To get started with wealth management software, research and choose a suitable platform. Next, set up your account and input your financial data.

Wealth management software helps manage your finances easily. It offers tools for budgeting, investing, and tracking expenses. Start by researching different options to find the best fit for your needs. Look for user reviews and features that match your financial goals.

After choosing a platform, create an account and enter your financial information. This might include bank accounts, investments, and loans. The software will then provide insights and recommendations. Regularly update your data to keep track of your financial health. This approach simplifies managing your money and helps you make informed financial decisions.

Introduction To Wealth Management Software

Starting your journey with wealth management software can be exciting. This guide will help you understand its importance and how to get started. Wealth management software simplifies tracking investments, managing assets, and planning finances. Let’s dive into the basics.

What Is Wealth Management Software?

Wealth management software is a digital tool. It helps manage financial assets and investments. Users can track their portfolio, analyze performance, and make informed decisions. This software often includes features like:

- Investment tracking

- Financial planning

- Risk analysis

- Tax management

Wealth management software offers a comprehensive view of financial health. It aids in making smart financial choices.

Importance Of Wealth Management Software

The importance of wealth management software cannot be overstated. Here are some key benefits:

| Benefit | Description |

|---|---|

| Centralized Information | All financial data in one place |

| Time-Saving | Automates many financial tasks |

| Improved Accuracy | Reduces human errors in calculations |

| Better Decision Making | Provides insights and analytics |

With wealth management software, users gain better control over their finances. They can plan for the future with confidence.

Key Features To Look For

Starting with wealth management software can be challenging. Knowing the key features helps choose the right tool. Below are the main features to consider:

Portfolio Management

Effective wealth management software must offer robust portfolio management. Look for features like:

- Real-time tracking of assets

- Automated asset allocation

- Performance analytics

- Risk assessment

These features help manage and optimize investments. They provide insights into portfolio performance and risks.

Financial Planning Tools

Financial planning tools are crucial for long-term success. Essential tools include:

- Budgeting and forecasting

- Retirement planning

- Tax optimization

- Goal setting and tracking

Such tools help create and follow financial plans. They ensure you stay on track with your financial goals.

Client Reporting

Accurate client reporting is vital for transparency. Important features in client reporting are:

- Customizable reports

- Automated report generation

- Data visualization

- Compliance tracking

These features help present clear and concise information. They build trust and ensure regulatory compliance.

| Feature | Benefit |

|---|---|

| Portfolio Management | Optimizes investments and tracks performance |

| Financial Planning Tools | Helps in budgeting and goal setting |

| Client Reporting | Ensures transparency and compliance |

Choosing The Right Software

Finding the right wealth management software can transform your financial planning. It is crucial to choose the software that fits your specific needs. Let’s explore how to choose the best tool for managing your wealth.

Assessing Your Needs

Before choosing a software, first assess your needs. This will help you narrow down your options.

- Identify your financial goals

- Understand the features you require

- Set a budget for the software

Knowing your goals and needs will guide your decision.

Comparing Different Options

Now, compare different options to find the best fit. Consider these key factors:

| Feature | Description |

|---|---|

| Ease of Use | Is the software user-friendly? |

| Compatibility | Does it work with your current systems? |

| Security | Is your data protected? |

| Support | Is customer support available? |

Use this table to compare and choose the best software. Make sure to select the one that aligns with your needs and offers the best features.

