To choose a trading algorithm platform, consider ease of use and available features. Evaluate security, cost, and customer support.

Choosing the right trading algorithm platform is crucial for success. Beginners should seek user-friendly interfaces. Important features include backtesting and risk management tools. Security is essential to protect your investments. Costs should fit your budget, avoiding hidden fees. Reliable customer support can solve issues quickly.

Research reviews from other users to gauge platform reliability. Ensure the platform supports your preferred markets. These steps will help you find a suitable trading algorithm platform.

Credit: www.instagram.com

Key Features To Consider

Choosing the right trading algorithm platform can seem challenging. To simplify this, consider the key features that make a platform effective and user-friendly. Below, we will discuss essential features such as user interface and customization options.

User Interface

A good user interface (UI) is crucial for a trading algorithm platform. The UI should be intuitive and easy to navigate. Look for platforms with clear and concise menus. Icons and buttons should be easy to understand. A cluttered interface can lead to mistakes and frustration.

Responsive design is also important. The platform should work well on both desktop and mobile devices. This ensures you can trade on the go. Additionally, look for a UI that offers real-time data visualization. Charts and graphs should update instantly to reflect market changes.

Customization Options

Customization options allow you to tailor the platform to your needs. This can include setting up personalized dashboards. Look for platforms that let you choose which data to display. Customizable alerts can also be very useful. Set alerts for specific price changes or market conditions.

Another key feature is the ability to create custom trading strategies. Some platforms offer drag-and-drop interfaces for this. Others may require coding knowledge. Choose a platform that matches your technical skills. This will ensure you can fully utilize the customization options available.

Performance Metrics

Choosing a trading algorithm platform requires understanding its performance metrics. These metrics help traders evaluate the efficiency and reliability of the platform. Focusing on key aspects like execution speed and historical data analysis can make a significant difference in trading success.

Execution Speed

Execution speed is crucial in trading. Faster execution means better chances of profit. When a platform executes trades quickly, traders can capitalize on market opportunities. Delays can lead to missed opportunities or losses.

| Execution Speed | Benefits |

|---|---|

| High | Increases profit chances |

| Low | Leads to missed opportunities |

- Check the platform’s latency.

- Look for real-time data processing.

- Ensure low delay in trade execution.

Historical Data Analysis

Historical data analysis helps in understanding past market trends. This data provides insights for future trades. A good platform should offer detailed historical data.

- Look for platforms with extensive historical data.

- Analyze the data for better trading strategies.

- Use historical data to backtest your algorithms.

Platforms that offer strong historical data analysis tools are preferred. They help in making informed trading decisions. Strong analysis tools can lead to better prediction accuracy.

Security Measures

Choosing the right trading algorithm platform is crucial. One of the most important factors to consider is security measures. This ensures your data and transactions remain safe. Here, we will discuss two key aspects of security: data encryption and user authentication.

Data Encryption

Data encryption protects your information from unauthorized access. It converts your data into a code. Only authorized users can read it. This keeps your trades and personal data secure.

- Encryption Protocols: Look for platforms using advanced encryption protocols like AES-256.

- SSL Certificates: Ensure the platform has SSL certificates. This secures data during transmission.

Both of these encryption methods are vital. They ensure your data remains private and secure from hackers.

User Authentication

User authentication verifies your identity. It ensures only you can access your account. This adds an extra layer of security.

- Two-Factor Authentication (2FA): Platforms should offer 2FA. This requires a second form of identification. It could be a code sent to your phone.

- Biometric Authentication: Some platforms use biometric data. This includes fingerprints or facial recognition.

These authentication methods help prevent unauthorized access. They keep your trading account safe.

Cost And Pricing Models

Choosing the right trading algorithm platform involves understanding the cost and pricing models. These models impact your profitability and overall trading experience. Let’s dive into the different pricing aspects of trading algorithm platforms.

Subscription Fees

Subscription fees are a common cost in trading algorithm platforms. They usually include access to the platform’s features and tools. Some platforms offer tiered subscription plans. These plans may provide more features at higher costs. Look for a platform that fits your budget and trading needs.

- Basic Plan: Limited features, suitable for beginners.

