Use trading algorithm platforms to automate and optimize trading operations. They help reduce errors and increase efficiency.

Trading algorithm platforms offer a robust solution for streamlining operations. These platforms automate trading tasks, which minimizes human errors. They process large amounts of data quickly, providing real-time insights. You can set specific criteria for trades, ensuring consistency. These platforms also help in backtesting strategies, which improves decision-making.

By using these tools, you save time and reduce stress. They are user-friendly and suitable for both beginners and experts. Overall, trading algorithm platforms make trading more efficient and profitable.

Credit: www.facebook.com

Introduction To Trading Algorithm Platforms

Trading algorithm platforms are revolutionizing the financial market. They automate trading processes, making them faster and more efficient. These platforms use complex algorithms to analyze market trends and make trading decisions. As a result, they reduce human error and increase profitability. Both novice and experienced traders can benefit from these advanced systems.

Importance Of Efficiency

Efficiency is crucial in trading. Fast decision-making can lead to significant profits. Trading algorithm platforms operate 24/7 without fatigue. They execute trades at lightning speed, often within milliseconds. This speed ensures traders can capitalize on opportunities immediately. Manual trading cannot match this level of efficiency.

Current Market Trends

The market is evolving rapidly. More traders are adopting algorithmic trading. These platforms provide real-time data analysis. They can handle vast amounts of data quickly. This capability helps traders stay ahead of market trends. Furthermore, they offer customizable strategies. Traders can tailor algorithms to fit their specific needs. This adaptability is essential in a dynamic market.

| Feature | Benefit |

|---|---|

| Real-time data analysis | Stay ahead of market trends |

| 24/7 operation | Continuous trading without fatigue |

| Customizable strategies | Adapt to specific trading needs |

| Speed | Execute trades in milliseconds |

- Automated trading: Reduces human error

- Profitability: Increases potential earnings

- Scalability: Handles large data volumes

Credit: kms-solutions.asia

Benefits Of Algorithmic Trading

Algorithmic trading has revolutionized the financial markets. It leverages complex algorithms to trade stocks, commodities, and other assets at high speed and efficiency. This method offers several advantages over traditional trading. Let’s delve into the key benefits of algorithmic trading.

Increased Speed

Algorithmic trading executes trades in milliseconds. This speed is crucial in today’s fast-paced financial markets. Human traders cannot compete with this level of speed. Quick execution ensures traders capture the best prices.

Speed also allows traders to exploit short-lived market opportunities. Algorithms can analyze multiple markets simultaneously. They can make split-second decisions, which gives traders a competitive edge.

Reduced Human Error

Algorithmic trading reduces human error significantly. Manual trading is prone to mistakes due to fatigue or emotional decisions. Algorithms follow predefined rules. They execute trades flawlessly every time.

With algorithms, there is no risk of emotional trading. Algorithms stick to the strategy without being influenced by fear or greed. This results in more consistent and reliable trading outcomes.

Here is a table summarizing the benefits:

| Benefit | Description |

|---|---|

| Increased Speed | Executes trades in milliseconds, capturing the best prices. |

| Reduced Human Error | Eliminates mistakes and emotional decisions, ensuring consistency. |

Choosing The Right Platform

Selecting the right trading algorithm platform can be challenging. The right choice can streamline operations and boost efficiency. But how do you choose the best one? Below are some key factors to consider and a comparison of popular platforms.

Key Features To Consider

When choosing a trading algorithm platform, focus on these key features:

- Customization: The platform should allow custom algorithm creation.

- User Interface: A simple, intuitive interface is crucial.

- Backtesting: Ensure the platform offers robust backtesting tools.

- Security: Look for high-security measures to protect your data.

- Speed: Fast execution times can make a huge difference.

Comparing Popular Platforms

Below is a comparison of some popular trading algorithm platforms:

| Platform | Customization | User Interface | Backtesting | Security | Speed |

|---|---|---|---|---|---|

| Platform A | High | Intuitive | Advanced | Strong | Fast |

| Platform B | Medium | User-Friendly | Basic | Moderate | Moderate |

| Platform C | Low | Complex | Advanced | Strong | Fast |

Choosing the right platform can significantly impact your trading success. Evaluate each platform based on these features to find the best fit for your needs.

