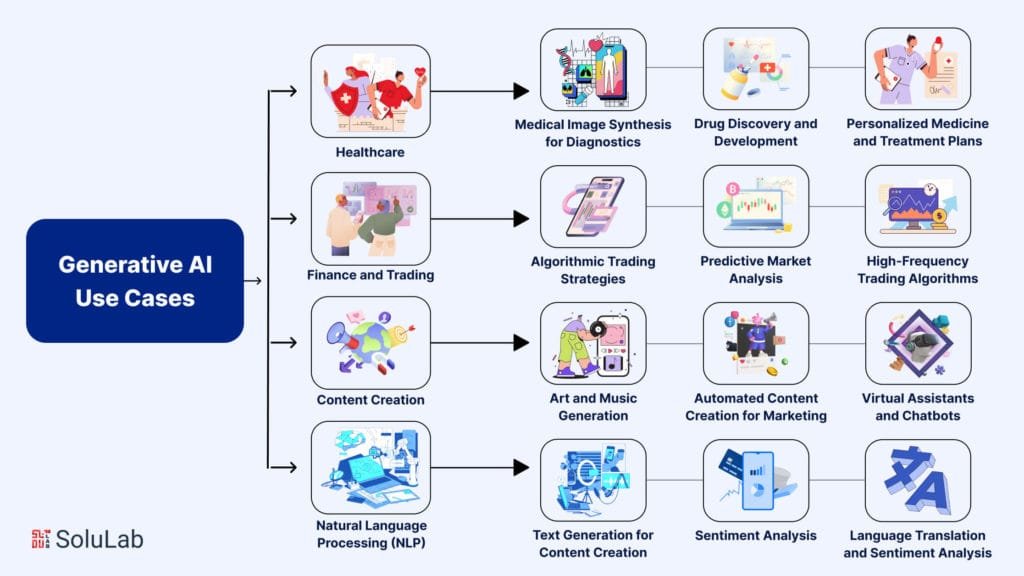

Trading algorithm platforms automate trading strategies and execute trades quickly. They help traders minimize risks and maximize profits.

Algorithmic trading, or algo-trading, uses computer programs to trade stocks and other assets. These platforms analyze market data and execute trades at optimal times. They eliminate human errors and emotional decisions, leading to better trading outcomes. Many traders and financial institutions use these platforms for their speed and efficiency.

Popular platforms include MetaTrader, TradeStation, and NinjaTrader. Each offers unique features for different trading needs. Algo-trading is essential for modern traders seeking to stay competitive in fast-paced markets. It helps in executing high-frequency trades and managing complex strategies effortlessly.

Credit: www.appventurez.com

Introduction To Trading Algorithm Platforms

Trading algorithm platforms are transforming the financial world. They use complex mathematical models to automate trading decisions. These platforms analyze market data in real-time. They can execute trades faster than any human.

What They Are

Trading algorithm platforms are software systems. They automate trading in financial markets. These platforms use pre-set rules and algorithms. The algorithms analyze data and execute trades.

Traders can customize these algorithms. This allows them to meet specific trading strategies. Some platforms also offer machine learning capabilities. This makes the algorithms smarter over time.

Importance In Modern Trading

Trading algorithm platforms have revolutionized modern trading. They offer several advantages:

- Speed: Algorithms can execute trades in milliseconds.

- Accuracy: They minimize human errors.

- Efficiency: Algorithms can process vast amounts of data.

- 24/7 Trading: They can trade around the clock.

These benefits make trading algorithm platforms essential. They help traders stay competitive.

| Feature | Benefit |

|---|---|

| Speed | Execute trades in milliseconds |

| Accuracy | Minimize human errors |

| Efficiency | Process vast amounts of data |

| 24/7 Trading | Trade around the clock |

Traders use these platforms to gain an edge. They can react faster to market changes. This can lead to higher profits.

