The wealth management software market is evolving rapidly. New technologies and solutions are emerging.

Wealth management software helps manage finances more effectively. It includes tools for financial planning, investment management, and client communication. Recent updates focus on AI and machine learning. These technologies enhance predictive analytics and personalized advice. Cloud-based solutions offer better accessibility and scalability.

Mobile apps make it easier to manage finances on the go. Security features are also improving to protect sensitive data. These advancements aim to improve user experience and efficiency. Wealth management software is becoming more user-friendly. It caters to both advisors and clients. The market is growing as demand for digital financial solutions increases.

Market Growth Trends

The wealth management software market is evolving rapidly. New technologies and trends are driving growth. Businesses are adapting to these changes to stay competitive. Let’s explore the latest market growth trends.

Current Market Size

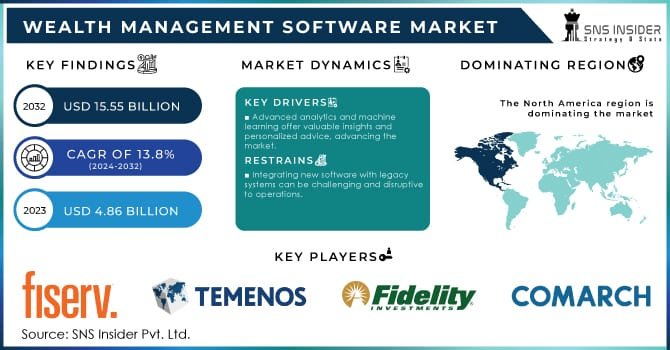

The current market size of wealth management software is significant. It has reached $3 billion in 2023. This growth is due to increased demand for digital solutions. Many firms are investing in advanced tools to manage assets.

According to recent reports, the market has grown by 10% annually. This growth is expected to continue in the coming years. The adoption of AI and machine learning is a key driver. These technologies enhance decision-making and risk management.

Projected Growth

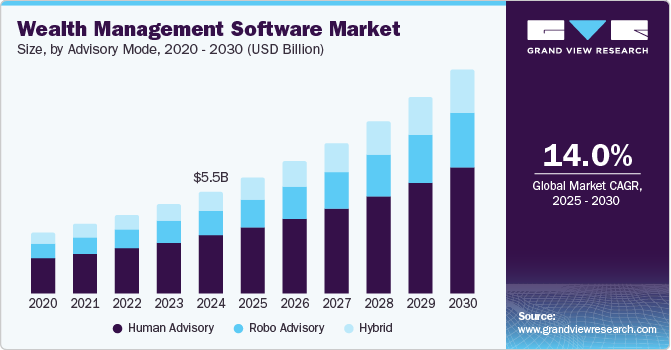

The future looks promising for the wealth management software market. Experts predict a compound annual growth rate (CAGR) of 12% by 2028. This means the market could be worth $5.5 billion in five years.

Several factors contribute to this projected growth:

- Rising demand for personalized financial advice

- Increased use of mobile platforms

- Emergence of blockchain technology

- Greater focus on cybersecurity

Let’s take a look at the projected growth in tabular form:

| Year | Market Size (in billions) |

|---|---|

| 2023 | $3 |

| 2025 | $4.2 |

| 2028 | $5.5 |

Businesses in this sector should prepare for significant changes. Adapting to new technologies will be crucial for success.

