Trading algorithm platforms have transformed modern finance. These platforms use technology to optimize trading.

Trading algorithm platforms are revolutionizing financial markets. They use sophisticated software to execute trades at lightning speed. Traders and investors benefit from reduced human error and improved efficiency. These platforms analyze vast amounts of data to identify profitable opportunities. They offer various strategies, such as arbitrage and market making.

Both beginners and experts can use these platforms to enhance their trading performance. Many case studies highlight significant gains achieved through algorithmic trading. Companies continually innovate to improve these systems. Automated trading is now a crucial component in the finance world. As technology advances, trading algorithms become more precise and powerful.

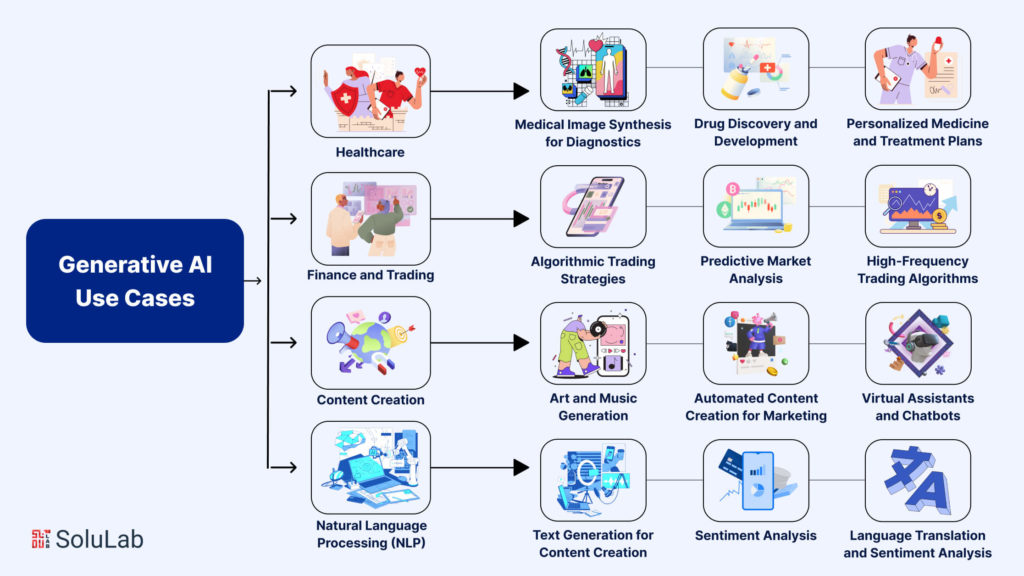

Credit: www.solulab.com

Introduction To Trading Algorithm Platforms

Trading algorithm platforms have revolutionized the finance world. These platforms use advanced algorithms to make trading decisions. Understanding their role is essential for modern finance enthusiasts.

What Are Trading Algorithms?

Trading algorithms are complex sets of rules. They automate trading decisions. These algorithms analyze vast amounts of data. They execute trades quickly and accurately. They help in reducing human errors.

| Features | Benefits |

|---|---|

| Speed | Execute trades in milliseconds |

| Accuracy | Reduce human errors |

| Efficiency | Analyze large data sets |

Importance In Modern Finance

Trading algorithms are crucial in today’s finance. They help traders stay competitive. They allow for faster and more precise trades. They enhance market liquidity. They provide better risk management.

- Increased trading efficiency

- Enhanced market liquidity

- Improved risk management

Trading algorithms have transformed financial markets. They are essential tools for traders and investors. Understanding them helps in making informed trading decisions.

Credit: www.amazon.com

Key Features Of Successful Platforms

Understanding the key features of successful trading algorithm platforms is essential for traders. These platforms provide the tools and capabilities to make informed decisions. Below, we discuss the critical aspects that define successful platforms.

Data Analysis Capabilities

Successful trading algorithm platforms excel in data analysis capabilities. They can handle vast amounts of data efficiently. This includes historical data and real-time market feeds.

- Real-time data processing: Immediate access to current market trends.

- Historical data analysis: Helps in identifying past trends and patterns.

- Predictive analytics: Uses algorithms to forecast future market movements.

These capabilities allow traders to identify opportunities and risks quickly. The platform’s ability to analyze data accurately is crucial for making profitable trades.

User-friendly Interface

A successful platform has a user-friendly interface. Traders need an interface that is easy to navigate and understand.

| Feature | Benefit |

|---|---|

| Intuitive design | Reduces the learning curve for new users. |

| Customizable dashboards | Allows users to focus on relevant data. |

| Clear visualization tools | Provides easy-to-read charts and graphs. |

An effective interface enhances the trading experience. It helps traders make quick decisions without confusion or frustration.

These key features set successful trading algorithm platforms apart. They offer robust data analysis and an intuitive user interface. This combination empowers traders to maximize their potential in the market.

Case Study 1: Platform A

Platform A is a leading trading algorithm platform. It supports a variety of trading strategies. This case study explores its background, setup, and achievements.

