To choose wealth management software, identify your needs and set a budget. Evaluate features, user reviews, and support options.

Wealth management software simplifies financial planning. It helps manage investments, track expenses, and plan for the future. First, determine your specific needs. Do you need budgeting tools, investment tracking, or tax planning features? Then, set a clear budget. Many options exist, from free apps to premium solutions.

Research each software’s features and read user reviews. Look for reliable customer support. Ensure the software is user-friendly and secure. Compare different options to find the best fit. A good wealth management tool can make managing finances easier and more efficient.

Introduction To Wealth Management Software

Managing wealth can be complex. Wealth management software makes it easier. This software helps in handling finances efficiently. It is a must for anyone serious about financial planning. Let’s dive into what wealth management software is and why it is important.

What Is Wealth Management Software?

Wealth management software is a tool. It helps manage personal and professional finances. This software can track investments, plan budgets, and provide financial insights. It is designed to simplify financial management tasks. You can access it on computers or mobile devices.

Importance In Financial Planning

Financial planning is crucial. Wealth management software plays a big role in it. Here are some key benefits:

- Organized Finances: Keeps all financial information in one place.

- Investment Tracking: Monitors investments and their performance.

- Budgeting: Helps create and stick to a budget.

- Financial Insights: Provides reports and insights for better decisions.

Using wealth management software ensures you stay on top of your finances. It helps you make informed decisions. This is essential for a secure financial future.

Key Features To Look For

Choosing the right wealth management software solutions is crucial for efficient financial management. Knowing the key features to look for can help in making an informed decision. This section will highlight the most important features to consider.

