Enhance productivity with wealth management software by automating financial tasks. Streamline your workflow and save valuable time.

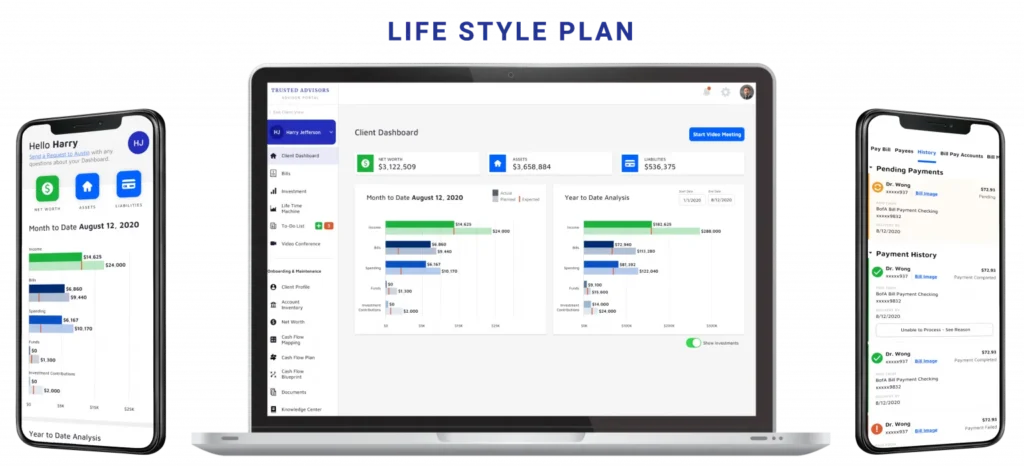

Wealth management software helps manage your finances efficiently. It automates routine tasks, reducing human error. This software provides real-time insights into your financial health. You can track investments, expenses, and income easily. With a user-friendly interface, even non-experts can use it.

Save time and focus on strategic decisions. Enhanced productivity leads to better financial outcomes. The software is secure, ensuring your data stays protected. It’s a valuable tool for anyone looking to manage wealth better. By using it, you can achieve financial goals faster and with less stress.

Introduction To Wealth Management Software

Managing finances effectively is crucial for both individuals and businesses. Wealth management software offers a comprehensive solution. It helps streamline financial planning and increase productivity.

Importance In Financial Planning

Wealth management software plays a vital role in financial planning. It helps track income, expenses, and investments. This software provides a clear picture of your financial health. It enables better decision-making. Tracking financial goals becomes easier.

With wealth management software, you can create detailed budgets. It helps in aligning spending with saving goals. The software also offers insights into financial trends. This assists in identifying areas for improvement. It helps in planning for future needs.

Key Features

Wealth management software has various features designed to enhance productivity and financial planning.

- Automated Tracking: Automatically track income, expenses, and investments. This saves time and reduces errors.

- Budgeting Tools: Create and manage budgets easily. This ensures spending aligns with financial goals.

- Financial Reporting: Generate detailed financial reports. This helps in understanding financial status better.

- Investment Management: Track and manage investments efficiently. It provides insights into investment performance.

- Tax Planning: Simplify tax planning and preparation. This ensures compliance with tax regulations.

- Goal Setting: Set and monitor financial goals. This keeps you focused on achieving them.

These features make wealth management software a powerful tool. It helps enhance productivity and effectively achieve financial goals.

Benefits Of Using Wealth Management Software

Enhancing productivity is crucial for financial advisors and wealth managers. Wealth management software offers numerous benefits, streamlining processes and enhancing efficiency. This section highlights the key benefits of using wealth management software.

Time Management

Time management is essential in the financial industry. Wealth management software helps save time by automating routine tasks.

- Automated data entry

- Quick access to client information

- Task scheduling and reminders

Automation allows advisors to focus on critical tasks. This results in better client service and increased productivity.

Improved Accuracy

Accuracy is vital in managing finances. Wealth management software ensures data accuracy through advanced algorithms.

- Error-free calculations

- Consistent data updates

- Detailed financial reports

Accurate data helps in making informed decisions. It reduces risks and enhances trust with clients.

| Benefit | Description |

|---|---|

| Time Management | Automation of routine tasks saves valuable time. |

| Improved Accuracy | Advanced algorithms ensure error-free data. |

Streamlining Financial Operations

Enhancing productivity in wealth management is vital. Wealth management software helps achieve this by streamlining financial operations. It simplifies processes, reduces errors, and saves time.