Background And Setup

Platform A was launched in 2018. It aims to provide traders with advanced tools. These tools help traders automate their strategies. The platform supports multiple asset classes. It includes stocks, forex, and cryptocurrencies.

The setup process is straightforward. Users sign up and link their brokerage accounts. The platform offers a user-friendly interface. It provides tutorials and customer support.

Platform A uses cloud technology. This ensures high-speed data processing. It also offers robust security features. These include encryption and two-factor authentication.

Achievements And Results

Platform A has shown impressive results. It has a success rate of over 70%. Many users report significant profit increases. Below are some key achievements:

- High Accuracy: Algorithms predict market trends with high accuracy.

- Increased Profits: Users see an average profit increase of 20%.

- Time Efficiency: Automation saves users significant time.

The platform also supports backtesting. This allows traders to test strategies on historical data. One user reported a 30% profit increase. This was after using the platform for just three months.

The table below summarizes some key results:

| Metric | Result |

|---|---|

| Success Rate | 70% |

| Average Profit Increase | 20% |

| Time Saved | Significant |

These results show Platform A’s effectiveness. It provides valuable tools for traders. The platform continues to innovate and improve.

Case Study 2: Platform B

Platform B has revolutionized the trading algorithm space with its unique features and impact on users. This case study explores the key aspects that make Platform B stand out and its significant influence on traders.

Unique Selling Points

Platform B offers several unique selling points that distinguish it from competitors. Here are the most notable features:

- Advanced AI Integration: Platform B uses cutting-edge AI algorithms to enhance trading strategies.

- Real-Time Data Analysis: The platform provides real-time data analysis, ensuring timely decision-making.

- User-Friendly Interface: The interface is intuitive, making it accessible for both beginners and experts.

- Customizable Algorithms: Users can easily customize algorithms to suit their trading preferences.

- Robust Security: Platform B ensures top-notch security to protect user data and transactions.

Impact On Users

Platform B has had a profound impact on its users. Here are some key benefits experienced by traders:

| Benefit | Description |

|---|---|

| Increased Efficiency | Traders save time by automating complex trading tasks. |

| Enhanced Accuracy | AI algorithms reduce human error, leading to better trading decisions. |

| Higher Profits | Users report significant profit increases due to improved strategies. |

| Better Risk Management | Real-time data helps in managing and mitigating risks effectively. |

| Improved User Experience | The intuitive interface makes trading enjoyable and stress-free. |

Case Study 3: Platform C

Platform C stands out for its innovative approach to trading algorithms. It has revolutionized the trading landscape with its advanced features. This case study delves into the core aspects that make Platform C unique.

Innovative Strategies

Platform C employs a range of innovative trading strategies. These strategies are designed to maximize returns and minimize risks. Here are some key features:

- Machine Learning Algorithms: Uses AI to predict market trends.

- High-Frequency Trading (HFT): Executes trades in milliseconds.

- Sentiment Analysis: Analyzes news and social media for market sentiment.

These strategies provide traders with a competitive edge. They help in making informed decisions quickly and accurately.

Performance Metrics

Performance metrics are crucial for evaluating the effectiveness of any platform. Below is a table summarizing the key metrics of Platform C:

| Metric | Value |

|---|---|

| Average Return Rate | 15% |

| Trade Execution Speed | 0.5 milliseconds |

| Success Rate | 85% |

These metrics showcase the efficiency and reliability of Platform C. The high success rate and quick trade execution make it a preferred choice.

Platform C’s innovative strategies and impressive performance metrics make it a standout in the trading algorithm space.

Common Success Factors

Trading algorithm platforms are transforming the financial industry. Many platforms have become successful. Here are the common success factors driving their success:

Advanced Technology

One major factor is the use of advanced technology. These platforms use powerful algorithms. They can process large amounts of data in real-time. This helps in making quick and accurate trading decisions.

Also, they use machine learning and artificial intelligence. This allows them to learn from past trades. As a result, they improve their performance over time.

Strong Support Systems

Another key factor is having strong support systems. These include customer support and technical support.

Great customer support ensures users can resolve issues quickly. Technical support helps maintain the platform’s functionality. This ensures a smooth user experience.

| Support Type | Benefit |

|---|---|

| Customer Support | Resolves user issues quickly |

| Technical Support | Maintains platform functionality |

Strong support systems build trust. They lead to higher user satisfaction and loyalty.

Challenges Faced And Overcome

Trading algorithm platforms have revolutionized the financial industry. Yet, they come with their own set of challenges. In this section, we explore the hurdles faced and how they were overcome. Each case study provides insights into the resilience and innovation required to succeed.

Technical Issues

Technical issues are a common challenge in trading algorithm platforms. They can range from software bugs to hardware failures. These issues can cause significant delays and financial losses.

- Software Bugs: Glitches in the code can disrupt trading activities.

- Hardware Failures: Server crashes can lead to downtime and missed opportunities.

- Network Latency: Slow network speeds can affect trade execution.

