Wealth management software pricing varies by provider and features. Plans often include tiered options for different needs.

Wealth management software helps manage financial portfolios efficiently. Many providers offer flexible plans to fit diverse requirements. Basic plans might cover essential features like account tracking and reporting. Advanced tiers can include investment analytics, risk management tools, and customer relationship management (CRM) capabilities.

Pricing typically depends on the number of users, features, and level of support. Small firms might find affordable solutions, while larger organizations may need more comprehensive packages. Always compare options to find the best fit for your needs. Wealth management software can streamline financial operations and improve decision-making, making it a valuable tool for financial professionals.

Introduction To Wealth Management Software

Wealth management software helps manage finances efficiently. It is essential for individuals and businesses aiming to grow their wealth. The software offers many tools for better financial planning.

Purpose And Benefits

Wealth management software serves several purposes:

- Financial Planning: Helps create detailed financial plans.

- Portfolio Management: Manages investments and assets.

- Risk Management: Identifies and mitigates financial risks.

- Tax Planning: Assists in optimizing tax liabilities.

Benefits of using wealth management software include:

- Efficiency: Automates many financial tasks.

- Accuracy: Reduces human errors in financial calculations.

- Insights: Provides valuable insights through data analysis.

- Customization: Tailors financial plans to individual needs.

Key Features To Look For

When choosing wealth management software, consider these key features:

- Comprehensive Dashboard: Provides an overview of your financial status.

- Investment Tracking: Monitors and manages investments.

- Risk Assessment: Analyzes and evaluates financial risks.

- Tax Optimization: Helps in efficient tax planning.

- Real-time Updates: Keeps you informed with the latest data.

- Reporting Tools: Generates detailed financial reports.

Choose software that fits your financial goals and needs. A good software streamlines your financial management. It makes handling finances simpler and more effective.

Factors Influencing Pricing

Wealth management software pricing varies based on several factors. These factors help determine the cost and value of the software. Understanding these can help make an informed decision.

Software Complexity

The complexity of the software plays a significant role in pricing. Advanced features and functionalities increase costs. Simple software with basic features is often less expensive. Complex systems offer more tools, analytics, and integrations.

Number Of Users

The number of users also affects the price. Software with more users requires more licenses. This increases the overall cost. Some providers offer tiered pricing based on user count. Here is an example of user-based pricing:

| Number of Users | Price per Month |

|---|---|

| 1-10 | $100 |

| 11-50 | $400 |

| 51-100 | $700 |

Customization Options

Customization options impact the pricing structure. Tailored solutions cost more than off-the-shelf products. Custom features cater to specific business needs. They provide a unique user experience. Companies often charge a premium for customization services.

Popular Pricing Models

Choosing the right pricing model for wealth management software can be challenging. Different pricing models cater to diverse needs and budgets. This section explores the most popular pricing models.

Subscription-based Pricing

Subscription-based pricing is common in the software industry. Users pay a regular fee, either monthly or annually. This model offers continuous updates and support.

- Monthly Subscription

- Annual Subscription

- Tiered Plans (Basic, Pro, Enterprise)

Subscription plans often include different features at each level. Users can choose the plan that fits their needs.

One-time Purchase

In a one-time purchase model, users pay a single fee. They get lifetime access to the software. This model is cost-effective in the long run.

- Single Payment

- No Recurring Fees

- Lifetime Access

One-time purchase models may not include regular updates. Users may need to pay extra for updates.

Freemium And Free Trials

Freemium models offer basic features for free. Users can pay to unlock advanced features. This model allows users to try the software before committing.

- Basic Features Free

- Pay for Advanced Features

- Try Before You Buy

Free trials are another popular option. Users get full access for a limited time. This helps users decide if the software meets their needs.