- Standard Plan: More features, ideal for intermediate traders.

- Premium Plan: All features, best for professional traders.

Some platforms offer monthly or annual subscription options. Annual subscriptions often come with a discount. Evaluate the features of each plan to ensure they meet your needs.

Commission Structures

Commission structures can vary widely between platforms. Some platforms charge a flat fee per trade. Others may take a percentage of your profits. Understanding these fees is crucial for managing your trading costs.

| Commission Type | Description |

|---|---|

| Flat Fee | A fixed fee per trade regardless of trade size. |

| Percentage Fee | A percentage of profits taken as commission. |

| Volume-Based Fee | Fees based on the volume of trades executed. |

Flat fee structures are predictable, making budgeting easier. Percentage fees align with your trading success, which can be beneficial. Volume-based fees may be ideal for high-frequency traders. Choose a commission structure that aligns with your trading style and volume.

Customer Support

Choosing a trading algorithm platform involves considering many aspects. One critical factor is customer support. Excellent customer support can make a significant difference in your trading experience. Below, we delve into the key aspects of customer support you should evaluate.

Availability

Customer support availability is crucial. Ensure the platform offers 24/7 customer support. This is especially important for traders in different time zones. Always check the support hours before committing to a platform.

Support Channels

Various support channels provide flexibility. Common channels include:

- Email Support: Ideal for detailed queries and documentation.

- Live Chat: Quick and convenient for immediate assistance.

- Phone Support: Best for urgent issues requiring a human touch.

- FAQ Sections: Useful for self-help and common questions.

- Community Forums: Great for peer support and shared experiences.

Evaluate the platform’s support channels. Make sure they align with your preferences and needs.

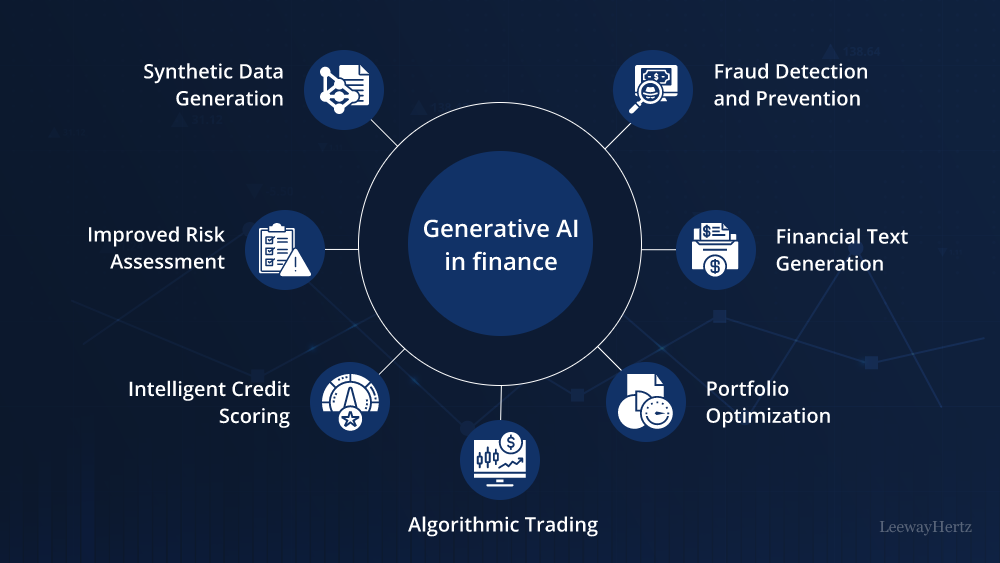

Credit: www.leewayhertz.com

Integration Capabilities

When choosing a trading algorithm platform, integration capabilities are vital. Seamless integration ensures smooth trading operations and enhances efficiency. Explore key aspects like API access and support for third-party tools to make an informed decision.

Api Access

API access is crucial for any trading platform. It allows you to connect different systems easily. Look for platforms that offer robust and well-documented APIs. This ensures your algorithms can interact seamlessly with the platform.

Consider the following features when evaluating API access:

- Ease of use: The API should be easy to understand and use.

- Documentation: Comprehensive documentation is essential for smooth integration.