Automation Of Tasks

Automation is a key feature of wealth management software. It efficiently handles repetitive tasks, such as scheduling payments, generating reports, and tracking investments.

- Saves time on routine tasks

- Reduces human errors

- Increases efficiency and accuracy

Automating tasks frees up time for more strategic activities. This can lead to better client service and increased productivity.

Centralized Data Management

Wealth management software provides a centralized data management system. All financial data is stored in one place. This makes it easy to access and manage.

| Benefits | Description |

|---|---|

| Easy Access | Data is available from any device, anytime. |

| Improved Collaboration | Teams can share and work on the same data. |

| Data Security | Robust security measures protect sensitive information. |

Centralized data management ensures data consistency. It also enhances decision-making by providing comprehensive insights quickly.

Enhancing Client Relationships

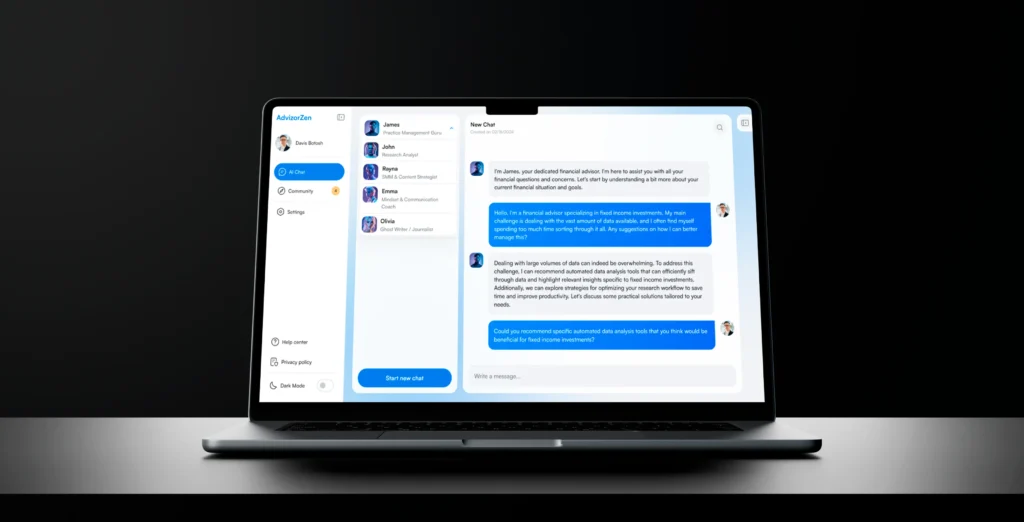

Enhancing client relationships is crucial for any wealth management firm. Building trust and maintaining effective communication ensure long-term success. Wealth management software can significantly enhance client relationships through personalized services and efficient communication.

Personalized Services

Wealth management software allows firms to offer personalized services tailored to individual client needs. The software analyzes client data to provide customized investment recommendations. Clients receive advice that aligns with their financial goals.

Moreover, personalized reports keep clients informed about their investments. These reports are easy to understand and visually appealing. Clients appreciate this level of attention and care.

Efficient Communication

Efficient communication is vital for maintaining strong client relationships. Wealth management software offers tools for seamless communication. Clients can connect with their advisors through multiple channels.

Email notifications keep clients updated on important changes. Advisors can send timely messages and updates. The software also supports secure messaging for sensitive information.

Additionally, clients can access their portfolio information anytime. This transparency builds trust and confidence in the firm.

Data Security And Compliance

Enhancing productivity through wealth management software brings significant advantages. One crucial aspect is data security and compliance. This ensures your sensitive financial data remains protected and meets regulatory standards.

Protecting Sensitive Information

Wealth management software uses advanced encryption to safeguard data. Sensitive client information stays secure, reducing the risk of data breaches.

- Multi-factor authentication

- Role-based access control

- Regular security audits

These measures ensure only authorized users access sensitive information. Data encryption in transit and at rest adds an extra layer of security. Regular updates and patches keep the system resilient against threats.

Regulatory Compliance

Wealth management software ensures compliance with financial regulations. It adheres to standards like GDPR, FINRA, and SEC.

| Regulation | Requirement |

|---|---|

| GDPR | Data protection and privacy |

| FINRA | Financial regulation and supervision |

| SEC | Securities and exchange regulation |

Automated compliance checks ensure adherence to these regulations. Regular reporting features help maintain transparency and accountability. These tools save time and reduce errors, enhancing productivity.

