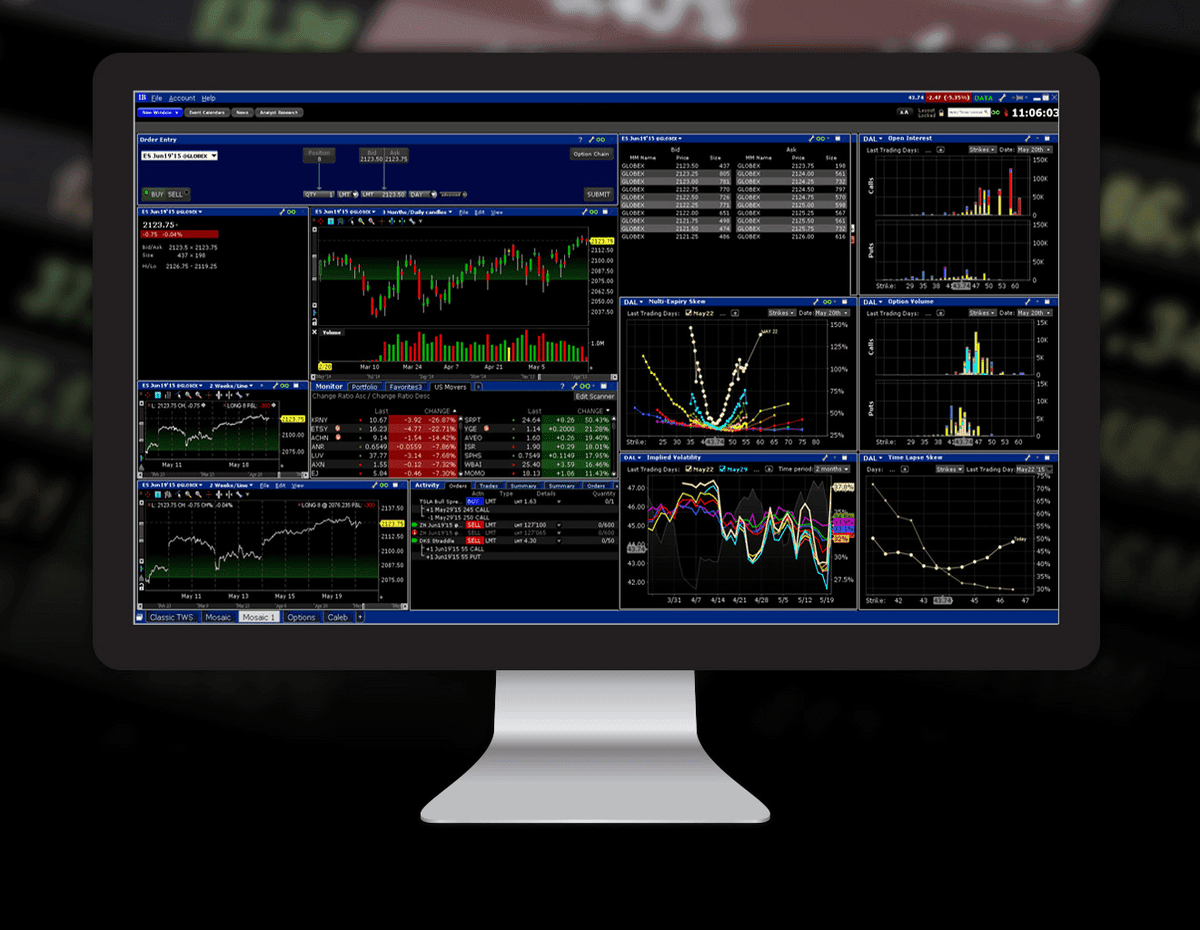

Trading algorithm platforms help automate trading strategies. They improve efficiency and accuracy.

Trading algorithm platforms software reviews provide insights into the best tools available. These platforms use advanced technology to execute trades automatically. They reduce human error and save time. Traders can backtest strategies with historical data. This helps in refining their approach.

Many platforms offer customizable features. Users can tailor them to their specific needs. Reviews highlight the user-friendliness and reliability of each platform. They also compare costs and support services. This information is crucial for making informed decisions. Choosing the right platform can enhance trading performance. It can also lead to better financial outcomes.