- Support: Ensure there is reliable support for API-related issues.

- Security: The API should offer secure data transmission.

Third-party Tools

Third-party tools can enhance the functionality of your trading platform. Check if the platform supports popular third-party tools and plugins. This can help you automate tasks and analyze data more effectively.

Key third-party tools to consider include:

- Data Analytics: Tools for data analysis and visualization.

- Automation: Automation tools for executing trades and managing orders.

- Monitoring: Monitoring tools to track performance and detect issues.

- Security: Tools for ensuring data security and compliance.

Incorporating these tools can significantly enhance your trading operations. Ensure your chosen platform supports these integrations for optimal performance.

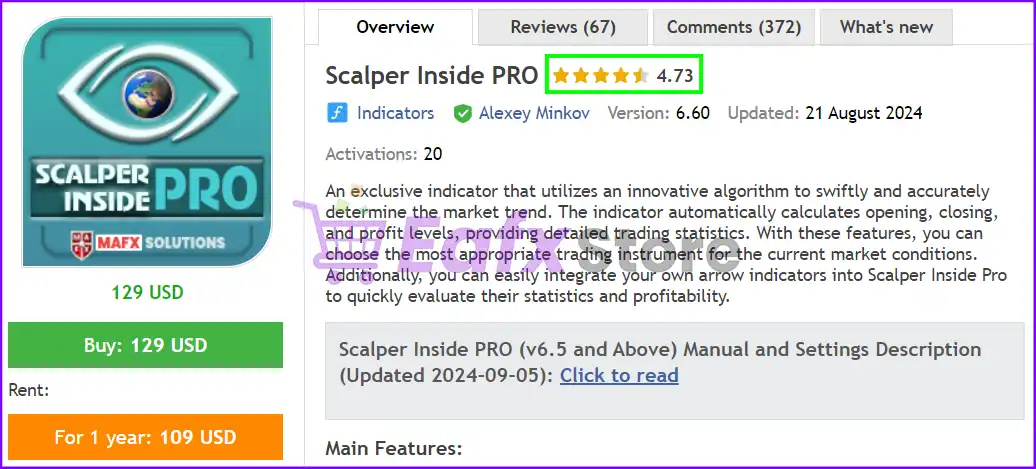

User Reviews And Feedback

Choosing the right trading algorithm platform can be challenging. User reviews and feedback play a crucial role in making an informed decision. They provide real-world experiences and insights from other traders. This can help you gauge the platform’s reliability and performance.

Reading Reviews

Start by reading reviews on reputable websites. Look for detailed feedback from actual users. Pay attention to both positive and negative comments. Positive reviews can highlight the platform’s strengths. Negative reviews can reveal potential issues or drawbacks. Ensure the reviews are recent and relevant to the latest version of the platform.

| Review Aspect | Details |

|---|---|

| Performance | How well does the platform execute trades? |

| Ease of Use | Is the interface user-friendly? |

| Customer Support | How responsive is the support team? |

| Cost | Are there any hidden fees? |

Community Forums

Joining community forums can provide valuable insights. These forums are filled with other traders discussing their experiences. Look for active forums with regular posts. Engage in discussions and ask specific questions. Forums can offer up-to-date information and tips from seasoned traders.

- Trade2Win

- Elite Trader

- Stack Exchange

Use these forums to gather more information. They can help you understand the real-world performance of the platform. Make sure to verify the information from multiple sources.

Credit: eafxstore.com

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software systems designed to execute trades automatically. They use algorithms to analyze market data and make trading decisions.

How To Choose The Best Trading Algorithm?

To choose the best trading algorithm, consider factors like performance, ease of use, and customer support. Research and compare different options.

What Features To Look For In A Trading Platform?

Look for features like real-time data, backtesting capabilities, and customization options. These features help optimize your trading strategy.

Are Trading Algorithms Profitable?

Trading algorithms can be profitable if properly designed and tested. They can minimize human error and execute trades faster.

Conclusion

Choosing the right trading algorithm platform is crucial. Evaluate features, costs, and support. Research thoroughly and test demos. Ensure the platform meets your needs. Make informed decisions for better trading success. Happy trading!