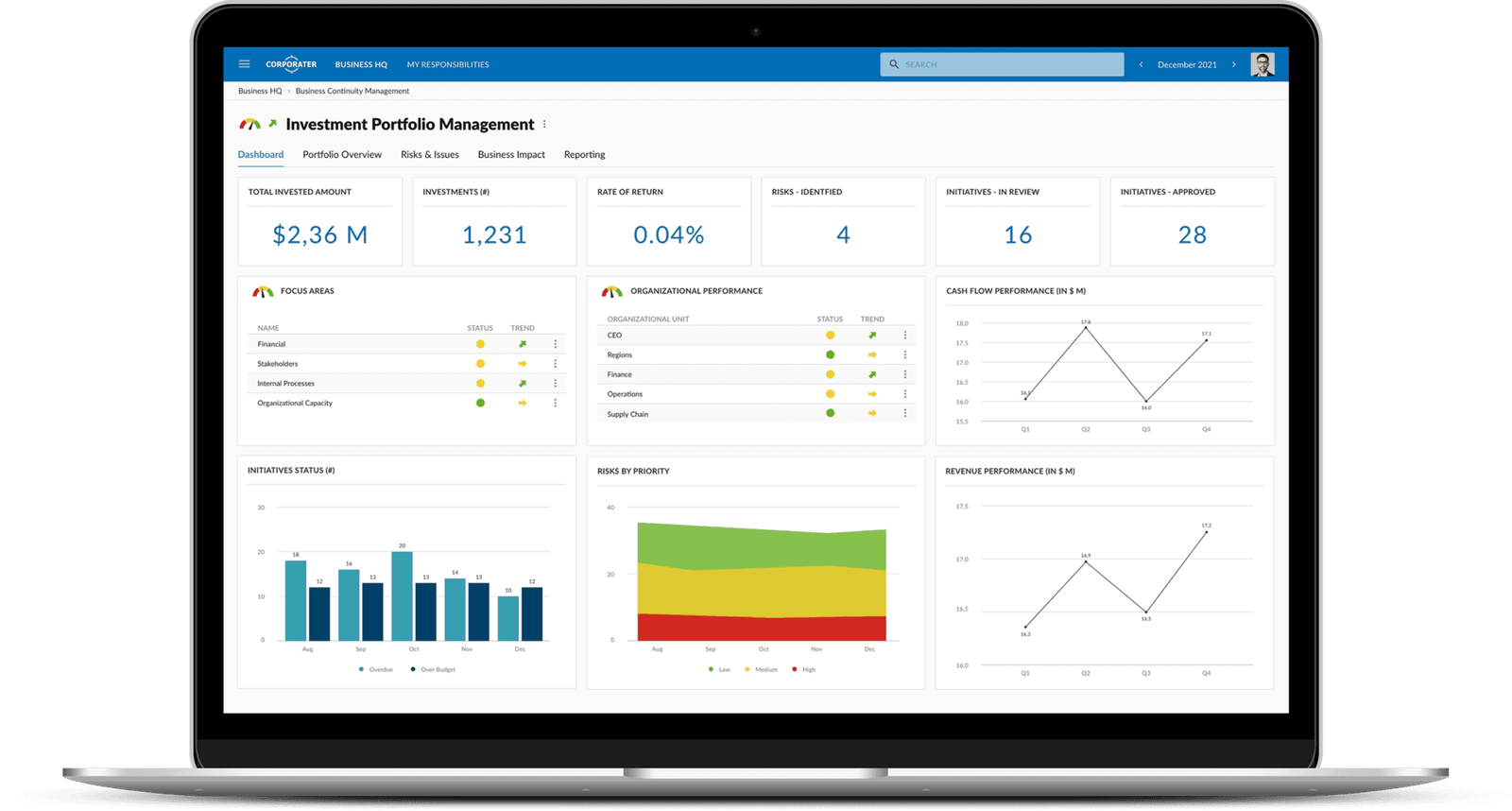

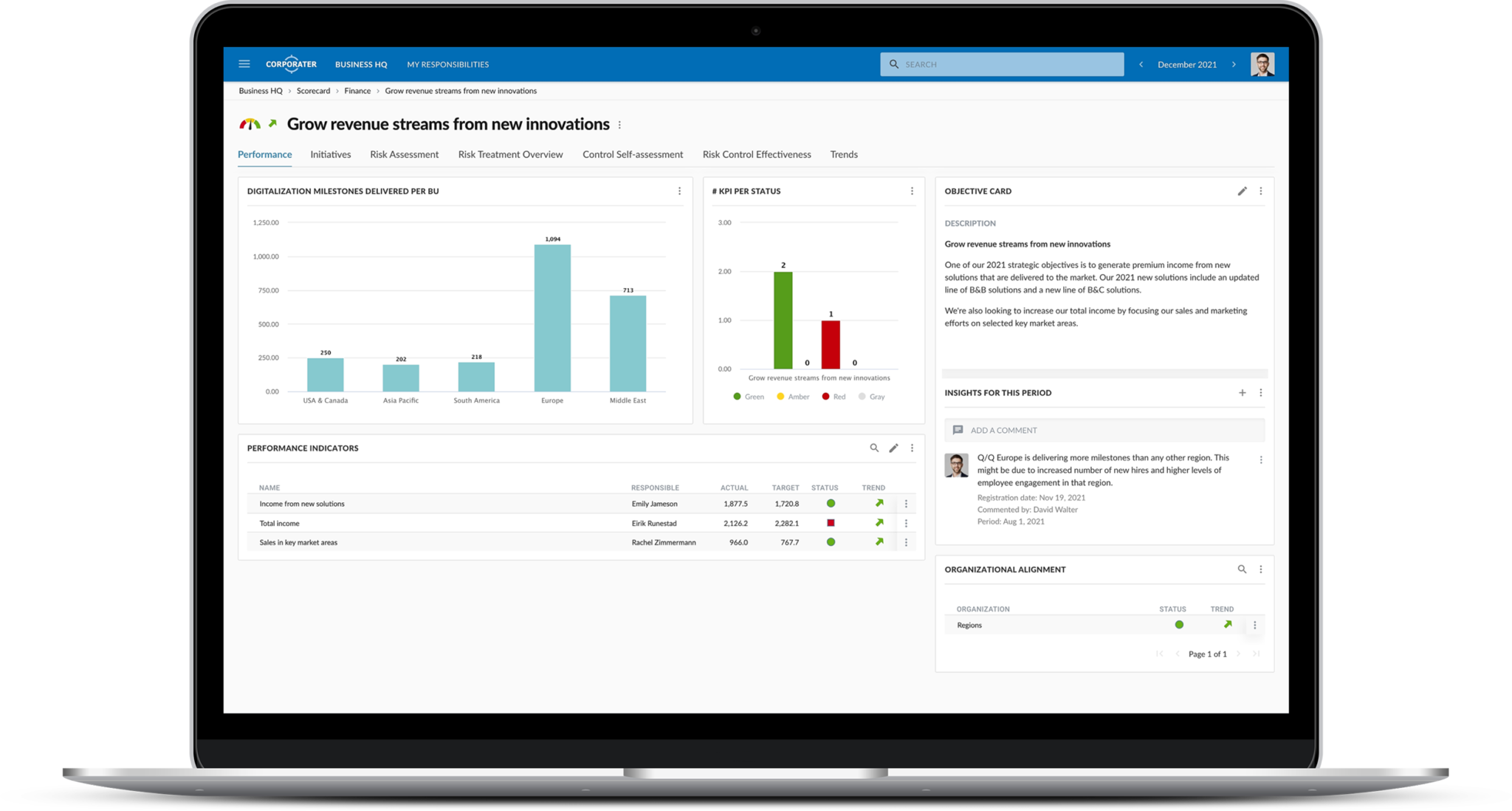

Credit: corporater.com

Setting Up Your Software

Starting with wealth management software can seem daunting. But setting up your software can be simple and efficient. Follow this guide to ensure a smooth setup process. Let’s dive into the key steps involved.

Installation Process

The first step is to install the software. Follow these steps to get started:

- Download the installer from the official website.

- Open the downloaded file to begin installation.

- Follow the on-screen instructions to complete the process.

- Restart your computer if prompted.

Ensure your system meets the required specifications. Check for updates after installation to ensure you have the latest version.

