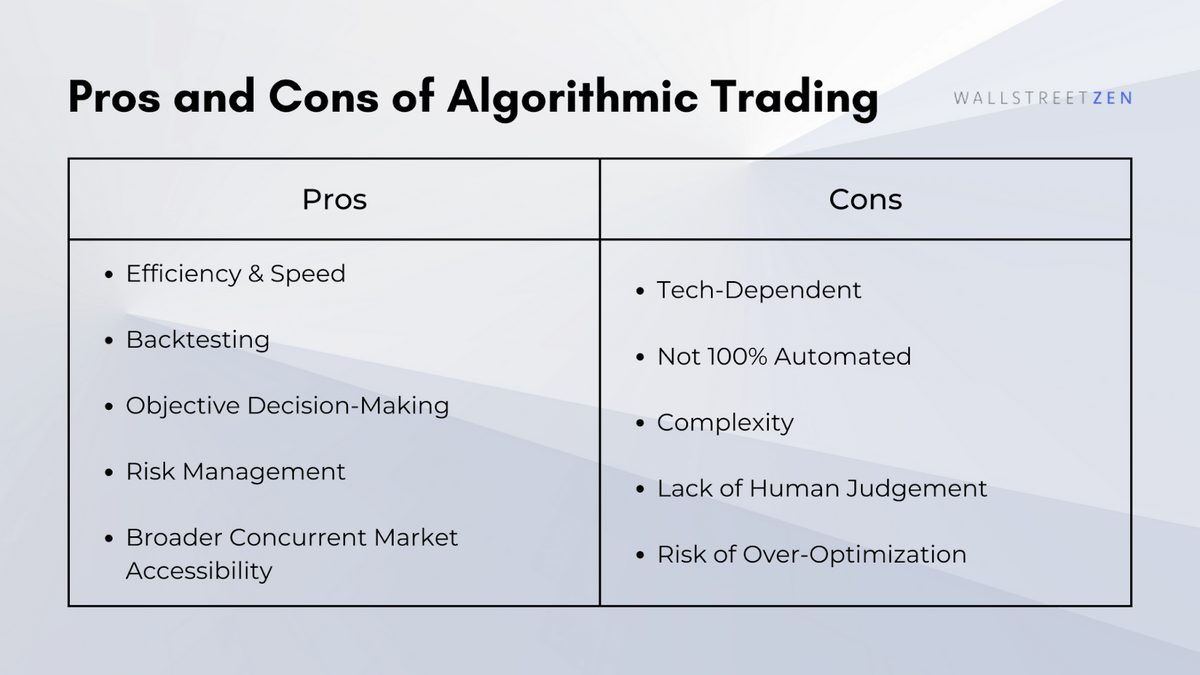

Pros: Trading algorithm platforms can automate trades and reduce human error. Cons: They require technical knowledge and can be costly.

Trading algorithm platforms, or algo-trading software, have revolutionized the financial markets. These platforms use complex algorithms to execute trades automatically. They are designed to make trading more efficient and accurate. Many traders use them to save time and reduce the risk of human error.

While the benefits are clear, there are also downsides. Algo-trading requires a solid understanding of programming and market dynamics. It can be expensive to set up and maintain. Traders must also stay vigilant as software can malfunction. Overall, algo-trading offers significant advantages but comes with challenges that need careful consideration.

Credit: www.wallstreetzen.com

Introduction To Trading Algorithms

Trading algorithms have revolutionized the way we trade. These smart systems can make trading decisions faster than humans. Many traders use these algorithms to automate their strategies. This section will introduce you to trading algorithms.

What Are Trading Algorithms?

Trading algorithms are computer programs. They execute trades automatically. These programs follow a set of rules. The rules can be based on timing, price, quantity, or other models. Traders use them to buy or sell securities at the best possible price.

These algorithms can process large amounts of data. They can analyze market conditions quickly. This allows traders to take advantage of market opportunities. They help minimize human error in trading.

History Of Algorithmic Trading

Algorithmic trading started in the 1970s. It began with simple order execution programs. In the 1980s, it became more advanced. Traders started using it for arbitrage and market-making.

In the 1990s, internet trading grew. This led to more complex algorithms. High-frequency trading became popular. It allowed traders to execute many trades in a fraction of a second.

Today, algorithmic trading is widespread. It accounts for a large portion of trading volume. The technology continues to evolve. It is becoming more sophisticated and accessible.

Advantages Of Trading Algorithm Platforms

Trading algorithm platforms have revolutionized the trading world. These platforms offer numerous benefits. They enhance trading efficiency and reduce errors. Let’s explore the key advantages of trading algorithm platforms.

Speed And Efficiency

Trading algorithm platforms operate at incredible speeds. Algorithms execute trades in milliseconds. This speed is impossible for human traders.

