To choose the best wealth management software, identify your needs first. Then, evaluate features, ease of use, and support.

Selecting the right wealth management software can be challenging. It plays a crucial role in managing finances effectively. Start by identifying your specific needs and goals. This helps in narrowing down the options. Look for software that offers comprehensive features, such as portfolio management and financial planning.

Ensure that the software is user-friendly and intuitive. Check for reliable customer support and regular updates. Cost is also an important factor; compare prices and value for money. Reading reviews and seeking recommendations can provide additional insights. With careful consideration, you can find the perfect software to streamline your wealth management.

Introduction To Wealth Management Software

Wealth management software is a key tool in today’s finance world. It helps individuals and firms manage their assets efficiently. With the right software, you can streamline your financial planning, investment management, and other wealth-related activities.

Importance In Modern Finance

Wealth management software plays a critical role in modern finance. It offers advanced features that simplify asset management. This software helps track investments in real-time. It provides valuable insights for better decision-making.

Here are some key reasons why it is important:

- Automation reduces manual tasks and errors.

- Real-time data helps monitor market changes.

- Custom reports offer personalized financial insights.

Key Benefits

The benefits of using wealth management software are vast. It can significantly improve your financial operations.

| Benefit | Description |

|---|---|

| Efficiency | Automates routine tasks, saving time and effort. |

| Accuracy | Minimizes errors in financial calculations. |

| Transparency | Provides clear and detailed financial reports. |

| Scalability | Grows with your financial needs. |

| Security | Protects sensitive financial information. |

Choosing the best wealth management software can transform your financial management. It enhances productivity and ensures better financial health.

Credit: www.10xsheets.com

Identifying Your Needs

Choosing the best wealth management software starts with identifying your needs. This helps narrow down the options. Begin by assessing your financial goals and considering user experience.

Assessing Financial Goals

Your financial goals dictate the type of software you need. If you aim to manage investments, look for features like portfolio management and performance tracking. For retirement planning, ensure the software has retirement calculators and planning tools.

Consider your short-term and long-term goals. Short-term goals might include budgeting or debt management. Long-term goals often cover estate planning and tax optimization. List your goals and match them with the software’s features.

Considering User Experience

User experience is crucial for ease of use. A complex interface can be frustrating. Check if the software offers an intuitive dashboard. Look for customizable reports and real-time updates.

Analyze the software’s mobile compatibility. Mobile access ensures you can manage finances on the go. Also, consider if the software supports multiple users. This is useful for family or team management.

| Feature | Importance |

|---|---|

| Portfolio Management | High |

| Budgeting Tools | Medium |

| Retirement Calculators | High |

| Mobile Compatibility | High |

| Customizable Reports | Medium |

Essential Features To Look For

Choosing the best wealth management software can be challenging. You need to find software that meets all your financial needs. In this section, we will explore the essential features to consider.