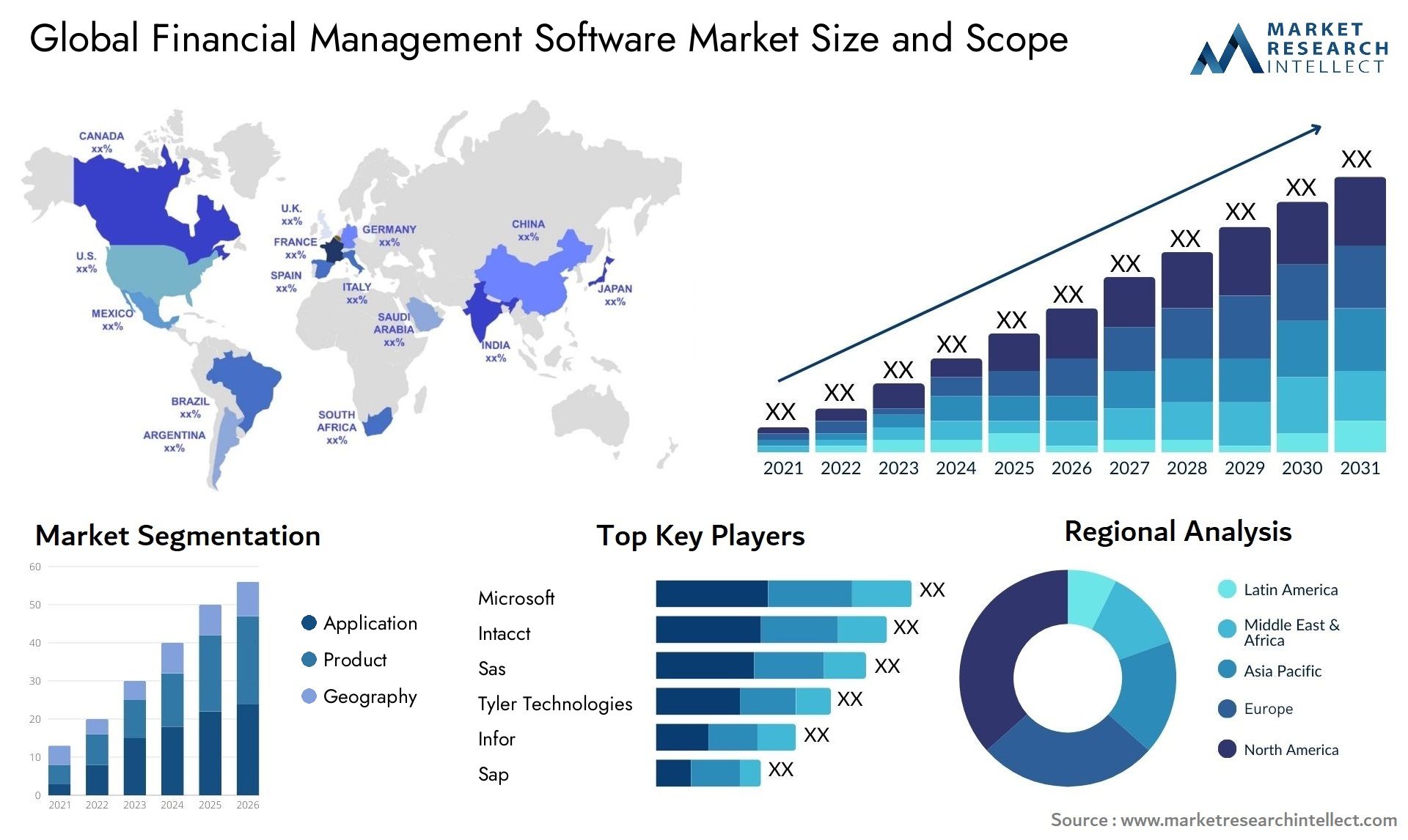

Credit: www.marketresearchintellect.com

Key Market Drivers

The wealth management software market is evolving rapidly. Various key market drivers fuel this growth. Below, we explore some of the primary factors influencing this dynamic sector.

Technological Advancements

Technological advancements play a crucial role in wealth management software. Artificial Intelligence (AI) and Machine Learning (ML) are transforming the industry. These technologies offer personalized financial advice and predictive analytics. Blockchain technology ensures secure and transparent transactions. Cloud computing provides scalable and cost-effective solutions. These advancements enhance the efficiency and effectiveness of wealth management software.

Regulatory Changes

Regulatory changes significantly impact the wealth management software market. Governments worldwide implement new regulations to ensure financial stability. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is crucial. Wealth management software must adapt to these evolving requirements. This ensures the protection of clients’ assets and data. Failure to comply with regulations can result in hefty fines and reputational damage.

| Key Market Driver | Impact |

|---|---|

| Technological Advancements | Enhanced efficiency, personalized advice, secure transactions |

| Regulatory Changes | Compliance, asset protection, data security |

The wealth management software market continues to grow. Understanding these key drivers is essential for staying competitive. Stay updated with the latest technological and regulatory trends to thrive in this dynamic market.

Emerging Technologies

The wealth management software market is rapidly evolving. Emerging technologies are transforming how firms manage and grow wealth. These innovations enhance efficiency, accuracy, and customer satisfaction.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing wealth management. These technologies can analyze vast amounts of data quickly. They provide insights that were previously impossible to obtain.

AI can predict market trends and suggest optimal investment strategies. ML algorithms learn from past data, improving predictions and recommendations over time. This results in better decision-making and increased profitability.

AI-powered chatbots offer personalized customer service. They can answer queries, provide updates, and even execute trades. This saves time for both clients and advisors.

Blockchain Integration

Blockchain technology is another game-changer in the wealth management industry. It offers a secure and transparent way to record transactions. Each transaction is encrypted and linked to the previous one, ensuring data integrity.

