Trading algorithm platforms can integrate with existing systems seamlessly. They enhance efficiency and optimize trading strategies.

Trading algorithm platforms are vital for modern finance. They automate trading, reduce human error, and increase speed. Integration with existing systems is crucial for success. This ensures smooth operations and data consistency. Compatibility with current software minimizes disruptions. It also leverages existing infrastructure, saving costs.

These platforms offer advanced analytics and real-time data. This helps in making informed decisions quickly. Choosing the right platform is essential. It must align with your system’s requirements. Proper integration improves performance and profitability. Effective integration leads to better trading outcomes. It’s a smart investment for any trading firm.

Introduction To Trading Algorithm Platforms

Trading algorithm platforms use computer algorithms to make trading decisions. These platforms help traders execute orders efficiently. They analyze market data and execute trades at optimal times. This reduces human error and increases trading efficiency. Integrating these platforms with existing systems is crucial for seamless operations.

Benefits Of Automation

Automation in trading provides numerous advantages:

- Speed: Algorithms execute trades faster than humans.

- Precision: Algorithms follow predefined rules, reducing errors.

- Consistency: Automated systems maintain consistent performance.

- 24/7 Operation: They can trade round-the-clock without fatigue.

These benefits make trading algorithm platforms essential for modern traders. They help in achieving optimal trading results and improving efficiency.

Market Trends

The market for trading algorithm platforms is growing rapidly. Key trends include:

- Increased Adoption: More traders are using algorithmic trading.

- Advanced Technologies: AI and machine learning enhance algorithms.

- Regulatory Changes: New regulations impact algorithmic trading.

- Integration Capabilities: Better integration with existing systems.

These trends shape the future of trading algorithm platforms. Staying updated with these trends is vital for traders and financial institutions.

Choosing The Right Platform

Choosing the right trading algorithm platform is crucial for seamless integration with existing systems. The right platform ensures efficiency, scalability, and robust performance. This section will guide you through the critical aspects to consider.

Key Features To Look For

When selecting a trading algorithm platform, focus on these key features:

- Ease of Integration: The platform should easily integrate with your existing systems.

- Customizability: It must allow customization to fit your specific needs.

- Real-time Data: Ensure it provides real-time data for accurate trading decisions.

- Security: Robust security features to protect your data and transactions.

- Support and Documentation: Comprehensive support and detailed documentation are essential.

Scalability Considerations

Scalability is vital for long-term success. Consider these factors:

| Factor | Description |

|---|---|

| Performance: | The platform must handle increased data loads efficiently. |

| Flexibility: | It should adapt to growing trading volumes without performance loss. |

| Infrastructure: | Robust infrastructure to support scaling operations. |

Choosing a platform with these features and scalability considerations ensures a smooth integration process. It also sets the foundation for future growth and success in trading.

Integration With Existing Systems

Integrating trading algorithm platforms with existing systems can be challenging yet rewarding. Proper integration can lead to enhanced efficiency and improved trading strategies. This section will explore the key aspects of integration, focusing on compatibility issues and data synchronization.

Compatibility Issues

Compatibility issues can arise when integrating new trading algorithms. These issues often relate to system architecture and software versions. Ensuring compatibility between new algorithms and existing systems is crucial. Testing in a controlled environment helps identify potential problems. Compatibility checks must be performed regularly to avoid disruptions.

| Issue | Description | Solution |

|---|---|---|

| Software Versions | Different versions may not work together. | Update both systems to the latest version. |

| System Architecture | Architectural mismatches cause integration failures. | Align architectural components. |

| API Compatibility | APIs may not support required operations. | Use compatible or custom APIs. |

Data Synchronization

Data synchronization ensures data consistency across platforms. Real-time data updates are critical for trading algorithms. Inconsistent data can lead to incorrect trading decisions. Implementing robust data synchronization methods is essential.

- Real-Time Updates: Ensure data updates in real-time to maintain accuracy.

- Data Validation: Regularly validate data to avoid discrepancies.

- Backup Systems: Maintain backup systems to prevent data loss.

Proper data synchronization can significantly improve trading performance. Ensure continuous monitoring and adjustment to keep systems aligned.