Credit: esgthereport.com

Introduction To Trading Algorithm Platforms

Trading algorithm platforms have revolutionized financial markets. They allow traders to execute strategies with precision and speed. These platforms have become essential for modern trading.

What Is Trading Algorithm Software?

Trading algorithm software automates trading decisions. The software uses predefined rules to place trades. These rules are based on price, timing, or other market conditions.

The software eliminates human error. It ensures trades are executed at the right moment. This increases the chances of profitability.

Importance Of Algorithmic Trading

Algorithmic trading offers many advantages. Firstly, it enhances execution speed. Algorithms can process data and execute trades faster than humans.

Secondly, it reduces emotional trading. Emotions can lead to poor decisions. Algorithms follow rules without bias.

Thirdly, it improves accuracy. Algorithms can analyze large datasets quickly. They identify opportunities that humans might miss.

Lastly, it allows for backtesting. Traders can test their strategies on historical data. This helps refine and improve trading strategies.

| Feature | Benefit |

|---|---|

| Speed | Faster trade execution |

| Accuracy | Identifies opportunities |

| Emotion-Free | Reduces poor decisions |

| Backtesting | Refines strategies |

These benefits make trading algorithm platforms indispensable. Traders can achieve better results. They gain a competitive edge in the market.

Criteria For Selecting Top Platforms

Choosing the right trading algorithm platform is crucial for success. Here are the key criteria to consider when selecting top platforms.

User-friendly Interface

A user-friendly interface makes trading smooth and efficient. Look for platforms with simple navigation. The dashboard should be intuitive. It should be easy to access key features. Clear and concise menus help in quick decision-making.

Consider platforms with customizable layouts. These allow traders to set up their workspace. A user-friendly interface can significantly reduce errors.

Performance And Reliability

Performance and reliability are paramount. The platform should execute trades swiftly. It must handle high volumes without lag. Consistent uptime ensures no missed opportunities. Look for platforms with a strong track record.

Check for regular updates and maintenance. This indicates a commitment to performance. Reliable platforms often have 24/7 support. This helps resolve issues promptly.

Customization Options

Customization options are vital for tailored trading strategies. Platforms should offer a range of tools and indicators. These help in creating personalized trading plans. Look for platforms with flexible algorithm settings.

Consider those that allow integration with other tools. Customization enhances the trading experience. It enables traders to adapt to market changes quickly.

| Criteria | Importance |

|---|---|

| User-Friendly Interface | Essential for efficiency |

| Performance and Reliability | Crucial for success |

| Customization Options | Vital for tailored strategies |

Top Trading Algorithm Platforms Of 2024

As we step into 2024, the world of trading algorithms is evolving rapidly. These platforms are designed to maximize trading efficiency and minimize risks. With numerous options available, finding the right platform can be daunting. Here, we review the top trading algorithm platforms of 2024 to help you make an informed decision.

Overview Of The Top 10 Picks

The trading algorithm platforms listed below are known for their outstanding performance and innovative features. These platforms have been carefully selected based on their reliability, user reviews, and unique offerings.

- MetaTrader 5

- QuantConnect

- AlgoTrader

- TradeStation

- Quantopian

- NinjaTrader

- MultiCharts

- TradingView

- Amibroker

- Quantower

Comparison Of Key Features

| Platform | Key Features | Price |

|---|---|---|

| MetaTrader 5 |

| Free |

| QuantConnect |

| Subscription |

| AlgoTrader |

| Custom Pricing |

| TradeStation |

| Subscription |

| Quantopian |

| Free |

| NinjaTrader |

| Subscription |

| MultiCharts |

| Subscription |

| TradingView |

| Free/Subscription |

| Amibroker |

| License Fee |

| Quantower |

| Subscription |

Platform 1: Features And Benefits

Platform 1 is a comprehensive trading algorithm platform. It offers a range of features and benefits. This section will cover the ease of use and advanced tools available on this platform.

Ease Of Use

Platform 1 is designed for all users. Both beginners and experts can use it easily. The interface is intuitive and user-friendly.

- Simple navigation

- Clear instructions

- Quick setup process

The platform provides step-by-step tutorials. These tutorials help users get started quickly. Support is available 24/7. Users can access help anytime they need it.

