Latest trends in wealth management software include AI-driven analytics and personalized client experiences. These innovations enhance efficiency and improve decision-making processes.

Wealth management software is evolving rapidly. AI-driven analytics help in predicting market trends. Personalized client experiences boost client satisfaction. Automation in reporting saves time and reduces errors. Cloud-based solutions offer flexibility and security. Mobile access allows clients to manage their portfolios on the go.

Integration with other financial tools provides a holistic view. Enhanced cybersecurity features protect sensitive data. These trends make wealth management more efficient and client-centric. Adopting these technologies can give firms a competitive edge. Wealth management firms should stay updated with these trends. This ensures they meet client expectations and regulatory requirements effectively.

Introduction To Wealth Management Software

Wealth management software helps manage finances with ease. It offers tools for investment, retirement, and tax planning. This software simplifies complex financial tasks.

Evolution Of Wealth Management

Wealth management began with simple spreadsheets. Early software only tracked expenses and income. Modern solutions are much more advanced.

Today’s systems use artificial intelligence. They provide personalized advice and automate many tasks. They integrate with banks and investment platforms.

| Era | Technology | Functionality |

|---|---|---|

| 1980s | Spreadsheets | Basic tracking |

| 2000s | Software applications | Comprehensive management |

| 2020s | AI and automation | Personalized advice |

Importance In Modern Finance

Wealth management software is essential today. It helps manage investments, savings, and spending. It provides insights for better decisions.

- Investment Management: Track and optimize your portfolio.

- Retirement Planning: Plan for a secure future.

- Tax Optimization: Reduce tax liabilities.

These features save time and reduce errors. They help achieve financial goals faster.

Ai And Machine Learning

The world of wealth management is evolving rapidly. AI and Machine Learning are transforming the industry. These technologies offer new opportunities and efficiencies. Wealth managers can now make smarter decisions and provide better services.

Predictive Analytics

Predictive analytics uses data to forecast future trends. This helps wealth managers anticipate market movements. They can advise clients based on data-driven predictions. This reduces risks and improves investment outcomes.

Below is a table showing some benefits of predictive analytics:

| Benefit | Description |

|---|---|

| Risk Reduction | Identifies potential market downturns |

| Enhanced Decision-Making | Provides data-driven insights |

| Client Satisfaction | Improves investment outcomes |

Automated Portfolio Management

Automated portfolio management uses AI to manage investments. It optimizes portfolios based on client goals and risk tolerance. This process is faster and more accurate than manual management.

- Balances risk and reward

- Rebalances portfolios automatically

- Reduces human error

Automated systems can analyze vast amounts of data quickly. They can adjust portfolios in real-time. This ensures investments are always aligned with client objectives. Wealth managers can focus on strategic planning instead of routine tasks.

Blockchain And Security

Blockchain technology is revolutionizing wealth management software. It offers enhanced security and transparency. Financial data is now more secure and transactions are more transparent. These improvements are essential for trust and efficiency in wealth management.

Enhanced Data Protection

Blockchain provides enhanced data protection for wealth management. Data is stored in encrypted blocks. This makes it nearly impossible for hackers to alter information. Each block is linked to the previous one. This creates a secure chain of data.

A key feature is decentralization. Unlike traditional databases, blockchain does not have a single point of failure. Data is distributed across multiple nodes. This ensures higher security and reduces the risk of data breaches.

Here are some benefits of blockchain in data protection:

- Encryption ensures data integrity

- Decentralization reduces hacking risks

- Immutability prevents unauthorized changes

Transparent Transactions

Blockchain enables transparent transactions in wealth management. Every transaction is recorded on a public ledger. This ledger is accessible to all network participants. Transparency enhances trust between clients and managers.

Transactions are time-stamped and verifiable. This means all parties can see the details of each transaction. It eliminates the need for intermediaries. This reduces costs and speeds up the process.

The transparency of blockchain offers:

- Increased trust and accountability

- Lower transaction costs

- Faster transaction processing

Blockchain and security innovations in wealth management are transforming the industry. Enhanced data protection and transparent transactions are key trends. They offer significant benefits for both clients and managers.