Credit: www.qlik.com

Api Utilization

API Utilization is critical in trading algorithm platforms. It ensures smooth integration with existing systems. This section will explore the fundamentals of APIs and best practices for their use.

Api Basics

APIs, or Application Programming Interfaces, are essential tools. They allow different systems to communicate seamlessly. In trading, APIs enable platforms to access market data, execute trades, and monitor portfolios.

APIs function through requests and responses. A client sends a request to the server. The server then sends a response back. This process is crucial for real-time trading operations.

| API Component | Description |

|---|---|

| Endpoint | The URL where the API can be accessed. |

| Request | The call made to the API to perform an action. |

| Response | The data returned by the API. |

Best Practices

Following best practices ensures efficient API utilization. Here are key practices:

- Authentication: Ensure secure access to your API. Use tokens or API keys.

- Rate Limiting: Control the number of requests. Prevent server overload.

- Error Handling: Provide clear error messages. Help users understand issues.

- Versioning: Use versioning for updates. Maintain compatibility with older systems.

Using these practices will enhance the performance and security of your trading algorithms. Effective API utilization leads to more reliable trading operations.

Security Measures

Security measures are crucial for trading algorithm platforms. They ensure the safety of sensitive data and operations. Effective security measures prevent unauthorized access and data breaches. Here, we’ll discuss key security aspects like data encryption and access control.

Data Encryption

Data encryption protects sensitive information. It converts data into unreadable code. Only authorized users can decode it. This keeps data safe from hackers and unauthorized access. Encryption is essential for securing trade algorithms and financial data.

Trading platforms use encryption protocols like AES and RSA. These protocols ensure high-level security. They protect data during transmission and storage. Encryption keys are kept secure and managed properly. This ensures only authorized parties can access the data.

| Encryption Protocol | Key Features |

|---|---|

| AES (Advanced Encryption Standard) | Strong encryption, widely used, fast and efficient |

| RSA (Rivest-Shamir-Adleman) | Public-key encryption, secure key exchange, strong security |

Access Control

Access control restricts unauthorized users from accessing the system. It defines who can access what data and resources. Access control is vital for maintaining the integrity of trading algorithms. It ensures that only authorized personnel can modify or execute trades.

There are different types of access control:

- Role-Based Access Control (RBAC): Access is based on user roles.

- Discretionary Access Control (DAC): Owners decide access permissions.

- Mandatory Access Control (MAC): Access is based on fixed policies.

Implementing strong access control helps prevent unauthorized actions. It also reduces the risk of internal threats. Users are given only the minimum permissions needed for their role. This principle is known as least privilege.

Testing And Validation

Testing and validation are crucial steps in integrating trading algorithm platforms with existing systems. They ensure the algorithms work correctly and perform as expected. Rigorous testing helps identify potential issues before deployment, ensuring smooth operation in live trading environments.

Simulated Environments

Using simulated environments for testing is essential. These environments replicate real market conditions without risking actual capital. They allow traders to evaluate the performance of algorithms under various scenarios.

- Replicate real market conditions

- Test multiple scenarios

- Identify potential issues

Simulated environments provide a safe space to refine and optimize trading strategies. They help developers understand how algorithms react to different market situations.

Performance Metrics

Tracking performance metrics is vital for validating trading algorithms. These metrics help assess the efficiency and effectiveness of the strategies.

| Metric | Description |

|---|---|

| Profitability | Measures the profit generated by the algorithm |

| Drawdown | Tracks the decline from a peak to a trough |

| Sharpe Ratio | Evaluates risk-adjusted return |

| Latency | Measures the time delay in order execution |

Analyzing these metrics helps improve trading strategies. It ensures the algorithms are robust and reliable.

Monitoring And Maintenance

Monitoring and Maintenance are essential for the smooth operation of trading algorithm platforms. Keeping a close eye on system performance ensures issues are identified and addressed promptly. Regular updates keep the system aligned with current market conditions and technological advancements. Let’s delve into the key aspects of monitoring and maintenance.