Popular Trading Algorithm Platforms

Trading algorithm platforms have transformed how traders engage with the market. These platforms provide tools that automate trading strategies. They help in making data-driven decisions rapidly. Here are some of the popular trading algorithm platforms.

Top Platforms

There are numerous platforms available for trading algorithms. Here are the top ones:

- MetaTrader 4 (MT4)

- QuantConnect

- TradeStation

- AlgoTrader

- Interactive Brokers

Key Features

| Platform | Key Features |

|---|---|

| MetaTrader 4 (MT4) |

|

| QuantConnect |

|

| TradeStation |

|

| AlgoTrader |

|

| Interactive Brokers |

|

Automating Trades

Trading algorithm platforms are revolutionizing the financial world. Automating trades allows for precise, emotion-free decision making. This leads to more efficient and profitable trading. These platforms execute trades based on pre-set criteria, eliminating human error. Let’s explore some benefits and examples of automated trading.

Benefits Of Automation

- Speed and Efficiency: Automated systems can execute trades in milliseconds.

- Emotion-Free Trading: Algorithms operate without emotional influence, ensuring consistency.

- Backtesting: Test strategies against historical data to validate effectiveness.

- Diversification: Spread risk by trading multiple assets simultaneously.

- 24/7 Trading: Algorithms can trade around the clock without fatigue.

Examples Of Automated Trading

Let’s look at some practical examples of automated trading in action.

| Platform | Use Case |

|---|---|

| MetaTrader 4 | Forex trading with customizable algorithms |

| Thinkorswim | Stock and options trading with automated scripts |

| TradeStation | Futures trading with built-in strategy testing |

MetaTrader 4 is popular for Forex trading. Users can create custom algorithms for precise trading. Thinkorswim allows for stock and options trading. It supports automated scripts for executing trades. TradeStation focuses on futures trading. It offers built-in tools for strategy testing and automation.

Automated trading provides numerous benefits. It can improve trading speed, accuracy, and profitability. These platforms are essential for modern traders seeking efficiency and success.

Risk Management

Risk management is crucial in trading algorithm platforms. Effective risk management helps protect investments and maximize returns. It involves strategies to minimize potential losses. Let’s explore how these platforms aid in mitigating risks and successful strategies used.

Mitigating Risks

Trading algorithms can analyze vast amounts of data quickly. They identify market patterns and trends that humans might miss. This helps in making informed decisions and reducing risks.

Algorithms use historical data to predict future market movements. They adjust strategies based on these predictions. This reduces the chances of unexpected losses.

Stop-loss orders are another feature in these platforms. They automatically sell assets when they reach a certain price. This limits losses and protects investments.

Diversification is also key in risk management. Algorithms can spread investments across various assets. This minimizes the impact of a poor-performing asset.

Successful Strategies

Successful trading strategies often include backtesting. This process tests strategies using historical data. It helps in refining strategies before applying them in real markets.

High-frequency trading is another effective strategy. Algorithms execute a large number of trades in milliseconds. This takes advantage of small price movements and reduces market risks.

Arbitrage is a strategy where algorithms exploit price differences across markets. They buy an asset in one market and sell it in another at a higher price. This guarantees profits with minimal risk.

Machine learning enhances trading strategies. Algorithms learn from past trades and market conditions. They continuously improve and adapt to new market trends.

Here’s a table summarizing the key strategies:

| Strategy | Description |

|---|---|

| Backtesting | Testing strategies using historical data |

| High-frequency trading | Executing numerous trades in milliseconds |

| Arbitrage | Exploiting price differences across markets |

| Machine learning | Algorithms learn and adapt to new trends |

High-frequency Trading

High-Frequency Trading (HFT) has revolutionized financial markets. It involves executing a large number of orders in fractions of a second. HFT uses sophisticated algorithms to capitalize on market inefficiencies. This technique has both supporters and critics due to its impact on market stability.