Credit: www.cbinsights.com

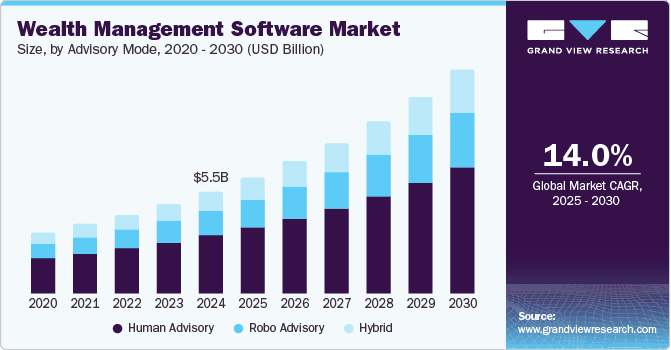

Robo-advisors

Robo-advisors are transforming the wealth management landscape. They use algorithms to provide financial advice online with minimal human intervention. These digital platforms are gaining popularity due to their efficiency and cost-effectiveness.

Cost-effective Solutions

Robo-advisors offer cost-effective solutions for managing investments. Traditional advisors charge high fees for their services. Robo-advisors, on the other hand, have lower operational costs. This allows them to pass the savings on to the investors.

| Traditional Advisors | Robo-Advisors |

|---|---|

| High fees | Low fees |

| Human interaction | Automated service |

| Personalized advice | Algorithm-based advice |

Lower fees make robo-advisors attractive for small investors. They can start investing with minimal funds. This opens up opportunities for everyone to grow their wealth.

Accessibility For All Investors

Robo-advisors are accessible to everyone. They remove barriers to entry for new investors. Their user-friendly platforms are easy to navigate. Investors can manage their portfolios from their smartphones.

- Low minimum investment requirements

- Easy-to-use interfaces

- 24/7 access to your portfolio

These features make investing simple for beginners. Even those with no prior experience can start investing. Robo-advisors help democratize the wealth management industry.

Personalization And Client Experience

Personalization and client experience are key trends in wealth management software. Today’s clients want more than just financial advice. They seek customized solutions that fit their unique needs. Wealth management software must adapt to offer these personalized experiences.

Customized Financial Plans

Customized financial plans are now a top priority. Advisors use software to create tailored plans for clients. These plans consider the client’s goals, risk tolerance, and investment preferences.

- Goal-based planning: Software helps set specific financial goals.

- Risk assessment tools: Evaluate and adjust risk levels based on client profiles.

- Investment tracking: Monitor and adjust investments to match goals.

User-friendly Interfaces

User-friendly interfaces enhance the client experience. Easy-to-use software makes financial management simple. Clients can access their information quickly and make informed decisions.

| Feature | Benefit |

|---|---|

| Intuitive dashboards | Provide a clear overview of finances. |

| Mobile accessibility | Access financial data on the go. |

| Real-time updates | Keep clients informed with the latest data. |

Clients value simplicity and efficiency. Software with user-friendly interfaces meets these needs. It ensures a seamless and enjoyable user experience.

Credit: www.ssctech.com

Integration With Other Financial Tools

The wealth management software industry is evolving rapidly. Integration with other financial tools is a key trend. This integration is transforming how financial data is managed and utilized. Users can now enjoy a seamless experience across various financial platforms.

Seamless Data Transfer

Seamless data transfer is a crucial feature in modern wealth management software. Clients can connect multiple financial accounts effortlessly. This feature ensures that all data is synchronized in real-time. No more manual data entry or tedious updates are necessary.

Software platforms now support various data formats. This flexibility allows for smooth integration with different financial tools. Clients can import and export data without compatibility issues. The process is quick and user-friendly.

Data security is also a top priority. Advanced encryption methods protect sensitive information during transfer. Clients can rest easy knowing their financial data is secure.

Unified Financial Dashboard

A unified financial dashboard is another significant trend. Users can view all their financial information in one place. This dashboard provides a comprehensive overview of their financial health.

The dashboard can display data from various sources:

- Bank accounts

- Investment portfolios

- Credit cards

- Loans

Interactive charts and graphs make it easy to understand complex data. Users can quickly identify trends and make informed decisions.

The dashboard is customizable to fit individual needs. Clients can choose which data to display and how to organize it. This personalization enhances the user experience.

Integration with other financial tools ensures that the dashboard is always up-to-date. Real-time updates provide the most accurate financial picture.

| Feature | Benefit |

|---|---|

| Seamless Data Transfer | Real-time synchronization, no manual updates needed |

| Unified Financial Dashboard | Comprehensive view of financial health, customizable |

Regulatory Compliance

Regulatory compliance is crucial in wealth management software. It ensures the software meets legal standards. This keeps sensitive financial data safe and secure. The software helps companies avoid legal issues. Compliance also builds trust with clients.

