The top wealth management software tools for 2025 are expected to be highly advanced. These tools aim to streamline financial planning and investment management.

In 2025, wealth management software tools will be more essential than ever. These tools help manage finances, plan investments, and analyze portfolios. They offer features like automated advice, risk assessment, and goal tracking. Users can expect better user interfaces and more integration with other financial services.

Security will be a top priority, ensuring data privacy. These tools cater to both individual investors and financial advisors. With evolving technology, these software tools will be easier to use and more efficient. They will save time, reduce errors, and improve financial outcomes for users.

Introduction To Wealth Management Software

Managing wealth has become easier with advanced software tools. These tools assist in tracking, planning, and growing your wealth. Wealth management software helps both individuals and businesses. It simplifies financial planning and investment management.

Modern wealth management software offers many features. These include portfolio management, asset tracking, and risk analysis. With these tools, users can make informed financial decisions. Let’s explore the importance of these financial tools.

Importance Of Financial Tools

Financial tools are crucial for effective wealth management. They help in organizing and understanding your finances. Financial tools provide insights into spending and saving habits. They also offer investment advice.

Key benefits include:

- Enhanced decision-making

- Better financial planning

- Risk management

- Improved investment strategies

Trends In Wealth Management

The wealth management industry is evolving rapidly. Here are some current trends:

- Artificial Intelligence (AI) and Machine Learning (ML)

- Robo-Advisors

- Blockchain Technology

- Personalized Financial Services

AI and ML help in predictive analysis and personalized advice. Robo-Advisors offer automated investment services. Blockchain ensures secure and transparent transactions. Personalized services cater to individual financial needs.

These trends are shaping the future of wealth management. Keeping up with these trends is essential. It ensures optimal use of wealth management software tools.

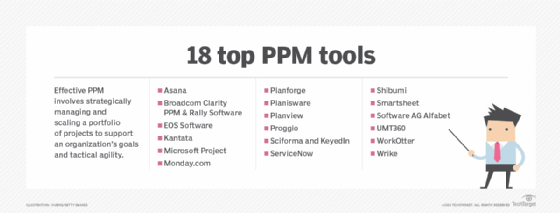

Credit: www.techtarget.com

Key Features To Look For

Choosing the right wealth management software is crucial. It helps to manage assets and finances efficiently. Here are key features to consider in top wealth management software tools for 2025:

User-friendly Interface

A user-friendly interface is essential. It ensures easy navigation and quick access to features. The interface should be intuitive and clean. Users should find important tools without hassle. A good interface reduces training time.

- Simple navigation

- Clear and clean design

- Quick access to features

- Reduced training time

Comprehensive Reporting

Comprehensive reporting is a must-have feature. It offers detailed insights into financial data. Reports should be customizable and easy to generate. They help in making informed decisions. Look for software with real-time reporting capabilities.

Key aspects of comprehensive reporting include:

| Feature | Description |

|---|---|

| Customizable Reports | Create reports tailored to specific needs |

| Real-Time Data | Access up-to-date financial information |

| Visual Representations | Graphs and charts for easier understanding |

| Automated Reports | Schedule reports to be generated automatically |

Top Wealth Management Software Tools

The wealth management industry is evolving rapidly. By 2025, advanced tools will dominate the scene. These tools help manage finances with ease and precision. Let’s explore the Top Wealth Management Software Tools for 2025.

Tool 1: Features And Benefits

Tool 1 offers a range of features that make financial management simple. Here are the key features and benefits:

- Automated Portfolio Management: Automatically rebalance portfolios to optimize returns.

- Risk Assessment: Analyze and mitigate financial risks effectively.

- Real-time Analytics: Gain insights with real-time data and charts.

- Customizable Reports: Generate reports tailored to user needs.

The benefits of using Tool 1 include:

- Time-saving: Automation reduces the need for manual intervention.

- Accuracy: Real-time data ensures precise financial decisions.

- Efficiency: Streamlined processes improve overall efficiency.

- Transparency: Clear reports enhance understanding and trust.