Implementing Algorithmic Strategies

Implementing algorithmic strategies can significantly enhance trading operations. These strategies use computer programs to execute trades at high speed. They rely on pre-defined instructions and can analyze large datasets quickly. This ensures better decision-making and improved profitability.

Backtesting Techniques

Backtesting techniques are crucial for algorithmic trading. They help in evaluating the effectiveness of a trading strategy. Traders can simulate the strategy on historical data. This provides insights into potential performance.

To backtest, you need reliable historical data. This data should be accurate and span multiple years. Use different time frames to test the strategy. Daily, weekly, and monthly data can yield different results.

A key aspect of backtesting is risk management. Ensure the strategy does not expose you to high risk. Monitor metrics like drawdown and volatility. These metrics help in assessing the risk associated with the strategy.

Optimizing Algorithms

Optimizing algorithms is essential for maximizing trading performance. Start with a simple algorithm and gradually add complexity. Focus on improving execution speed and accuracy.

Consider using machine learning to refine your algorithms. Machine learning can help in identifying patterns in large datasets. This can lead to better prediction and decision-making.

Monitor the performance of your algorithms regularly. Adjust parameters based on market conditions. This ensures your algorithms remain effective over time.

You can use the table below to track algorithm performance:

| Algorithm | Performance Metric | Current Value | Target Value |

|---|---|---|---|

| Algorithm 1 | Win Rate | 65% | 70% |

| Algorithm 2 | Drawdown | 5% | 3% |

Optimizing algorithms is an ongoing process. Stay updated with the latest developments in trading technology. This will help you maintain a competitive edge in the market.

Risk Management

Effective risk management is crucial for any trading strategy. Trading algorithm platforms can help streamline operations by identifying and mitigating potential risks. In this section, we’ll explore how these platforms enhance risk management.

Identifying Potential Risks

Trading algorithm platforms use data analysis to identify potential risks. They analyze market trends and historical data. This helps in predicting future market movements. Algorithms can detect anomalies and trends. This reduces the likelihood of unexpected losses.

Mitigation Strategies

Once potential risks are identified, mitigation strategies can be implemented. These platforms offer various risk management tools. Some common strategies include:

- Setting stop-loss orders to limit losses

- Diversifying investments to spread risk

- Using hedge strategies to protect against market volatility

Below is a table summarizing key risk mitigation strategies:

| Strategy | Description |

|---|---|

| Stop-Loss Orders | Automatically sell assets at a predetermined price to cap losses. |

| Diversification | Invest in various assets to reduce exposure to any single asset’s risk. |

| Hedging | Use financial instruments to offset potential losses in investments. |

By utilizing these strategies, traders can significantly reduce risk. Trading algorithm platforms thus ensure safer and more efficient trading operations.

Monitoring And Maintenance

Effective monitoring and maintenance are crucial for the smooth operation of trading algorithm platforms. These aspects ensure that your trading algorithms perform optimally and adapt to market changes. Let’s dive into the key areas of monitoring and maintenance that can help streamline your trading operations.

Real-time Monitoring

Real-time monitoring is essential for tracking your algorithm’s performance. It helps you identify any issues instantly and take corrective action. Real-time monitoring provides continuous insights into your trades, enabling you to make informed decisions.

Key features of real-time monitoring include:

- Live performance metrics – Track the success rate of your trades.

- Alert systems – Receive notifications for any anomalies.

- Data visualization – View trading data in intuitive charts and graphs.

Implementing robust real-time monitoring ensures that your trading algorithms run smoothly and efficiently.

Regular Updates And Upgrades

Regular updates and upgrades are vital for keeping your trading algorithm platform secure and efficient. Technology evolves rapidly, so your platform must evolve too. Updating your algorithms helps them stay relevant and effective in changing market conditions.

Consider the following aspects for updates and upgrades:

- Software updates – Ensure your platform is using the latest version.

- Algorithm improvements – Regularly refine your trading strategies.