Initial Configuration

After installation, proceed with the initial configuration. This step is crucial for optimal performance:

- Open the software and log in using your credentials.

- Set up your user profile with accurate details.

- Configure your account settings, including language and time zone.

- Import your financial data or link your bank accounts.

Review the default settings and adjust them as needed. Customize the dashboard for easy access to important features.

| Configuration Step | Action Required |

|---|---|

| Profile Setup | Enter personal details |

| Account Settings | Adjust preferences |

| Data Import | Link accounts or upload data |

| Dashboard Customization | Arrange widgets |

Take your time with each step. Each step ensures your software functions effectively. Setting up correctly saves time in the long run. Happy wealth managing!

Integrating With Other Systems

Integrating wealth management software with other systems boosts efficiency. It helps in creating a seamless workflow. This integration ensures data consistency and reduces manual errors. Let’s explore how to connect your wealth management software with various systems.

Connecting To Financial Accounts

Connecting your wealth management software to financial accounts is essential. It allows real-time updates and accurate financial tracking. Follow these steps to connect:

- Locate the integration settings in your software.

- Select the financial institutions you want to connect.

- Enter your login credentials for each account.

- Authorize the connection to sync data.

Once connected, you can view all financial data in one place. This feature saves time and provides a comprehensive overview of your finances.

Syncing With Crm Tools

Syncing your wealth management software with CRM tools is equally important. It helps in managing client relationships effectively. Follow these steps to sync with CRM tools:

- Open the integration settings in your wealth management software.

- Select the CRM tool you use.

- Provide your CRM login credentials.

- Authorize the integration to enable data flow.

After syncing, client data will update automatically. This ensures you have the latest information for client interactions.

Integrating these systems enhances your wealth management capabilities. It streamlines your processes and improves data accuracy.

Training And Support

Starting with wealth management software can feel overwhelming. Yet, with proper training and support, the transition becomes smooth. Let’s explore how user training programs and customer support can help.

User Training Programs

User training programs are essential for mastering new software. These programs often include:

- Interactive tutorials to guide users step-by-step.

- Video lessons covering key features and functions.

- Webinars hosted by experts to answer common questions.

- Hands-on workshops for practical experience.

Training programs ensure users understand the software. This leads to better productivity and ease of use.

Accessing Customer Support

Good customer support is crucial for resolving issues quickly. Here are common support options:

| Support Option | Details |

|---|---|

| 24/7 Live Chat | Immediate help anytime you need it. |

| Email Support | Send detailed queries and get solutions. |

| Phone Support | Talk directly to a support agent. |

| Knowledge Base | Access articles and FAQs for self-help. |

With these support options, users can resolve issues swiftly. This minimizes downtime and frustration.

Security Considerations

Security is crucial in wealth management software. This ensures your financial data stays safe. Implementing robust security measures helps protect sensitive information. Below are key security considerations for wealth management software.

Data Encryption

Data encryption is essential. It converts data into a secure format. Only authorized users can access this data. Encryption protects data both at rest and in transit.

- At Rest: Data stored on servers is encrypted.

- In Transit: Data moving between systems is encrypted.

Use advanced encryption standards. This ensures high-level security. Regularly update encryption protocols. This protects against new threats.

User Access Controls

User access controls restrict who can view or modify data. They help prevent unauthorized access. Implementing strict access controls is vital.

| Access Level | Description |

|---|---|

| Admin | Full access to all data and settings. |

| Manager | Access to most data and settings. |

| User | Limited access to specific data and features. |

Set strong passwords for all users. Use multi-factor authentication for added security. Regularly review and update access permissions.