Real-time Monitoring

Real-time monitoring helps in tracking the algorithm’s performance instantly. This includes:

- Tracking trade execution times

- Identifying potential errors or bugs

- Monitoring market conditions

- Ensuring compliance with trading rules

Real-time data feeds and dashboards provide a visual representation of system health. Alerts and notifications can be configured to signal anomalies. This proactive approach helps in minimizing risks and maximizing profits.

Regular Updates

Regular updates to the trading algorithm are crucial. These updates include:

- Incorporating new market data

- Improving algorithmic strategies

- Enhancing security protocols

- Fixing identified bugs

Scheduled maintenance windows ensure minimal disruption. Version control systems manage different updates seamlessly. Keeping the system updated ensures optimal performance and competitiveness.

Case Studies

Examining real-world case studies provides valuable insights into trading algorithm platforms’ integration with existing systems. These studies reveal both the successes and challenges encountered. Understanding these aspects can guide future integrations for better outcomes.

Successful Integrations

Several companies have successfully integrated trading algorithm platforms into their existing systems. One notable example is ABC Finance. They integrated a custom trading algorithm with their legacy system. This move enhanced their trading efficiency and reduced manual errors.

Another success story is XYZ Investments. They utilized an off-the-shelf trading algorithm platform. The integration streamlined their trading operations and improved decision-making speed.

| Company | Integration Type | Outcome |

|---|---|---|

| ABC Finance | Custom Algorithm | Enhanced Efficiency |

| XYZ Investments | Off-the-shelf Platform | Streamlined Operations |

Lessons Learned

From these integrations, several key lessons emerged. ABC Finance found that custom algorithms require extensive testing. Testing ensures compatibility with existing systems. They also learned the importance of ongoing maintenance.

XYZ Investments discovered that off-the-shelf platforms can offer faster deployment. However, they require careful customization to fit specific needs. Both companies emphasized the need for comprehensive training for staff. Training ensures smooth transitions and maximizes the benefits of new systems.

- Extensive testing is crucial for custom algorithms.

- Ongoing maintenance ensures sustained performance.

- Faster deployment with off-the-shelf platforms.

- Careful customization to meet specific needs.

- Comprehensive training for staff is essential.

Future Trends

The integration of trading algorithm platforms with existing systems is evolving quickly. Future trends in this field promise exciting advancements. These advancements will make trading more efficient and secure.

Ai And Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are transforming trading. These technologies analyze vast amounts of data quickly. This allows for better decision-making and predictive analysis.

AI can identify patterns and trends that humans might miss. ML algorithms learn from past data to improve future trading strategies. This reduces the risk and increases the profitability of trades.

Here are some key benefits of AI and ML in trading:

- Real-time data analysis: Faster and more accurate trading decisions.

- Predictive analytics: Better forecasting of market trends.

- Automated trading: Executes trades based on pre-set criteria.

- Risk management: Identifies and mitigates potential risks.

Blockchain Integration

Blockchain technology is another game-changer for trading algorithm platforms. It provides a secure and transparent way to record transactions. This reduces the chances of fraud and errors.

Blockchain integration ensures the integrity of trading data. It also enables faster settlement times and lower transaction costs.

Key advantages of blockchain in trading include:

- Enhanced security: Immutable and transparent transaction records.

- Reduced costs: Lower fees compared to traditional systems.

- Faster settlements: Quicker transaction processing times.

- Decentralization: Removes the need for intermediaries.

These future trends in trading algorithm platforms will reshape the industry. They will make trading more efficient, secure, and profitable.