- Security patches – Protect your platform from vulnerabilities.

Staying up-to-date with these elements ensures that your trading operations remain competitive and secure.

| Monitoring Aspect | Importance |

|---|---|

| Real-time Monitoring | Immediate issue detection |

| Software Updates | Enhance platform performance |

| Security Patches | Protect against threats |

Case Studies

Trading algorithm platforms have revolutionized the trading industry. They have streamlined operations and increased efficiency. Let’s explore some case studies that demonstrate their impact.

Success Stories

Several companies have successfully integrated trading algorithm platforms. Their operations have become more efficient. Here are a few success stories:

- Company A: This company used a trading algorithm to automate trades. They saw a 30% increase in profits within a year.

- Company B: By implementing an algorithm platform, Company B reduced operational costs by 20%. Their error rates also dropped significantly.

- Company C: This firm utilized a custom algorithm to predict market trends. Their trade accuracy improved by 25%, boosting overall revenue.

Lessons Learned

These case studies provide valuable insights. Companies should consider these lessons when adopting trading algorithm platforms:

- Customization is key: Tailor algorithms to fit specific business needs. This ensures better performance and results.

- Continuous monitoring: Regularly monitor algorithms to maintain accuracy. This helps in adapting to market changes quickly.

- Training and support: Provide adequate training for the team. This ensures they can effectively use and manage the platform.

| Company | Key Benefit | Improvement |

|---|---|---|

| Company A | Automated Trades | 30% Increase in Profits |

| Company B | Reduced Costs | 20% Reduction in Operational Costs |

| Company C | Improved Accuracy | 25% Boost in Trade Accuracy |

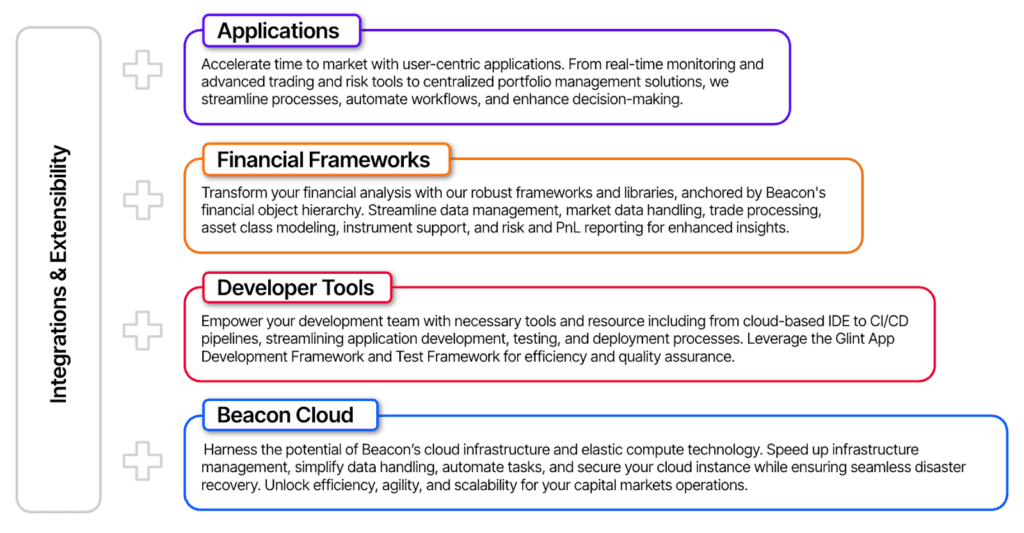

Credit: www.beacon.io

Future Of Algorithmic Trading

The future of algorithmic trading holds many exciting possibilities. Emerging technologies and trends are shaping the way we trade. Algorithmic trading platforms are becoming more advanced and efficient.