Efficiency is another significant advantage. Algorithms analyze vast amounts of data quickly. They make decisions based on this data. This leads to better trading outcomes.

Additionally, trading algorithms work 24/7. They don’t need breaks or sleep. This constant operation ensures that trading opportunities are never missed.

Elimination Of Human Error

Human traders can make mistakes. Emotions can cloud judgment. Fatigue can lead to errors. Trading algorithms eliminate these issues.

Algorithms follow predefined rules. They don’t get emotional or tired. This reduces the risk of costly mistakes.

Moreover, trading algorithms ensure consistency. They apply the same strategy every time. This leads to more reliable trading results.

Summary

Trading algorithm platforms offer numerous advantages. They enhance speed and efficiency. They eliminate human error. These benefits make them a valuable tool for traders.

Enhanced Market Analysis

Trading algorithm platforms offer enhanced market analysis capabilities. They process vast amounts of data quickly. This makes them invaluable for traders. Let’s explore the pros and cons through two key aspects.

Data Processing Capabilities

Data processing capabilities are a significant advantage of trading algorithm platforms. These platforms can analyze large datasets in seconds. This is something humans can’t achieve. They can process data from various sources:

- Stock Market Data

- News Articles

- Social Media Posts

- Economic Reports

This vast data processing helps in identifying market trends. It also aids in spotting profitable opportunities. But, there are some cons to consider:

| Pros | Cons |

|---|---|

| Quick data analysis | High cost of software |

| Handles large datasets | Requires technical expertise |

Advanced Predictive Models

Advanced predictive models are another core strength. These models use machine learning and AI to forecast market movements. They can predict future trends with a high degree of accuracy. This can significantly enhance trading strategies.

These models use different techniques:

- Regression Analysis

- Neural Networks

- Support Vector Machines

These techniques provide deep insights. They help in making informed trading decisions. Yet, there are some drawbacks:

| Pros | Cons |

|---|---|

| High prediction accuracy | Complex algorithms |

| Improves trading strategies | Potential for overfitting |

Credit: www.wallstreetzen.com

Risk Management Benefits

Trading algorithm platforms software offers numerous risk management benefits for traders. These benefits can significantly enhance a trader’s ability to manage and mitigate risks. Below, we explore some of the key benefits of using such software.

Automated Risk Controls

One major benefit of trading algorithm platforms software is the automated risk controls. These controls help in monitoring and managing risks without manual intervention.

- Automated stop-loss orders to limit potential losses.

- Real-time monitoring of market conditions.

- Immediate execution of risk management strategies.

These features ensure that traders can react quickly to market changes. This reduces the potential for significant losses.

Diversification Strategies

Another advantage is the ability to implement diversification strategies easily. Diversifying trades can spread risk across multiple assets.

Algorithm platforms allow traders to:

- Trade multiple assets simultaneously.

- Allocate funds based on pre-set diversification rules.

- Adjust portfolio allocations in real-time.

These capabilities help in reducing the impact of adverse movements in any single asset.

Trading algorithm platforms software enhances risk management through automation and diversification. This empowers traders to navigate the markets with greater confidence.

Drawbacks Of Trading Algorithm Platforms

Trading algorithm platforms offer many benefits, but they also have several drawbacks. These downsides can affect both new and experienced traders. Here, we discuss some of the main drawbacks.

High Initial Costs

Trading algorithm platforms often come with high initial costs. You need to invest in the software itself, which can be expensive. Additionally, you might need specialized hardware to run the algorithms efficiently. These costs add up quickly. High initial costs can be a barrier for small traders. It is important to budget for these expenses before diving in.

Complexity And Maintenance

The complexity of trading algorithms is another significant drawback. Creating and managing these algorithms requires advanced knowledge. You need to understand both trading strategies and coding. This complexity can be overwhelming for new users.

Maintaining the software is also challenging. Regular updates are necessary to keep the algorithms effective. Changes in market conditions require constant tweaking of the algorithms. This ongoing maintenance requires time and expertise. If you lack these skills, you may need to hire a professional.

Potential Technical Issues

Trading algorithm platforms offer numerous advantages. Yet, they are not flawless. Potential technical issues can disrupt trading activities. Here, we explore two major challenges: system failures and data feed problems.

System Failures

System failures can halt trading operations. This can lead to missed opportunities. They often occur due to hardware malfunctions. Sometimes, software bugs cause these issues. Regular system updates are essential. Regular maintenance also helps prevent these failures.

- Hardware Issues: Physical components can break down.

- Software Bugs: Errors in the code can disrupt operations.

- Server Downtime: Servers can crash, causing delays.