How It Works

HFT platforms use complex algorithms and powerful computers. These systems analyze market data in real-time. They execute trades at lightning speed, often within milliseconds. The goal is to profit from small price discrepancies. HFT firms place trades faster than human traders can react.

These platforms rely on low-latency networks. This minimizes the time it takes for data to travel. They also use co-location services. This means placing their servers close to the exchange’s servers. This setup reduces the time to execute trades.

Real-world Examples

Several firms dominate the HFT landscape. Let’s look at some examples:

| Firm | Specialization |

|---|---|

| Virtu Financial | Market making and arbitrage |

| Citadel Securities | Equities, options, and futures trading |

| Two Sigma Securities | Algorithmic trading and statistical analysis |

Virtu Financial is known for market making and arbitrage. They use HFT to provide liquidity to markets. This helps in narrowing bid-ask spreads.

Citadel Securities focuses on equities, options, and futures trading. They use HFT to manage large volumes of trades efficiently.

Two Sigma Securities specializes in algorithmic trading and statistical analysis. Their HFT strategies are designed to detect and exploit market patterns.

- HFT strategies are diverse and complex.

- They often include arbitrage, market making, and event-based trading.

- HFT firms require vast amounts of data and computational power.

HFT has a significant impact on modern financial markets. It enhances liquidity and market efficiency. But it also raises concerns about fairness and stability.

Machine Learning In Trading

Machine learning has transformed trading. It uses data to predict market trends. This technology helps traders make better decisions. Machine learning models analyze large datasets quickly. They identify patterns and opportunities that humans might miss.

Integrating Ai

Integrating AI in trading platforms boosts efficiency. AI algorithms can process vast amounts of data. They provide real-time insights and predictions. Traders use these insights to execute trades faster. AI helps in reducing human errors. It also enhances risk management.

AI can automate trading strategies. It can adjust them based on market conditions. This adaptability is crucial in volatile markets. AI-based platforms offer backtesting features. Traders can test their strategies on historical data. This helps in refining and improving them.

Case Studies

Many companies successfully use AI in trading. For example, Goldman Sachs uses AI to manage its trading operations. Their AI systems analyze market data and execute trades. This has increased their trading efficiency and profitability.

JPMorgan Chase employs AI for its trading algorithms. Their AI platform, LOXM, executes trades with high precision. It uses machine learning to learn from past trades. This helps in making better trading decisions in the future.

| Company | AI Platform | Benefits |

|---|---|---|

| Goldman Sachs | Proprietary AI | Increased efficiency, reduced errors |

| JPMorgan Chase | LOXM | High precision, better decisions |

These case studies show the power of AI in trading. They highlight how machine learning can enhance trading performance. Companies that adopt AI gain a competitive edge. They can respond faster to market changes. This leads to better profitability and growth.

Backtesting Strategies

Backtesting strategies help traders test their trading algorithms. It uses historical data to see how well a strategy would have worked. This step is crucial before using real money.

Importance Of Backtesting

Backtesting helps traders understand how their strategies would perform. It reduces the risk of losing money. Traders can see potential issues and fix them early. It saves both time and resources.

Traders can use backtesting to compare different strategies. They can choose the one that performs best. This way, they make informed decisions.

| Benefit | Description |

|---|---|

| Risk Reduction | Minimizes the chances of financial loss. |

| Efficiency | Saves time and resources by identifying issues early. |

| Comparison | Allows traders to compare multiple strategies. |

Successful Backtesting Cases

There are many examples of successful backtesting cases. One example is the moving average crossover strategy. Traders use it to identify market trends. They test it against historical data to confirm its effectiveness.

Another example is the momentum trading strategy. This strategy looks at the speed of price changes. Traders backtest it to ensure it can predict future price movements accurately.

- Moving Average Crossover Strategy

- Momentum Trading Strategy

- Mean Reversion Strategy

These strategies have proven successful through backtesting. They help traders make more informed decisions and increase their chances of success in the market.