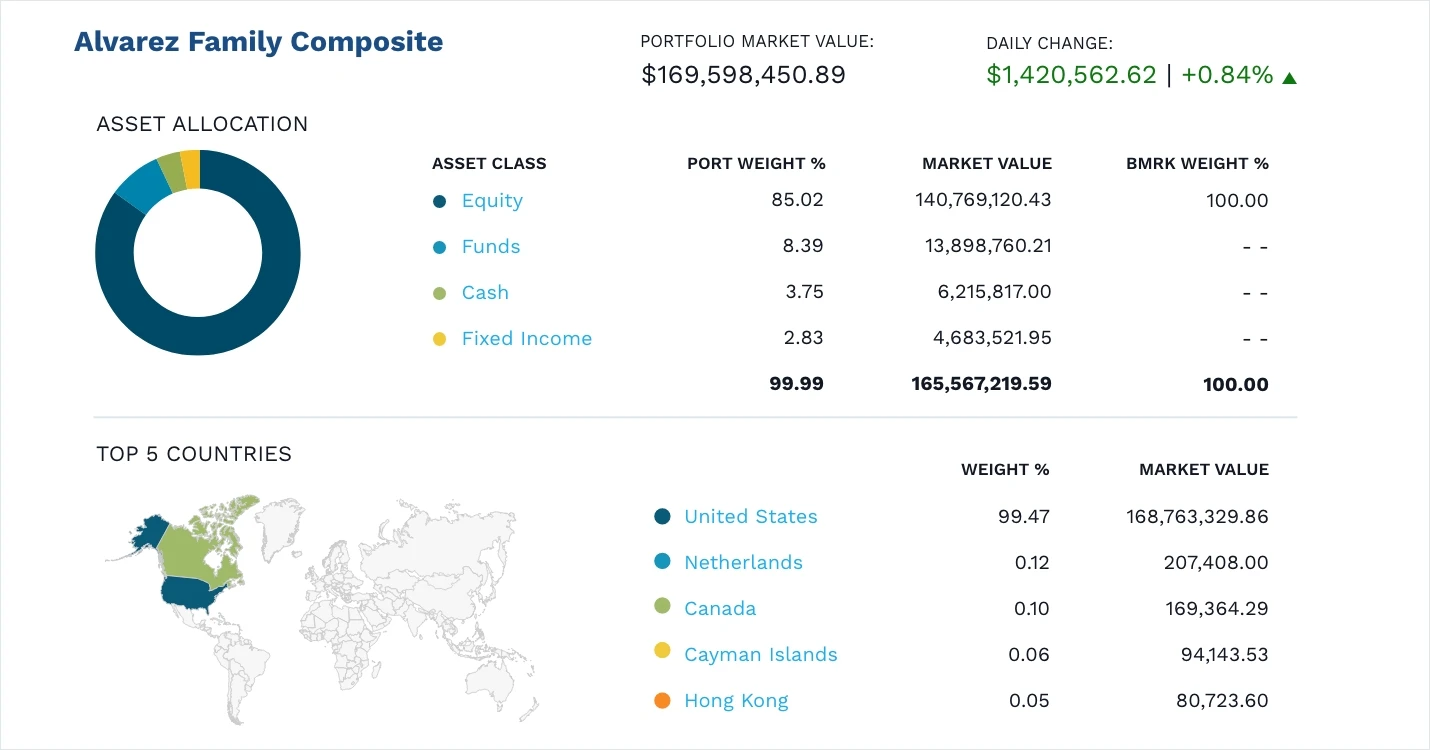

Portfolio Management

A robust portfolio management system is essential. It helps track various investments and assets. Look for features that offer:

- Comprehensive asset tracking

- Performance analysis

- Real-time data updates

- Customizable reporting

These features ensure you have a clear overview of your financial status. They help in making informed investment decisions. A good portfolio management tool should also integrate seamlessly with other financial systems.

Risk Analysis Tools

Effective risk analysis tools are vital for managing financial risks. They help in identifying potential threats and opportunities. Key features to look for include:

- Risk assessment models

- Stress testing capabilities

- Scenario analysis

- Real-time risk monitoring

These tools help in understanding the impact of different risk factors. They enable proactive risk management. A good risk analysis tool helps in safeguarding your investments.

Evaluating Security Measures

Choosing the right wealth management software solutions is crucial. One key aspect to consider is the security measures in place. Ensuring your data remains secure is paramount. Below, we explore essential security features.

Data Encryption

Data encryption is vital for protecting sensitive information. Ensure the software uses strong encryption methods. Look for AES-256 encryption standards. This level of encryption is robust and reliable.

Check if the software encrypts data both in transit and at rest. This dual encryption offers more security. Review the encryption protocols used. SSL/TLS protocols are industry standards for data protection.

Access Controls

Access controls manage who can view or edit data. Strong access controls are essential. The software should offer role-based access controls (RBAC). This ensures users access only the data they need.

Look for features like multi-factor authentication (MFA). MFA adds an extra layer of security. Check if the software allows for customizable user permissions. This flexibility ensures better data protection.

| Security Feature | Importance |

|---|---|

| Data Encryption | High |

| Access Controls | High |

| Multi-Factor Authentication | Medium |

Remember, security is not optional. It is a crucial part of any wealth management software solution. Strong security measures protect your data and build trust with clients.

User-friendly Interface

A user-friendly interface is essential for any wealth management software solution. It ensures that users can easily navigate and utilize the software, thereby enhancing their overall experience. Let’s dive into the key aspects of a user-friendly interface.

Ease Of Navigation

Ease of navigation is crucial for a positive user experience. A well-designed interface helps users find what they need quickly.

- Clear menus: Menus should be straightforward and easy to understand.

- Logical flow: The software should guide users naturally from one task to another.

Customizable Dashboards

Customizable dashboards allow users to tailor their experience. They can focus on the most relevant information for their needs.

| Feature | Description |

|---|---|

| Widgets | Users can add, remove, and arrange widgets as they like. |

| Themes | Different themes offer visual customization. |

Customizable dashboards enhance productivity and satisfaction. They make the software more intuitive and user-centric.

Integration Capabilities

Choosing the right wealth management software solution requires careful consideration. One critical factor is Integration Capabilities. This ensures that the software can seamlessly work with other tools and systems your business relies on.

Compatibility With Other Tools

Ensure the wealth management software is compatible with existing tools. This includes accounting software, CRM systems, and data analysis tools. Compatibility reduces the time spent on manual data transfers.

The software should support various file formats. This ensures smooth data exchange. Look for software that can integrate with popular financial tools. This makes your workflow more efficient.

Api Support

Check if the software offers API support. APIs allow different software systems to communicate. This is crucial for automating tasks and improving efficiency.

With API support, you can customize the software. Tailor it to meet your specific needs. Ensure the API is well-documented and easy to use. This helps your IT team integrate it smoothly.

| Feature | Importance |

|---|---|

| Compatibility with Tools | High |

| API Support | High |

Integration capabilities are crucial for the efficiency of wealth management software. Ensure the software you choose meets these criteria.