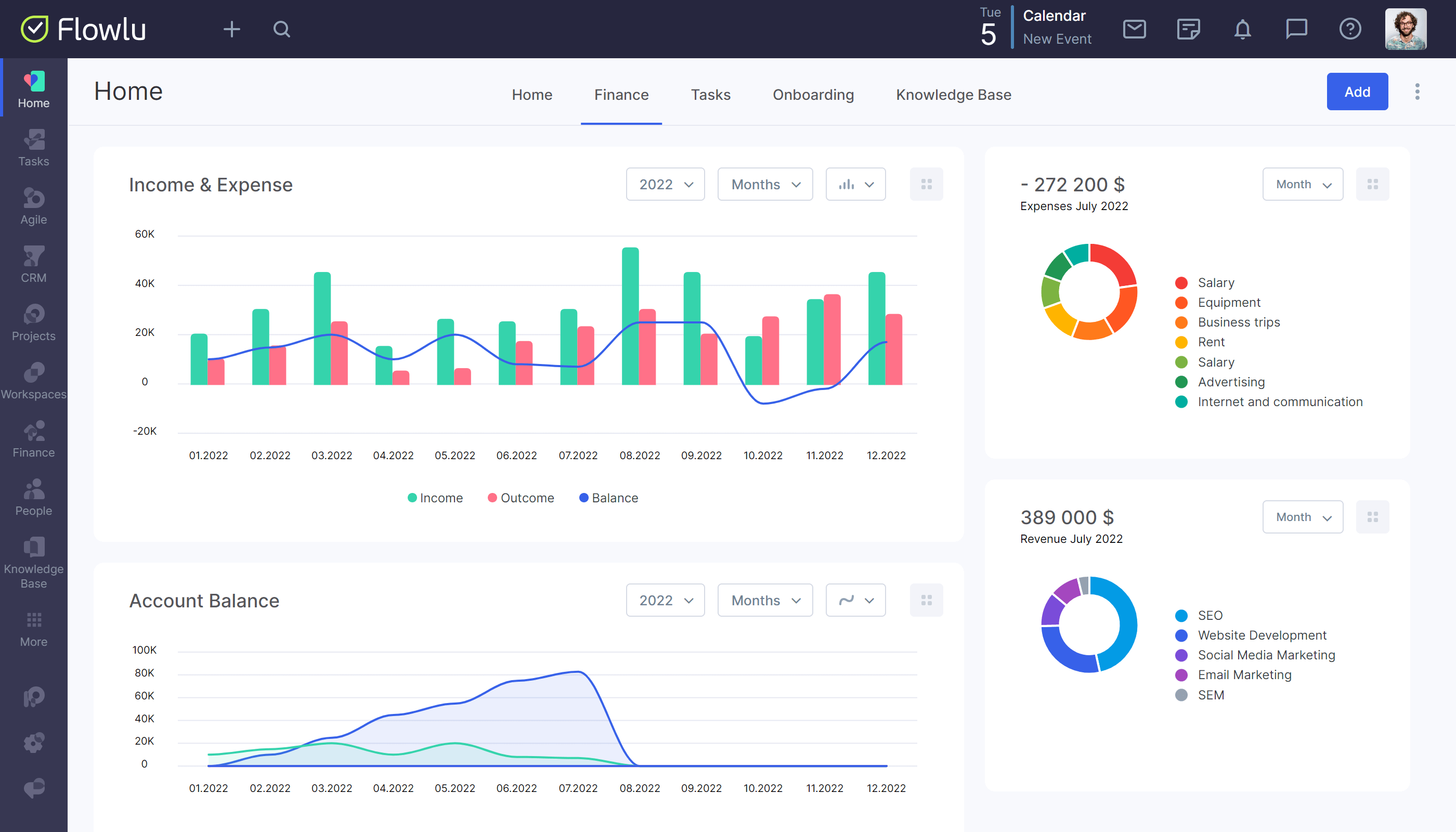

Credit: www.flowlu.com

Maximizing Software Benefits

Maximizing the benefits of wealth management software is essential for financial success. Understanding how to use the software can unlock its full potential. This section will guide you on how to maximize software benefits effectively.

Regular Software Updates

Regularly updating your wealth management software ensures optimal performance. Updates often include new features and security enhancements. Always check for updates and install them promptly.