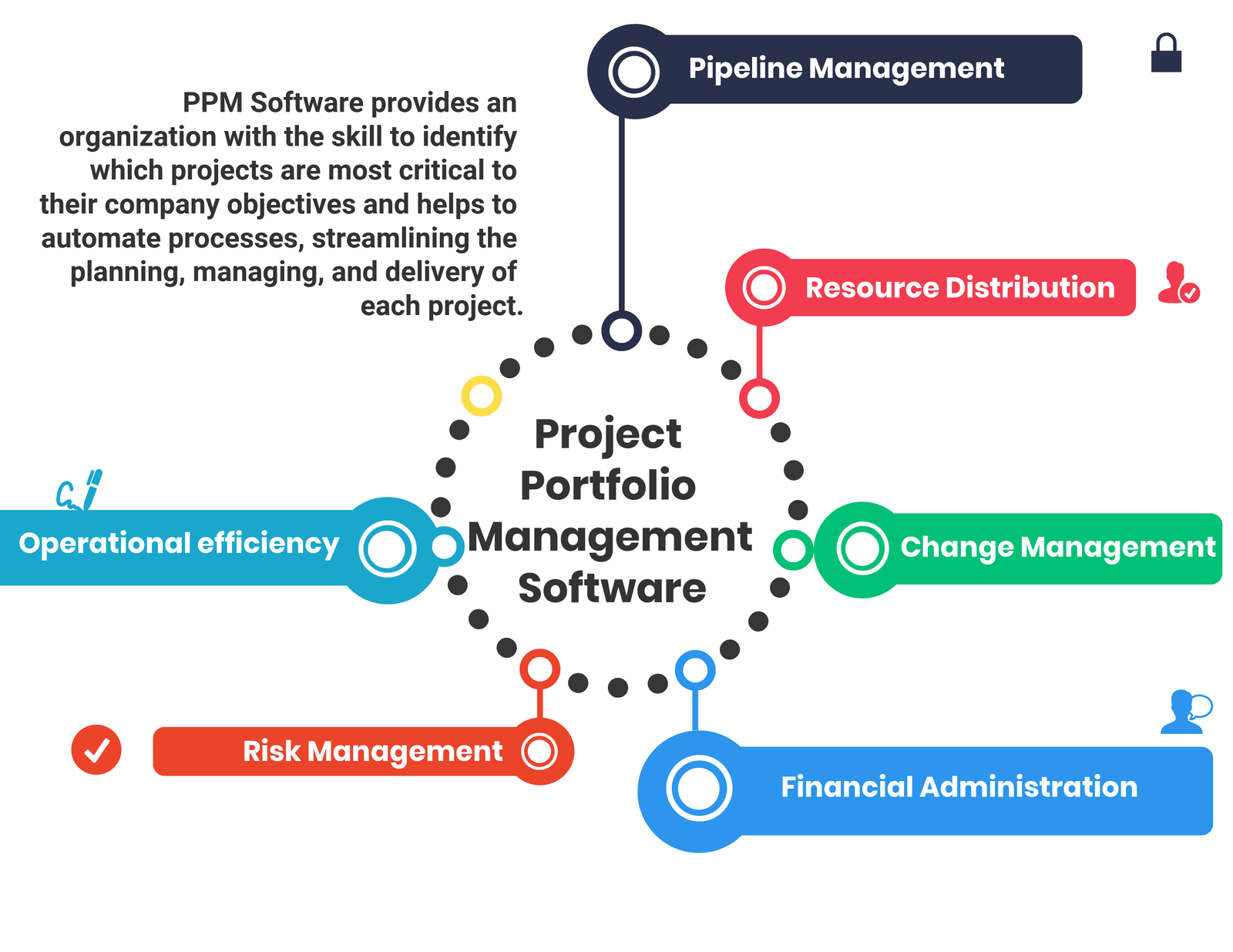

Portfolio Management

A great wealth management software should offer robust portfolio management features. This includes the ability to track investments, monitor performance, and make adjustments. Here are some key aspects:

- Real-time tracking of assets

- Performance analytics

- Transaction history

- Customizable reports

Risk Analysis Tools

Risk analysis is crucial for managing your wealth. Effective software should provide comprehensive risk analysis tools. These tools help you understand and mitigate risks. Important features include:

- Risk assessment reports

- Scenario analysis

- Stress testing

- Value at Risk (VaR) calculations

Below is a table summarizing the essential features:

| Feature | Description |

|---|---|

| Real-time tracking | Monitor assets as they change |

| Performance analytics | Analyze the performance of your investments |

| Transaction history | Keep track of all transactions |

| Customizable reports | Create reports tailored to your needs |

| Risk assessment reports | Identify potential risks |

| Scenario analysis | Evaluate different financial scenarios |

| Stress testing | Test your portfolio under extreme conditions |

| Value at Risk (VaR) | Measure the potential loss in value |

Credit: www.predictiveanalyticstoday.com

Evaluating Security Measures

Choosing the best wealth management software is crucial. One key aspect to consider is security measures. Proper security ensures that sensitive financial data remains safe. Let’s dive into some essential security features.

Data Encryption

Data encryption is vital for protecting financial information. It transforms data into a secure format. Here are some important points:

- Encryption Standards: Ensure the software uses strong encryption standards, like AES-256.

- Data in Transit: The software should encrypt data during transmission. This prevents interception by unauthorized parties.

- Data at Rest: Ensure that stored data is encrypted. This adds an extra layer of protection.