Blockchain reduces the risk of fraud and errors. It provides a tamper-proof record of all transactions. This enhances trust and confidence among clients.

Smart contracts are a key feature of blockchain. They automatically execute actions when certain conditions are met. This reduces the need for intermediaries and speeds up processes.

The integration of blockchain in wealth management software offers several benefits:

- Increased security and transparency

- Reduced fraud and errors

- Faster transaction processing

- Lower operational costs

These innovations are shaping the future of wealth management. Firms that adopt these technologies will gain a competitive edge.

Top Software Providers

The wealth management software market is evolving at a fast pace. Top software providers play a significant role in shaping this landscape. They offer cutting-edge tools and solutions to meet the growing demands of clients. Here, we explore the leading companies and innovative startups driving change in this sector.

Leading Companies

Several established companies are leading the wealth management software market. They provide comprehensive solutions to streamline processes and enhance client experiences.

- Fidelity WealthCentral: Offers integrated portfolio management and financial planning tools.

- Envestnet: Known for its robust platform that supports investment management and advisor technology.

- Orion Advisor Services: Provides a suite of tools for portfolio accounting, performance reporting, and compliance.

- Morningstar Office: Combines research, analytics, and portfolio management in one platform.

- eMoney Advisor: Focuses on financial planning and client relationship management.

These companies have a strong market presence. They continuously innovate to stay ahead in the competitive landscape.

Innovative Startups

Startups bring fresh ideas and technologies to the wealth management software market. Their innovative solutions address specific challenges faced by financial advisors and firms.

- Addepar: Delivers a data-driven platform for portfolio management and analytics.

- Personal Capital: Combines digital wealth management tools with personalized advice.

- Betterment: Offers automated investment solutions with a focus on simplicity and efficiency.

- SigFig: Provides robo-advisory services with a user-friendly interface.

- Vestwell: Specializes in modernizing retirement plan management through innovative technology.

These startups are gaining traction. They introduce unique solutions that appeal to tech-savvy advisors and clients.

The wealth management software market is rich with options. Both established companies and startups contribute to its dynamic nature.

Customer Preferences

The wealth management software market is evolving rapidly. Customer preferences are driving many of these changes. Understanding these preferences is crucial for developers and financial advisors. Let’s delve into the key aspects shaping these preferences.

User Experience

User experience is a top priority for clients. They seek intuitive and easy-to-navigate interfaces. The software should require minimal training and offer a seamless journey.

Clients prefer dashboard views that summarize key data points. Visual aids like charts and graphs make information easier to digest. Real-time updates and alerts also enhance user satisfaction.

| Feature | Client Preference |

|---|---|

| Dashboard | Summarized, visual data |

| Navigation | Intuitive and easy |

| Alerts | Real-time updates |

Customization Needs

Clients demand customizable options to suit their unique needs. They want to tailor the software to their specific financial goals. This includes setting personalized alerts and notifications.

Flexibility in report generation is also important. Clients prefer tools that allow them to generate custom reports. These reports must reflect their unique criteria and investment strategies.

- Personalized Alerts: Custom notifications based on personal financial goals.

- Custom Reports: Tailored to specific criteria and strategies.

- Flexible Interface: Ability to modify and configure dashboards.

By addressing these preferences, wealth management software can better meet client needs.

Credit: www.marketresearchintellect.com

Regional Insights

The wealth management software market is growing rapidly. Regional insights are crucial for understanding market dynamics. Different regions have unique trends and developments. Let’s explore the latest updates in North America and Asia-Pacific.

North America

North America leads the wealth management software market. The region has a high adoption rate of digital solutions. Financial institutions invest heavily in technology. This boosts the demand for advanced wealth management software.

- United States: The U.S. is the largest market in North America. Major players include BlackRock, Fidelity, and Charles Schwab. They continuously innovate and adopt new technologies.

- Canada: Canada follows closely behind. Canadian financial institutions focus on enhancing client experiences. They invest in AI and machine learning for personalized services.

North America also sees a rise in robo-advisors. These digital platforms offer automated, algorithm-driven financial planning services. They appeal to tech-savvy investors seeking low-cost options.

Asia-pacific

The Asia-Pacific region shows significant growth in wealth management software. Emerging economies drive this growth. Increased wealth and digital transformation are key factors.

- China: China is a major player in this market. The country has a large population of high-net-worth individuals. Chinese firms invest in cutting-edge technologies to cater to their needs.

- India: India is another important market. The rapid adoption of digital banking services fuels demand. Indian startups and fintech firms are developing innovative wealth management solutions.