Here is why regular updates are important:

- Enhanced Security: Protects against the latest threats.

- New Features: Adds new tools for better management.

- Bug Fixes: Resolves existing issues for smooth operation.

Utilizing Advanced Features

Advanced features can significantly boost your wealth management strategy. Learning to use these features can provide deeper insights and more control.

| Feature | Benefit |

|---|---|

| Automated Reports | Saves time and provides detailed financial summaries. |

| Portfolio Analysis | Offers insights into investment performance. |

| Tax Optimization | Helps in minimizing tax liabilities efficiently. |

Here are steps to utilize advanced features:

- Identify the features that suit your needs.

- Learn how to use these features through tutorials.

- Regularly use these features for better results.

Maximizing software benefits involves staying updated and using advanced features. This ensures your wealth management software works efficiently for you.

Common Challenges And Solutions

Starting with wealth management software can be daunting. Users often face common challenges. Understanding these challenges is key to success. Here, we explore solutions to ease the process.

Technical Issues

Technical issues are a major hurdle. Compatibility problems can arise. Software might not work well with existing systems. Frequent updates can also cause disruptions.

Here are some solutions:

- Ensure software compatibility with current systems.

- Schedule updates during off-hours.

- Provide ongoing technical support.

Using these steps can minimize disruptions. Having a dedicated IT team helps. They can quickly resolve any issues.

User Adoption

User adoption is another common challenge. Employees might resist new software. They may find it difficult to learn. Effective training is crucial.

Consider these solutions:

- Offer comprehensive training sessions.

- Provide user-friendly guides and tutorials.

- Encourage feedback and make necessary adjustments.

Engaging training sessions are key. Make them interactive and fun. This ensures employees feel confident using the software. Encouraging feedback fosters a sense of involvement.

Credit: yalantis.com

Future Trends In Wealth Management Software

Wealth management software is evolving rapidly. New trends shape the future of the industry. Innovations are transforming the way users manage their finances. Two major trends are AI and automation, and mobile accessibility.

Ai And Automation

Artificial Intelligence (AI) is revolutionizing wealth management. AI analyzes vast amounts of data quickly. This helps in making informed decisions.

Automation simplifies routine tasks. It reduces the need for manual effort. Automated processes save time and reduce errors.

- AI-driven insights: These provide personalized financial advice.

- Robo-advisors: Automated platforms manage investments efficiently.

- Predictive analytics: These tools forecast market trends.

AI and automation improve efficiency. They enhance the user experience. They help manage portfolios effectively.

Mobile Accessibility

Mobile accessibility is crucial in today’s digital age. Users want to manage wealth on-the-go. Mobile apps provide convenience and flexibility.

Key features of mobile-friendly wealth management software include:

- Real-time updates: Users get instant notifications.

- Secure transactions: Mobile platforms offer robust security.

- Easy navigation: Intuitive interfaces make financial management simple.

Mobile accessibility ensures users stay connected. It allows users to make quick decisions. It enhances the overall client experience.

| Trend | Benefit |

|---|---|

| AI and Automation | Improves decision-making and efficiency |

| Mobile Accessibility | Offers convenience and real-time updates |

Frequently Asked Questions

What Is Wealth Management Software?

Wealth management software helps manage and grow your financial assets. It offers tools for budgeting, investing, and tracking performance.

How Does Wealth Management Software Work?

Wealth management software integrates your financial data. It analyzes and offers insights for better investment decisions. It helps automate financial tasks.

What Features To Look For In Wealth Management Software?

Look for investment tracking, budgeting tools, and performance analysis. Ensure it offers security and customer support. Customization is also important.

Is Wealth Management Software Secure?

Yes, most wealth management software uses encryption. This ensures your financial data is protected. Always choose reputable software with strong security measures.

Conclusion

Starting with wealth management software boosts your financial planning. It simplifies tracking and managing your investments. With the right tools, your financial goals become clearer. Take the first step today. Your future self will thank you.