Integration With Other Financial Tools

Integration with other financial tools is crucial for wealth management software. It allows seamless data flow and enhances overall productivity. This integration ensures a comprehensive view of financial health, making wealth management more efficient and effective.

Seamless Connectivity

Seamless connectivity is vital for wealth management software. It links various financial tools effortlessly. This connectivity ensures real-time data updates. Users can see all their financial information in one place.

Here are some benefits of seamless connectivity:

- Real-time data synchronization across all financial tools

- Improved decision-making based on accurate, up-to-date information

- Reduced manual data entry, saving time and reducing errors

- Enhanced user experience with a unified interface

These benefits make wealth management smoother and more efficient. Users can manage their wealth with less hassle and more confidence.

Enhanced Functionality

Enhanced functionality is another key aspect. Integration with other tools boosts the software’s capabilities. Users get access to advanced features and tools.

Here’s how enhanced functionality benefits users:

- Comprehensive financial analysis with integrated reporting tools

- Automated investment tracking for better portfolio management

- Advanced budgeting tools for improved financial planning

- Tax optimization features integrated with tax software

These functionalities provide a more complete wealth management solution. Users can handle complex financial tasks with ease.

In conclusion, integrating wealth management software with other financial tools offers significant advantages. It enhances productivity, provides a comprehensive view, and simplifies financial management.

Choosing The Right Software

Choosing the right wealth management software can enhance productivity. It streamlines processes, saves time, and improves efficiency. Selecting the appropriate software is crucial for maximizing benefits.

Key Considerations

When selecting wealth management software, consider the following key factors:

- Usability: The software should be easy to use.

- Integration: It should integrate with existing systems.

- Features: Look for essential features like portfolio management and reporting.

- Security: Ensure the software has robust security measures.

- Support: Reliable customer support is vital.

Top Solutions In The Market

Here are some top wealth management software solutions available:

| Software | Key Features | Price Range |

|---|---|---|

| Software A | Portfolio management, financial planning, CRM | $$ |

| Software B | Risk analysis, reporting, compliance tools | $$$ |

| Software C | Data visualization, integration, mobile access | $ |

Future Trends In Wealth Management Software

Wealth management software continues to evolve rapidly. New technologies are shaping the future. AI, machine learning, and blockchain are key trends to watch. These trends promise to transform wealth management. They offer increased efficiency and security.

AI and Machine Learning

Artificial Intelligence (AI) and machine learning are revolutionizing wealth management. These technologies automate routine tasks. They provide personalized financial advice. AI can analyze vast amounts of data quickly. It identifies investment opportunities. Machine learning improves decision-making processes. It learns from past data and predicts future trends. This helps advisors offer better recommendations.

Benefits of AI and Machine Learning:

- Automation of repetitive tasks

- Personalized financial advice

- Data analysis for better investment opportunities

- Improved decision-making processes

Blockchain Technology

Blockchain technology is another game-changer. It brings transparency and security to wealth management. Blockchain records transactions in a decentralized ledger. This ensures data integrity. It reduces fraud and errors. Smart contracts on blockchain automate compliance. They also streamline operations.

Benefits of Blockchain Technology:

- Transparency in transactions

- Enhanced security of data

- Reduction in fraud and errors

- Automation of compliance through smart contracts

These future trends in wealth management software are promising. They bring efficiency, accuracy, and security. Embracing these technologies can enhance productivity significantly.

Frequently Asked Questions

What Is Wealth Management Software?

Wealth management software is a digital tool that helps manage financial assets. It streamlines processes and enhances productivity for both individuals and financial advisors.

How Does Wealth Management Software Enhance Productivity?

It automates routine tasks like portfolio management and reporting. This allows financial advisors to focus on strategic planning and client interactions, improving overall efficiency.

Can Wealth Management Software Improve Financial Decision-making?

Yes, it provides real-time data and analytics. This allows for more informed and timely financial decisions, ultimately enhancing financial outcomes.

Is Wealth Management Software Secure?

Most wealth management software uses advanced security measures. These include encryption and two-factor authentication to protect sensitive financial information.

Conclusion

Boost your productivity with wealth management software. It streamlines tasks and saves time. Simplify your financial planning and make informed decisions. Enjoy better organization and reduced stress. Start using wealth management software today. Enhance your efficiency and achieve your financial goals with ease.