Trading algorithm platforms improve productivity by automating trades and reducing human error. They also analyze market data quickly and efficiently.

Trading algorithm platforms have revolutionized the financial industry. These platforms automate trades, making processes faster and more accurate. They analyze vast amounts of market data in real-time. This helps traders make better decisions quickly. Automation reduces human error, increasing efficiency and productivity.

Beginners and experienced traders benefit from these tools. They save time and reduce stress. With easy-to-use interfaces, these platforms are accessible to everyone. They help traders stay competitive in fast-paced markets. Overall, trading algorithm platforms are essential for modern trading, enhancing productivity and profitability.

Credit: resumeworded.com

Introduction To Trading Algorithms

Trading algorithms have transformed the financial markets. They use predefined rules to make trading decisions. These algorithms can analyze data faster than humans. This improves efficiency and accuracy in trading. In this blog post, we explore trading algorithms and their evolution.

What Are Trading Algorithms?

Trading algorithms are sets of instructions. They execute trades in financial markets. These instructions are based on various inputs:

- Price

- Timing

- Volume

- Other market factors

Algorithms can process large datasets quickly. This allows traders to respond to market changes in real-time. They reduce the emotional impact of trading decisions. This leads to more consistent results.

Evolution Of Trading Platforms

Trading platforms have evolved significantly over the years. Early platforms were manual and slow. They required human intervention at every step. Modern platforms use advanced technology. This includes high-speed internet and powerful computers.

Key stages in the evolution of trading platforms:

- Manual Trading: Human brokers executed trades manually.

- Electronic Trading: Introduction of computer-based trading systems.

- Algorithmic Trading: Use of automated systems to execute trades.

- High-Frequency Trading: Algorithms executing trades in microseconds.

Today’s platforms offer various features:

| Feature | Description |

|---|---|

| Real-time Data | Access to live market data instantly. |

| Backtesting | Testing strategies using historical data. |

| Risk Management | Tools to manage and mitigate trading risks. |

| Customizable Algorithms | Ability to create and modify trading algorithms. |

These advancements have made trading more efficient. They have improved productivity for traders worldwide.

Benefits Of Using Algorithmic Trading

Algorithmic trading has revolutionized the world of finance. It automates trading strategies, bringing numerous benefits to traders. In this section, we explore the benefits of using algorithmic trading. These benefits include increased speed and efficiency, and reduced human error.

Increased Speed And Efficiency

Algorithmic trading executes orders at lightning speed. It can analyze vast amounts of data in milliseconds. This speed gives traders a significant edge in the market.

Efficiency is another key advantage. Algorithms can operate continuously without fatigue. They ensure trades are executed at the best possible price. This efficiency maximizes profits and minimizes losses.

Here is a table showing the differences between traditional and algorithmic trading:

| Aspect | Traditional Trading | Algorithmic Trading |

|---|---|---|

| Speed | Minutes to Hours | Milliseconds |

| Efficiency | Human Limitation | Continuous Operation |

Reduced Human Error

Human error is a common issue in trading. Emotions often affect decision-making. Algorithmic trading eliminates this problem. Algorithms are not influenced by emotions. They follow predefined rules strictly.

By reducing human error, algorithmic trading increases accuracy. This leads to more consistent and reliable results. Traders can trust their strategies more.

- Eliminates emotional decisions

- Follows predefined rules strictly

- Increases accuracy and consistency

Overall, algorithmic trading enhances productivity significantly. Its benefits are undeniable. Traders can achieve better results with less effort.

Core Components Of Trading Algorithms

Trading algorithms have revolutionized the world of finance. These algorithms automate trading processes, increasing productivity and reducing human error. Understanding the core components of trading algorithms is essential for anyone interested in modern trading strategies. This section delves into the most critical aspects: data analysis and decision-making models.

Data Analysis

Data analysis is the backbone of trading algorithms. It involves collecting, processing, and interpreting vast amounts of market data. This data comes from various sources such as:

- Stock prices

- Trading volumes

- Economic indicators

- News articles

Algorithms use this information to identify patterns and trends. These patterns help predict future market movements. Effective data analysis can lead to higher accuracy in trade predictions. It also enables traders to make informed decisions.

Decision Making Models

Decision-making models are crucial for executing trades. These models use the insights gained from data analysis. They determine the best times to buy or sell assets. Common types of decision-making models include:

- Statistical Models: These use historical data to forecast future trends.

- Machine Learning Models: These adapt and improve over time by learning from new data.

- Rule-Based Models: These follow predefined rules set by traders.