| Model | Features | Cost |

|---|---|---|

| Subscription-Based | Regular Updates, Support | Monthly/Yearly Fee |

| One-Time Purchase | Lifetime Access | Single Payment |

| Freemium/Free Trials | Basic Free, Paid Advanced | Varies |

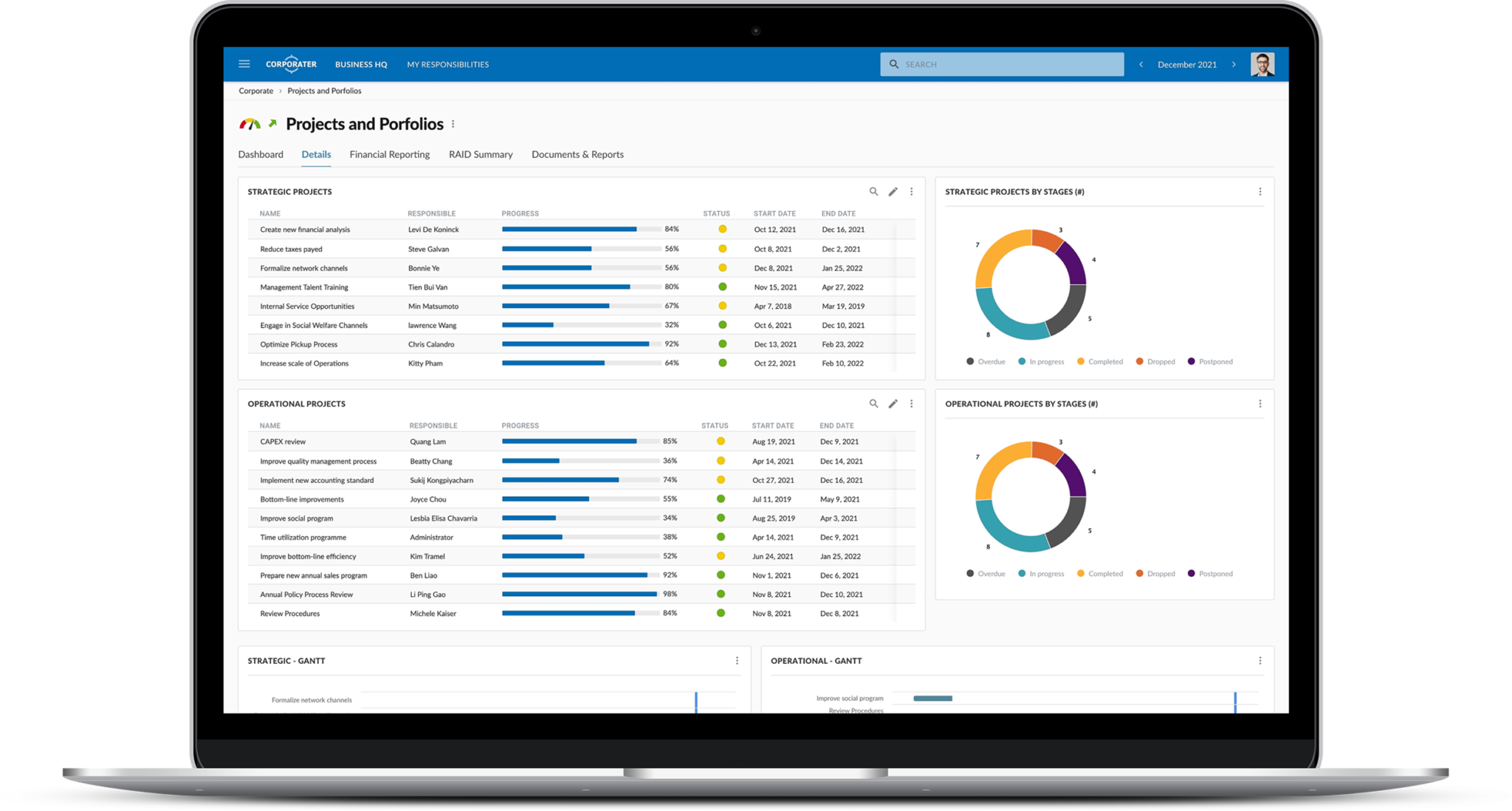

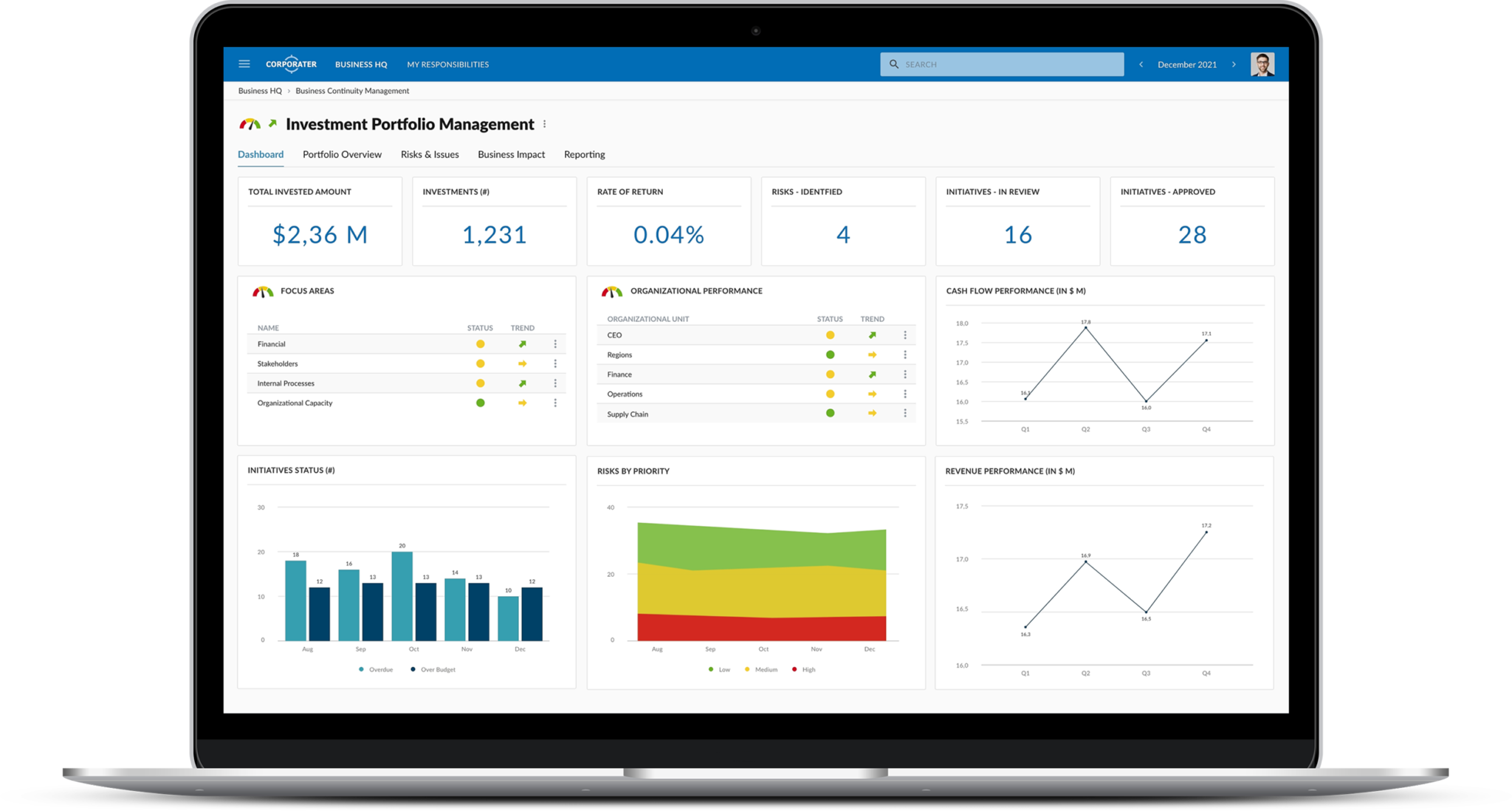

Credit: corporater.com

Top Wealth Management Software

Finding the best wealth management software can be a daunting task. We have simplified this for you by listing the top wealth management software. These platforms offer various features and pricing plans to suit different needs. Let’s explore the top wealth management software options available today.

Software A Overview

Software A is a leading wealth management solution that offers comprehensive features. It is designed to cater to the diverse needs of financial advisors and firms.

- Features:

- Portfolio management

- Client reporting

- Risk assessment

- Pricing Plans:

Plan Price Features Basic $100/month Basic Portfolio Management Pro $200/month Advanced Reporting Enterprise Custom Pricing All Features

Software B Overview

Software B offers robust tools for financial planning and asset management. It is ideal for both small and large firms looking to streamline operations.

- Features:

- Investment tracking

- Client dashboards

- Automated workflows

- Pricing Plans:

Plan Price Features Starter $150/month Investment Tracking Professional $300/month Client Dashboards Premium Custom Pricing All Features

Software C Overview

Software C stands out with its advanced analytics and reporting tools. It helps financial advisors make informed decisions and improve client satisfaction.

- Features:

- Data analytics

- Custom reports

- Client portals

- Pricing Plans:

Plan Price Features Essential $120/month Data Analytics Advanced $250/month Custom Reports Ultimate Custom Pricing All Features

Comparing Pricing Plans

Choosing the right wealth management software plan can be challenging. This guide will help you understand the different pricing plans available. We’ll compare Basic Plans, Advanced Plans, and Enterprise Plans to find the best fit for your needs.