It is crucial to have backup systems. These can mitigate the impact of failures. Regular monitoring can detect issues early.

Data Feed Problems

Data feed problems can affect trading decisions. Accurate data is vital for trading algorithms. Data feed issues can lead to incorrect trades. These problems arise from various sources. Poor internet connections can disrupt data feeds. Server issues at the data provider’s end can also cause problems.

- Internet Connectivity: A stable connection is essential.

- Provider Downtime: Data providers can experience outages.

- Data Delays: Latency can affect real-time data accuracy.

Reliable data sources are crucial. Regular checks ensure data integrity. Having multiple data providers can reduce risks.

Regulatory And Ethical Concerns

Trading algorithm platforms software has revolutionized the financial markets. It offers speed, efficiency, and automation. But with these advantages come significant regulatory and ethical concerns. These concerns revolve around market manipulation risks and compliance requirements. Understanding these issues is crucial for traders and developers alike.

Market Manipulation Risks

One of the primary ethical concerns is market manipulation. Algorithms can exploit market inefficiencies. This can lead to unfair advantages for certain traders. For instance, high-frequency trading algorithms can move markets in milliseconds. This speed can disadvantage retail investors. It can also increase market volatility.

Market manipulation can take many forms. Here are a few examples:

- Spoofing: Placing fake orders to influence prices.

- Quote Stuffing: Flooding the market with orders to slow down competitors.

- Wash Trading: Buying and selling to create false activity.

These practices are unethical and often illegal. They undermine market integrity and investor trust.

Compliance Requirements

Compliance is another critical aspect of trading algorithms. Regulatory bodies set strict rules to ensure fair trading. Traders must adhere to these compliance requirements. Failure to comply can result in hefty fines or legal actions.

Some key compliance requirements include:

- Regular audits: Ensuring algorithms operate within legal boundaries.

- Transparency: Providing clear information about trading strategies.

- Data security: Protecting sensitive financial information.

Regulatory frameworks vary by region. For example, the SEC in the U.S. and ESMA in Europe have different rules. Traders must stay updated with the latest regulations. This ensures their algorithms remain compliant and ethical.

:max_bytes(150000):strip_icc()/Roboadvisor-roboadviser_final-9c0f2c35944e4da6aae8646a832069d1.png)

Credit: www.investopedia.com

Future Of Algorithmic Trading

The future of algorithmic trading looks bright. It promises more efficiency and profits. New technologies and industry trends are shaping this future. Here, we explore these exciting developments.

Emerging Technologies

Artificial Intelligence (AI) and Machine Learning (ML) are game-changers. They enhance trading algorithms. AI can analyze vast amounts of data quickly. ML helps in predicting market trends with high accuracy. Quantum computing is another technology on the rise. It can process complex algorithms faster than ever.

Blockchain technology is adding transparency and security. It ensures all transactions are tamper-proof. Cloud computing provides scalable and cost-effective solutions. Traders can access powerful computing resources without heavy investments.

| Technology | Impact |

|---|---|

| Artificial Intelligence | Quick data analysis |

| Machine Learning | Accurate market predictions |

| Quantum Computing | Faster processing |

| Blockchain | Enhanced security |

| Cloud Computing | Cost-effective solutions |

Industry Trends

There is a rise in high-frequency trading (HFT). This involves executing orders in fractions of a second. HFT traders use advanced algorithms to gain a competitive edge. Social trading is becoming popular. Traders share strategies and copy successful trades.

Regulation and compliance are also evolving. Governments are implementing stricter rules. They aim to ensure fair trading practices. Sustainable and ethical trading is gaining traction. Traders now consider environmental and social factors in their strategies.

- High-Frequency Trading (HFT)

- Social Trading

- Regulation and Compliance

- Sustainable and Ethical Trading

The future of algorithmic trading is exciting. Emerging technologies and industry trends are driving this evolution. Traders must stay updated to leverage these advancements.

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software solutions that automate trading strategies. They use algorithms to execute trades based on predefined rules.

Are Trading Algorithm Platforms Worth It?

Yes, trading algorithm platforms can be worth it. They offer speed, accuracy, and the ability to backtest strategies. However, they require initial setup and monitoring.

What Are The Pros Of Trading Algorithms?

The pros include faster execution, reduced emotional trading, and the ability to handle large datasets. They also allow for backtesting and optimization.

What Are The Cons Of Trading Algorithms?

The cons include high initial costs, complexity, and the need for constant monitoring. They can also be vulnerable to technical failures.

Conclusion

Trading algorithm platforms offer both benefits and challenges. They can boost profits and save time. Yet, they require technical skills and have risks. Weigh the pros and cons before choosing. Make informed decisions for successful trading. Remember, no system is perfect.

Start small and learn as you go.