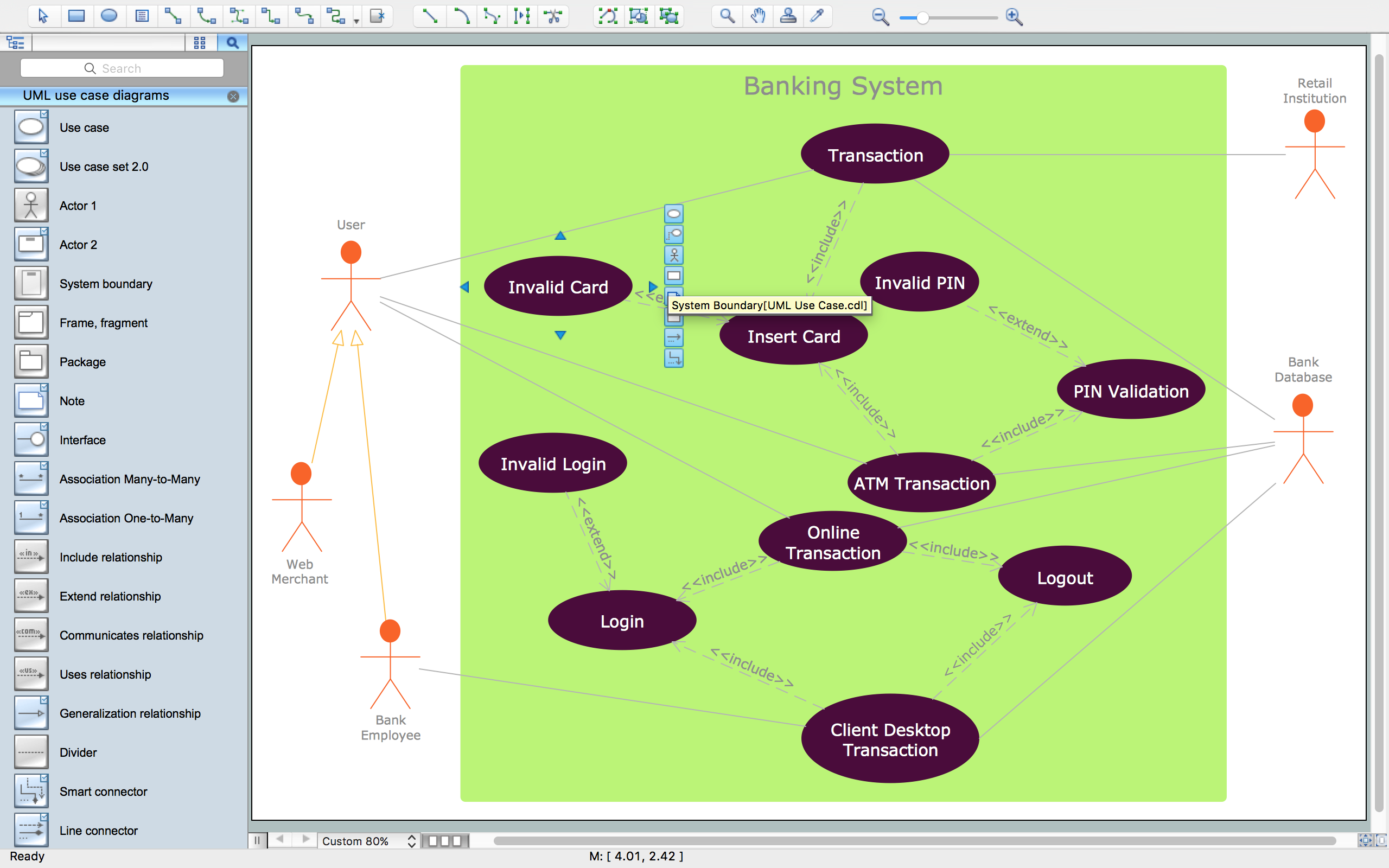

Credit: www.conceptdraw.com

Future Of Trading Algorithms

The future of trading algorithms looks promising with rapid technological advancements. The financial markets are evolving, and so are the tools used for trading. Trading algorithms are becoming more sophisticated, leveraging emerging technologies and predicted trends.