The region also benefits from supportive government policies. These policies encourage digital transformation and financial inclusion. This creates a favorable environment for wealth management software providers.

| Region | Key Trends |

|---|---|

| North America | High adoption of digital solutions, rise of robo-advisors, major players like BlackRock and Fidelity |

| Asia-Pacific | Growth in emerging economies, increased wealth, digital transformation, supportive government policies |

Challenges And Opportunities

The wealth management software market is evolving rapidly. With constant technological advancements, it faces unique challenges and presents numerous opportunities. Below, we explore the key challenges and opportunities in this dynamic market.

Security Concerns

Security remains a top priority in wealth management software. Financial data is extremely sensitive. Protecting it from cyber-attacks is crucial. Firms must invest in robust security measures. This includes encryption, multi-factor authentication, and regular security audits.

Data breaches can damage a firm’s reputation. Ensuring client data safety builds trust. Regulations like GDPR and CCPA mandate strict data protection. Compliance with these regulations is essential. Failure to comply can result in heavy fines.

| Security Measure | Benefit |

|---|---|

| Encryption | Protects data in transit and at rest |

| Multi-Factor Authentication | Enhances user account security |

| Regular Security Audits | Identifies and fixes vulnerabilities |

Market Opportunities

The wealth management software market offers significant growth potential. Integration with AI and machine learning can enhance decision-making. AI-driven insights can provide personalized investment advice. This improves client satisfaction and retention.

Cloud-based solutions are gaining traction. They offer scalability and flexibility. Firms can manage resources more efficiently. Reducing costs and improving performance is possible with cloud integration.

- AI and machine learning for better insights

- Cloud-based solutions for scalability

- Increased client satisfaction through personalized advice

Expanding into emerging markets presents new opportunities. Asia-Pacific and Latin America show rapid economic growth. Firms can tap into these regions for new clients.

Credit: www.grandviewresearch.com

Future Outlook

The wealth management software market is evolving rapidly. The future holds significant advancements and opportunities. With technology evolving, the landscape will change dramatically. Here’s what to expect.

Predicted Trends

Experts foresee several key trends shaping the market. These trends include:

- Artificial Intelligence (AI): AI will enhance client interactions and data analysis.

- Blockchain Technology: Blockchain will ensure secure and transparent transactions.

- Cloud-based Solutions: Cloud computing will offer flexibility and scalability.

- Personalization: Customized solutions will meet individual client needs better.

AI will play a central role. It will improve decision-making and efficiency. Blockchain will provide secure and transparent transactions. Cloud-based solutions will offer flexibility and scalability. Personalization will cater to individual client needs.

Investment Areas

Wealth management firms are focusing on several investment areas:

- Technology Integration: Merging traditional methods with modern tech.

- Client Experience: Enhancing client interactions and satisfaction.

- Data Security: Investing in robust cybersecurity measures.

- Regulatory Compliance: Ensuring adherence to global regulations.

Technology integration is essential. It combines traditional and modern methods. Enhancing client experience is a priority. Firms invest in better client interactions. Data security is crucial. Investing in robust cybersecurity measures is vital. Regulatory compliance is another focus area. Firms must adhere to global regulations.

| Investment Area | Focus |

|---|---|

| Technology Integration | Merging traditional and modern methods |

| Client Experience | Improving client interactions and satisfaction |

| Data Security | Enhancing cybersecurity measures |

| Regulatory Compliance | Adhering to global regulations |

The future outlook of wealth management software is promising. Key trends and investment areas will shape this market. Firms must stay updated to remain competitive.

Frequently Asked Questions

What Are The Latest Trends In Wealth Management Software?

The latest trends include AI integration, enhanced data analytics, and cloud-based solutions. These advancements improve efficiency and client service. Automated financial planning tools are also popular.

How Is Ai Changing Wealth Management Software?

AI is revolutionizing wealth management by offering predictive analytics and personalized investment strategies. It enhances decision-making and improves client experiences with tailored recommendations.

Why Is Cloud-based Wealth Management Software Popular?

Cloud-based software offers scalability, flexibility, and cost savings. It allows real-time data access and enhances collaboration. It also ensures data security and compliance.

What Features Are Crucial In Modern Wealth Management Software?

Key features include robust data analytics, AI integration, and secure cloud solutions. User-friendly interfaces and customization options are also important. They improve client engagement and operational efficiency.

Conclusion

The wealth management software market is evolving rapidly. Keeping up with trends is crucial. New features enhance user experience and efficiency. Stay informed to make the best decisions. Embrace these advancements for better financial management. The future holds exciting possibilities for growth and innovation.