Tool 2: Features And Benefits

Tool 2 is another excellent choice for wealth management. Below are its standout features and benefits:

- Advanced Analytics: Utilize predictive analytics for better financial planning.

- Client Management: Manage client relationships with integrated CRM tools.

- Tax Optimization: Optimize tax strategies to maximize savings.

- Mobile Access: Access data and tools from any mobile device.

The benefits of using Tool 2 are:

- Better Planning: Predictive analytics aid in accurate financial planning.

- Improved Client Relations: CRM tools enhance client satisfaction.

- Cost Efficiency: Tax optimization helps save money.

- Accessibility: Mobile access ensures data is always at your fingertips.

Credit: www.imaginarycloud.com

Comparison Of Leading Tools

Choosing the right wealth management software tool can be challenging. Each tool offers unique features and benefits. This section will compare the leading tools of 2025, focusing on pricing models and customer support.

Pricing Models

Understanding the pricing models is crucial for making an informed decision. Below is a comparison table of the top tools’ pricing models:

| Tool | Pricing Model | Cost |

|---|---|---|

| Tool A | Subscription | $50/month |

| Tool B | One-time purchase | $500 |

| Tool C | Freemium | Free with $20/month for premium features |

Tool A offers a subscription model. It charges $50 per month. This model ensures continuous updates and support.

Tool B uses a one-time purchase pricing model. It costs $500. This option might be cost-effective for long-term use.

Tool C follows a freemium model. The basic features are free. Users can upgrade to premium features for $20 per month.

Customer Support

Customer support is a vital aspect of any software tool. Here’s how the top tools compare:

- Tool A: 24/7 support through chat, email, and phone.

- Tool B: Email support with a 24-hour response time.

- Tool C: Community forums and limited email support.

Tool A provides 24/7 support via chat, email, and phone. This ensures help is always available.

Tool B offers email support. They guarantee a 24-hour response time. This might be suitable for users who don’t need immediate assistance.

Tool C offers support through community forums. They also provide limited email support. This can be beneficial for users who prefer community-based help.

Security And Privacy Concerns

As we move into 2025, the landscape of wealth management software tools is evolving rapidly. One of the most critical aspects to consider is security and privacy concerns. With more sensitive financial data being stored and processed digitally, ensuring robust protection measures is paramount.

Data Encryption

Data encryption is essential for protecting sensitive information. It transforms data into a secure format that is unreadable without a decryption key. This process ensures that even if data is intercepted, it remains inaccessible to unauthorized users.

Types of Data Encryption:

- Symmetric Encryption: Uses a single key for both encryption and decryption.

- Asymmetric Encryption: Utilizes a pair of keys – a public key for encryption and a private key for decryption.

Many top wealth management software tools offer end-to-end encryption. This means data is encrypted on the sender’s device and only decrypted on the recipient’s device. This level of security is crucial for protecting financial data from cyber threats.

User Authentication

User authentication is another vital aspect of security and privacy. It ensures that only authorized users can access sensitive financial information. Modern wealth management tools use advanced authentication methods to enhance security.

Common Authentication Methods:

- Two-Factor Authentication (2FA): Requires users to provide two forms of identification.

- Biometric Authentication: Uses unique biological traits like fingerprints or facial recognition.

- Multi-Factor Authentication (MFA): Combines multiple methods for a higher level of security.

Implementing these methods helps in preventing unauthorized access and protecting user data. It adds an extra layer of security, making it more difficult for hackers to compromise accounts.

To summarize the importance of security in wealth management software, here’s a table outlining key features:

| Feature | Benefit |

|---|---|

| Data Encryption | Protects data from unauthorized access |

| Two-Factor Authentication | Enhances user account security |

| Biometric Authentication | Provides a unique and secure access method |

| End-to-End Encryption | Ensures data is secure during transmission |

Integration With Other Financial Services

As we step into 2025, the landscape of wealth management software tools continues to evolve. One of the key trends is the integration with other financial services. This integration allows users to manage all their financial needs in one place. Whether it’s banking, investment tracking, or other services, seamless integration simplifies life. Below, we explore some crucial aspects of this integration.