Adherence To Standards

Wealth management software must follow strict guidelines. These guidelines include GDPR, SOX, and FINRA. Adhering to these standards is essential. It ensures that all financial data is handled properly. This protects clients’ information from breaches.

Companies use the latest encryption technologies. This keeps data safe during transmission and storage. Regular audits are also important. They check that the software remains compliant over time.

Impact On Software Development

Regulatory compliance affects software development. Developers need to stay updated with laws. This can influence how they design and update the software. Compliance requirements can increase development costs.

Developers might need to integrate compliance modules. These modules ensure the software can handle new regulations. This makes the software more robust and reliable.

| Regulation | Purpose | Impact |

|---|---|---|

| GDPR | Protects user data | Strict data handling rules |

| SOX | Financial transparency | Regular financial audits |

| FINRA | Market integrity | Compliance checks |

In summary, regulatory compliance is key. It shapes how wealth management software is developed and maintained. Staying compliant is a continuous process. It requires ongoing updates and vigilance.

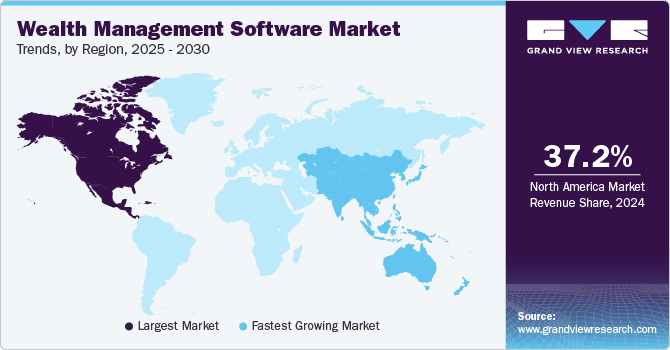

Credit: www.grandviewresearch.com

Future Outlook

The future of wealth management software looks bright with new trends. These trends promise to reshape the industry. Let’s explore what’s coming next in this space.

Emerging Technologies

New technologies are shaping the future of wealth management software. Artificial Intelligence (AI) is leading the way. AI helps in predicting market trends. It also aids in personalizing investment strategies.

Blockchain technology is another game-changer. It ensures secure and transparent transactions. This boosts client trust and reduces fraud.

Robo-advisors are becoming more popular. They offer automated financial advice. This makes wealth management accessible to everyone.

Potential Challenges

Despite the advancements, there are challenges ahead. One major challenge is data security. With more data being stored online, the risk of breaches increases.

Another challenge is regulatory compliance. Laws and regulations are constantly changing. Keeping up with these changes can be difficult for companies.

The rapid pace of technological change is also a challenge. Companies must adapt quickly to stay competitive. This requires continuous investment in new technologies.

Frequently Asked Questions

What Are The Latest Trends In Wealth Management Software?

Wealth management software is evolving with AI, machine learning, and automation. These technologies enhance personalization, risk assessment, and efficiency. Cloud computing and mobile access are also trending, allowing clients and advisors to manage portfolios on-the-go.

How Does Ai Impact Wealth Management Software?

AI impacts wealth management software by providing advanced data analytics and personalized recommendations. It improves risk assessment and automates routine tasks. This increases efficiency and client satisfaction. AI also helps in predicting market trends, aiding better investment decisions.

Why Is Mobile Access Important In Wealth Management Software?

Mobile access is crucial as it allows clients and advisors to manage portfolios anytime, anywhere. It enhances convenience and responsiveness. Mobile apps provide real-time updates, secure transactions, and easy communication. This improves client engagement and satisfaction.

What Role Does Cloud Computing Play In Wealth Management Software?

Cloud computing offers scalability, flexibility, and cost-efficiency in wealth management software. It ensures data security and disaster recovery. Cloud-based solutions facilitate remote access and collaboration. This enhances operational efficiency and client service.

Conclusion

Wealth management software is evolving rapidly. Staying updated is crucial for success. Embrace new trends to enhance efficiency and client satisfaction. Choose solutions that fit your needs. Future-proof your wealth management strategies today. Stay ahead with the latest technology. Don’t miss out on these advancements.

Your clients will thank you.