Advanced Tools

Platform 1 offers a wide range of advanced tools. These tools help traders make informed decisions.

| Tool | Benefit |

|---|---|

| Real-time Data Analysis | Provides up-to-date market insights |

| Customizable Algorithms | Allows for personalized trading strategies |

| Backtesting | Tests strategies on historical data |

Users can also access automated trading features. The platform executes trades based on pre-set conditions. This saves time and reduces human error.

These advanced tools empower traders. They help in maximizing profits and minimizing risks.

Platform 2: Features And Benefits

Platform 2 offers a range of features for traders. It combines advanced technology with user-friendly design. This section explores its key features and benefits.

User Experience

Platform 2 is known for its exceptional user experience. The interface is intuitive and easy to navigate. Users can quickly access tools and data. The platform supports multiple devices, ensuring flexibility. It offers customizable dashboards tailored to individual needs.

- Intuitive interface

- Easy navigation

- Multi-device support

- Customizable dashboards

Security Measures

Security is a top priority for Platform 2. It uses advanced security measures to protect user data. End-to-end encryption ensures data privacy. The platform employs multi-factor authentication to prevent unauthorized access. Regular security audits are conducted to maintain high standards.

| Security Feature | Benefit |

|---|---|

| End-to-End Encryption | Ensures data privacy |

| Multi-Factor Authentication | Prevents unauthorized access |

| Regular Security Audits | Maintains high standards |

Platform 3: Features And Benefits

Platform 3 stands out in the trading algorithm software market. It offers an array of features designed to enhance trading efficiency and effectiveness. Below, we will explore the key features and benefits of Platform 3.

Performance Metrics

Platform 3 provides detailed performance metrics to track trading success. These metrics include:

- Real-time Data: Access to live market data ensures timely decisions.

- Backtesting Capabilities: Test your strategies against historical data.

- Risk Management: Tools to manage and minimize trading risks.

| Metric | Description |

|---|---|

| Profit/Loss Ratio | Measures the net profit against total loss. |

| Win Rate | Percentage of winning trades. |

| Drawdown | Shows the peak-to-trough decline during a specific period. |

Support And Resources

Platform 3 excels in providing comprehensive support and resources for its users. Key features include:

- 24/7 Customer Support: Get help anytime, day or night.

- Extensive Knowledge Base: Access tutorials, guides, and FAQs.

- Community Forums: Engage with other traders and share insights.

The platform also offers dedicated account managers for personalized support. This ensures users get the most out of the software.

Overall, Platform 3’s features and benefits make it a top choice for traders seeking robust tools and reliable support.

Pricing And Plans

Choosing the right trading algorithm platform can be daunting. Pricing and plans are crucial factors to consider. This section breaks down the different options available. Understanding these can help you make an informed decision.

Free Vs Paid Versions

Many trading algorithm platforms offer free versions. These free versions are great for beginners. They often include basic features and limited support. A free version helps you understand the software. However, it may lack advanced tools and customization options.

Paid versions, on the other hand, offer comprehensive features. These include advanced analytics, priority support, and more. Paid versions are ideal for experienced traders. They provide the tools needed to maximize profits. Investing in a paid version can be beneficial in the long run.

Subscription Models

Trading algorithm platforms usually offer various subscription models. These models can be monthly, quarterly, or yearly. Each model has its own benefits and costs. Here is a table summarizing different subscription models:

| Subscription Model | Cost | Features |

|---|---|---|

| Monthly | $30/month | Basic features, standard support |

| Quarterly | $80/quarter | All monthly features, additional tools |

| Yearly | $300/year | All quarterly features, premium support |

Choosing the right subscription model depends on your needs. Monthly subscriptions are flexible. They allow you to test the platform without a long-term commitment. Quarterly subscriptions offer better value. They include extra tools that can enhance your trading strategies. Yearly subscriptions provide the best value. They come with premium support and all available features.

Consider your trading goals and budget. This will help you choose the best pricing plan. Always check for discounts and promotions. Some platforms offer special deals that can save you money.

:max_bytes(150000):strip_icc()/dotdash_Fina_Pick_the_Right_Algorithmic_Trading_Software_Feb_2020-01-e58558a7c8f14325ab0edc2a7005ab68.jpg)

Credit: www.investopedia.com

User Reviews And Feedback

Users provide valuable insights into trading algorithm platforms. Their experiences can guide new users. Let’s explore user reviews and feedback.