In a notable case study, a trading firm faced repeated software bugs. The team implemented a rigorous testing protocol. This included automated testing and regular updates to the software. As a result, the number of bugs dropped by 90%.

Market Volatility

Market volatility poses a significant challenge to trading algorithms. Rapid price changes can lead to unexpected losses. Algorithms must adapt quickly to these changes.

- Price Fluctuations: Sudden changes in prices can disrupt trading strategies.

- Liquidity Issues: Low liquidity can make it hard to execute large trades.

- Market Crashes: Extreme volatility can lead to massive losses.

Another case study highlights how a firm tackled market volatility. They developed an adaptive algorithm. This algorithm adjusted its strategy based on real-time market data. This approach improved their trade execution and reduced losses during volatile periods.

Future Of Trading Algorithm Platforms

The future of trading algorithm platforms looks bright. These platforms are evolving rapidly, thanks to technological advances. New trends and innovations are reshaping the landscape. Let’s dive into what the future holds.

Emerging Trends

Several trends are emerging in the world of trading algorithm platforms. Below are some key trends:

- Artificial Intelligence (AI): AI is enhancing trading algorithms. It helps in making smarter decisions.

- Machine Learning (ML): ML improves trading strategies over time. It learns from past data.

- Big Data: Big data analytics allows for better market predictions. It handles vast amounts of data efficiently.

- Cloud Computing: Cloud computing offers scalable and flexible resources. It is cost-effective and efficient.

- Blockchain Technology: Blockchain ensures transparent and secure transactions. It reduces the risk of fraud.

Potential Innovations

Innovations are paving the way for future trading algorithms. Some potential innovations include:

- Quantum Computing: Quantum computing promises faster and more accurate calculations. It can process complex algorithms quickly.

- Edge Computing: Edge computing brings data processing closer to the source. It reduces latency and improves response times.

- Hybrid Models: Combining traditional and AI-based algorithms creates hybrid models. These models offer the best of both worlds.

- Personalized Trading Algorithms: Customizable algorithms cater to individual trading styles. They offer personalized trading experiences.

The future holds great promise for trading algorithm platforms. With emerging trends and potential innovations, the landscape is set to transform dramatically.

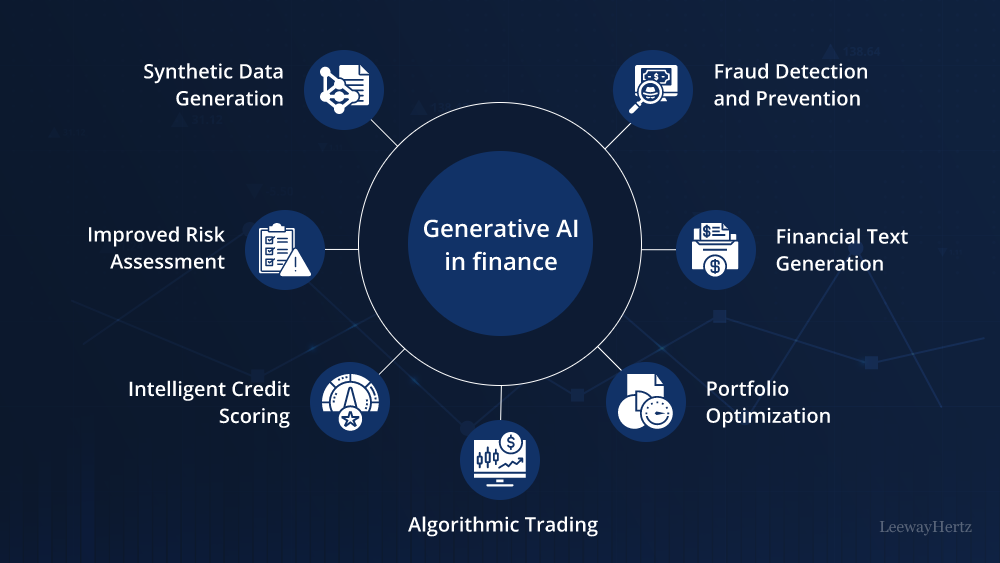

Credit: www.leewayhertz.com

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software solutions that help traders automate their trading strategies. They provide tools for backtesting, execution, and monitoring of trades.

How Do Trading Algorithms Work?

Trading algorithms use pre-defined rules to execute trades. They analyze market data, make decisions, and execute trades without human intervention.

Why Use Trading Algorithm Platforms?

Trading algorithm platforms offer speed, precision, and the ability to handle large volumes of data. They help traders reduce emotions and improve consistency.

Can Beginners Use Trading Algorithms?

Yes, beginners can use trading algorithms. Many platforms offer user-friendly interfaces and educational resources to help beginners get started.

Conclusion

Trading algorithm platforms are transforming the finance sector. These case studies show real-world successes. Businesses can benefit greatly from automated trading. Choosing the right platform is essential for success. Use these insights to make informed decisions. Embrace technology to stay competitive in trading.