Basic Plans

Basic plans are ideal for small businesses and individual users. They offer essential features at an affordable price. These plans usually include:

- Portfolio management

- Basic reporting tools

- Email support

- Mobile access

Here is a table comparing features of various basic plans:

| Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Monthly Cost | $29 | $35 | $40 |

| Users Allowed | 1 | 2 | 2 |

| Storage | 5GB | 10GB | 15GB |

Advanced Plans

Advanced plans are great for growing businesses with more needs. They include all basic features plus:

- Advanced analytics

- Customizable dashboards

- Priority support

- Automated workflows

Here is a table comparing features of various advanced plans:

| Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Monthly Cost | $59 | $65 | $75 |

| Users Allowed | 5 | 10 | 15 |

| Storage | 50GB | 100GB | 150GB |

Enterprise Plans

Enterprise plans are designed for large organizations. They offer the highest level of features and support. These plans often include:

- Unlimited users

- Dedicated account manager

- Custom integrations

- 24/7 support

Here is a table comparing features of various enterprise plans:

| Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Monthly Cost | $199 | $250 | $300 |

| Users Allowed | Unlimited | Unlimited | Unlimited |

| Storage | 500GB | 1TB | Unlimited |

Credit: corporater.com

Best Value For Money Options

Investing in the right wealth management software can be a game-changer. Finding the best value for your money means choosing software that offers the right balance of features and cost. Here, we break down some of the top options for different budget levels.

Affordable Choices

Budget-friendly wealth management software doesn’t have to lack features. Many affordable choices provide the essential tools you need.

- Basic Financial Planning: Tools that help you track income and expenses.

- Portfolio Management: Simple tools to manage your investment portfolio.

- Customer Support: Access to basic customer support services.

Affordable options usually cost between $10 to $30 per month. These are ideal for small businesses or individual users.

Mid-range Solutions

Mid-range solutions offer more advanced features. These options are perfect for growing businesses or individuals with more complex needs.

- Advanced Reporting: Detailed financial reports and analytics.

- Integration Capabilities: Ability to integrate with other financial tools and software.

- Enhanced Security: Advanced security features to protect your data.

Prices for mid-range solutions range from $50 to $100 per month. These plans offer a good balance of features and cost.

Premium Offerings

Premium offerings are for those who need the best features and support. These plans are typically used by large businesses or high-net-worth individuals.

- Comprehensive Financial Planning: In-depth financial planning tools and services.

- Dedicated Support: Access to dedicated customer support representatives.

- Customizable Options: Highly customizable software to fit specific needs.

Premium plans usually start at $150 per month and can go higher. They offer the most advanced features and highest level of support.

Customizable Solutions

Choosing the right wealth management software involves more than just price. Customizable solutions can make a significant difference. These solutions allow you to tailor the software to meet your unique needs. They also offer scalability, ensuring your software can grow with your business.

Tailored Features

Customizable wealth management software provides tailored features. These features can be adjusted to fit your specific requirements. Some key features include:

- Investment tracking

- Client management

- Financial planning tools

These tailored features help you manage your clients better. They also improve your efficiency and productivity.

Scalability Considerations

Scalability is another important aspect of customizable solutions. As your business grows, your software should grow too. Scalable software ensures you don’t outgrow your system. Here are some scalability considerations:

- User capacity: Can the software handle more users?

- Data storage: Is there enough storage for growing data?

- Feature expansion: Can new features be added easily?

Scalability helps you avoid costly software changes in the future. It also ensures a smooth transition as your business expands.

| Feature | Basic Plan | Advanced Plan | Enterprise Plan |

|---|---|---|---|

| Investment Tracking | Yes | Yes | Yes |

| Client Management | Basic | Advanced | Comprehensive |

| Financial Planning Tools | No | Yes | Yes |

| Scalability | Limited | Moderate | High |

Credit: www.planforge.io

Frequently Asked Questions

What Is Wealth Management Software?

Wealth management software helps manage investments, assets, and financial planning. It provides tools for financial advisors and investors. It enhances decision-making and efficiency.

How Much Does Wealth Management Software Cost?

The cost varies based on features and providers. Basic plans start around $50 per month. Advanced plans can exceed $500 monthly.

Are There Free Wealth Management Tools?

Yes, some providers offer free versions with limited features. These are suitable for individuals or small businesses. However, they may lack advanced functionalities.

What Features Should I Look For?

Look for portfolio management, financial planning, and reporting tools. Ensure it includes security, integration, and customer support. Customization options are also beneficial.

Conclusion

Choosing the right wealth management software is crucial. Compare pricing and plans carefully. Consider your needs and budget. Look for features that match your goals. The right software can streamline your financial planning. Make a smart choice for better wealth management.