Positive Experiences

Many users praise trading algorithm platforms. They find these platforms easy to use. Below is a table summarizing some common positive experiences:

| Feature | User Feedback |

|---|---|

| Ease of Use | Users appreciate simple and intuitive interfaces. |

| Performance | Many users report high success rates with algorithms. |

| Customer Support | Quick and helpful responses from support teams. |

Common Complaints

Despite positive feedback, users also express concerns. Here are some common complaints:

- Technical Glitches: Users experience occasional software bugs.

- Cost: Some find subscription fees high.

- Learning Curve: New users sometimes struggle initially.

Understanding these complaints can help improve platform design. It ensures better user experiences.

Future Trends In Algorithmic Trading

Algorithmic trading is evolving rapidly. New trends are shaping the future. This section explores the latest trends in algorithmic trading.

Ai And Machine Learning Integration

AI and machine learning are revolutionizing trading. Algorithms now learn from data. They adapt to market changes quickly. This makes trading more efficient.

AI can predict market trends. It analyzes vast amounts of data in seconds. This reduces human error. It also increases profitability.

Machine learning helps in creating smarter algorithms. These algorithms can identify patterns. They can also make decisions faster. Traders now rely on these technologies. They offer a competitive edge.

Regulatory Changes

Regulations are constantly evolving. They impact algorithmic trading significantly. New rules ensure fairness and transparency. They protect market participants.

Regulatory bodies monitor trading activities closely. They enforce compliance. Algorithms must adhere to these regulations. This prevents market manipulation.

Compliance with regulations is crucial. It avoids legal issues. It also builds trust with clients. Traders need to stay updated. They must adapt their strategies accordingly.

| Trend | Impact |

|---|---|

| AI and Machine Learning | Increases efficiency and profitability |

| Regulatory Changes | Ensures fairness and transparency |

These trends are reshaping the landscape. They offer new opportunities. They also present challenges. Staying informed is key. It ensures success in algorithmic trading.

Credit: www.facebook.com

Conclusion And Recommendations

After evaluating various trading algorithm platforms, it’s crucial to summarize findings. This helps in making informed decisions. The right platform boosts your trading strategies. Below, we provide our final thoughts and recommendations based on our analysis.

Final Thoughts

Choosing a trading algorithm platform depends on specific needs. Some platforms excel in user-friendliness. Others offer advanced analytical tools. It’s essential to consider your trading goals and expertise level. Remember, the best platform is one that meets your requirements.

Best Platform For Different Needs

Different traders have different needs. Here are our top recommendations based on various criteria:

| Need | Recommended Platform | Key Features |

|---|---|---|

| Beginner-Friendly | AlgoTrader | User-friendly interface, comprehensive tutorials |

| Advanced Analytics | QuantConnect | Robust analytical tools, extensive data sets |

| Cost-Effective | MetaTrader | Free basic features, affordable premium options |

| Customizability | TradeStation | Highly customizable, extensive API support |

Make sure to test the platforms using their free trials. This helps in understanding their features better.

- Identify your trading needs.

- Match those needs with the platform’s features.

- Use free trials to test the platform.

- Consider the cost versus the benefits.

By following these steps, you can find the best platform for your trading needs.

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software applications that execute trades automatically. They use pre-programmed instructions and algorithms to optimize trading performance.

How Do Algorithmic Trading Platforms Work?

Algorithmic trading platforms work by using complex mathematical models. They analyze market data and execute trades based on predefined criteria.

What Are The Benefits Of Trading Algorithm Software?

Benefits include increased trading speed, reduced human error, and the ability to analyze vast amounts of data. They can also help in executing complex trading strategies.

Which Features To Look For In Trading Algorithm Platforms?

Look for features like backtesting, real-time data analysis, and user-friendly interfaces. Also, consider the platform’s compatibility with various markets and assets.

Conclusion

Choosing the right trading algorithm platform is crucial. It can boost your trading success. Consider features, ease of use, and customer support. Read reviews and compare options. Make an informed decision to meet your needs. Happy trading and good luck!