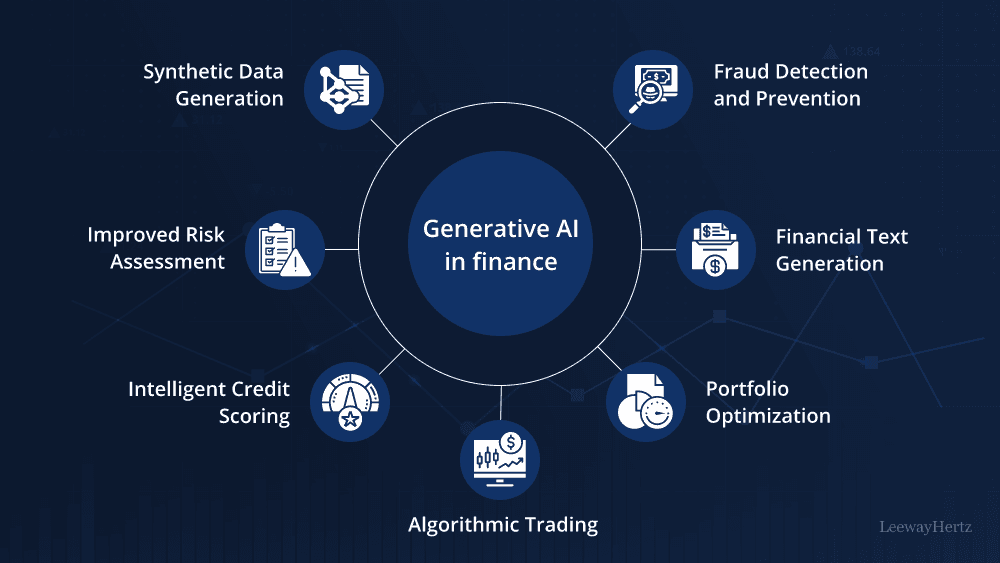

Emerging Technologies

Artificial Intelligence (AI) is revolutionizing trading algorithms. AI can analyze vast amounts of data quickly. This leads to better decision-making and faster trades.

Machine Learning (ML) is another key technology. ML algorithms learn from data patterns. They improve over time, making trading more profitable.

Blockchain technology ensures transparent and secure transactions. This reduces fraud and increases trust in the trading system.

Quantum Computing offers unparalleled processing power. It can solve complex trading problems in seconds.

Predictions And Trends

Algorithmic trading is expected to grow rapidly. More traders will adopt these platforms for their efficiency and accuracy.

Decentralized Finance (DeFi) will play a significant role. It allows peer-to-peer transactions without intermediaries. This makes trading faster and cheaper.

Regulatory changes will impact algorithmic trading. Governments are creating new laws to ensure fair practices.

Ethical AI in trading will become a priority. Ensuring algorithms make unbiased and fair decisions will be crucial.

Integration with other technologies such as the Internet of Things (IoT) will enhance trading platforms. Real-time data from various sources will improve trading strategies.

| Technology | Impact on Trading |

|---|---|

| Artificial Intelligence | Better decision-making and faster trades |

| Machine Learning | Improved trading algorithms over time |

| Blockchain | Secure and transparent transactions |

| Quantum Computing | Solving complex trading problems quickly |

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software systems that use algorithms to execute trading strategies. They help automate trades, optimize trading processes, and improve efficiency. They can analyze vast amounts of data quickly and make trading decisions based on predefined criteria.

How Do Algorithmic Trading Platforms Work?

Algorithmic trading platforms use complex mathematical models to analyze market data and execute trades. They follow predefined strategies and criteria to make decisions. These platforms can process large volumes of data in real-time, ensuring quick and accurate trades.

Why Use Trading Algorithm Platforms?

Using trading algorithm platforms streamlines operations, reduces human error, and enhances trading efficiency. They offer speed and precision that human traders can’t match. They also help in managing large data sets and executing complex strategies.

What Are The Benefits Of Trading Algorithms?

Trading algorithms offer several benefits including speed, accuracy, and consistency. They reduce emotional trading decisions and improve efficiency. They also allow for back-testing strategies on historical data to ensure viability.

Conclusion

Streamline your trading with algorithm platforms for better efficiency. Save time, reduce errors, and boost profits. These platforms offer smart solutions for traders. Simplify your operations today. Embrace the future of trading with advanced algorithms. Make your trading journey smoother and more profitable.