User Authentication

User authentication verifies the identity of users. It is crucial for preventing unauthorized access. Key features to look for include:

- Multi-Factor Authentication (MFA): MFA requires users to provide multiple forms of identification. This makes it harder for intruders to access accounts.

- Biometric Authentication: This includes methods like fingerprint or facial recognition. It adds an extra layer of security.

- Role-Based Access Control (RBAC): RBAC limits access based on user roles. This ensures that only authorized users can access sensitive information.

By focusing on these security measures, you can choose a wealth management software that keeps your financial data safe.

Integration Capabilities

Choosing the best wealth management software involves many factors. One crucial factor is integration capabilities. Good software should connect with your existing systems and third-party apps. This allows for seamless operations and improved efficiency.

Compatibility With Existing Systems

Check if the software is compatible with your current systems. This includes your CRM, accounting software, and other tools. Compatibility saves time and reduces data entry errors. It also ensures smooth data flow across all platforms.

Below is a table showing what to check for compatibility:

| System Type | Compatibility Check |

|---|---|

| CRM | Data syncing and contact management |

| Accounting Software | Financial data integration |

| Portfolio Management Tools | Real-time updates and reporting |

Third-party Integrations

Good wealth management software should support third-party integrations. This includes tools for financial analysis, reporting, and client communication. Integrating third-party apps enhances the software’s functionality. It allows you to offer better services to your clients.

Consider the following third-party integrations:

- Financial Analysis Tools: For detailed market analysis

- Reporting Software: For generating comprehensive reports

- Client Communication Tools: For efficient client interactions

Choose software that supports APIs for easy integration. This makes it easier to connect with various third-party tools.

Credit: www.clariontech.com

Cost Considerations

Choosing the best wealth management software requires understanding the costs involved. This includes both initial expenses and ongoing fees. Here’s how to navigate these cost considerations effectively.

Upfront Costs

Upfront costs are the initial expenses for acquiring the software. These costs can vary significantly. Some software providers charge a one-time fee. Others may offer subscription-based models with lower upfront costs.

Compare different pricing models. Look for hidden charges. Consider the following factors:

- Licensing Fees

- Installation Costs

- Customization Fees

Licensing fees might be a significant part of the upfront cost. Some software requires a per-user license. Installation costs include setting up the software on your systems. Customization fees cover tailoring the software to your needs.

Ongoing Fees

Ongoing fees are recurring expenses to maintain the software. These can include subscription fees, support charges, and update costs. Here’s a breakdown:

| Fee Type | Description |

|---|---|

| Subscription Fees | Monthly or annual payments for using the software. |

| Support Charges | Fees for customer support and technical assistance. |

| Update Costs | Expenses for software updates and new features. |

Subscription fees ensure continuous access to the software. Support charges provide help when you encounter issues. Update costs keep your software current and secure.

Evaluate these ongoing fees carefully. Ensure they fit within your budget. Consider the long-term value of the software. A higher upfront cost might save money on ongoing fees.

Customer Support And Training

Choosing the best wealth management software involves several factors. One crucial aspect is Customer Support and Training. Reliable support and comprehensive training ensure smooth software usage. Below, we explore this in detail.

Availability Of Support

Good customer support is essential. Check if support is available 24/7. This helps resolve issues quickly. Look for multiple support channels like:

- Phone

- Live chat

Some companies offer dedicated account managers. They provide personalized assistance. This can be very helpful for complex issues.

Training Resources

Effective training resources are vital. They help users understand the software. Look for comprehensive documentation. This should include:

- User manuals

- FAQs

- Guides

Many providers offer video tutorials. These can be easier to follow. Check if there are live webinars. These offer interactive learning.

Some companies provide in-person training. This can be beneficial for larger teams. Ensure the training resources are regularly updated. This keeps you informed about new features.

Below is a table summarizing important aspects of customer support and training:

| Aspect | Details |

|---|---|

| Support Availability | 24/7, Multiple Channels, Dedicated Account Managers |

| Training Resources | Documentation, Video Tutorials, Webinars, In-person Training |

Reading Reviews And Testimonials

Choosing the best wealth management software can be challenging. Reading reviews and testimonials is a key step. Reviews provide real user insights. Testimonials show how the software meets user needs. Both help you make informed decisions.