Emerging Technologies

Several emerging technologies are shaping the future of trading algorithms:

- Artificial Intelligence (AI): AI helps in predicting market trends and making decisions.

- Machine Learning (ML): ML algorithms learn from data to improve trading strategies.

- Blockchain: Blockchain ensures transparent and secure transactions.

- Quantum Computing: Quantum computing can solve complex calculations faster than traditional computers.

These technologies are enhancing the efficiency and accuracy of trading algorithms. They enable traders to respond swiftly to market changes.

Predicted Trends

Several trends are expected to dominate the future of trading algorithms:

- Increased Automation: More trades will be executed automatically without human intervention.

- High-Frequency Trading (HFT): HFT will become more prevalent, offering faster trade execution.

- Personalized Trading Strategies: Algorithms will tailor strategies based on individual trader preferences.

- Enhanced Risk Management: Algorithms will better manage risks by analyzing vast amounts of data.

These trends will likely make trading more accessible and efficient. Traders will benefit from improved performance and reduced risks.

Below is a table highlighting the key differences between traditional and algorithmic trading:

| Aspect | Traditional Trading | Algorithmic Trading |

|---|---|---|

| Execution Speed | Slower | Faster |

| Decision Making | Human-based | Machine-based |

| Risk Management | Manual | Automated |

| Market Analysis | Limited | Comprehensive |

The future of trading algorithms is bright with the integration of advanced technologies. These tools will revolutionize how trades are executed and managed.

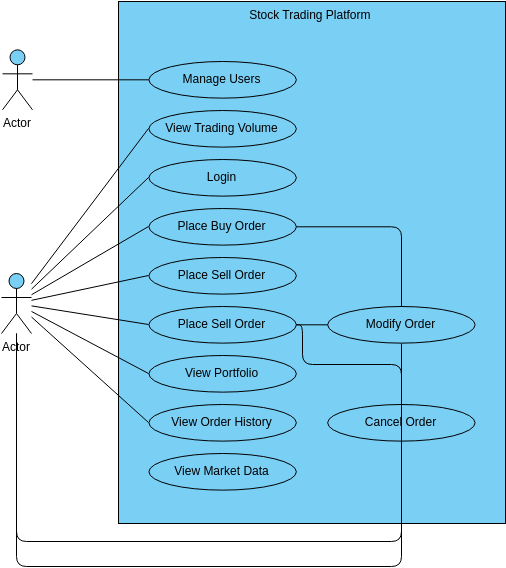

Credit: online.visual-paradigm.com

Frequently Asked Questions

What Are Trading Algorithm Platforms?

Trading algorithm platforms are software applications used to automate trading decisions. They use pre-defined rules and algorithms. Traders can execute buy and sell orders automatically based on these algorithms.

How Do Trading Algorithms Work?

Trading algorithms work by analyzing market data and executing trades based on pre-set rules. They can identify trends, make predictions, and execute orders. This is done without human intervention.

What Are The Benefits Of Using Trading Algorithms?

The benefits include faster trade execution, reduced human error, and the ability to analyze large datasets. They also help in executing complex strategies and improving trading efficiency.

Can Beginners Use Trading Algorithm Platforms?

Yes, many trading algorithm platforms are beginner-friendly. They offer educational resources, user-friendly interfaces, and demo accounts. This helps beginners to learn and practice before trading with real money.

Conclusion

Trading algorithm platforms offer diverse, practical applications. They streamline trading processes efficiently. From automated stock trading to cryptocurrency management, these tools prove invaluable. Understanding their use cases can enhance trading strategies. Embrace these platforms to stay ahead in the competitive market.

Explore and leverage them for improved trading outcomes.