Credit: www.profilesw.com

Customer Support And Training

Choosing the right wealth management software solution is crucial for financial success. One key aspect to consider is Customer Support and Training. Proper support and training ensure that you and your team can effectively use the software to its full potential.

Availability Of Support

Excellent customer support is essential for smooth operations. Look for software providers that offer 24/7 support. This ensures you get help whenever needed. Verify if they provide multiple support channels. These can include:

- Phone

- Live Chat

Quick response times are crucial. Aim for providers with fast response rates. Check if they have a dedicated support team. This often means better service quality. Also, verify if they offer multilingual support. This is important for global operations.

Training Resources

Proper training resources help you utilize the software effectively. Look for software that offers comprehensive training materials. These can include:

- User manuals

- Video tutorials

- Webinars

Some providers also offer in-person training sessions. This can be very beneficial for new users. Ensure the training resources are easy to understand. They should cover all features of the software. Check if the training materials are regularly updated. This ensures you are always using the latest features.

Additionally, some providers offer certification programs. These programs can help you become an expert in using the software. This can be a valuable addition to your skill set.

| Support Feature | Details |

|---|---|

| 24/7 Support | Round-the-clock assistance |

| Multilingual Support | Support in various languages |

| Response Time | Quick and efficient responses |

| Training Resources | User manuals, videos, webinars |

| Certification Programs | Become a certified expert |

Cost Considerations

Choosing the right wealth management software solution can be challenging. One crucial aspect is understanding the cost considerations. This includes evaluating pricing models and identifying hidden fees. Understanding these aspects ensures a well-informed decision.

Pricing Models

Wealth management software can have various pricing models. Here are some common ones:

- Subscription-based: Regular monthly or yearly fees.

- Per-user pricing: Costs depend on the number of users.

- Tiered pricing: Different levels based on features and services.

- Pay-as-you-go: Charges based on actual usage.

Understanding these models helps in selecting the most cost-effective option. Ensure the chosen model aligns with your budget and needs.

Hidden Fees

Hidden fees can significantly increase the total cost. It’s crucial to identify and understand these potential charges.

| Type of Fee | Description |

|---|---|

| Setup Fees | Initial costs for software installation and configuration. |

| Maintenance Fees | Ongoing costs for software updates and support. |

| Transaction Fees | Charges for each transaction processed through the software. |

| Customization Fees | Costs for personalized features or integrations. |

Being aware of these fees helps in making an informed decision. It ensures there are no surprises in the future.

Credit: www.hyland.com

Expert Recommendations

Choosing the right wealth management software can be challenging. Expert recommendations can help make the process easier. Experts suggest looking for features that enhance efficiency and accuracy. This guide will explore top software solutions and real-world success stories.

Top Software Solutions

Here are some of the top wealth management software solutions recommended by experts:

- Personal Capital – Known for its robust tools and user-friendly interface.

- Wealthfront – Offers automated investment management with advanced financial planning tools.

- Betterment – Provides comprehensive financial advice and retirement planning.

- eMoney Advisor – Features extensive planning and reporting capabilities for advisors.

- MoneyGuidePro – Focuses on goal-based financial planning with interactive tools.

Success Stories

Successful implementation of wealth management software can transform financial advising:

- Case Study 1: A financial advisor increased client satisfaction by 40% using eMoney Advisor.

- Case Study 2: Wealthfront’s automated tools helped a small firm grow assets under management by 50% in one year.

- Case Study 3: Personal Capital’s user-friendly interface led to a 30% rise in client engagement for a mid-sized advisory firm.

These success stories highlight the impact of choosing the right software. It can improve efficiency, client satisfaction, and overall business growth.

Credit: www.factset.com

Frequently Asked Questions

What Is Wealth Management Software?

Wealth management software helps manage investments, financial planning, and client portfolios. It’s essential for financial advisors and wealth managers.

Why Choose Wealth Management Software?

Choosing wealth management software improves efficiency, accuracy, and client satisfaction. It automates tasks and provides valuable insights.

What Features To Look For In Wealth Management Software?

Look for portfolio management, financial planning tools, client reporting, and integration capabilities. Security is also crucial.

How Does Wealth Management Software Benefit Advisors?

It saves time, reduces errors, and enhances client service. Advisors can focus on strategic planning.

Conclusion

Choosing the right wealth management software is crucial. It simplifies financial tasks and decisions. Consider features, security, and support when selecting. Take time to research and compare options. The right software enhances efficiency and growth. Make an informed choice for better financial management.