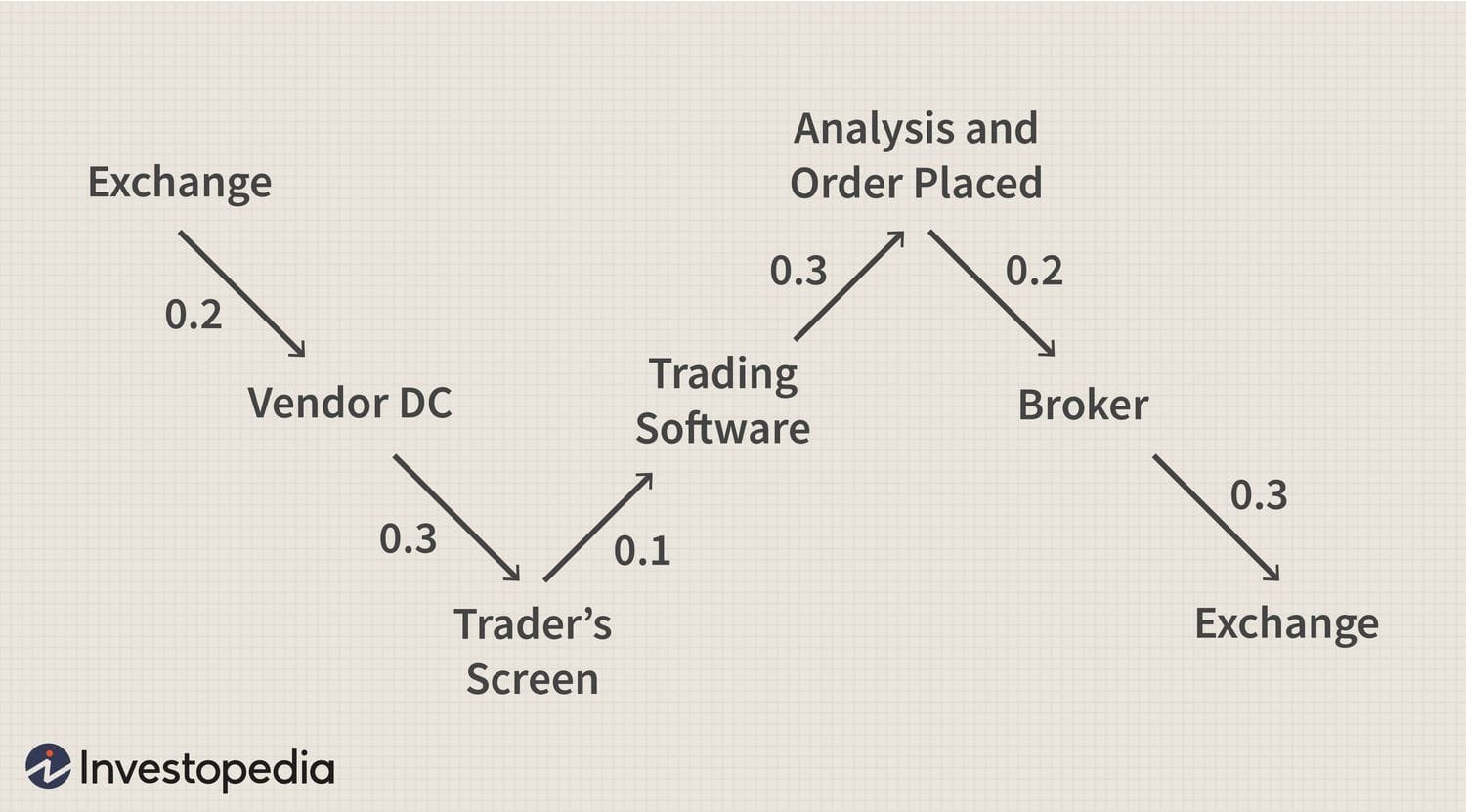

How Do Trading Algorithms Work?

Trading algorithms analyze market data and make trade decisions. They execute trades at optimal prices and times.

What Features To Look For In A Trading Algorithm Platform?

Look for real-time data, backtesting, customization, and security features. User-friendly interfaces are also important.

Are Trading Algorithm Platforms Safe?

Yes, they are generally safe. Choose reputable platforms with strong security measures and positive user reviews.

Conclusion

Choosing the best trading algorithm platform is crucial for success. Evaluate your needs carefully. Check for user-friendly interfaces and strong security measures. Compare costs and features. Read user reviews and seek expert advice. Making an informed choice can boost your trading results.

Start exploring your options today.