Analyzing User Feedback

User feedback offers a wealth of information. It highlights common issues and praises. Look for software with positive reviews and few complaints. Pay attention to feedback about usability, customer support, and features. Here are some key points to consider:

- Usability: Is the software easy to use?

- Customer Support: Are users satisfied with the support?

- Features: Does the software offer the features you need?

Read both positive and negative reviews. This gives a balanced view. Check multiple review sites for a wider perspective.

Consulting Industry Experts

Industry experts can provide valuable insights. They often test multiple software solutions. Their reviews are usually detailed and reliable. Consulting experts helps you understand the pros and cons of different software. Here are some benefits of consulting experts:

- Expertise: Experts have in-depth knowledge.

- Comparisons: Experts often compare multiple solutions.

- Trends: Experts are aware of industry trends.

Check expert reviews on well-known websites. Follow industry blogs and forums. This helps you stay updated on the best options available.

Making The Final Decision

Choosing the best wealth management software requires careful consideration. Making the final decision involves comparing options and evaluating trial periods and demos. This section will guide you through these critical steps.

Comparing Options

Start by listing all potential software options. Create a table to compare key features.

| Software | Key Features | Pricing | Customer Support |

|---|---|---|---|

| Software A | Portfolio Management, Tax Optimization | $$ | 24/7 Support |

| Software B | Investment Tracking, Financial Planning | $$$ | Email Support |

| Software C | Risk Analysis, Reporting Tools | $ | Phone Support |

Consider these key features:

- Portfolio Management: Track and manage investments.

- Tax Optimization: Minimize tax liabilities.

- Financial Planning: Plan for future financial goals.

Trial Periods And Demos

Many providers offer trial periods or demos. Utilize these to test the software.

During the trial period, focus on:

- User Interface: Is it easy to navigate?

- Functionality: Does it meet your needs?

- Support: Is customer service responsive?

Evaluate each demo critically. Take note of any limitations or issues.

By following these steps, you can confidently select the best wealth management software.

Conclusion And Next Steps

Choosing the best wealth management software is a critical decision. It can impact your financial success. This section will guide you through the next steps. We will focus on implementing your choice and monitoring performance.

Implementing Your Choice

Once you have selected the best wealth management software, it’s time to implement it. Follow these steps for a smooth implementation:

- Install the Software: Download and install the software. Follow the setup instructions.

- Setup User Accounts: Create user accounts for all team members. Assign appropriate access levels.

- Import Data: Import your financial data into the software. Ensure data accuracy.

- Customize Settings: Adjust the software settings to fit your needs. Set up alerts and notifications.

- Training: Train your team on how to use the software. Provide detailed guides and resources.

Monitoring Performance

After implementation, it’s important to monitor the software’s performance. This ensures it meets your expectations:

- Regular Reviews: Schedule regular reviews to assess the software’s performance.

- Feedback Loop: Collect feedback from users. Address any issues promptly.

- Performance Metrics: Track key performance metrics. Ensure the software is delivering value.

- Updates: Keep the software updated. Install patches and updates as they become available.

- Support: Utilize customer support for troubleshooting. Ensure you have access to technical assistance.

By following these steps, you can ensure your chosen software helps you manage your wealth effectively. Implementing and monitoring the software will maximize its benefits.

Frequently Asked Questions

What Is Wealth Management Software?

Wealth management software is a tool that helps manage financial assets. It offers features like portfolio management, financial planning, and investment tracking.

Why Use Wealth Management Software?

Using wealth management software simplifies asset management. It provides accurate insights, automates tasks, and helps in making informed financial decisions.

How To Choose The Best Wealth Management Software?

To choose the best software, consider features, user reviews, and pricing. Ensure it meets your specific financial needs and goals.

What Features Should Wealth Management Software Have?

Key features include portfolio management, financial planning, and investment tracking. Look for customization options and robust security measures.

Conclusion

Choosing the best wealth management software is crucial for financial success. Evaluate features, security, and user reviews carefully. Remember, good software simplifies managing wealth. Make an informed decision to enhance your financial planning. The right choice can lead to better financial outcomes.

Happy investing!