Credit: medium.com

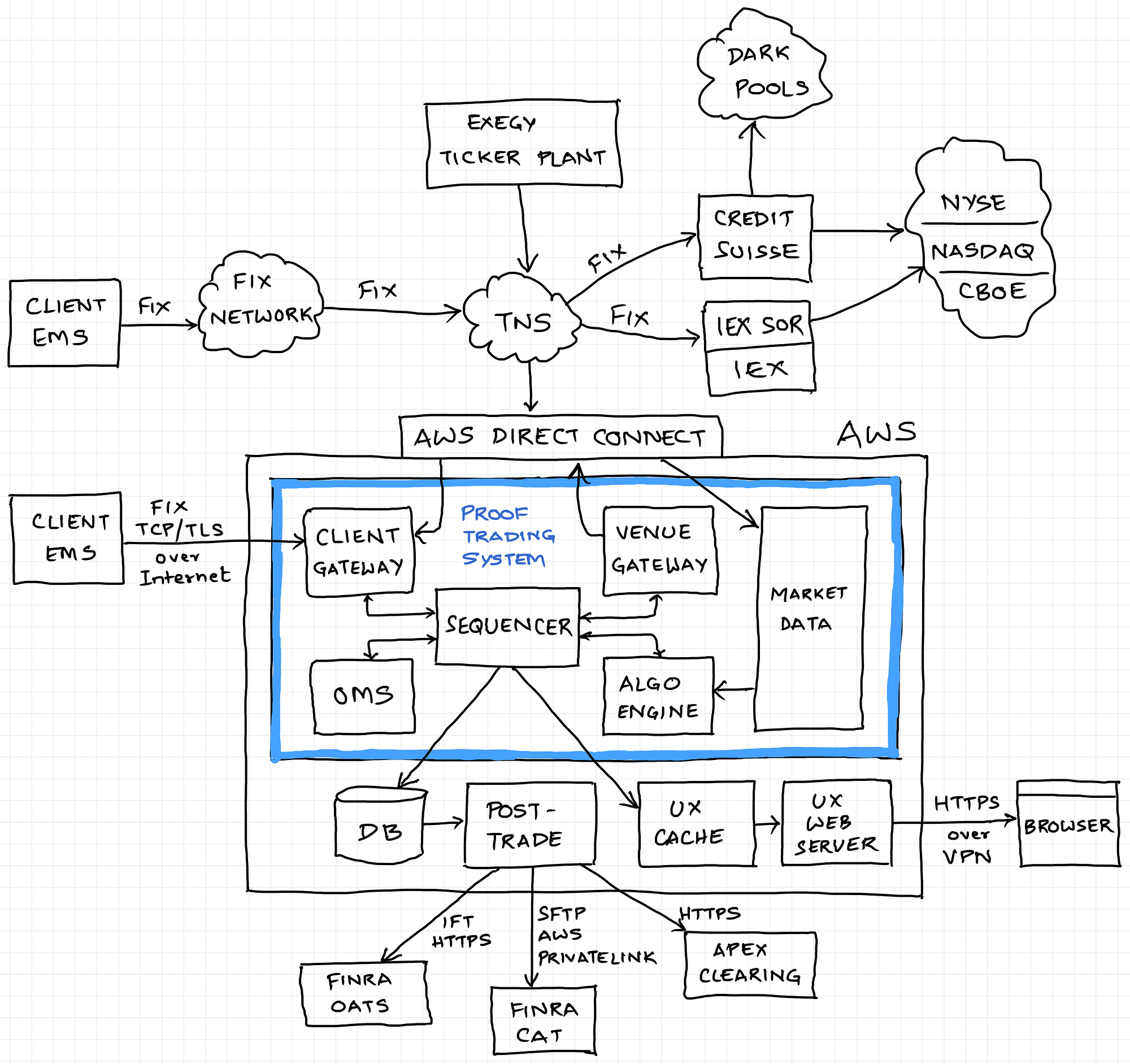

Credit: aws.amazon.com

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software systems that use algorithms to execute trades. They help automate trading processes and analyze market data.

How To Integrate Trading Algorithms With Existing Systems?

Integrate trading algorithms by using APIs, data feeds, and compatible software. Ensure seamless data flow and system compatibility for efficient trading.

Why Integrate Trading Algorithms With Current Systems?

Integration enhances trading efficiency, reduces manual errors, and improves decision-making. It allows better use of data and automated trading strategies.

What Are The Benefits Of Using Trading Algorithms?

Trading algorithms provide faster execution, reduced human errors, and improved accuracy. They analyze vast amounts of data quickly for better trading decisions.

Conclusion

Integrating trading algorithms with existing systems boosts efficiency and accuracy. It enhances decision-making and streamlines operations. This integration reduces manual errors and saves time. Adopting these platforms can lead to better trading outcomes. Upgrade your system for a competitive edge in the market.

Start integrating today and see the benefits.