Each model has its strengths and weaknesses. Statistical models are reliable for short-term predictions. Machine learning models excel in adapting to changing market conditions. Rule-based models are simple but less flexible.

Combining different models can yield better results. Traders often use hybrid models for more accurate predictions. Effective decision-making models can significantly enhance trading productivity. They reduce the time needed for manual analysis and trading.

Popular Trading Algorithm Platforms

Trading algorithm platforms have transformed how traders interact with the market. These platforms automate trading, increasing productivity and efficiency. Below, we explore some popular trading algorithm platforms.

Platform Features

Each trading algorithm platform offers unique features to enhance trading.

- MetaTrader 4 (MT4): Known for its user-friendly interface and advanced charting tools.

- QuantConnect: Provides extensive data libraries and supports multiple programming languages.

- TradingView: Offers powerful charting tools and a large community of traders.

- AlgoTrader: Focuses on institutional-grade trading strategies and backtesting.

User Experience

User experience varies across different trading algorithm platforms.

| Platform | Ease of Use | Support |

|---|---|---|

| MetaTrader 4 (MT4) | High | Excellent |

| QuantConnect | Moderate | Good |

| TradingView | High | Excellent |

| AlgoTrader | Moderate | Good |

Each platform’s ease of use impacts trader productivity. Some platforms offer better support, helping users resolve issues quickly.

Implementing Trading Algorithms

Implementing trading algorithms can greatly enhance productivity in trading. Automating trades can save time and reduce human error. With the right tools, you can make informed decisions quickly.

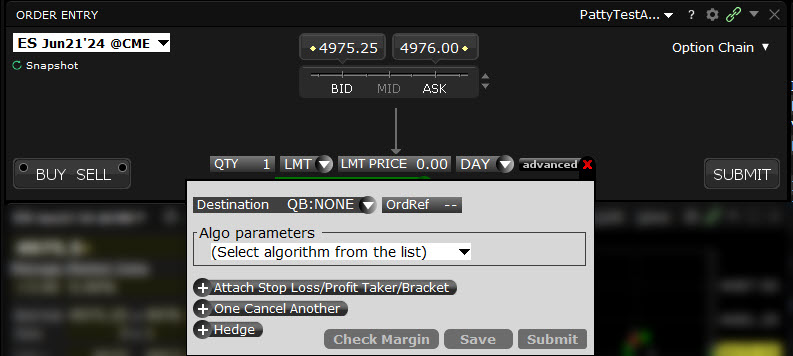

Setup And Configuration

Setting up a trading algorithm platform is the first crucial step. This involves choosing the right software that fits your trading needs. Some popular platforms include MetaTrader, NinjaTrader, and QuantConnect.

After selecting a platform, configure it to match your trading style. This includes setting up data feeds, selecting brokers, and integrating APIs. Ensuring your platform is properly configured can prevent errors during trading.

| Platform | Features | Best For |

|---|---|---|

| MetaTrader | Custom Indicators, Automated Trading | Forex Trading |

| NinjaTrader | Advanced Charting, Market Analysis | Futures Trading |

| QuantConnect | Backtesting, Algorithm Development | Algorithmic Trading |

Backtesting Strategies

Backtesting is crucial to validate your trading algorithms. This involves testing your strategies with historical data to see how they would have performed. Most trading platforms offer built-in backtesting tools.

To backtest effectively, follow these steps:

- Select historical data relevant to your trading strategy.

- Run your algorithm on this data.

- Analyze the results to identify strengths and weaknesses.

Backtesting helps you refine your strategies without risking real money. It provides insights into potential profitability and risk. Regularly backtest your algorithms to keep them relevant in changing markets.

Incorporating trading algorithms into your workflow can significantly boost productivity. With proper setup and thorough backtesting, you can make smarter trading decisions faster.