Banking Integration

Banking integration is vital for a comprehensive wealth management solution. By linking bank accounts directly with wealth management software, users can view their financial status in real-time. This feature helps in tracking daily expenses, managing savings, and optimizing budgets.

- View account balances and transactions in real-time.

- Automate savings and budget allocations.

- Receive alerts for low balances or large transactions.

With banking integration, users can also set up automatic transfers and bill payments. This ensures that all financial activities are streamlined and efficient.

Investment Tracking

Investment tracking is another crucial feature of modern wealth management tools. It helps users to monitor their investment portfolios, track performance, and make informed decisions. By integrating with various investment platforms, the software provides a comprehensive view of all assets.

- Monitor stock performance and market trends.

- Track returns on investments in real-time.

- Analyze risk and diversify portfolios effectively.

Investment tracking tools often come with predictive analytics. This helps users forecast future performance based on historical data. Such insights are invaluable for making strategic investment decisions.

User Reviews And Testimonials

User reviews and testimonials give insights into the effectiveness of software tools. These insights help potential users make informed decisions. They provide real-world experiences and highlight both strengths and weaknesses. Below, we explore success stories and common criticisms from users of the top wealth management software tools for 2025.

Success Stories

Many users praise the efficiency and ease of use. John D., a financial advisor, shares, “This software has streamlined my workflow. I can manage clients’ portfolios effortlessly.”

Emily S., a wealth manager, states, “The reporting features are top-notch. I can generate detailed reports in minutes.”

Michael T. notes, “The customer support is excellent. They resolve issues quickly and efficiently.”

| Feature | Positive Feedback |

|---|---|

| Ease of Use | Streamlines workflow, user-friendly interface |

| Reporting | Generates detailed reports quickly |

| Customer Support | Responsive and helpful |

Common Criticisms

Despite the positive feedback, there are common criticisms. Some users find the cost high. Sarah L. mentions, “The software is great, but it’s pricey for small firms.”

David M. points out, “There is a learning curve. It took me a while to get used to it.”

Anna K. adds, “Occasional bugs can be frustrating. They should improve their testing process.”