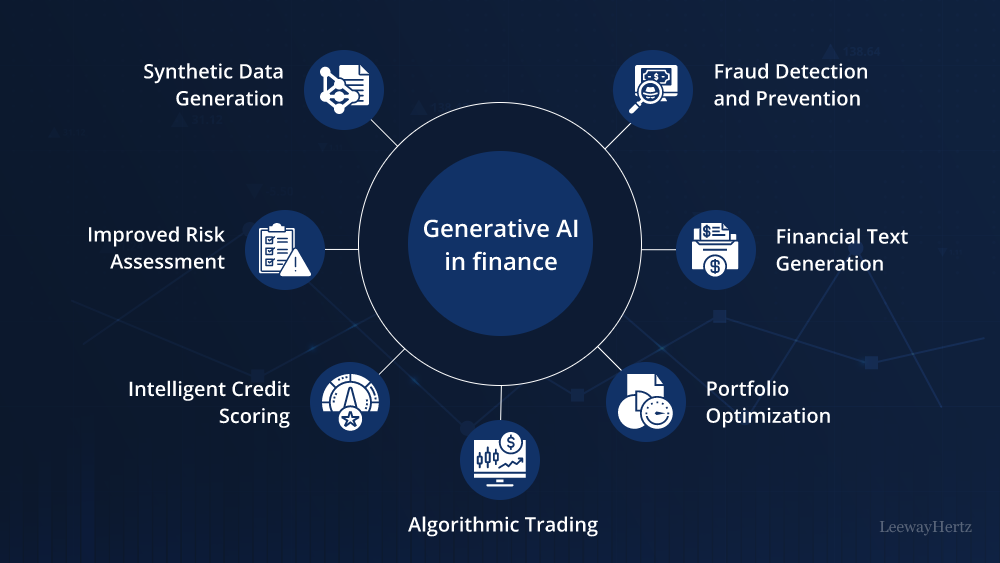

Credit: www.leewayhertz.com

Challenges In Algorithmic Trading

Algorithmic trading platforms aim to improve productivity in trading. But they face many challenges. These challenges can impact performance and profits. Understanding these hurdles helps in making better trading decisions.

Market Volatility

Market volatility is a major challenge in algorithmic trading. Sudden price changes can lead to unexpected losses. Algorithms must adapt quickly to these changes. High volatility periods are especially risky. Traders need robust strategies to handle market swings.

Here are some key points about market volatility:

- Can cause sudden price fluctuations

- Algorithms must react swiftly to avoid losses

- High volatility periods need stronger strategies

Technical Glitches

Technical glitches can disrupt trading operations. These glitches can come from software bugs or network issues. Even a small error can cause significant financial loss. Ensuring system reliability is crucial.

Common technical glitches include:

| Type of Glitch | Impact |

|---|---|

| Software Bugs | Can cause incorrect trade executions |

| Network Issues | May lead to delayed orders |

| Hardware Failures | Can halt trading operations |

Traders must regularly update their systems. This helps in reducing the risk of technical glitches. Regular maintenance ensures smooth trading operations.

Future Trends In Trading Algorithms

As trading algorithms continue to evolve, they significantly enhance productivity for traders. The future of trading algorithms holds exciting prospects. These advancements promise to revolutionize the financial markets.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming trading algorithms. These technologies can analyze vast amounts of data quickly. They identify patterns and trends that humans might miss.

ML models learn from historical data. They improve their predictions over time. This leads to more accurate trading strategies. AI algorithms can also adapt to changing market conditions. This adaptability boosts productivity.

Using AI and ML, trading platforms can offer personalized trading insights. Traders receive tailored advice based on their preferences. This saves time and enhances decision-making.

Regulatory Changes

Regulatory changes impact trading algorithms significantly. New regulations often aim to ensure fair trading practices. They also protect investors from fraud.

Automated trading platforms must comply with these regulations. This compliance includes implementing robust security measures. It also involves maintaining transparency in trading activities.

Regulations can drive innovation in algorithmic trading. Platforms might develop new features to meet regulatory requirements. This can improve overall productivity.

Traders must stay updated on regulatory changes. This knowledge helps them adjust their strategies accordingly. It ensures they remain compliant while maximizing productivity.

| Trend | Impact on Productivity |

|---|---|

| AI and Machine Learning | Enhanced data analysis and personalized insights |

| Regulatory Changes | Compliance and innovation in trading features |

The future of trading algorithms looks promising. AI, ML, and regulatory changes play a crucial role. These trends will continue to drive productivity in trading.

Credit: www.ibkrguides.com

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software solutions that use algorithms to automate trading strategies. These platforms can analyze market data, execute trades, and manage portfolios efficiently.

How Do Trading Algorithms Improve Productivity?

Trading algorithms improve productivity by automating trading processes. They reduce manual work, analyze vast data quickly, and execute trades faster than humans.

Can Trading Algorithms Reduce Errors?

Yes, trading algorithms can significantly reduce errors. They eliminate human emotions and mistakes by following predefined rules for trading.

Are Trading Algorithms Suitable For Beginners?

Trading algorithms can be suitable for beginners. They simplify trading processes and provide automated solutions, allowing novices to participate in the market.

Conclusion

Trading algorithm platforms significantly boost productivity. They automate complex tasks efficiently. This saves time and reduces errors. Traders can focus on strategy and decision-making. Improved productivity leads to better results. Embrace these platforms for a competitive edge. Start optimizing your trading activities today.

Experience the benefits of increased efficiency.