- High cost for small firms

- Initial learning curve

- Occasional software bugs

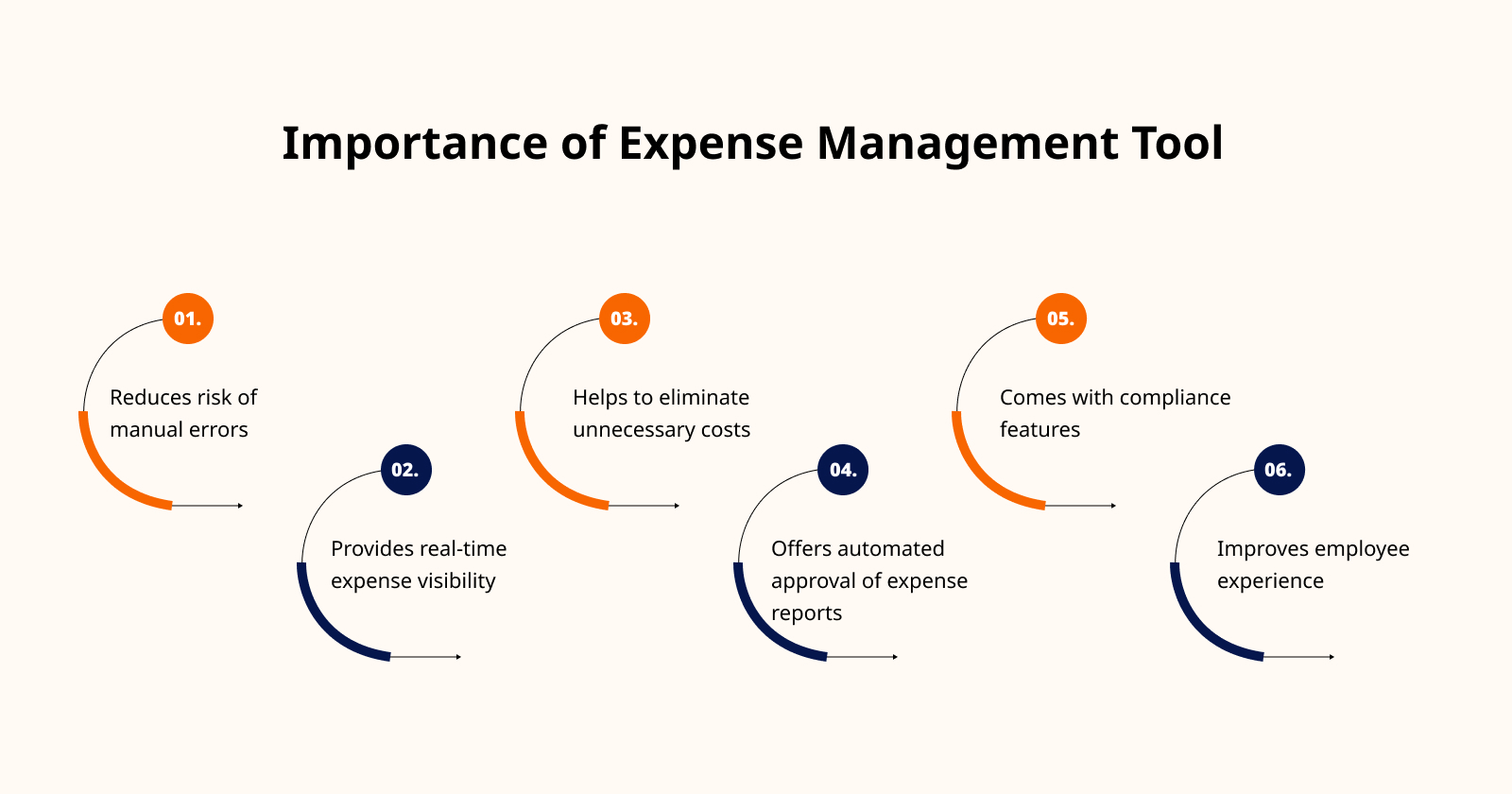

Credit: www.invoicera.com

Future Of Wealth Management Software

The future of wealth management software is bright. New technologies are transforming the industry. These tools are becoming smarter and more efficient. They help manage money better than ever before. Let’s dive into the exciting advancements shaping the future.

Ai And Automation

AI and automation are game-changers in wealth management. AI can analyze data faster than humans. It identifies trends and predicts market movements. This helps advisors make better decisions.

Automation handles repetitive tasks. This saves time and reduces errors. Clients get faster and more accurate service. Here are some key benefits of AI and automation in wealth management:

- Enhanced data analysis

- Predictive analytics

- Automated portfolio management

- Improved client communication

Regulatory Changes

Regulatory changes are reshaping the industry. New rules ensure better protection for investors. Compliance is now more complex. Wealth management software tools help navigate these changes. They ensure firms stay compliant and avoid penalties.

These tools monitor regulations automatically. They alert advisors to any updates. This ensures all actions are within legal limits. Here are some features of regulatory compliance tools:

- Real-time regulation monitoring

- Automated compliance checks

- Detailed audit trails

- Risk management solutions

The future of wealth management software is promising. AI and automation, along with regulatory changes, are driving this evolution. Embrace these advancements for a more efficient and compliant future.

Frequently Asked Questions

What Is Wealth Management Software?

Wealth management software helps manage financial assets. It provides tools for investment tracking, portfolio management, and financial planning.

How Does Wealth Management Software Work?

Wealth management software integrates various financial tools. It helps in tracking investments, analyzing performance, and planning future financial goals.

What Features Should I Look For In Wealth Management Software?

Look for features like portfolio management, financial planning, tax optimization, and real-time data analytics.

Can Wealth Management Software Improve Investment Returns?

Yes, it can. The software provides data-driven insights and strategies, helping you make informed investment decisions.

Conclusion

Choosing the right wealth management software is crucial for success. These tools simplify financial planning and investment management. They help you stay organized and make informed decisions. As 2025 approaches, consider these options to enhance your financial strategies. Stay ahead with the best technology available.